The bears have awakened. Dow dropped 3.6 percent. Are bears friends of gold?

What Happened?

Yesterday, U.S stocks experienced their worst performance since February. The Dow Jones closed down 831 points, or 3.6 percent. It was its second worst day of the year, as one can see in the chart below.

Chart 1: Dow Jones over the last twelve months.

The bears did not spear the S&P500. The index plunged 3.2 percent, marking its biggest daily decline since February, as the next chart clearly shows.

Chart 2: S&P500 over the last twelve months.

Importantly, the weakness did not start yesterday. The S&P500 experienced a five-day losing streak, the longest since November 2016. And in October, the index is down more than 4.4 percent.

Why It Happened?

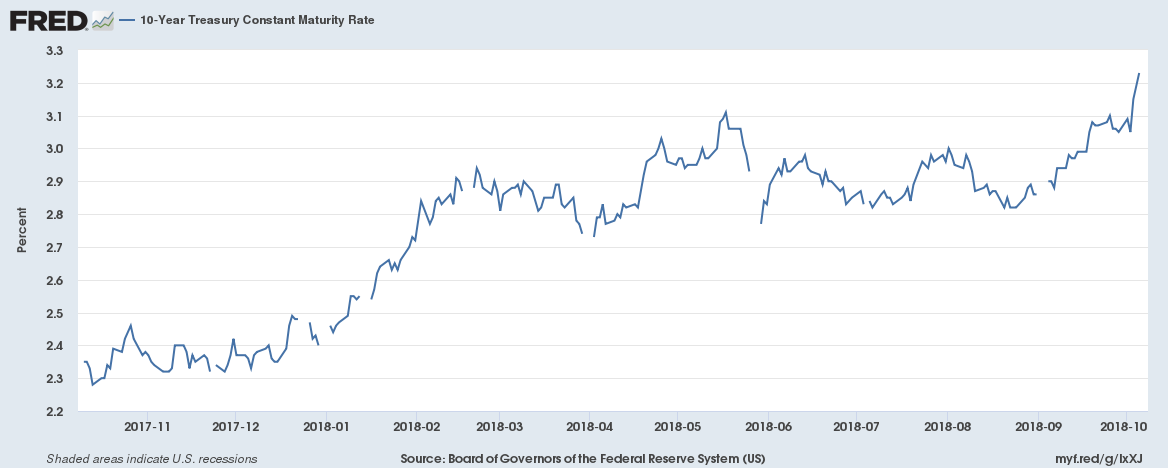

Why did the bears awake? As always, there are many explanations. Some people point out rising interest rates. Indeed, as the Fed has been gradually rising the federal funds rate, the bond yields followed suit. As one can see in the chart below, the 10-year Treasury yields jumped above 3.2 percent in October, the highest level in a few years. Higher rates make bonds more appealing relatively to the more risky equities.

Chart 3: 10-Year US Treasury Yield over the last twelve months.

Other analysts mention global trade wars in general and the trade dispute between the US and China in particular. After Vice President Mike Pence very hawkish remarks about China a few days ago, investors could start to worry that the trade dispute transformed into trade war. Indeed, the risk aversion has risen. The CBOE Volatility Index spiked about 44 percent to 22.96, the highest level since the beginning of April.

And do not forget about the correction in China’s stock market which started on Monday. In 2015-2016, concerns about China’s economy led to the global rout. Trade wars will not help China’s economy, so investors fear about the potential slowdown.

However, it might just be a bull market correction. You know, corrections sometimes happen – and they are actually healthy for the market. Surely, it’s too early to state this with certainty, but has anything really changed in the economy? The Fed has been hiking for months, so it’s not a surprise. Neither Trump’s trade war is something new for the investors. And the US real economy seems to continue its growth. The Atlanta Federal Reserve’s GDP Now forecast model showed yesterday that the U.S. economy is expanding at a 4.2 percent annualized rate in the third quarter.

Implications for Gold

Will the stock-market sell-off boost the gold prices? Well, it’s actually happening. As the chart below shows, the price of gold has surpassed $1,200 today.

Chart 4: Gold prices since October 9 to October 11.

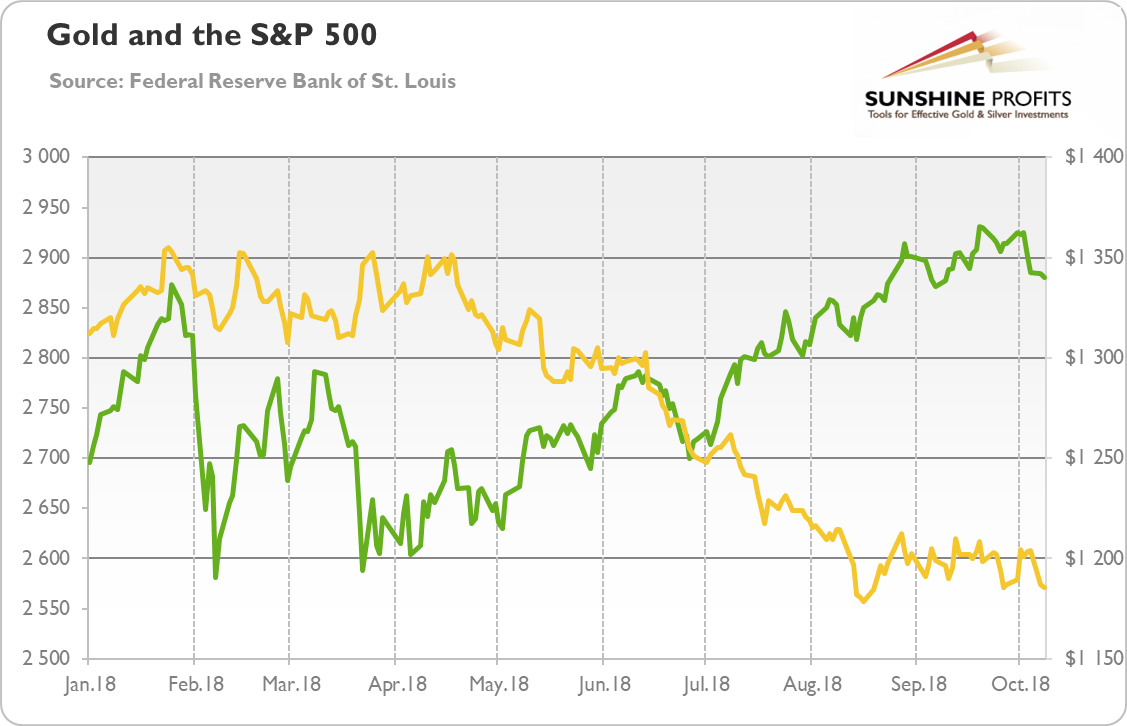

It makes sense. When risk aversion rises, safe-havens, such as gold, benefit. However, gold does not have to rally. Let’s look at the chart below. As one can see, the yellow metal declined in tandem with the S&P500 in February.

Chart 5: Gold prices (yellow line, right axis) and the S&P500 Index (green line, left axis) in 2018.

Indeed, if traders have finally acknowledged that the Fed is going to continue its policy of gradual tightening and just repositioned themselves, the gains in gold might be temporary. But if we see a more permanent bear market or a rise in the risk aversion, gold may rally in a more sustained way. What is important here is that interest rates are rising because of the economic growth. The normalization of monetary policy, although it may cause some market volatility, should be positive for the economy in the long run. This is bad news for the gold bulls, at least from the fundamental perspective.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview