Monday was a special day in the oil market, to say the least. First ever, if you will. But what does the turmoil imply for the gold market?

Oil Prices Plunge Below Zero

By now, we're all used to negative real interest rates and even negative nominal interest rates or bond yields. But on Monday, it turned out that even oil prices could go negative! Unfortunately, it does not mean that we now get paid on filling up the gas tank. Nor it implies that the economic laws ceased to operate while the world ends. As Nadia Simmons explained in the Oil Trading Alert, the negative oil prices only meant that the nearest futures contract for the WTI was trading below 0, as there is oversupply right now that resulted in the storage shortage for oil. So, investors tried to sell their futures before oil would be delivered to them with nowhere to store it.

I am not an oil expert - so I encourage you to read Oil Trading Alerts - but from the fundamental point of view, oil prices should rebound somewhat (not necessarily to the pre-pandemic level) in the long run. After all, the global demand for oil declined about 30 percent, while the OPEC and Russia agreed to cut production by about 10 percent. But the price of oil declined as much as two thirds! And, as the old economic adage says, the cure for low prices of a commodity (so it does not work for gold which behaves more like a currency) are low prices - producers will have to cut production at some point in the future (or they go bankrupt, also decreasing the supply), which should restore the equilibrium in the market.

Gold To Oil Ratio Surges

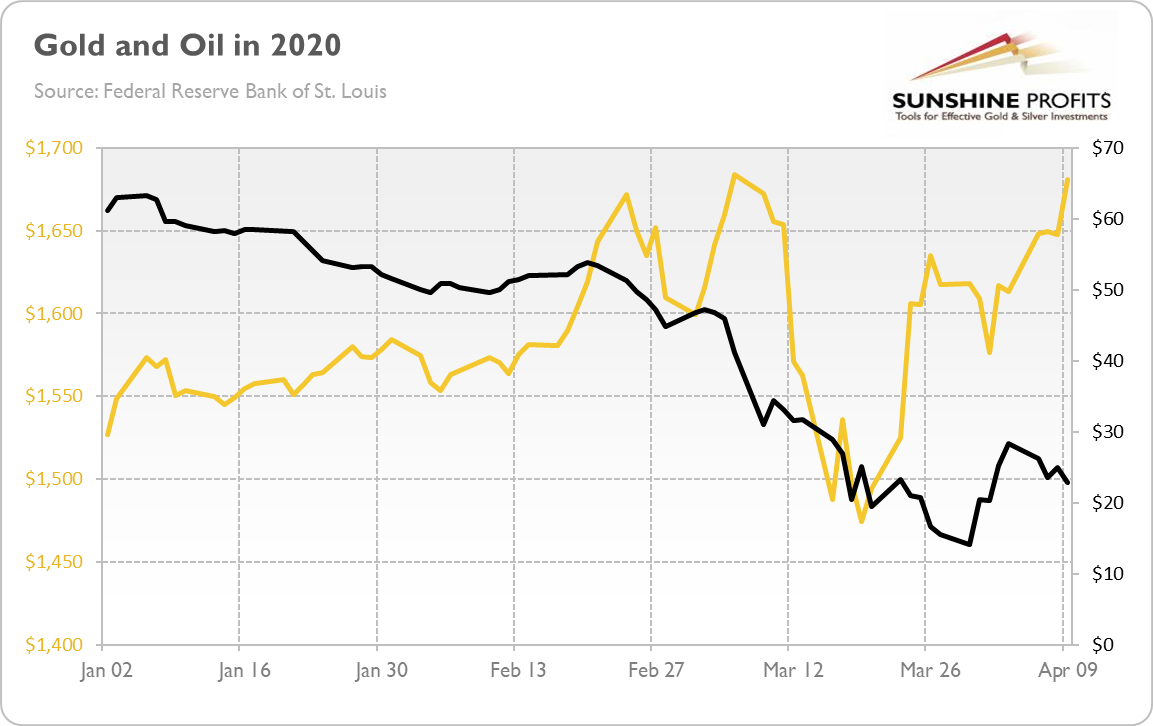

What is really interesting for us, is the relationship between the gold and oil prices. Unfortunately we have only data up to April 9, but you'll get the point anyway. As the chart below shows, we are observing right now a divergence between these two commodities. Although oil prices plunged by two third, the price of gold actually increased in the aftermath of the coronavirus pandemic.

Chart 1: Gold prices (yellow line, left axis, London PM Fix) and the crude oil prices (black line, right axis, WTI) from January 2 to April 9, 2020

Well, it should not be surprising - after all, gold is not merely a commodity, but also a monetary metal and the safe-haven currency. So, in times of economic crises, when global demand plunges while the risk aversion soars, gold outperforms industrial commodities. However, the scale of the divergence is striking.

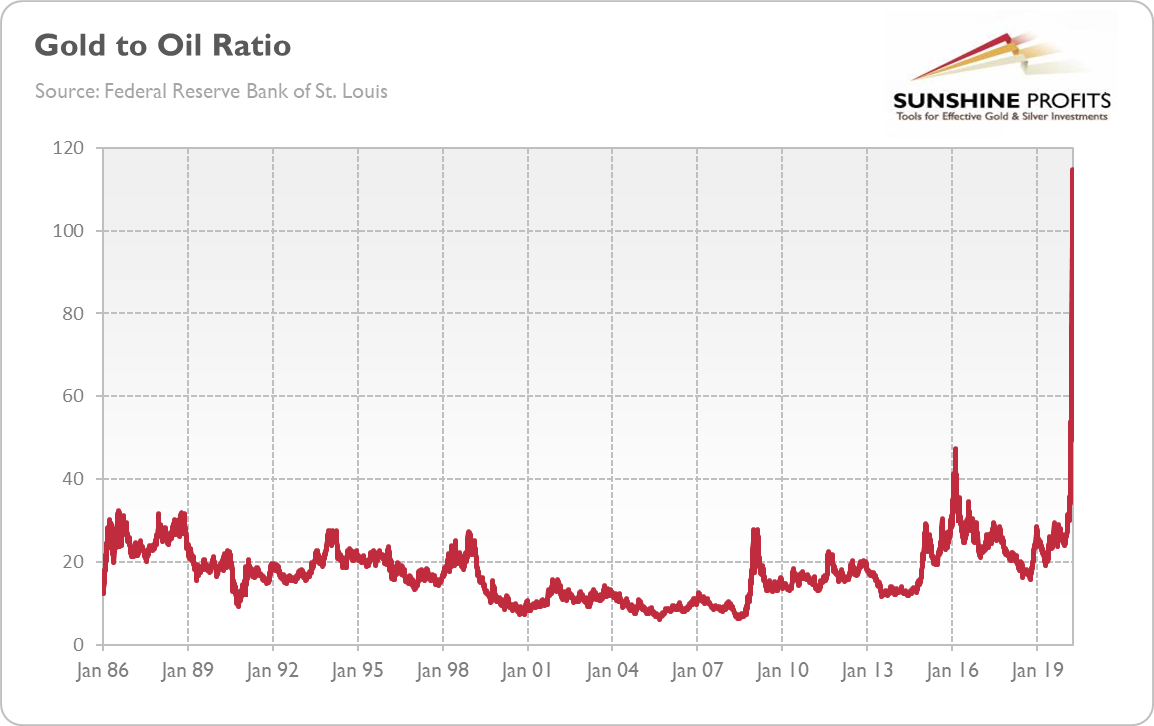

Let's take a look at the chart below, which shows the gold to oil ratio. As one can see, the ratio between these two prices soared, increasing above 100 in March. You cannot notice this on the chart, but the ratio is now above 70, still much more than the historical average (we see similar trends in the ratio between gold and other precious metals). Gold may obviously go down in the short term, especially if we see a selloff in the stock market, but we think that oil prices would rather rise in the longer run. They can increase, of course, in tandem with gold prices, although at a different pace.

Chart 2: Gold to oil price ratio from January 1986 to April 2020

S&P 500 to Oil Ratio Also Soars

What is also interesting, is the current divergence between the oil market and the stock market. As the chart below shows, the ratio between black gold and the S&P 500 has soared recently.

Chart 3: S&P 500 to Oil Ratio from April 2015 to April 2020

This is really striking. Oil prices collapsed because global demand plunged. But why didn't the stock market fall as much? If the stock market is forward-looking, why the oil market is not looking through the valley as well? I know that both markets have their specific features (we deal with the key US stock index in Stock Trading Alerts) and that there are many companies in the S&P 500 not as sensitive to the same factors as the oil price is. But the observed divergence may suggest that not only the oil price should rebound in the long run (if we assume that the ratio is likely to reverse to the mean, which does not have to happen), but also that the stock market may eventually decline further.

After all, the stocks of oil producers should suffer after the carnage in the oil market. In particular, the US shale oil industry may be hit. It should strengthen gold as a safe-haven asset and as a hedge against equities, although the selloff in the stock market may pull gold down initially, as we observed it in March.

Implications for Gold

What does it all mean for the gold market? Well, the turmoil in the oil market could add the volatility in the stock market. It fell on Monday and Tuesday, but it remains to be seen whether we will see further declines on the way. Although there is sometimes correlation between oil prices and gold prices (due to their sensitivity to inflation), this time we see a clear divergence, as gold behaves like the safe-haven currency, not the commodity. There is also an intriguing divergence between the oil market and the stock market, which can be partially explained by the Powell's put, i.e., the Fed's ability to support the financial markets in times of turbulence. But, I have a good news for the gold bulls: the Fed can inflate financial assets, but it can't print gold, so eventually we should see higher gold prices.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.