Only one digit has changed. But it may have profound consequences, sending the country closer to junk status. Meanwhile, Rome and Brussels clash over budget plan. Will that duel benefit or harm the yellow metal?

Only One Notch Above Being Junk

Italian drama continues. On Friday, Moody’s, one of the most significant rating agencies in the world, downgraded the Italian credit rating from Baa2 to Baa3. It means that Italy’s local and foreign-currency bonds are now only one notch above junk territory. The move was not surprising, as well as the reasons behind this decision:

- A material weakening in Italy's fiscal strength, with the government targeting higher budget deficits for the coming years than Moody's previously assumed.

- The negative implications for medium-term growth of the stalling of plans for structural economic and fiscal reforms.

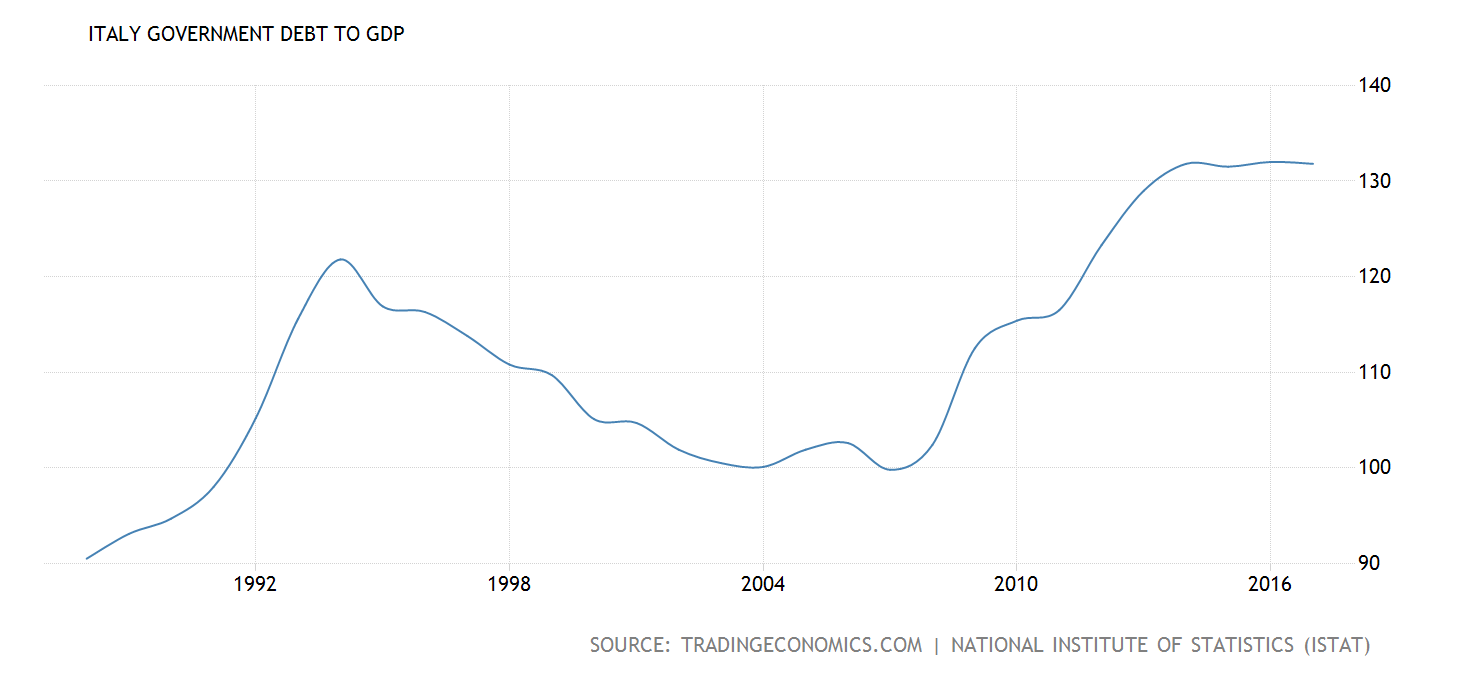

According to Moody’s, higher fiscal deficits in coming years imply that Italy’s public debt will not start trending down, but it will rather remain close to the current 130 percent of GDP – a very high level (see the chart below), which makes the country vulnerable to future negative shocks.

Chart 1: Italy’s public debt to GDP from 1988 to 2017.

On a more positive note, both sides struck more conciliatory tones. Although the Economy Minister Giovanni Tria defended Italy’s 2019 budget which hikes the deficit to 2.4 percent of GDP, he promised not to inflate its deficit any further in the years ahead. And Italy’s Prime Minister Giuseppe Conte dismissed any suggestion that Italy might have to abandon the euro or leave the European Union.

And Moody’s kept the outlook at stable, which calmed investors. As one can see on the chart below, the yield on 10-year Italian government bonds dropped yesterday.

Chart 2: Yields on Italy’s 10-year Government Bonds from January 2017 to October 2018.

However, Italian bond yields remain elevated, which feeds through to the nation’s banks. As they are the biggest holders of the government debt (owning about 28 percent of Italy’s public debt), the fall in bond prices (i.e. the rise in yields) undermines the value of their capital. Indeed, the UniCredit shares have lost more than around 30 per cent of their value in a year, while Italian bank shares sank in general (tracked by the Boost FTSE MIB Banks ETP) to the lowest level since early 2017, as the next chart shows.

Chart 3: The Boost FTSE MIB Banks ETP since early 2017.

Implications for Gold

The current turmoil in Italy clearly shows that the global financial crisis and the resulting banking crisis in the Eurozone have not ended yet. European banks, and Italian in particular, are still fragile. Although the Italy’s government’s expansionary fiscal policy may support the GDP growth in the near-term, the downside risks for the Italian economy are mounting. It’s true that the banking sector has seen a visible improvement since the Great Recession. However, if the bond yields remain elevated, there might be a renewed banking crisis.

It could help gold, especially given the current positive sentiment. But the problems in the EU should drag the euro and support the greenback (both euro and gold rose before the EU decision on Italy’s budget), which would limit any potential rise in the safe-haven demand for gold.

One thing is certain. Although we hear more conciliatory tones from both sides, the Italy’s budget dispute is not over yet. So it will be a hot week, both for Italy and gold: today, Brussels will decide next steps on Italy’s budget, while the ECB will hold its monetary policy meeting on Thursday. Finally, Standard & Poor’s, another leading credit rating agency, will update its view on Italy this Friday. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview