Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

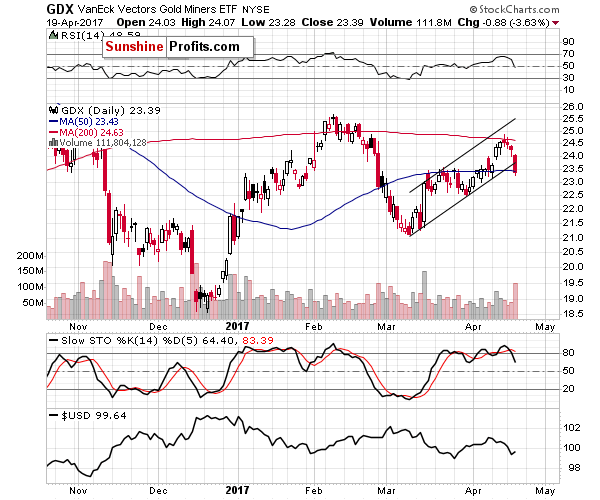

The precious metals market moved lower yesterday, but the decline was particularly visible in the case of the mining stocks. The GDX ETF broke through its rising support line and the session was accompanied by one of the highest volume levels that we’ve seen this year. Is the decline in the precious metals really starting?

That appears to be the case. Miners are not only underperforming, but they also show substantial weakness on their own due to the mentioned breakdown. Let’s take a closer look at the GDX chart (charts courtesy of http://stockcharts.com).

Mining stocks ended the session visibly below the rising support line, which suggests that it's just a beginning of a bigger move down. On the other hand, miners didn’t break below their 50-day moving average and they didn’t confirm the breakdown in terms of closing below the support line for 3 consecutive trading days. The implications are still bearish, though, due to the size of the volume, which is an important factor and could be viewed as a confirmation by itself.

The sell signal in the Stochastic indicator is quite visible now, which makes it more bearish than was the case yesterday.

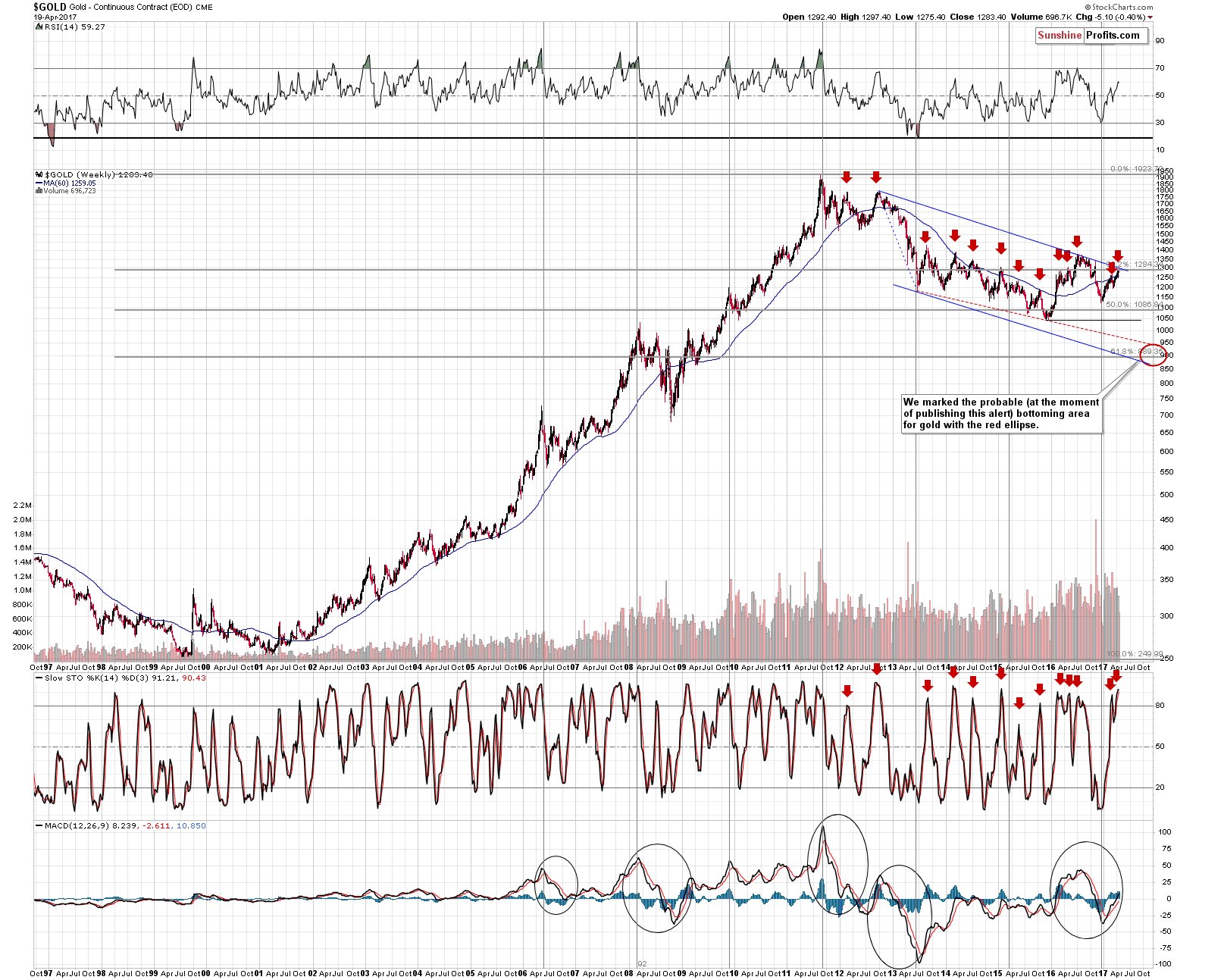

Yesterday’s decline caused gold to move back below the 38.2% Fibonacci retracement level based on the entire 1999 – 2011 bull market and it’s clear that gold didn’t break above the declining, long-term resistance line (marked in blue).

Interestingly, this line is also visible if the above chart would be drawn using a linear scale instead of a logarithmic one and in this case the line starts at the 2011 top. This makes the resistance line even stronger and unlikely to be successfully broken. Generally, a logarithmic scale is usually more useful, but the fact that both approaches provide strong resistance only makes it stronger.

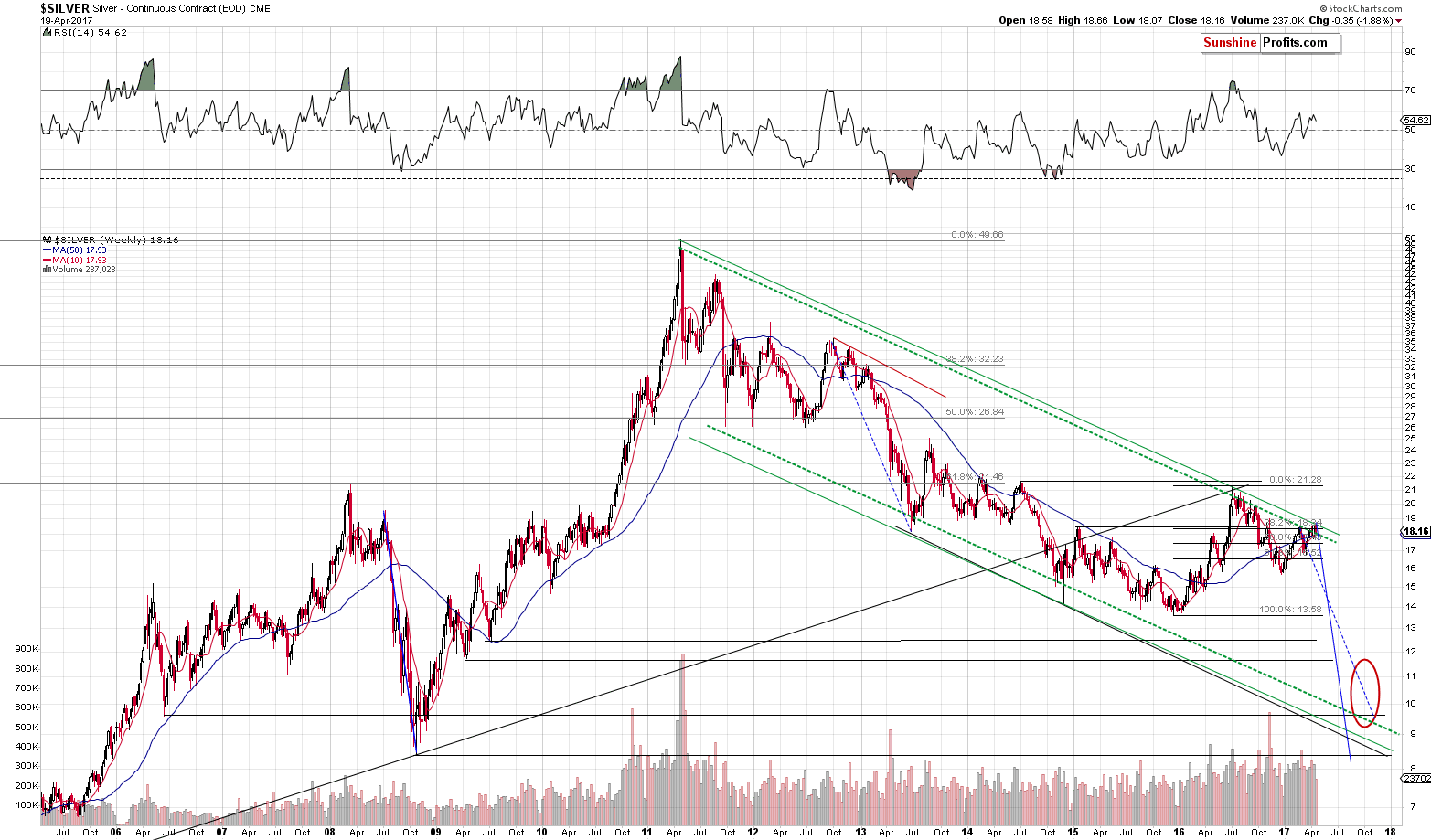

In the April 15 Alert, we wrote the following about silver:

Silver moved and closed the week above the declining long-term resistance line. We previously wrote that this resistance line was very important, so the question is if the breakout changes anything. In our view, this is generally not the case, as the week was not quite representative – there was no trading on Friday. Still, if gold was to move higher (to $1,310 or so), then the above chart provides us with an analogous upside target – the upper, long-term green line (based on the same major tops as the lower line, but drawn through intra-day tops). It’s currently at about $18.70 – just 10 cents above this week’s high. So, the upside is quite limited.

Silver has indeed moved lower after it reached the upper of the declining, long-term, green resistance lines. The lower one (based on weekly closes) is currently at about $18, so if silver manages to close the week below it (which seems likely), the previous breakout will be invalidated and it would likely trigger another powerful decline. For now, the fact that the upper resistance line held, continues to have bearish implications – the upside is very limited and the downside is huge.

Summing up, the direct change that we saw in the precious metals market this week is the breakdown below the rising short-term support line in the case of mining stocks. Since it was accompanied by huge volume, the implications are clearly bearish even though the breakdown wasn’t confirmed in terms of 3 consecutive closing prices. This, plus other factors discussed previously support the expectation of lower precious metals prices in the coming weeks.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: exit-profit-take level: $1,063; stop-loss: $1,317; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $44.57

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $104.26; stop-loss: $10.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Last week, two important U.S. economic reports were released. What do they imply for the gold market?

March Inflation, Retail Sales and Gold

S&P 500 index lost 0.2% on Wednesday, following relatively strong intraday move up. Will it extend its short-term consolidation even further? Is holding short position still justified?

Stock Trading Alert: More Uncertainty As Investors Await Quarterly Earnings Releases

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold steady on safe-haven demand amid N.Korea, France concerns

Asia Gold- Indian jewellers stock up with eye on festive demand

Gold to end 2017 lower at US$1,200/oz: OCBC forecaster

Gold's Top Forecaster Says Prices May Hit $1,350 by Year-End

Digging Miles Underground for Mere Specks of Gold

=====

In other news:

Dollar Declines as European Stocks Erase Advance: Markets Wrap

Hard Dose of Reality Hits Anti-Brexit Campaigners

ECB Officials Inch Toward the Day They Discuss Stimulus Exit

North Korea warns of 'super-mighty preemptive strike' as U.S. plans next move

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts