Powell has recently came up with the metaphor of wandering in the darkness. Will golden sunshine brighten the dark?

I Am the Fed Chair and I Know Nothing

On November 14th, Powell discussed global perspectives in Dallas Fed with its President, Robert Kaplan. He characterized the Fed’s stance, providing an interesting analogy:

A non-economic example [of the approach adopted by the Fed] would be you’re walking through a room full of furniture and the lights go off. What do you do? You slow down. You stop, probably, and feel your way. So it’s not different with policy.

Has Powell just admitted that the most important central bank in the world is basically straying in the dark? That it is like a lost kid in a fog, rambling idly without a fixed direction or aim? Last year, Yellen described low US inflation as mystery. Now, Powell moved further and confessed that he knew nothing. It’s a bit disturbing, but maybe the Fed Chair is just a disciple of Socrates who understands that attaining wisdom is to admit own ignorance. Yeah, maybe.

Am I Dove, Now?

Jokes aside. Has Powell tilted toward the dovish camp? Well, he has definitely softened his tone recently. As we reported last week, Powell suggested that the federal funds rate might be closer to the neutral level that he thought previously.

However, we have wait for the economic projections – the FOMC members will update their rate forecasts in the so-called dot-plot at their meeting in December 18-19. As a reminder, the median forecast in September was for three increases of 25 basis points each in 2019. But the Committee was far from unanimity. The birds tweet that the voting members were actually evenly split among two, three and four hikes next year.

Will some hawks transform into doves? It’s possible, but not likely. What is more likely is that some hawks will transform into centrists. But even if all members who were voting for four hikes will start to opt for only three raises, the median number of proposed hikes will not change. Two more officials would have to argue for only two hikes to change the picture.

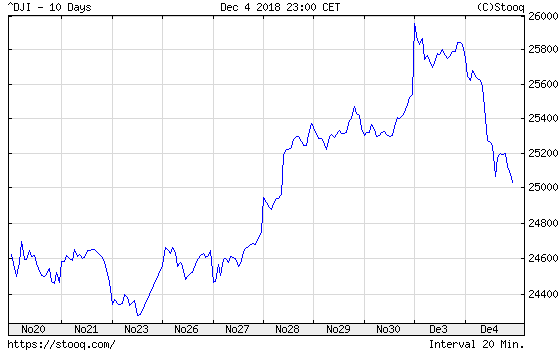

Will that happen? As Richard Clarida and Mary Dole add their dots for the first time, the plot may change, indeed. Trump exert some pressure on Powell & Company. The US housing market has recently slowed down, possibly in reaction to rising interest rates. The stock market tumbled again this week, with Dow Jones falling sharply (see the chart below), after the arrest of the CFO of Huawei. So, the Fed officials may soften their views.

Chart 1: Dow Jones over the last ten days.

However, the macroeconomic picture still supports the hawkish case. Inflation is at the 2-percent target. And the recent Beige Book reported that wage growth tended to the higher side of a modest to moderate pace in most Fed’s districts. Rising wages could lead the Fed officials more worried about the future inflation. Moreover, the labor market is beyond several estimates of full employment and companies complain on the shortage of qualified workers. In such environment, the FOMC members may be not comfortable turning more dovish.

Implications for Gold

What does it all mean for the gold market? Well, it depends on what will emerge from the darkness through which Powell and his colleagues try to maneuver. We believe that the US economy will continue its expansion in 2019, so the Fed will not drop its policy of gradual tightening of monetary policy. We expect that the status quo will remain with us, so gold should stay within its sideway trend.

However, when it reaches its bottom, it could start to rally later next year, as the macroeconomic picture could become more friendly for the precious metals. Even when the Fed will hike interest rates three times in 2019, it will mean a slowdown in the pace of normalization. So, tightening is exhausting its potential. At the same time, fiscal accommodation should run low, which imply more neutral policy mix. It should mean somewhat less strong US dollar, which would support the yellow metal in the future.

We will write more about our 2019 fundamental forecast for the gold market in the January edition of the Market Overview. After the FOMC meeting in December we will know much more. But one thing is already certain: when the dark falls, what you need is sunshine!

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview