Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 0.81% as profit taking and the Baker Hughes report weighed on the price. Thanks to these circumstances, light crude reversed and declined to the short-term support line. Will oil bears manage to break below it in the coming day(s)?

On Friday, crude oil gave up some gains as traders locked in profits from the recent rally. The same day, Baker Hughes report showed that oil rigs in the U.S. fell by 26 to 734 in the previous week. Although it is the lowest level since November 2010, the pace of decline appears to be slowing (a week ago, the report showed that oil rig count decreased by 42). This fact weighed on investors’ sentiment and watered down the price of the commodity. As a result, light crude slipped to the short-term support line. Will it stop oil bears and trigger a rebound in the coming week? (charts courtesy of http://stockcharts.com).

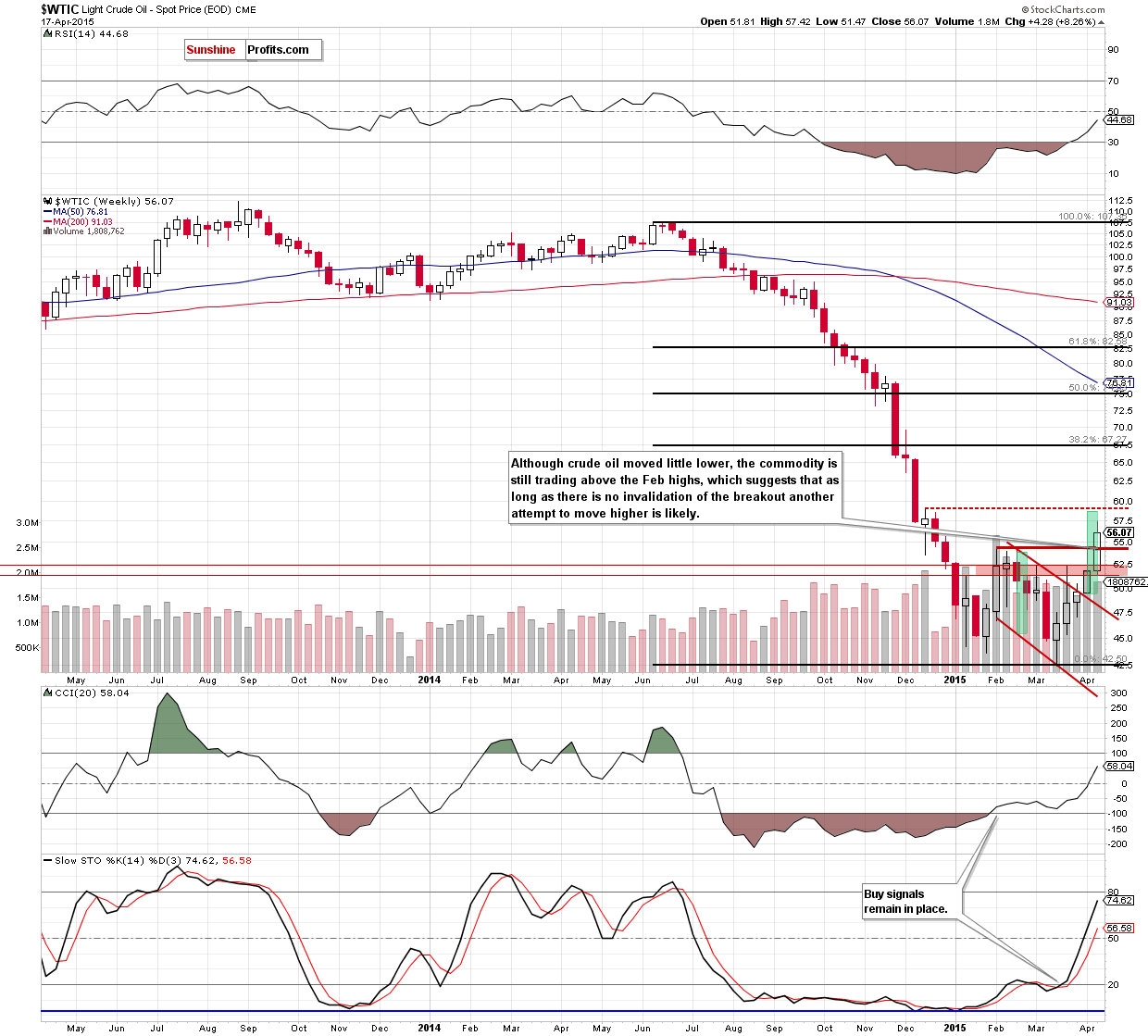

Looking at the charts from the long-and medium-term perspective, we see that although crude oil moved little lower, the overall situaion hasn’t changed much as the commodity is still trading above the previously-broken Feb highs and well above the upper line of the decining trend channel. This suggests that as long as there is no invalidation of the breakout above the previous 2015 highs another attempt to move higher is likely.

Nevertheless, we should still keep in mind what we wrote on Friday:

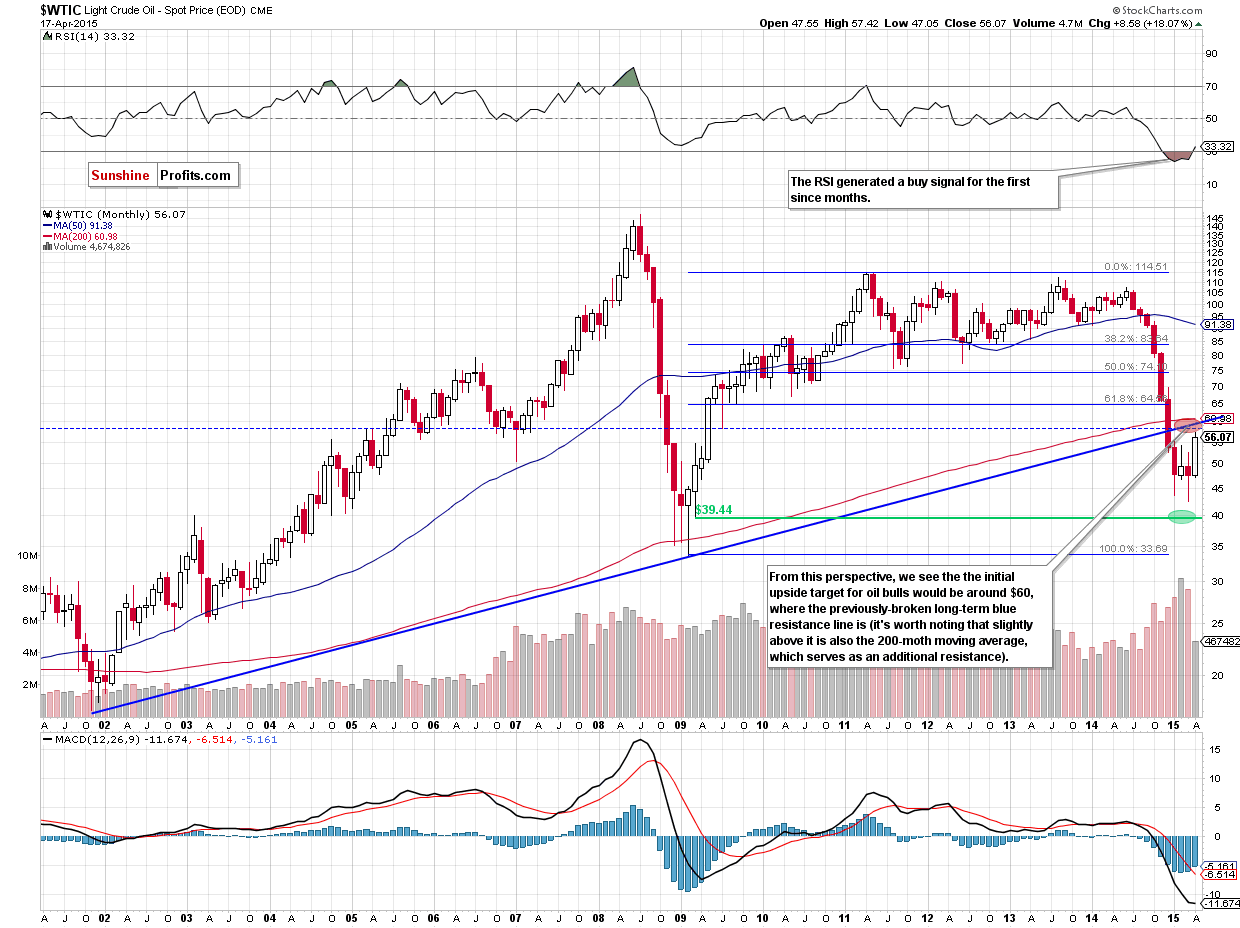

(…) the space for further rally might be limited by the solid resistance zone around the level of $60. (…) the above-mentioned resistance zone is created by the 200-month moving average (that stopped major declines 2 times: in 2001 and 2008/2009) and the very long-term rising resistance line based on 2001 and 2009 bottoms.

Additionally, in this area the size of the upward move will correspond to the height of the declining trend channel (marked on the weekly chart below), which could encourage day traders to take profits and trigger a pullback (please note that slightly lower is also the mid-Dec high of $59.04) (…)

Having said that, let’s take a closer look at the daily chart. Will the very short-term picture give us more clues about future moves? Let’s find out.

In our previous summary, we wrote the following:

(…) Taking into account the proximity to the resistance zone and the size of volume that accompanied yesterday’s increase (it was much smaller than day before), we still believe that crude oil will correct shortly.

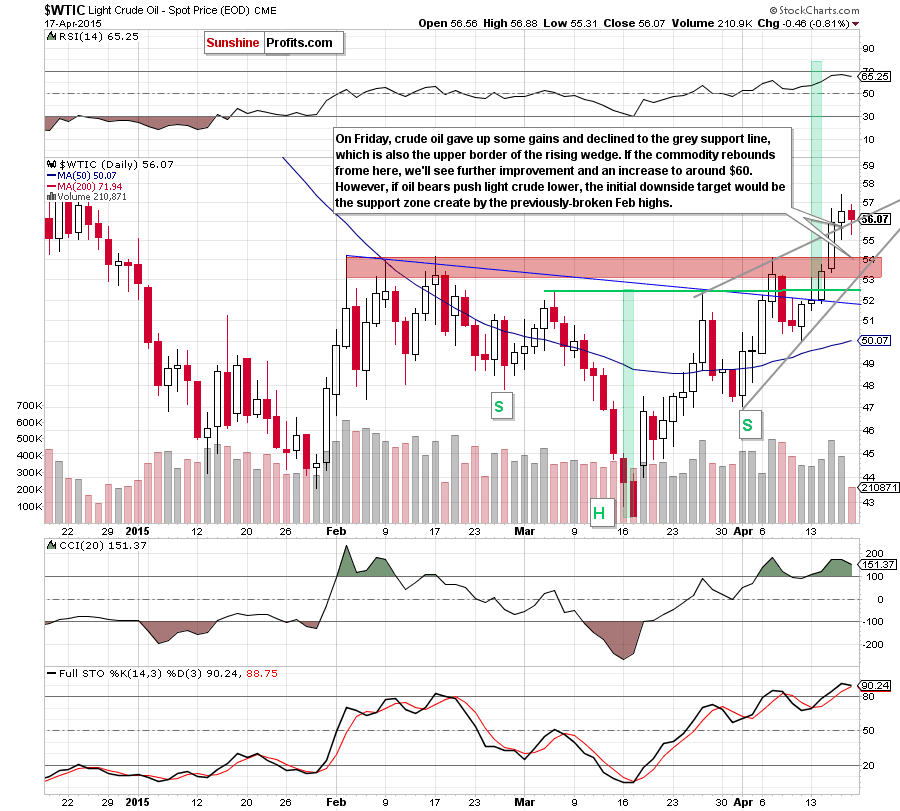

From this perspective, we see that oil bears pushed the commodity lower as we expected. With Friday’s downswing crude oil declined to the grey support line, which is also the upper line of the rising wedge. If this support encourages oil bulls to act, light crude will rebound from here and test the recent highs. However, taking into account the current position of the daily indicators, it seems that further deterioration s just around the corner.

If this is the case, and light crude invalidates earlier breakout above this line, it would be a negative signal, which will trigger a drop to the support zone created by the Feb highs (around $54.15-$54.24) or even to the lower line of the formation (currently around $53) in the coming days.

Summing up, the outlook for the crude oil market remains bullish (Wednesday’s breakout above the Feb highs and its positive impact on future moves is still in effect), but we think that waiting for a bottom of the current pullback before entering long positions is a good idea. This should at the same time lower the risk and increase the potential profits, thus greatly improving the risk/reward ratio. We’ll keep you – our subscribers – informed.

Very short-term outlook: mixed

Short-term outlook: bullish

MT outlook: mixed with bullish bias

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts