Briefly: in our opinion, full (200% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Practically nothing happened yesterday in gold, silver, mining stocks, USD Index, EUR/USD, and USD/JPY. Nothing happened in terms of the daily closing prices and we didn’t see much action intraday either. Yet, it doesn’t mean that there were no implications. Conversely, in case of one part of the precious metals market, the lack of action was very important.And it has impact on the short-term outlook.

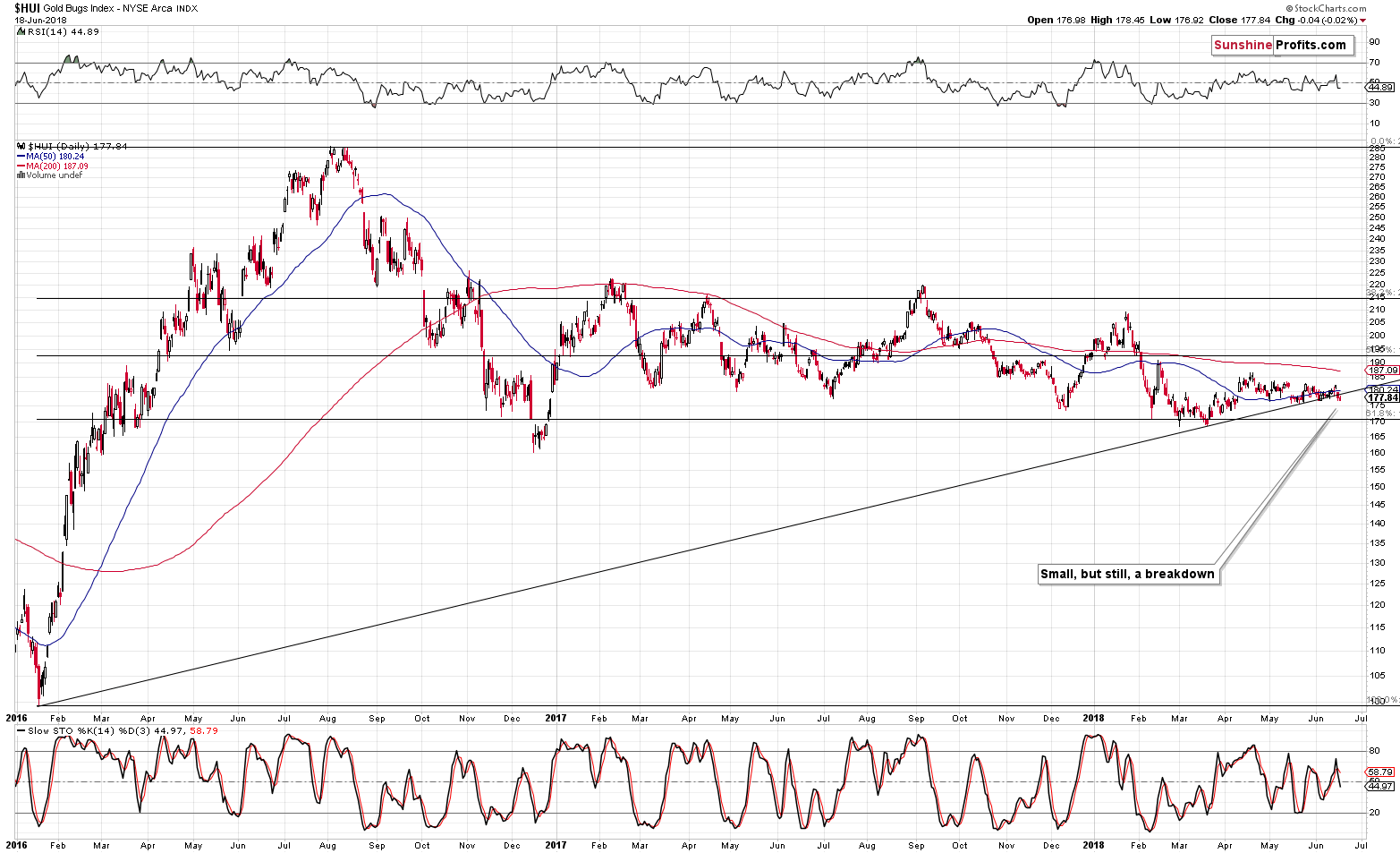

It was the (lack of) action in the HUI Index. It didn’t do anything, but it didn’t do anything after a breakdown, which means that it’s very close to confirming it and this already makes the outlook more bearish. Before moving to the miners, however, let’s take a look at gold.

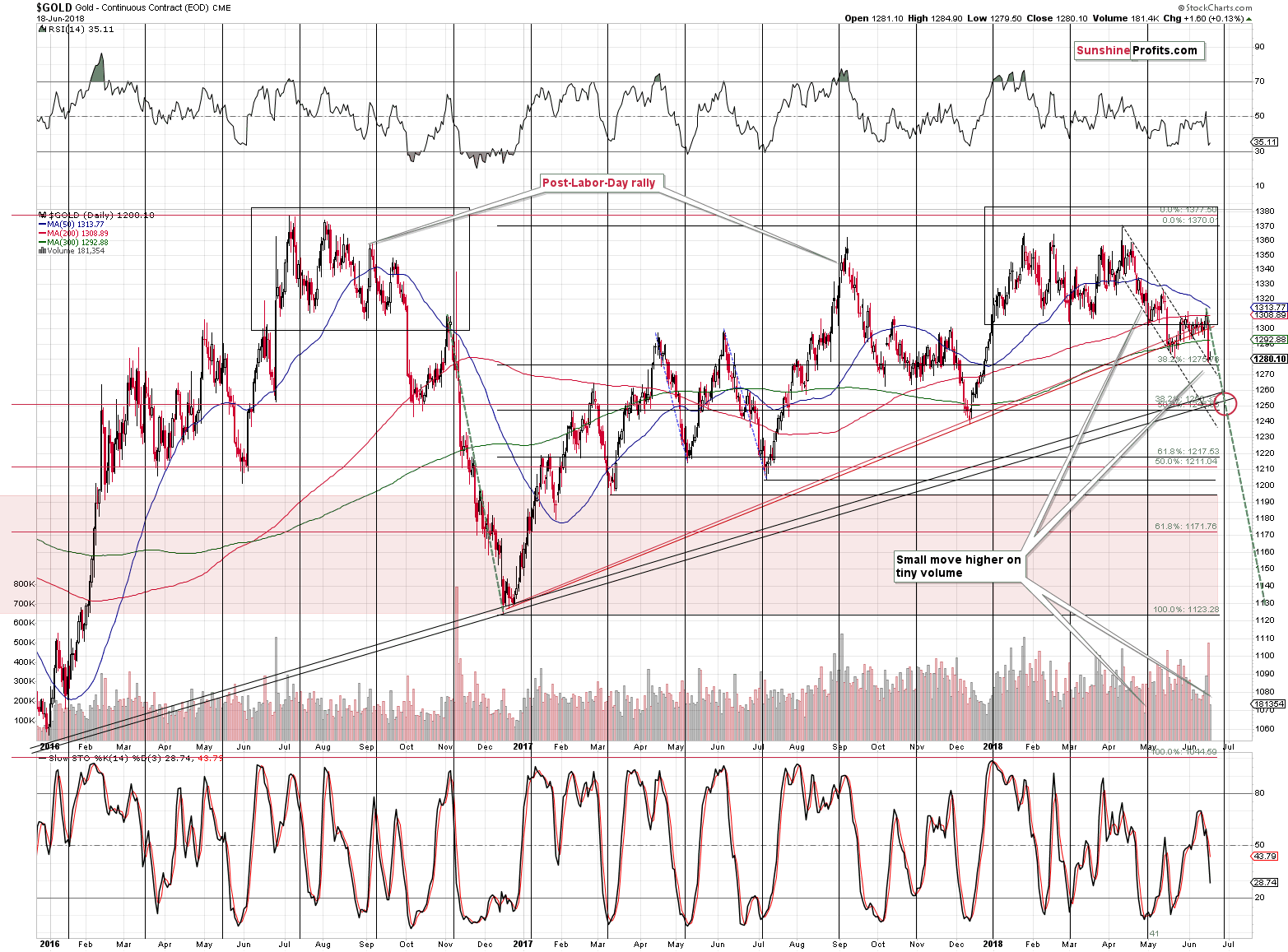

Gold moved higher very insignificantly, and the volume was very low. That’s a classic breather after a big move that doesn’t change the outlook. Moreover, that’s exactly what we saw on April the 27th and it had this textbook implication. Consequently, everything that we wrote about the precious metals market yesterday remains up-to-date. If you didn’t have the chance to read yesterday’s analysis so far, we encourage you to do so today.

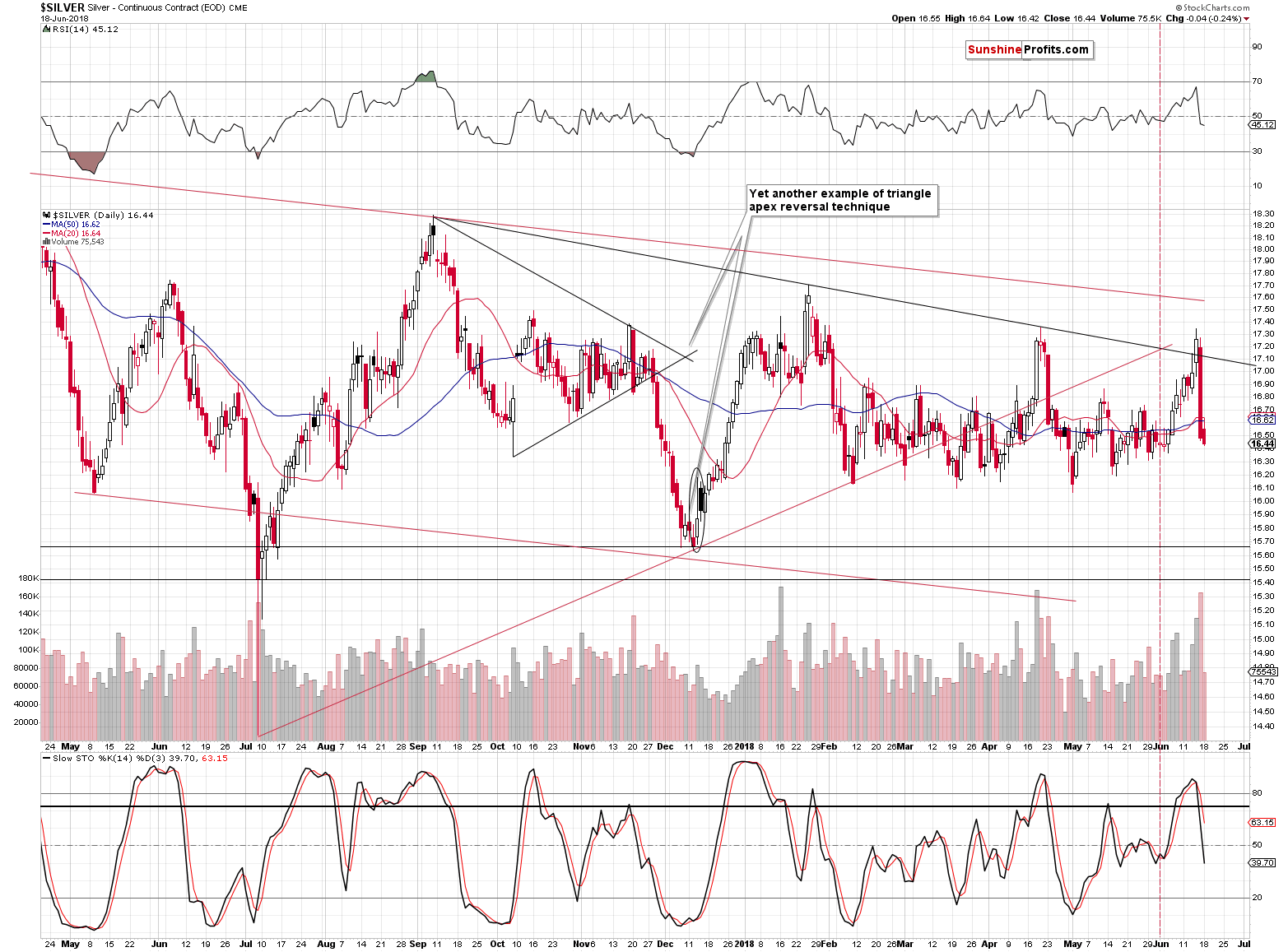

Silver moved lower on average volume, which is normal during a decline. The decline in volatility is a way of the market taking a breather, but unlike in case of gold, there was not enough strength among the silver bulls to prevent the daily decline.

Given the regularity in the recent bottoms, the silver bulls may be planning to take advantage of a move to $16.10 or so. That’s why we may see a temporary bounce from this level, but we don’t expect it to be anything major.

Nothing happened in case of gold stock, but this actually has some implications. Bearish implications. The reason is that this is the second daily close after a breakdown below the critical, long-term support line. It generally takes 3 consecutive market closes for a breakout or breakdown to be confirmed on the precious metals market and since we saw the second close, we are only one day away from the full confirmation. The implications of the breakdown are therefore not yet fully bearish, but definitely more bearish than they were yesterday.

Additionally, please note that there are sell signals from the Stochastic indicator on all above charts. These signals are not subtle, but clear and so are the bearish implications.

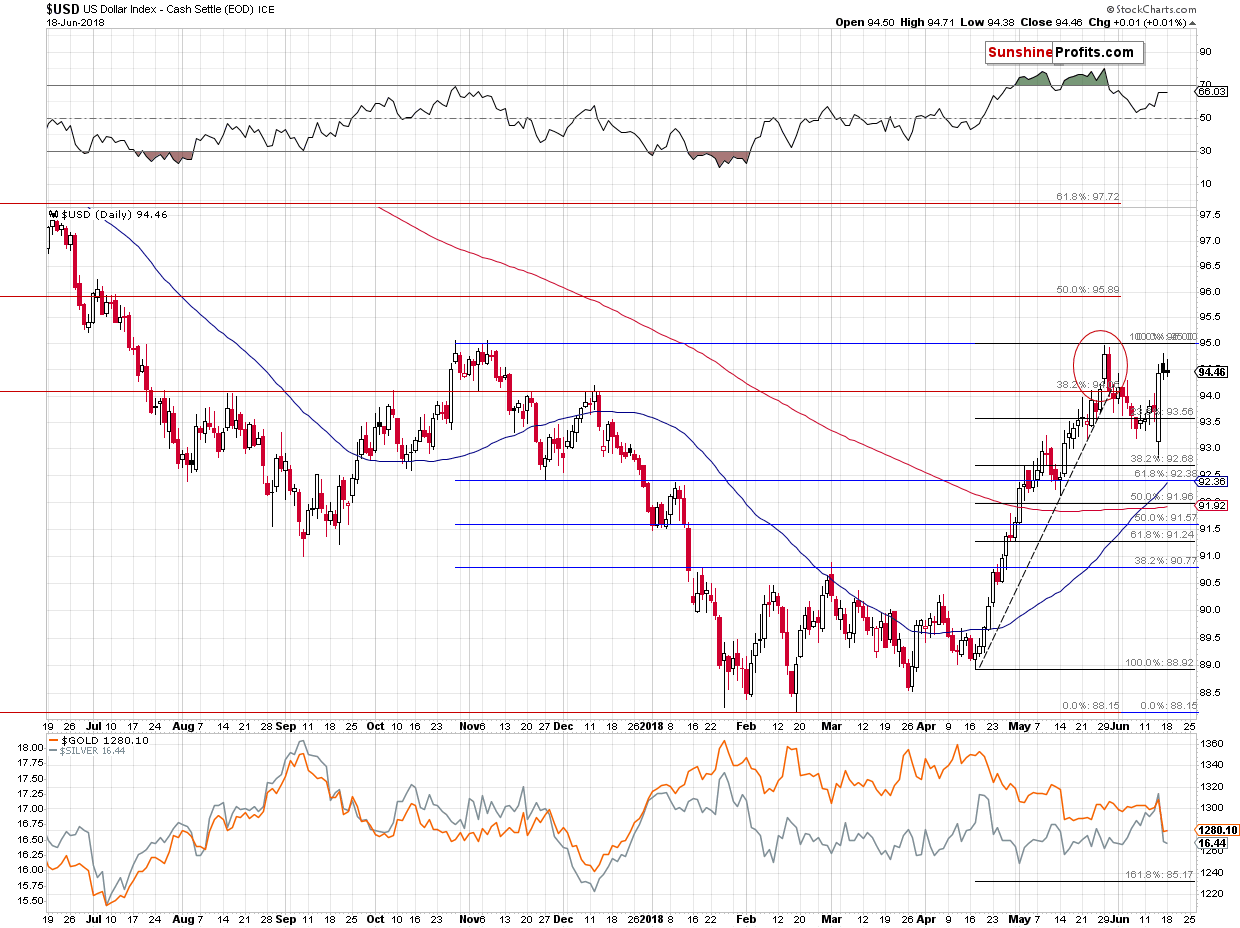

The above chart shows how little changed on the currency markets yesterday. That’s quite natural for any market to take a breather after a big move and it seems that we're seeing the same thing on many markets, i.e. in precious metals, currencies, and crude oil.

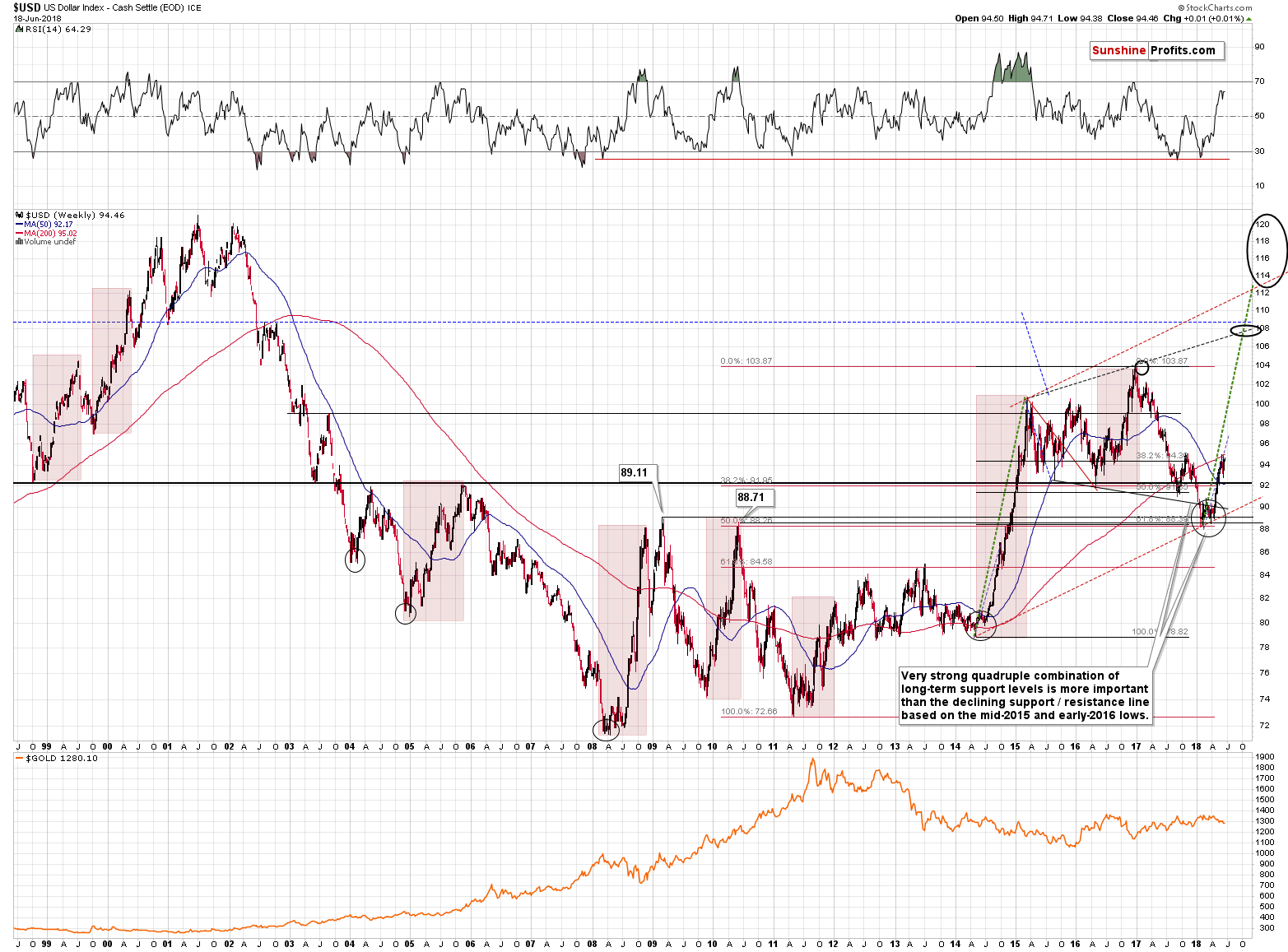

The interesting thing about the recent corrective downswing in the USD Index is that it’s visible from the long-term perspective and that at the first sight it appears similar to what we had seen in the second half of 2014. Since both: 2014-2015 and the current rally started in a similar way and then corrected likewise, the analogy between them is even stronger than it was before the correction. The implications for the following weeks and months are bullish for the US currency (and the USD/JPY pair), which makes them bearish for the precious metals market and the EUR/USD pair.

Summary

Summing up, yesterday’s lack of action seems to be a pause within the decline, not its end. On Friday, the precious metals market declined in tune with the multiple signals that we had described in the previous alerts and it seems that the decline is just starting. There is quite likely to be a pause or a corrective upswing when gold moves close to the $1,250 level, but it doesn’t seem that it will generate anything more than just a brief correction. The analogous target prices are $16.10 for silver, and $21 for the GDX. Based on the nearby turning points, it seems that we might see some kind of reversal on Wednesday or Thursday this week and then on next Wednesday, June the 27th.

Will it be justified to exit the short positions and to perhaps open long ones in order to profit from this bounce? It’s a tough call. We’ll have to wait for what happens on Wednesday and Thursday and see what kind of confirmations we get. If miners bottom before gold and show strength on Thursday, then we might adjust the current position or even switch it. We’ve done something similar in crude oil recently, taking profits from short positions on June the 5th (crude oil at about $64.20) and re-entering them on June the 13th (crude oil at $66.78), but at this time we don’t have the same number of signals pointing to a move higher from $1,250 or so in gold as we had in case of crude oil. If we see them, we’ll report to you accordingly.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (200% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,251; stop-loss: $1,382; initial target price for the DGLD ETN: $48.88; stop-loss for the DGLD ETN $37.48

- Silver: initial target price: $15.73; stop-loss: $18.06; initial target price for the DSLV ETN: $27.58; stop-loss for the DSLV ETN $19.17

- Mining stocks (price levels for the GDX ETF): initial target price: $21.03; stop-loss: $23.54; initial target price for the DUST ETF: $28.88; stop-loss for the DUST ETF $21.16

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – but if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $30.62; stop-loss: $36.14

- JDST ETF: initial target price: $59.68 stop-loss: $40.86

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Two of the most powerful men in the world. Trump? Putin? Xi? Nah. Chairman Jerome Powell and President Mario Draghi. Let’s analyze their recent press conferences!

Chairman for People and Arrogant Eurocrat

The last couple of weeks have been disheartening for Bitcoin bulls. The currency has been on a move down. Is this about to end? The answer to this question determines whether the profits on our hypothetical positions are about to grow.

Short-term Turnaround in Bitcoin Might Not Be What You Think

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold prices gain as U.S.-China trade spat stokes safe-haven buying

How Do You Measure U.S.-China Trade War And What’s It To Gold?

Monsoon Could Push Gold Price Higher As Rural Demand Picks Up. Where Is Gold Headed?

=====

In other news:

Deepening Trade Dispute Triggers Risk-Off Moves: Markets Wrap

BOE August Rate Increase in Question as U.K. Economy Falters

Crypto Celebrity McAfee Stops Touting ICOs, Citing ‘SEC Threats’

OPEC sees strong oil market, possible need for more output

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts