Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, the commodity declined as domestic crude oil stockpiles increased to a record. In this environment, light crude closed another session under the support/resistance line. Will we see further deterioration in the coming days?

Yesterday, the U.S. Energy Information Administration said in its weekly report that domestic crude-oil stockpiles rose by 5.3 million barrels to 489 million barrels last week, which confirmed numbers released by the American Petroleum Institute on Tuesday. In this way, crude oil in storage has increased for 15 straight weeks, which pushed the price of the commodity lower and resulted in another daily close below the support/resistance line. Will we see a test of the Feb highs in the coming days? (charts courtesy of http://stockcharts.com).

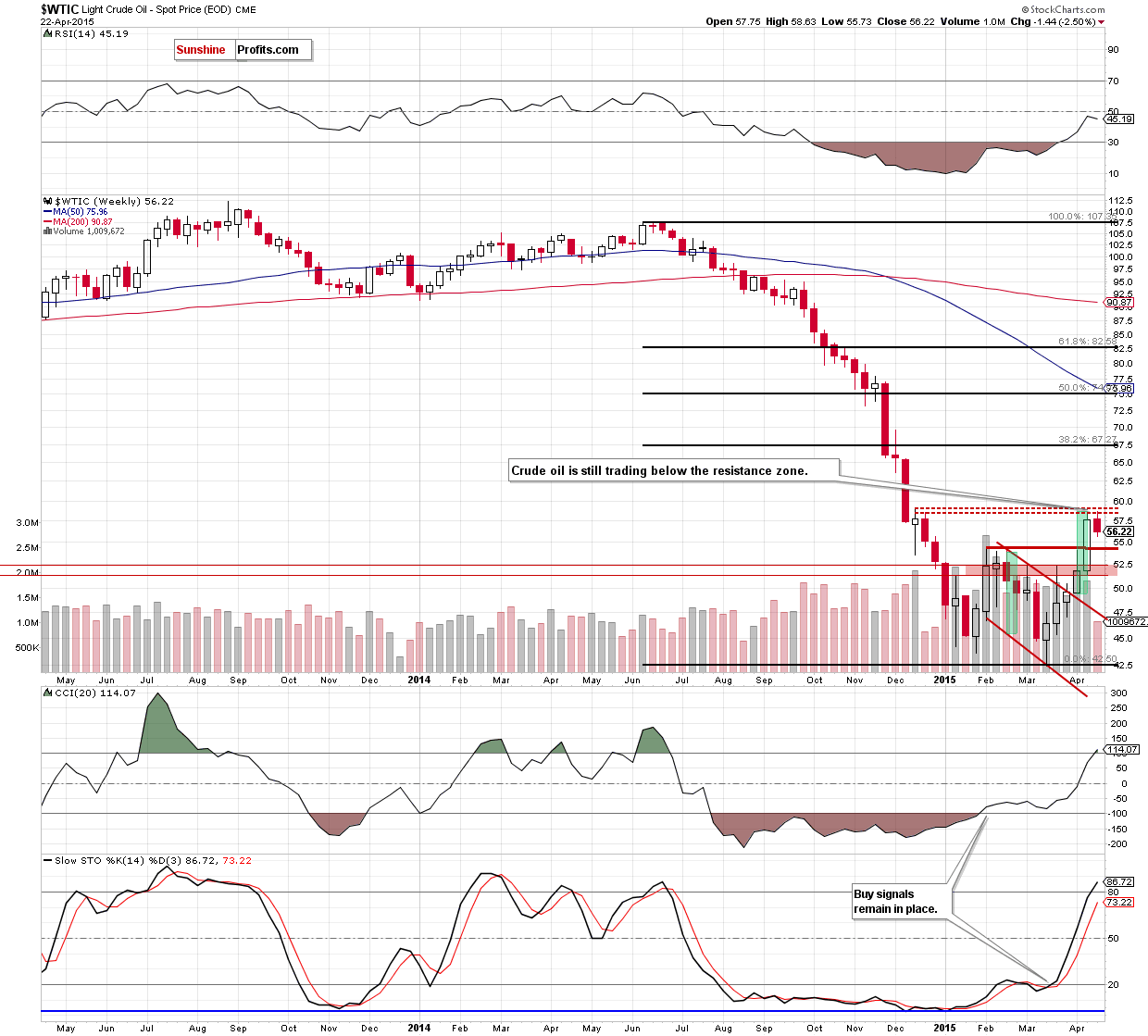

Although crude oil moved little lower, the situation in the medium term hasn’t changed as the commodity is still trading between the resistance area created by the Dec 15 and Dec 22 highs and support zone based on the Feb highs.

Will the very short-term picture give us more clues about future moves? Let’s examine the daily chart and find out.

Yesterday, we wrote the following:

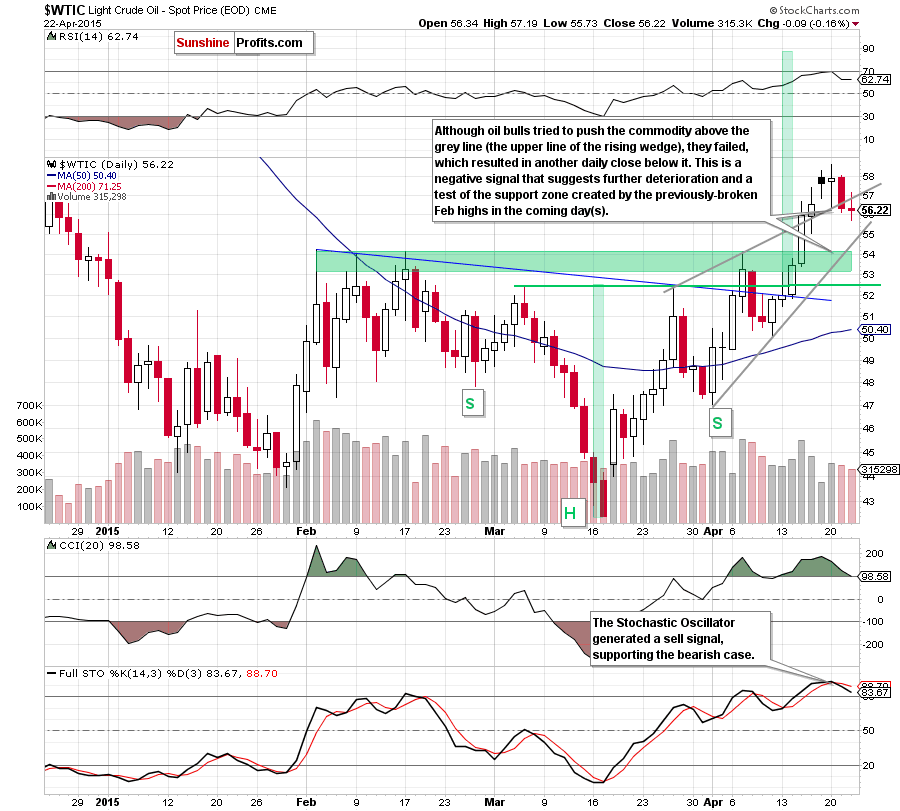

(…) crude oil not only reached our downside target, but also closed the day below the grey support line. This is a negative signal, which suggests further deterioration (especially when we factor in sell signals generated by the RSI and Stochastic Oscillator).

On the daily chart, we see that although oil bulls tried to push the commodity above the grey line (the upper line of the rising wedge), they failed, which resulted in another daily close below it. Additionally, the CCI generated a sell signal, which makes the very short-term outlook bearish and suggests that lower values of light crude are still ahead us. If this is the case, the downside target from our last commentary will be in play:

(…) If (…) light crude moves lower in the coming day(s), we’ll see a drop to the support zone created by the Feb highs (around $54.15-$54.24) and the lower line of the rising wedge.

Summing up, crude oil closed another day below the upper line of the rising wedge, which in combination with sell signals generated by all daily indicators marked on the chart suggests further deterioration and a test of the support zone created by the Feb highs and the lower line of the rising wedge (around $54.15-$54.24) in the coming day(s).

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts