Please log in to read the entire text.

If you don’t have a login yet, please select your access package.

The pandemic winter will take longer than we thought. The longer we struggle with the coronavirus, the brighter gold could shine.

A long, long time ago, there was a bad virus, called the coronavirus, that killed many people all around the world and severely hit the global economy. Luckily, smart scientists developed vaccines that defeated the coronavirus and ended the pandemic. Since then, humankind lived happily – and healthy – ever after.

Sounds beautiful, doesn’t it? This is the story we were all supposed to believe. The narrative was that the development of vaccines would end the pandemic and we would quickly return to normalcy. However, it turns out that this was all a fairy tale – the real struggle with the coronavirus is more challenging than we thought.

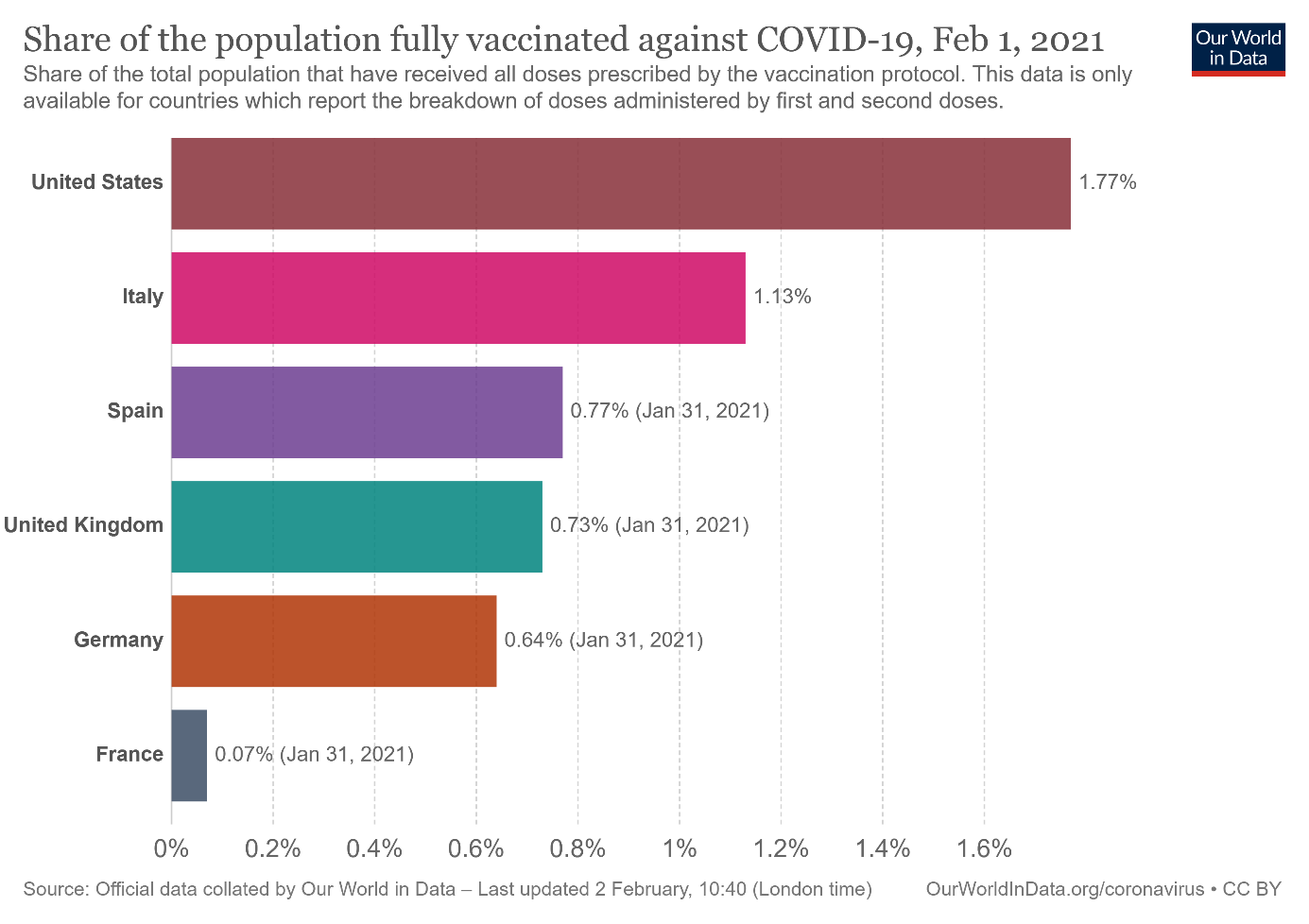

First, the rollout of vaccinations has been very, very slow. As the chart below shows, on February 1, 2021, only about 1.77 percent of Americans became fully vaccinated against COVID-19.

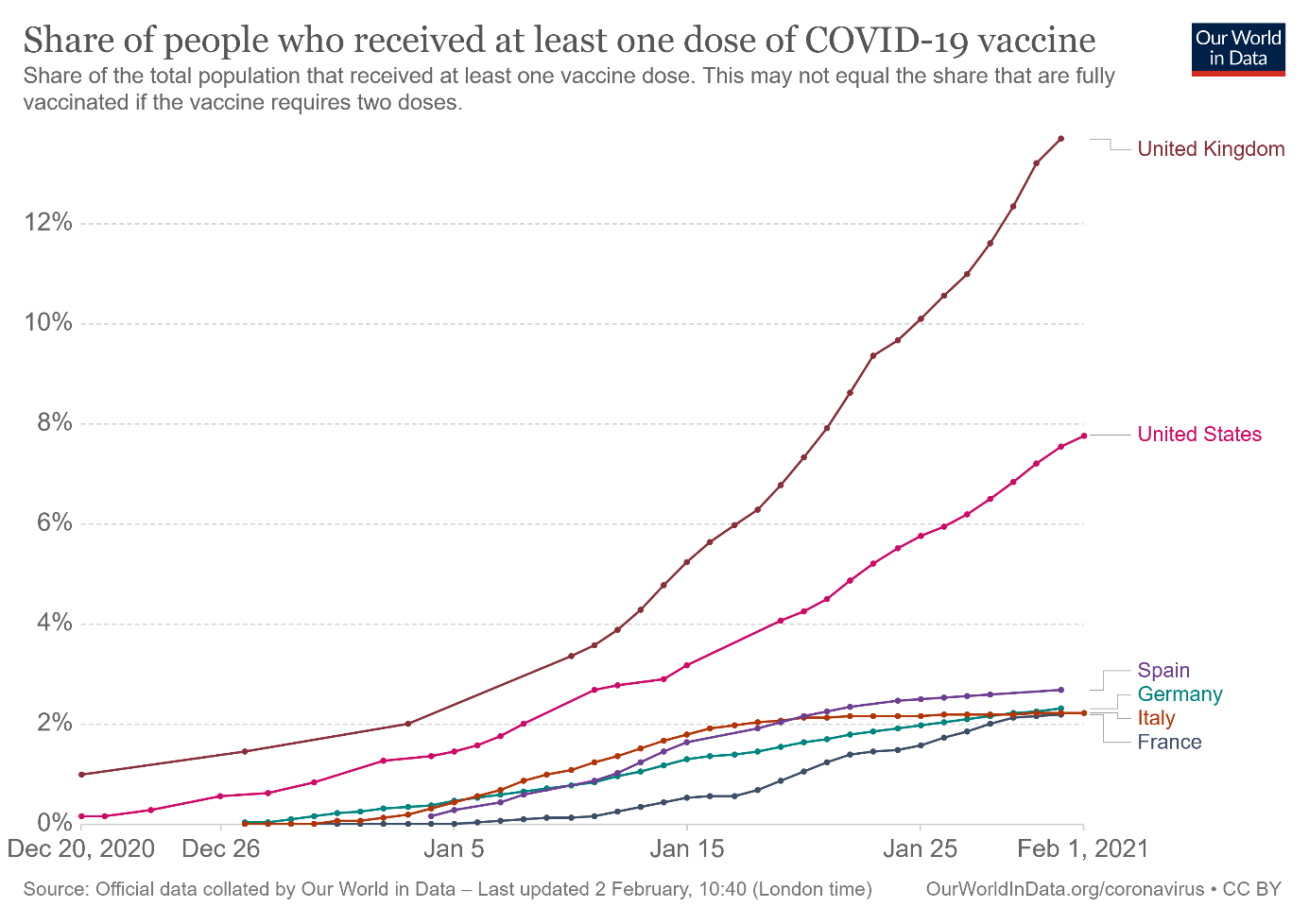

Of course, full protection requires two doses, so it takes some time. But in many countries, the share of the population which received at least one dose of the vaccine is also disappointingly low, as the chart below shows.

It means that our progress towards herd immunity is really sluggish. At such a pace, we are losing the race between injections and infections. And we will not reach herd immunity until the second half of the year or even the next winter…

Second, there is the problem of mutations. The new strains are rapidly popping up which poses a great risk in our fight with the coronavirus. One of these new variants was identified in the United Kingdom and quickly spread through the country. Although it’s not more lethal, it’s more infectious, which makes it more dangerous overall. And the more variants emerge, it’s more likely that we could see a mutation resistant to our current treatments and vaccines. Indeed, some of the mutations change the surface protein, spike, and have been shown to reduce the effectiveness of combating the coronavirus by monoclonal antibodies.

The really bad part is that these two problems are strongly connected. The longer the vaccinations take, the more active cases we have. The more active cases we have, the more mutations happen, as each new infection implies more copies of the coronavirus, which gives it more chances to mutate. The more mutations occur, the higher the odds of a really nasty strain. Therefore, the longer the vaccination process takes, the more probable it is that it will not work and that vaccine-resistant variants might emerge.

Given that in many countries vaccinations are practically the only rational strategy to fight the virus, the vaccine-resistant strain would be a serious blow. Surely, some vaccines could be relatively easily updated, but their rollout would still require time – time we don’t have.

What does it all imply for the gold market? Well, the more sluggish the vaccinations, the higher the risk that something goes wrong and that our battle with COVID-19 will take more time. The longer the fight, the slower the economic recovery. The longer and bumpier road toward herd immunity, the slower lifting sanitary restrictions and social distancing measures, and the later we come back to normalcy. The longer we live in Zombieland, the easier fiscal and monetary policies will be, and the brighter gold will shine.

Another issue is that we shouldn’t forget about the possibility of the pandemic’s long economic shadow. A recent paper has examined the effects of 19 major previous pandemics, finding a long shadow of the economic carnage. Although financial markets are still (wrongly, I believe) betting on a V-shaped recovery, the history suggests that a double dip is likely, as eight of the last 11 recessions experienced it. Recessions sound golden, don’t they?

However, there is one caveat here. The sensitivity of economic activity to COVID-19 infections and restrictions has significantly diminished since the Great Lockdown in the spring of 2020. There are three reasons for that. First, people fear the coronavirus less. Second, epidemic restrictions are better targeted and implemented. Third, entrepreneurs adopted better to cope with the epidemic.

The greater resilience of the economy means a smaller downturn and fewer long-term scars, which will limit any upward COVID-19 related impact on gold prices. But a softer economic impact also implies a quicker recovery, which – together with the upcoming big government stimulus – could increase consumer prices, thus supporting gold prices through the inflation channel. Indeed, commodity prices have been surging in 2021, so gold may follow suit.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the February Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.