Some people think that the pandemic is dying out and that its end will stop the bull market in gold. But these claims are not entirely true: the epidemic is not over globally, and gold fundamentals will remain positive even after the containment of the coronavirus.

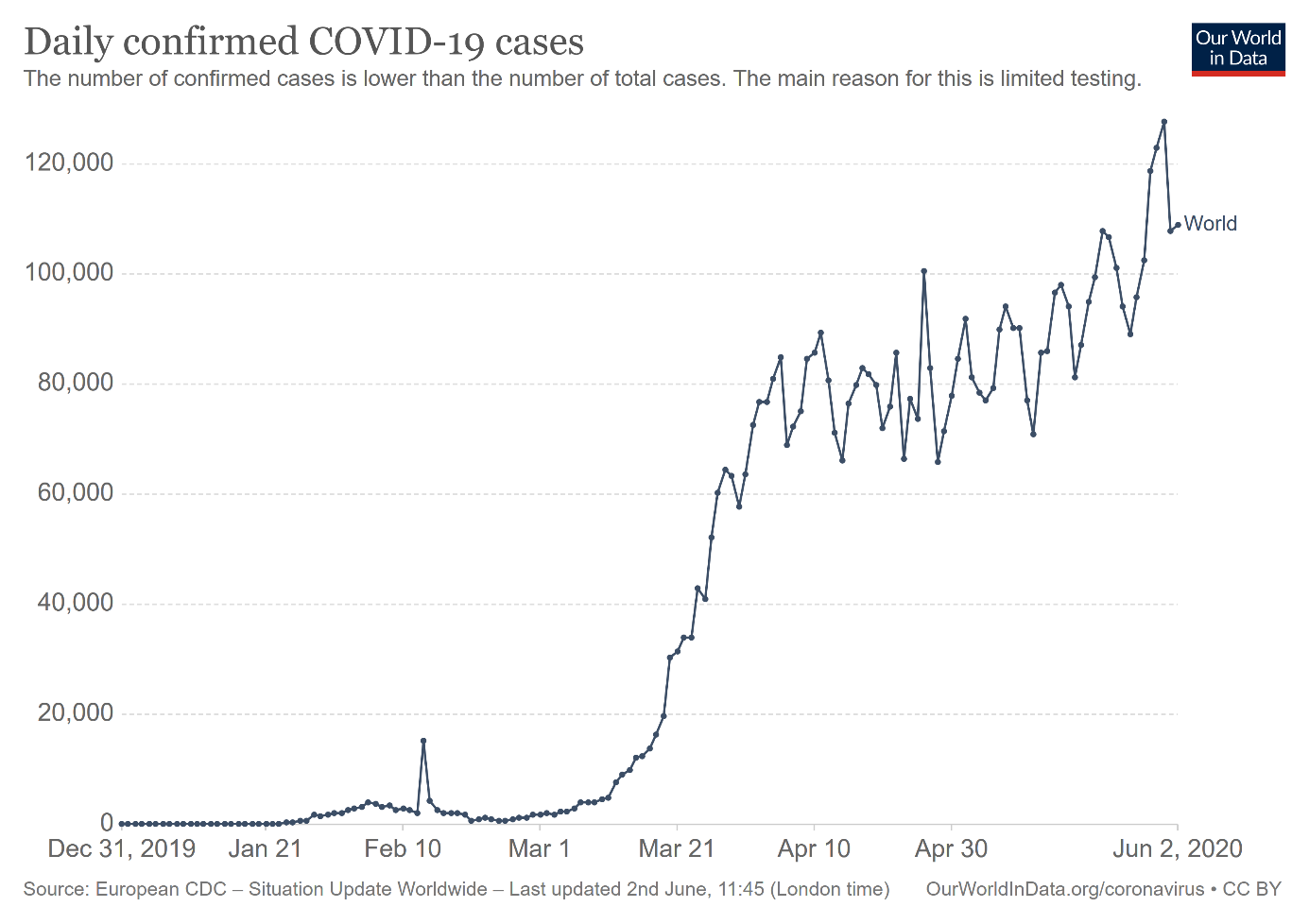

It seems that people are getting less worried about the COVID-19 epidemic. People go to pubs to drink beer with their friends, while the stock market is rallying. Meanwhile, the pandemic is far from over. Actually, the global number of new confirmed cases is constantly rising. On May 31, the WHO reported almost 128,000 cases, the most in a single day since the outbreak began, as the chart below shows.

It does not look like the end of the epidemic, does it? So why many people are relaxed, chilling on the beaches, while investors are so bullish? Are they blind to the drama happening right now?

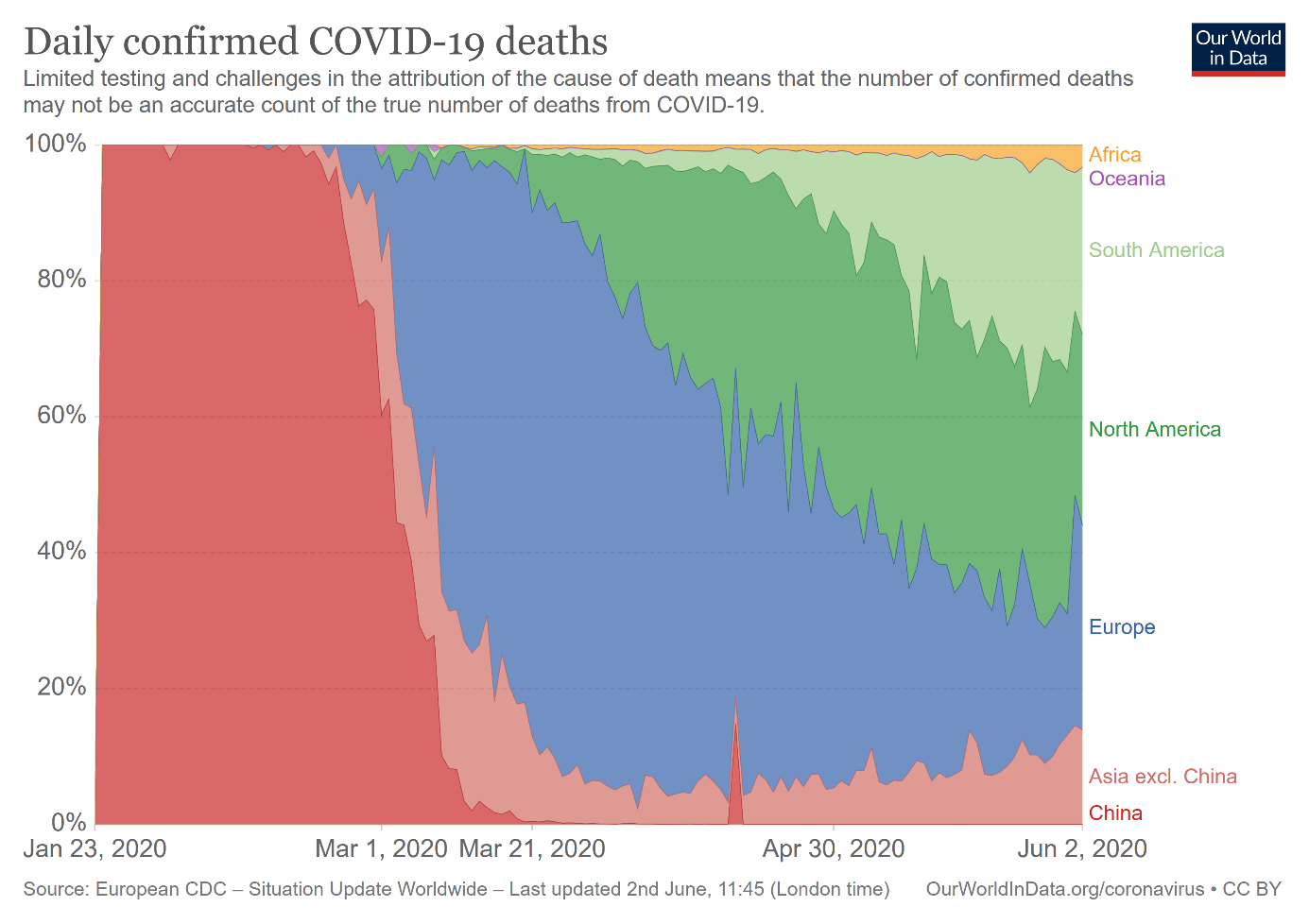

Well, not necessarily. You see, there is a significant geographical divergence. While many richer countries are emerging from lockdowns, the number of new coronavirus cases is rising in poorer countries. As the chart below shows, the share of daily cases in Europe and North America is declining versus South America, Africa and Asia.

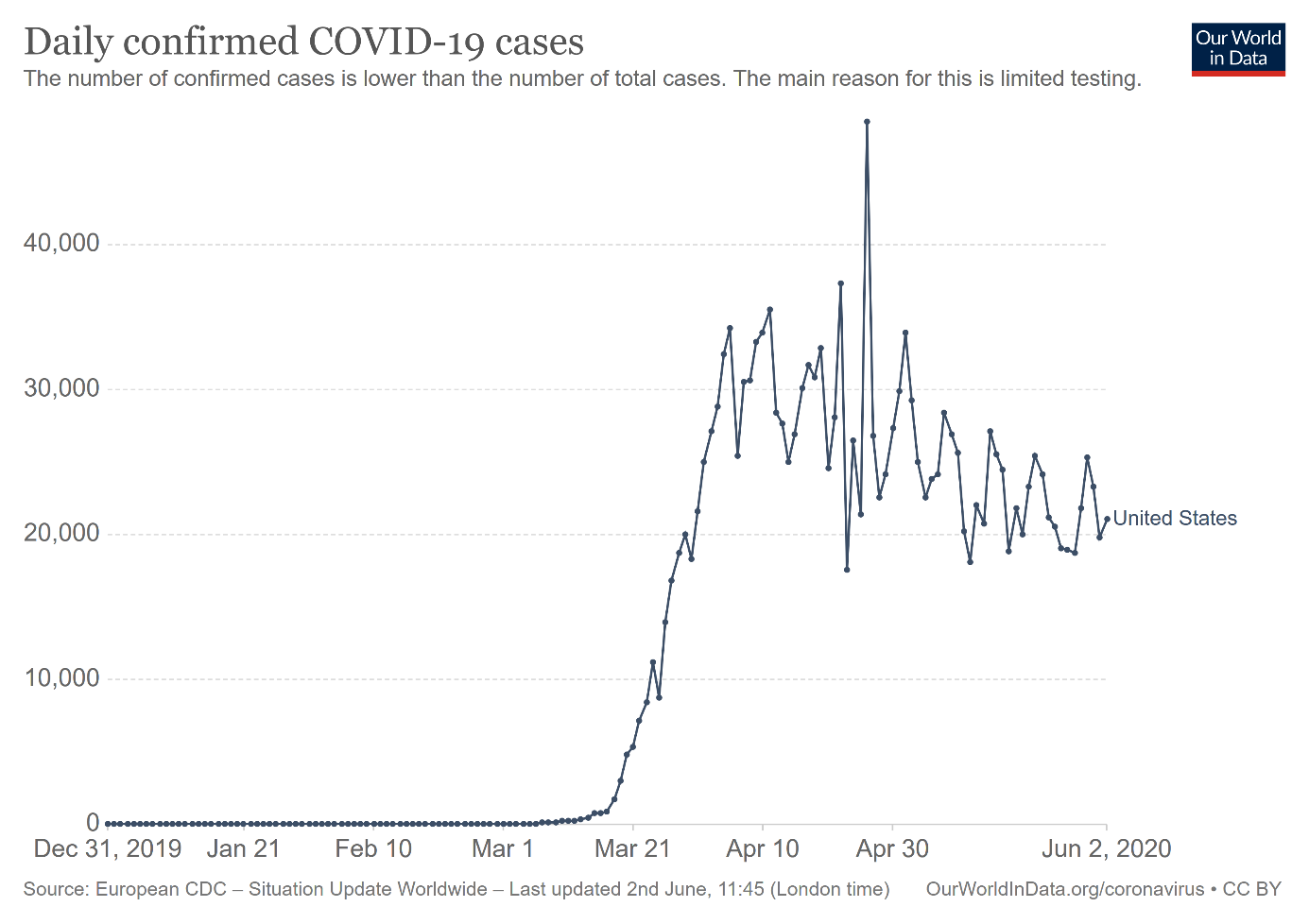

In particular, the chart below shows that situation in the US is normalizing. Not that the epidemic is over, but the peak is behind Americans and the trend is downward.

We know that it sounds brutal, but these are the facts. The stock market investors focus on what is happening in Western countries (and China, which is the factory hub for the West, and one of the biggest economies in the world, if not the biggest), shrugging off the problems of poorer countries. And the fact is that the coronavirus is gradually becoming the problem of developing economies. This is because the pandemic initially moved from China to Europe and then to North America - and only later to less developed countries. Another issue is that the Western countries were better prepared to cope with a pandemic than many poorer countries, so they are slowly containing the pandemic (its first wave at least).

The declining number of confirmed daily cases plus easing restrictions plus hopes for additional economic stimulus triggered expectations for swift recovery from a coronavirus crisis. The rebound is certain, but we would call for more caution. You see, the epidemic is not over, but even if it is, the economy is not likely to quickly return to the pre-pandemic level.

At the very beginning, many people were too complacent about the threat. Then, they overreacted and became too pessimistic. And, now, they can be too optimistic. After all, it's very difficult to live under lockdown and chronic stress for several weeks, so perhaps now some people must be relieved. We understand them, as we are also fed up with social distancing. But just because you close your eyes, it does not make you are invisible. The virus is still among us.

However, and luckily, the new coronavirus will not wipe out humanity and destroy the economy. But the pandemic and lockdown are not events that could be erased. They will leave scars and many businesses will not reopen.

Implications for Gold

What does it all mean for the global economy and the gold market? The pandemic is not over. Actually, it is getting worse as the rising number of infections in poorer countries shows. However, the epidemic is gradually being extinguished in the West. So, investors became more optimistic and started anticipating smooth sailing, although we still do not have a sufficient number of tests, or effective treatment, not to say a vaccine. Nor we have seen any signs of a V-shaped recovery.

When investors become more optimistic, they shift from safe-haven assets such as gold and turn into risky ones. This is a downside risk factor for the gold market. But such a transition could also soften the US dollar, supporting gold. Another supportive drivers are dovish monetary policy and loose fiscal policy, high public debts and negative real interest rates - importantly, these factors are not likely to go away anytime soon. So, gold fundamentals remain positive and they should support the gold price.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.