Not much happened yesterday on the precious metals market, but the situation became more bearish anyway. Why? Because the factors that impact gold, silver, and mining stocks don’t come only from the PM market itself. In today’s globalized economy, no market can move entirely on its own and we see the same thing in gold and the rest of the PM sector. The two key actions that we need to take into account today is what happened in the currency markets. The USD Index’s breakout to new 2018 highs is one thing, and the second thing is the strong sign that gold’s relative strength to the former is likely over. Taken together they paint a coherent outlook for the precious metals sector. And it’s terrible.

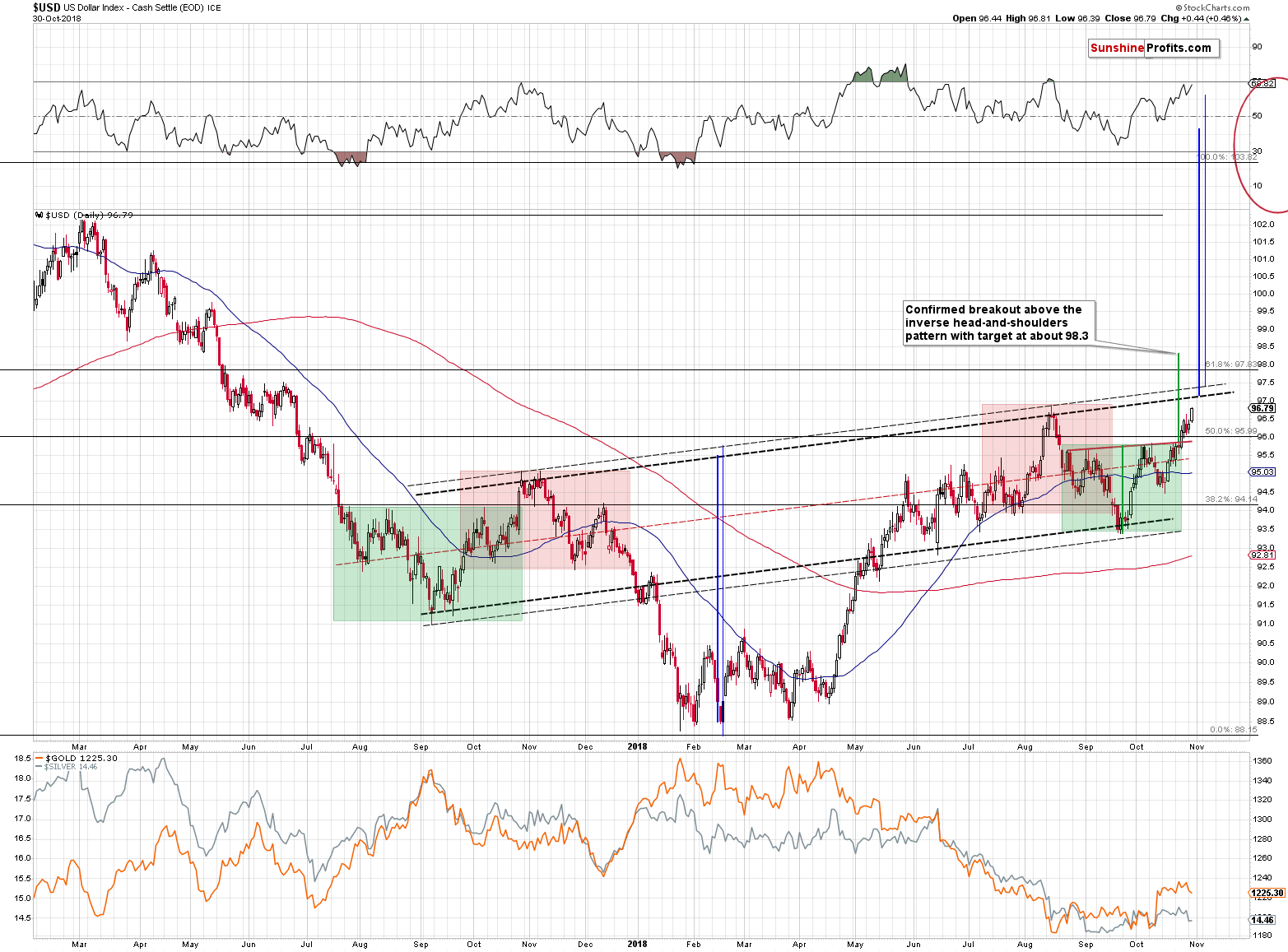

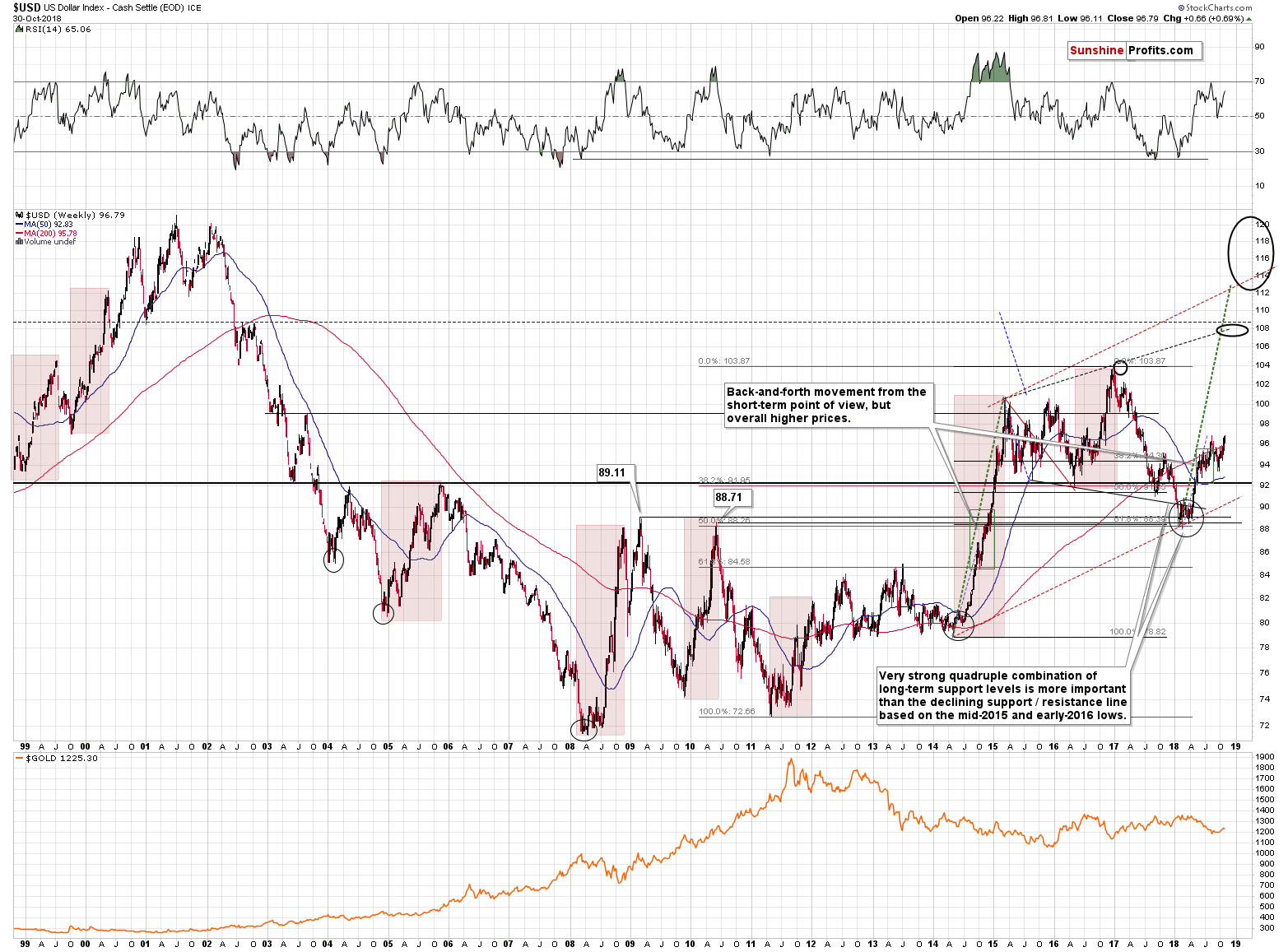

First and foremost: we saw the breakout to new 2018 highs in the USD Index in terms of the closing prices.

USD’s Bullish Outlook

There was no breakout in terms of intraday highs, but there was a clear one in terms of the daily closes. Yesterday’s close of 96.79 is definitely higher than the previous 2018 high of 96.61 that we saw on August 14th. The technical developments based on closing prices tend to be more important than the ones based on the intraday prices, so the bullish implications are already present.

Naturally, they will be more bullish once the breakout is confirmed, but the odds are that it will be confirmed. And there are three reasons for it.

The first reason is the recent verification of the breakout above the local (marked with green) inverse head-and-shoulders pattern. The target based on this formation is approximately 98.3.

The second reason is the reflective nature of the USD Index that seems to be turning into the powerful long-term inverse head-and-shoulders pattern. The latter is not completed yet, so it has no implications on its own, but the reflective nature of the recent movement does. To be clear, the October / November 2017 top is like the August 2018 top as they both took form of head-and-shoulders tops and we marked them with red. The outside shoulders of the top above-mentioned formations (left in 2017 and right in 2018) were the inside shoulders of the inverse head-and-shoulders patterns. We marked them with green.

As we wrote earlier, the current inverse head-and-shoulders pattern has no direct implications yet as the price has not yet broken above its neck level, let alone confirmed such breakout. But, in light of the striking similarity between the 2017 decline and this year’s upswing, it’s likely that this formation will be completed.

The third reason is the long-term analogy to the previous big upswings.

This year’s rally is still similar to what we saw in 2008, 2010 and to the 2014-2015 upswing. The most recent consolidation was (given yesterday’s breakout it appears to be completed) bigger, but still similar to the one that we saw in 2010. Please note that based on the above chart, the USD Index is likely to move above the 2017 high, perhaps significantly so – to the 108 level, or even higher.

Taking all three points into account, the next few weeks and months look very promising for the US currency.

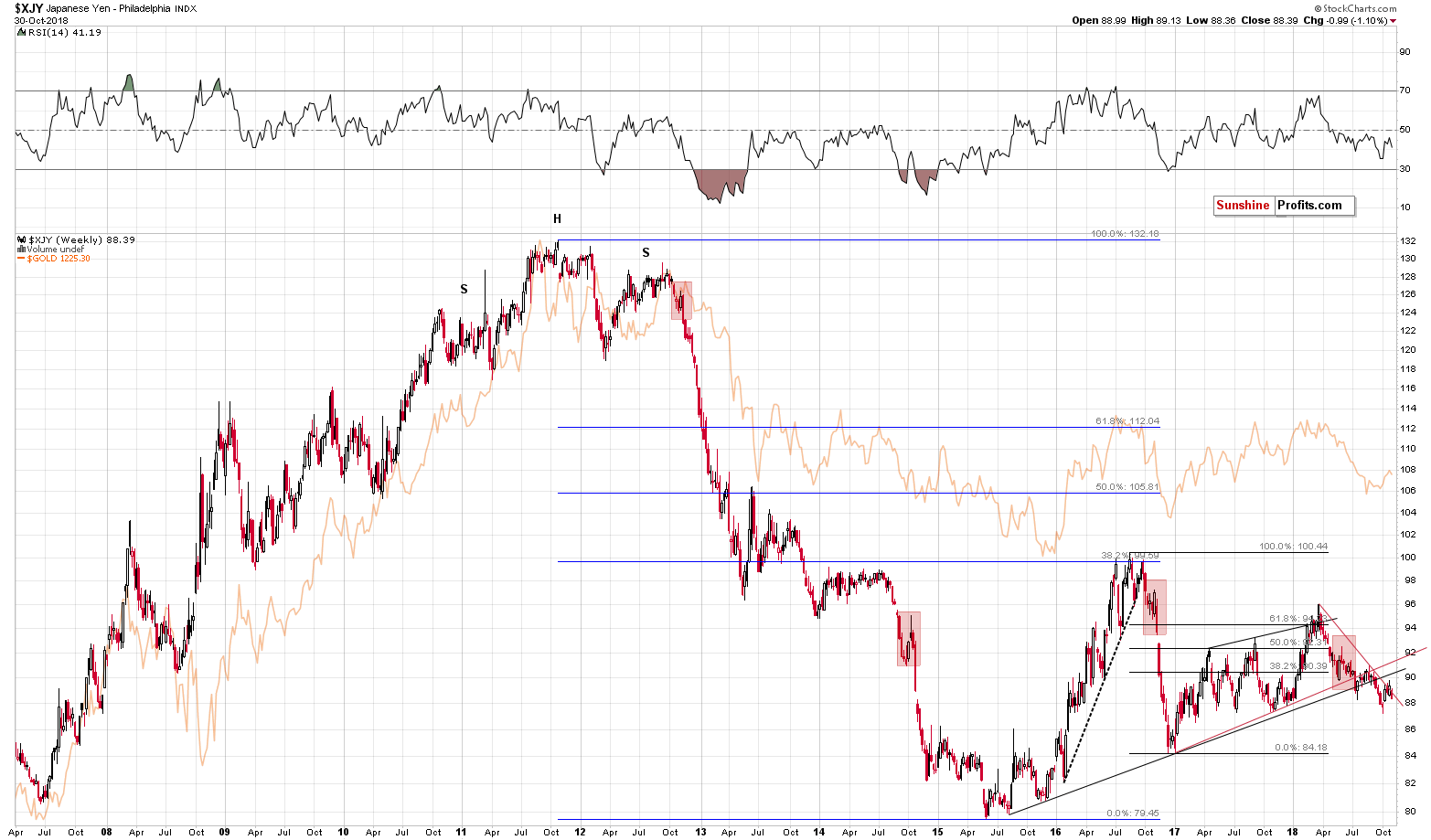

We can’t say the same about the Japanese currency, though. At least not with relation to the USD.

Yen’s Failed Breakout

The Japanese yen moved a bit higher after confirming the breakdown below the key rising support line based on the 2015 and 2016 lows, and even briefly moved above the declining red resistance line. This move was quickly invalidated, and the outlook is clearly bearish.

Why do we mention this with regard to the precious metals market? Because the yen has been particularly strongly connected with gold’s performance. Gold’s moves may not always be in perfect tune with the ones of the yen and at times one market leads the other, but overall the link between them is very strong and very important.

With the outlook bearish for the yen and very bullish for the USD Index, the implications for the precious metals sector are very bearish.

And what about the euro and gold?

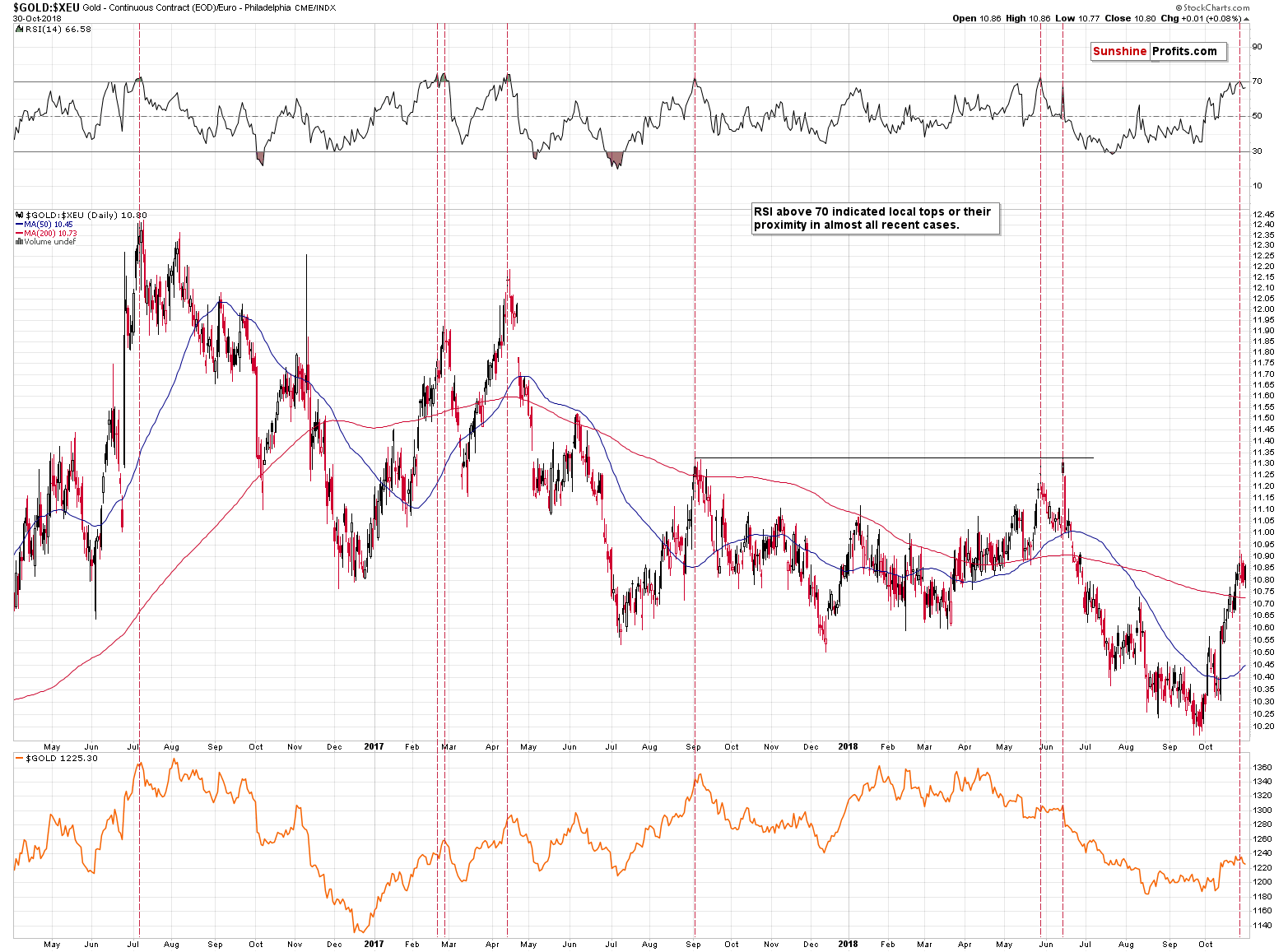

Gold’s European Signal

Looking at the gold price in terms of the euro provides us with a very effective sell signal. In practically all cases when the RSI moved above 70, it meant that the local top is in or about to be in (marked with vertical red lines on the above chart). That’s exactly what we saw a few days ago and the implications are bearish.

This means that while recently gold remained relatively strong in light of the increasing values of the USD Index, this kind of performance is not likely to continue. Conversely, gold is likely to underperform relative to the USD Index and it seems that we are seeing one of the confirmations in today’s pre-market trading. Gold and silver are down, while the USD Index is basically unchanged.

The above, combined with the very bullish outlook for the USD Index, makes the outlook particularly bearish for gold in the following weeks.

Consequently, while this week’s decline in gold was quite small so far, it doesn’t mean that it will stay this way for much longer. The trend regarding gold’s strength of reaction to USD movement has most likely already reversed and we can expect significant declines very soon.

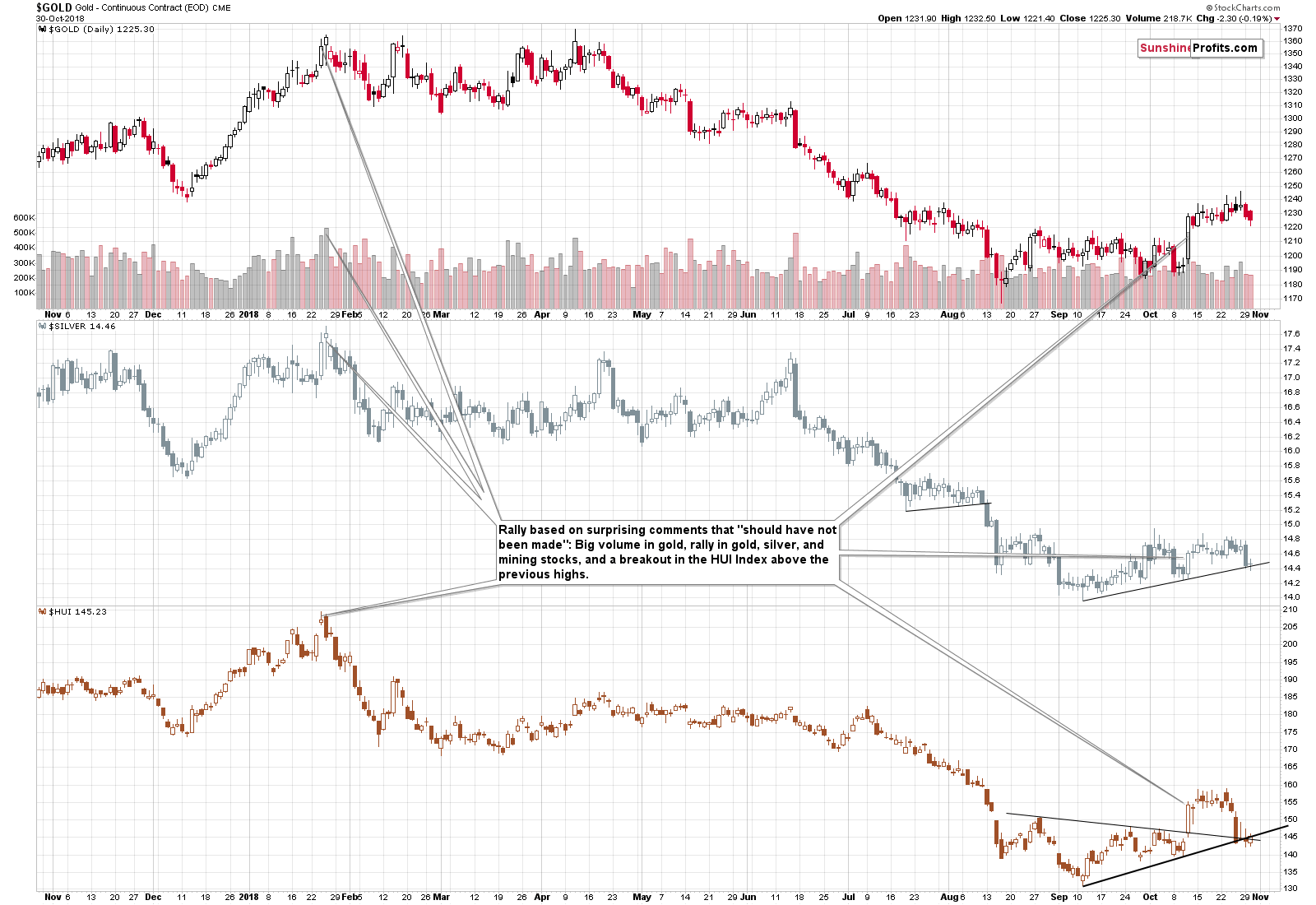

Gold stocks moved a bit higher yesterday, while gold moved lower, which may appear to be a bullish sign, but it’s much too early to say so. Miners were the first to decline in the recent days, so it simply seems that gold’s reaction was delayed. It’s within the definition of what’s normal at this time and doesn’t appear to be a bullish divergence in gold.

Before summarizing, let’s take a closer look at the silver market.

Silver Short-term Analogy

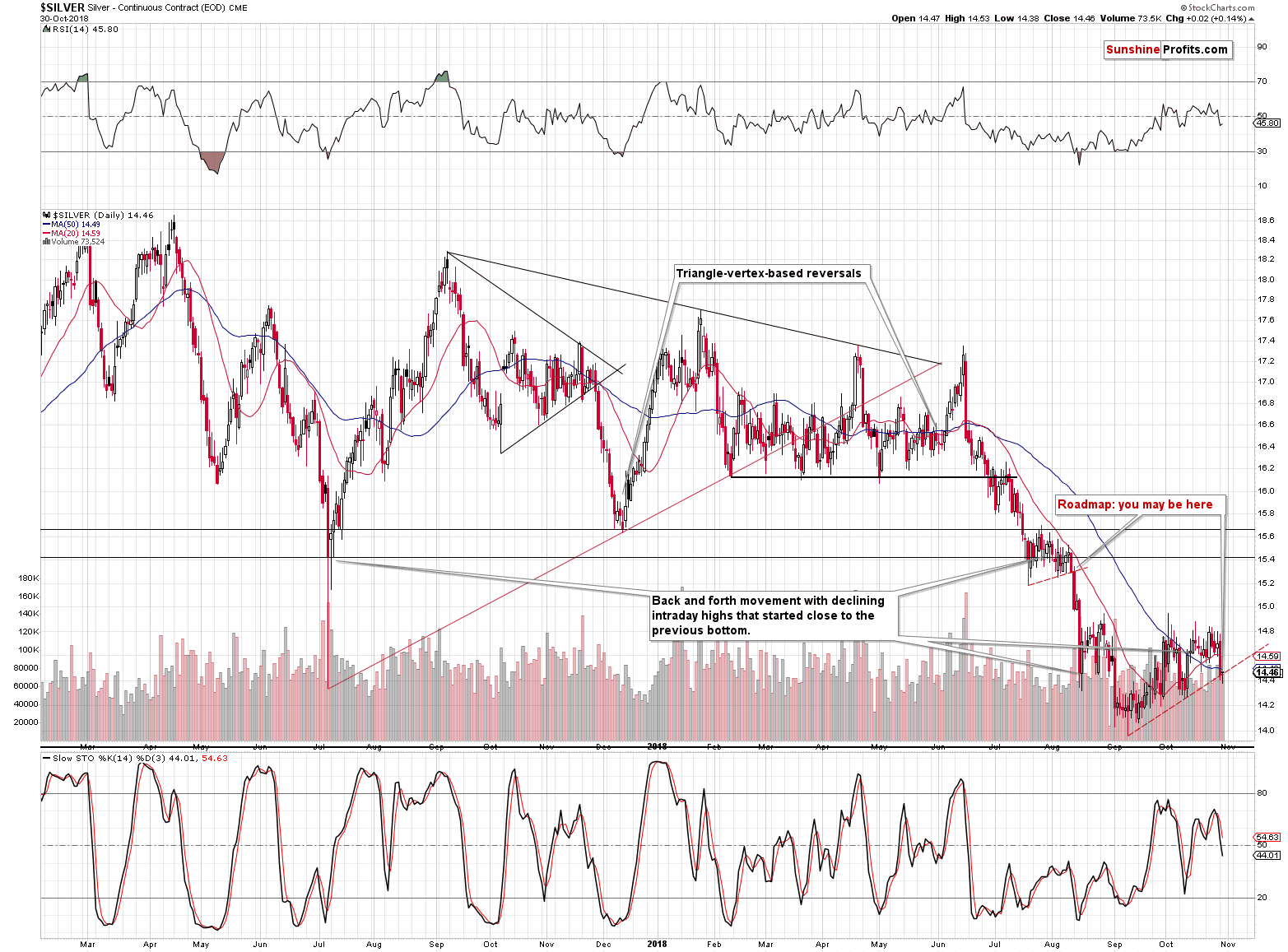

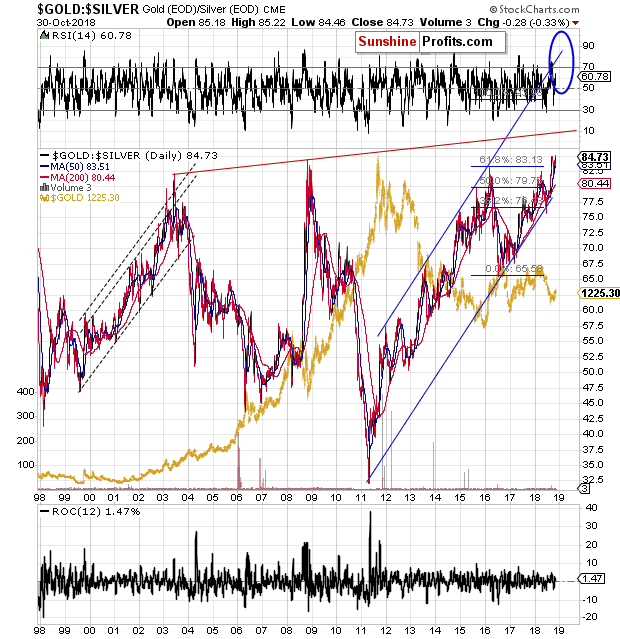

Silver is leading gold in the decline as well, but it’s a normal course of action given the situation in the gold to silver ratio.

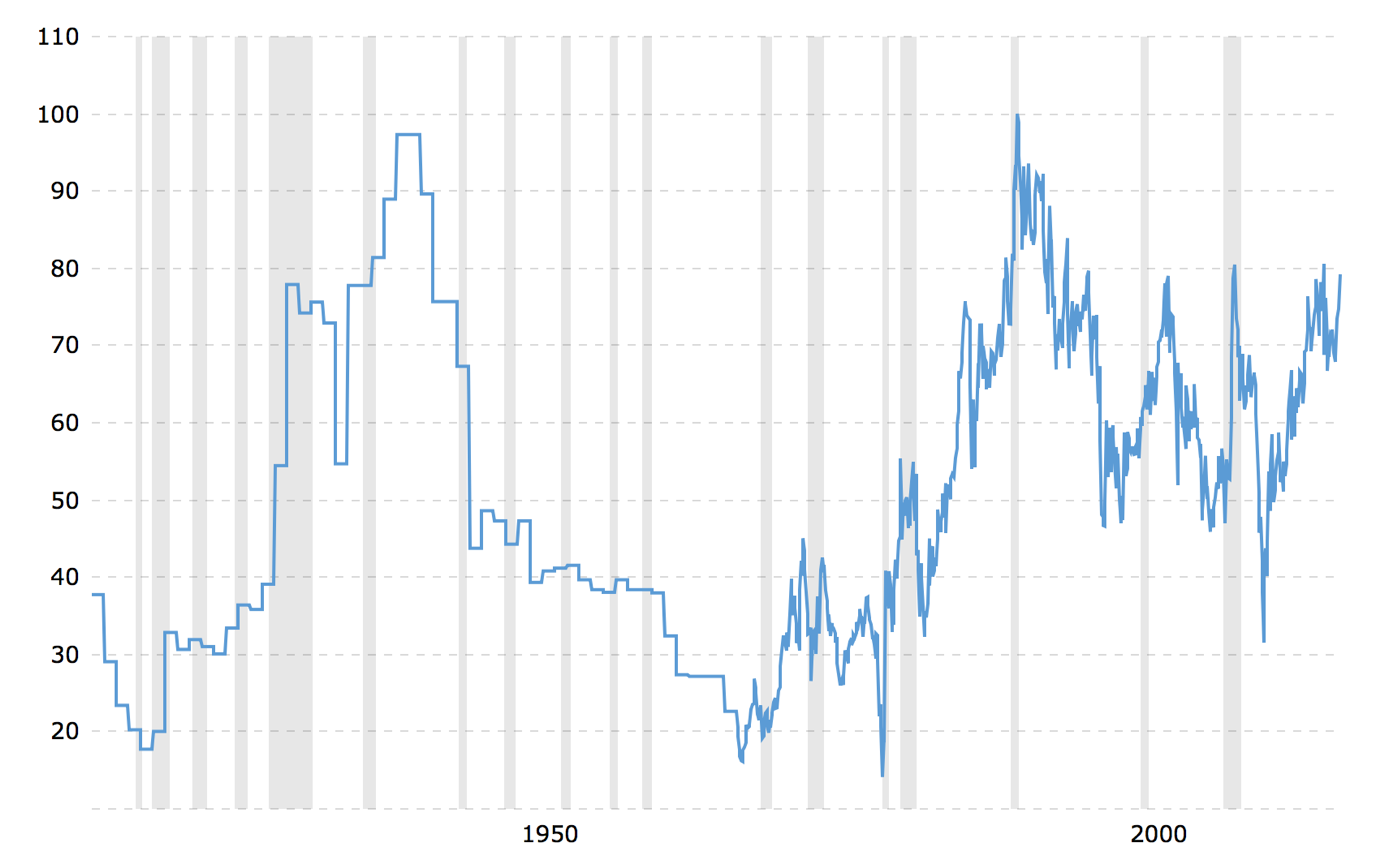

The ratio moved above the recent highs and it’s most likely on its way to its true long-term highs at about 100. The above chart is not long-term enough to feature those highs, but the one below is.

The real long-term target is at about 100 – this level stopped the huge rallies in the ratio in two key cases in the past, which makes it a natural target for the current rally (note: the above chart is not based on the most recent prices – in reality the ratio is already above the 2003 and 2008 highs).

The 100 target is also very important from the psychological point of view. The round numbers tend to work very well as support and resistance levels simply because a lot of people tend to notice them. “Silver now 100x as expensive as gold” would be an appealing headline, while “Silver now at 87.42x as expensive as gold” is not.

Moving back to silver’s more short-term chart, please note that the white metal has been recently moving back and forth with lower intraday highs. This seems like nothing special, until you notice that almost exactly the same thing happened in late July and early August. Right before the sharp $1+ decline.

And it’s not only the shape that’s alike. We can see similarity also in terms of the price level around which both consolidations took place. It was a major bottom in terms of the daily closing prices. In July and August silver moved back and forth around the July 2017 bottom. In this case, silver is moving around the mid-August bottom.

Moreover, this time, silver is consolidating after breaking below a very important long-term support line.

If the similarity to the July – August is to continue (and that’s likely), then we may have just seen the pre-slide move. Please compare where silver closed on Monday and yesterday and where it closed on August 10th. In both cases that was a move to the rising support line that was based on the previous short-term lows. If the analogy is to continue, we get a very bearish silver price prediction. Namely, silver is likely to decline significantly shortly – perhaps even today.

Still, please keep in mind that even a few-day-long delay in the powerful slide is not something that would invalidate the above analogy, because the sideways trading pattern that we saw in July and August was shorter than the current one. A pattern that took longer to form can have a longer pause before the final breakdown from it – it’s normal. Consequently, just because we haven’t seen the big slide yesterday, it doesn’t mean that one isn’t coming very soon. It most likely is just around the corner.

Summary

Summing up, there are multiple factors in place that point to much lower precious metals and mining stock prices in the coming days and weeks and it seems that the recent strong performance of gold relative to the USD Index is over. The outlook for the precious metals sector is very bearish. Gold is still likely to rally to $6,000 or so, but not before declining significantly first.

On a side note, before calling us perma-bears, please note that we were bullish (in terms of long-term investments) on precious metals for years – until April 2013. We’re looking for the true bottom in the precious metals sector, not because we’re its or gold investors’ enemy. Conversely, we’re that true friend that tells you if something’s not right, even if it may be unpleasant to hear.

Naturally, the above is up-to-date at the moment of publishing it and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis (including the intraday ones, when things get hot), we invite you to subscribe to our Gold & Silver Trading Alerts.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts