China and the U.S. have reached a preliminary agreement, which softens their trade war, while the landslide victory of Conservative Party in the UK parliamentary elections clears the path to Brexit. Given that downside risks for the global economy are now significantly lower, how much do investors still need gold?

UK Parliamentary Elections and Gold

On Thursday, the British people voted in another snap parliamentary election (the third such since 2015) called by Boris Johnson in October due to increasing parliamentary deadlock over Brexit. The Conservative Party won a landslide victory. The Tories got 43,6 percent of votes which translated into 365 seats. It means a net gain of 48 seats since 2017 elections. As a result, the Johnson's party won with a majority of 80 seats, the highest since 1987. The Scottish National Party also gained seats which can lead to the second referendum on Scotland's independence in the future. In contrast, the Labor Party performed disastrously, losing 60 seats, which was their worst result in more than 80 years. Jeremy Corbyn, the party's leader, has already said he will step down early next year.

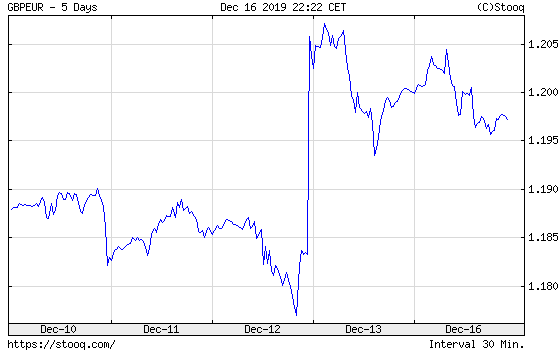

What is, however, the most important, is that the results empower the prime minister which promised to 'get Brexit done' by the end of January. It means that the odds of Bremain diminished, while the chances of a quick exit increased. You might have different opinions on Brexit, but the prolonged uncertainty was certainly harmful for the economy. Now, that uncertainty is removed and companies can implement long-term plans once again. This is why the pound has soared after the results were published, as the chart below shows. The markets were simply fed up with the uncertainty which was finally removed. And the relief came, then. Thus, the results are bad for safe havens such as gold.

Chart 1: GBP/EUR exchange rate from December 10 to December 16, 2019

Phase One Trade Deal and Gold

On Friday, President Trump announced that the US and China had agreed to phase one trade deal. The 25-percent tariffs on Chinese imports would remain but the 15-percent tariffs levied on other goods would be cut in half. Moreover, the additional, penalty tariffs set for December 15th will not be implemented. In exchange, China agreed to purchases of U.S. agricultural and other goods. The two sides will also start immediately negotiations on more contentious issues such as intellectual property, technology transfer, etc. Trump tweeted:

We have agreed to a very large Phase One Deal with China. They have agreed to many structural changes and massive purchases of Agricultural Product, Energy, and Manufactured Goods, plus much more. The 25% Tariffs will remain as is, with 7 1/2% put on much of the remainder. The Penalty Tariffs set for December 15th will not be charged because of the fact that we made the deal. We will begin negotiations on the Phase Two Deal immediately, rather than waiting until after the 2020 Election. This is an amazing deal for all. Thank you!

Of course, the agreement is just a phase one of the thorough deal and still a lot may happen on the way. So, we are not sure whether the announced success is a real game changer for the global economy. However, the benefits are indisputable. No further tariffs were added, and some of the September tariffs were reduced, while China has agreed to buy $200 billion more in U.S. goods and services over two years. From the fundamental point of view, the deal removed a key source of uncertainty for the global economy that hampered business investments and purchases of risky assets. Hence, the deal could revive the risk appetite among investors and make safe-haven assets, including gold, to struggle.

Implications for Gold

What a big change has happened in the last few days! Not so long ago, the global economy was suffered from the uncertainty stemming from Sino-American trade war and Brexit. These risks were so grave that the Fed decided to deliver a few interest rate cuts, just as an insurance (but do not count on hikes when there risks dissipated!). Everyone was talking about recession and gold prices soared, peaking in early September.

Fast forward to today, and the path looks way clearer now. Boris is determined to deliver Brexit quickly, maybe even in January. Meanwhile, across the pond, Trump stroke a phase one of the trade deal. There is still a long way to go, but the specter of the full-blown trade war is over. The impact of geopolitical events on the gold prices is often exaggerated, but the easing of concerns about the two major sources of uncertainty for the global economy should revive the risk appetite, hitting gold and other safe-haven assets.

However, the yellow metal has shrugged off the last week's developments so far, which is good news, as one can see in the chart below. So, maybe, the price of gold will not adjust downward after the big news from Friday. Or it could even increase, given historically strong January gold performance.

Chart 2: Gold prices from December 13 to December 16, 2019

Having said this, the reduced risk aversion should fundamentally support the stock market at the expense of precious metals market. We will be watching carefully how the situation evolves, stay tuned!

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.