Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Monday, crude oil reversed and declined sharply, erasing most of Friday’s increase. How did this price action affect the technical picture of the black gold?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) invalidation of the breakdown under the lower border of the purple rising trend channel. Although this is a positive development, we should keep in mind that Friday’s move materialized on smaller volume than earlier declines, which raises some doubts about oil bulls’ strength.

Additionally, crude oil futures (…) reversed and declined earlier today, which increases the probability of further declines in the very near future.

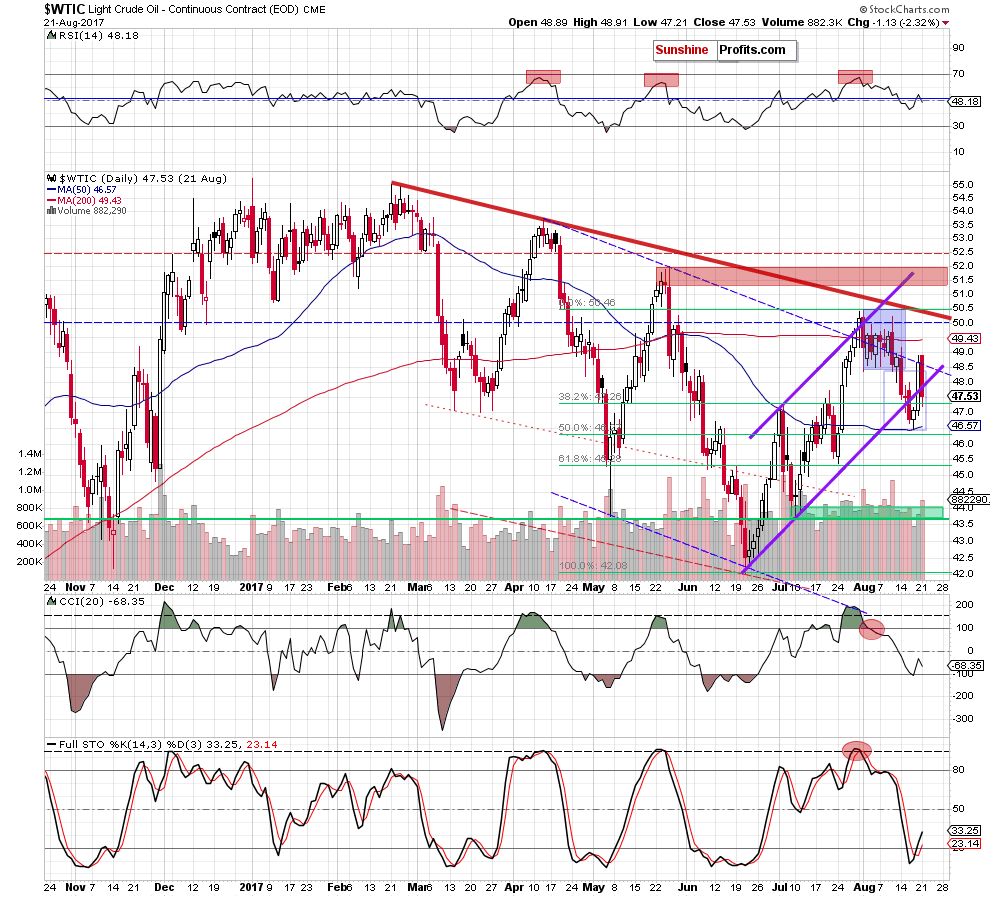

Looking at the daily chart, we see that the situation developed in line with the above scenario and oil bears stopped further increases, triggering a pullback. As a result, light crude declined sharply and erased most of Friday’s increase. Thanks to yesterday’s price action crude oil came back below the lower border of the purple rising trend channel, which is a bearish development. What’s more important, yesterday’s drop materialized on visibly higher volume than earlier upswings, which confirms who lead the market.

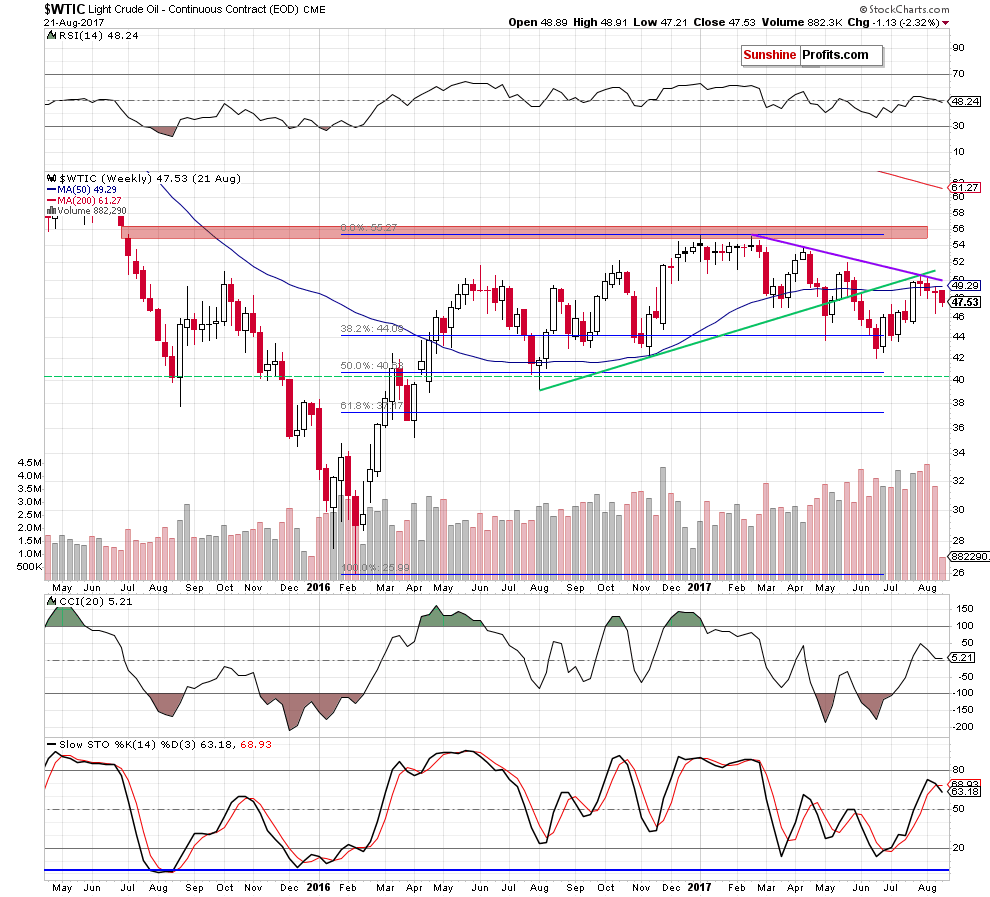

Additionally, the black gold remains under the medium-term resistances marked on the chart below, which suggests that as long as there is no breakout above them (above the 50-week moving average, the purple declining resistance line based on the previous highs and the previously-broken medium-term green line) another bigger move to the upside is not likely to be seen.

Finishing today’s alert we would like to comment the price action that we saw in the previous hours (not seen on the above charts yet). Crude oil moved higher and climbed above $48, but did this increase change anything? In our opinion, it didn’t. Why? Because in this area is currently the lower border of the purple rising trend channel, which suggests that today’s move may be a verification of yesterday’s breakdown. Therefore, if the commodity closes today’s session under this resistance line, oil bears will receive another reason to act and we’ll likely see further deterioration. As always, we’ll keep you - our subscribers - informed should anything change.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short (already profitable) positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts