157,000. Is that few or many? And what does it mean for the gold market? Let’s read our article about the recent employment report and find out!

Slowdown without Slowdown

U.S. nonfarm payrolls slow downed in July. The economy added only 157,000 jobs last month, while MarketWatch had expected 195,000. The gains were widespread – however, job creation was the strongest in professional and business services (+51,000), leisure and hospitability (+40,000), and manufacturing (+37,000). Interestingly, government, financial activities, mining, utilities, and transportation and warehousing combined cut about 26,000 jobs.

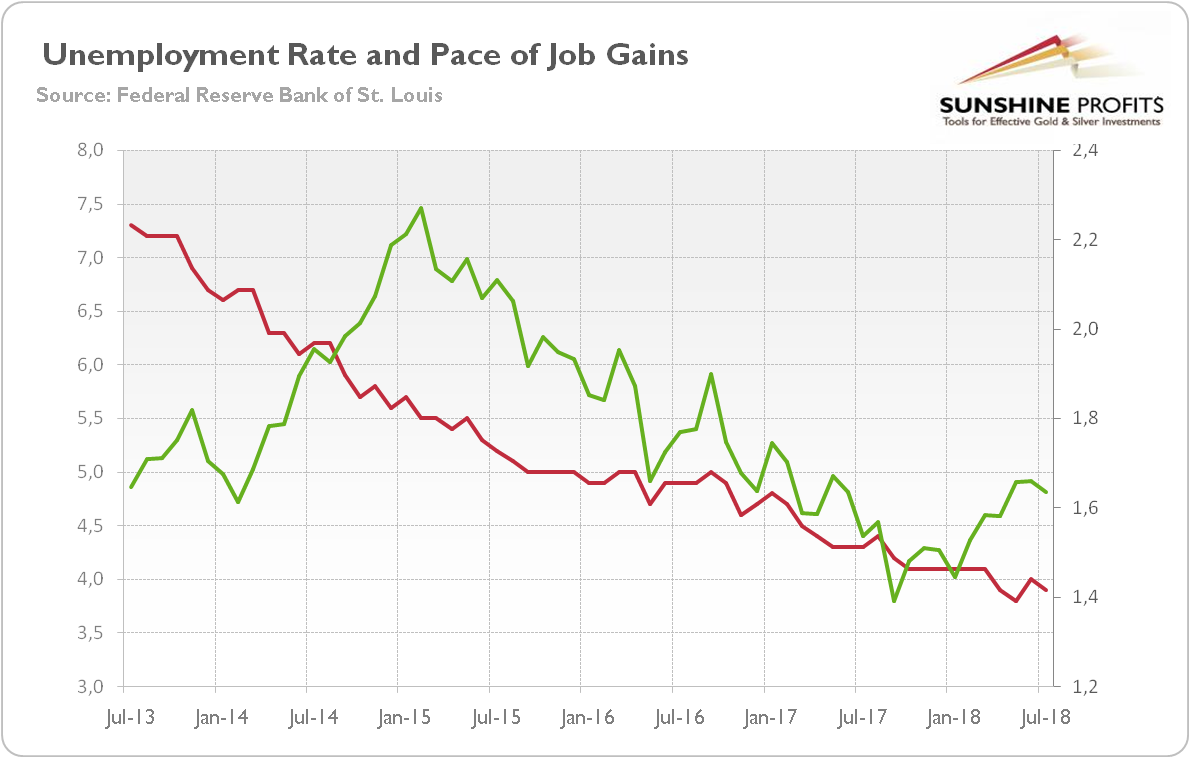

The July increase in total payrolls followed a rise of 248,000 in June (after an upward revision). However, the weak headline number was balanced by revisions for May and June. With those, employment gains in these two months combined were 59,000 more than previously reported. In consequence, after revisions, job gains have averaged 224,000 per month over the last three months, still significantly above the level needed for a gradual tightening of the labor market. And, although the pace of job creations declined somewhat in July, it has remained positive, and generally in an upward trend since the fall of 2017, as the chart below shows.

Chart 1: U.S. unemployment rate (red line, left axis, U-3, in %) and total nonfarm payrolls percent change from year ago (green line, right axis, % change from year ago) from July 2013 to July 2018.

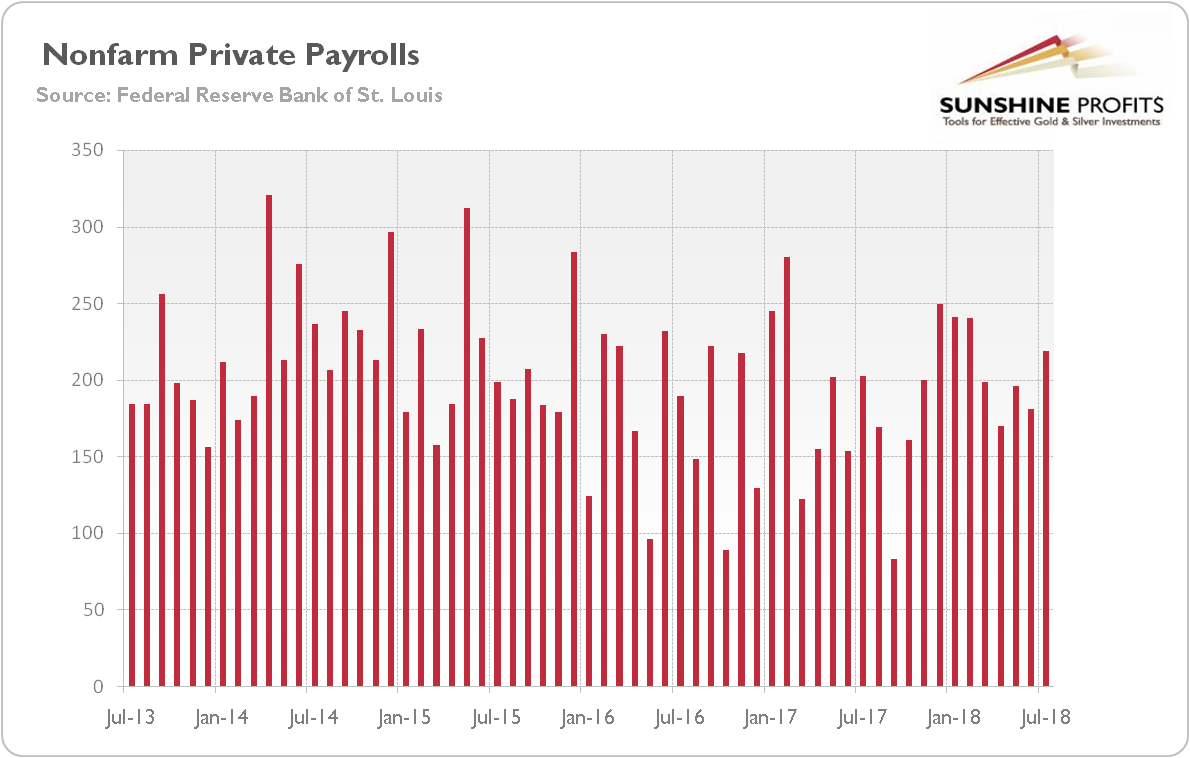

Moreover, the weak headline was mainly caused by cuts in jobs in the government, which we actually like, as more people may work now for the private sector (however, the cuts probably stem from the reduction in education during the summer). Let’s take a look at the chart below, which paints total U.S. nonfarm private payrolls. As you can see, the monthly gains have been solid recently. And they actually accelerated in July! Hence, the pace of employment gains remains healthy, which may be disappointing for some gold bulls.

Chart 2: Total U.S. nonfarm private payrolls (monthly change from year ago) from July 2013 to July 2018.

Unemployment Declines, While Wages Increase

The unemployment rate returned to its previous level of 3.9 percent, after an increase in June to 4.0 percent. Importantly, unemployment declined with the labor force participation rate unchanged. So the decline did not result from the discouragement of job-seekers. The labor-to-employment ratio was little changed.

What is also worth noting is that the unemployment rate for workers 25 years and older with less than a high-school diploma hit 5.1 percent in July, the lowest rate in the data series which starts in 1992. It means that the circle of beneficiaries of the tight labor market widens.

The average hourly earnings for all employees on private nonfarm payrolls rose by 7 cents to $27.05. It implies that they increased 2.7 percent over the year. Although it’s the same percent change as in May and June, and below expectations, wages are steadily rising. Hence, the U.S. labor market tightened further, which should please the FOMC members, but potentially upset gold bulls. Remember the broader macroeconomic context: the report comes a week after the BEA reported that the U.S. economy rose 4.1 percent this spring. Wage growth is somewhat subdued, but it shows that there is potential for further hiring. Some slack still remains, which means that economic expansion may continue.

Implications for Gold

What does it all mean for the precious metals market? Well, it’s true that job growth slowed a bit in July, but it followed two months of very strong gains. And the unemployment rate fell again. The U.S. labor market remains, thus, in good health, especially the private sector. Investors shouldn’t focus only on the headline, but they should look deeper. The recent employment report was solid, so it should not bring a relief for gold.Fed is likely to stay on track. The hike in September is not endangered. And the report does little to alter the outlook for gradually rising rates after that. As Dante wrote: all of these who don’t believe in two more hikes in 2018: abandon hope all ye who enter here!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview