Last week, a few important U.S. economic reports were released. What do they imply for the gold market?

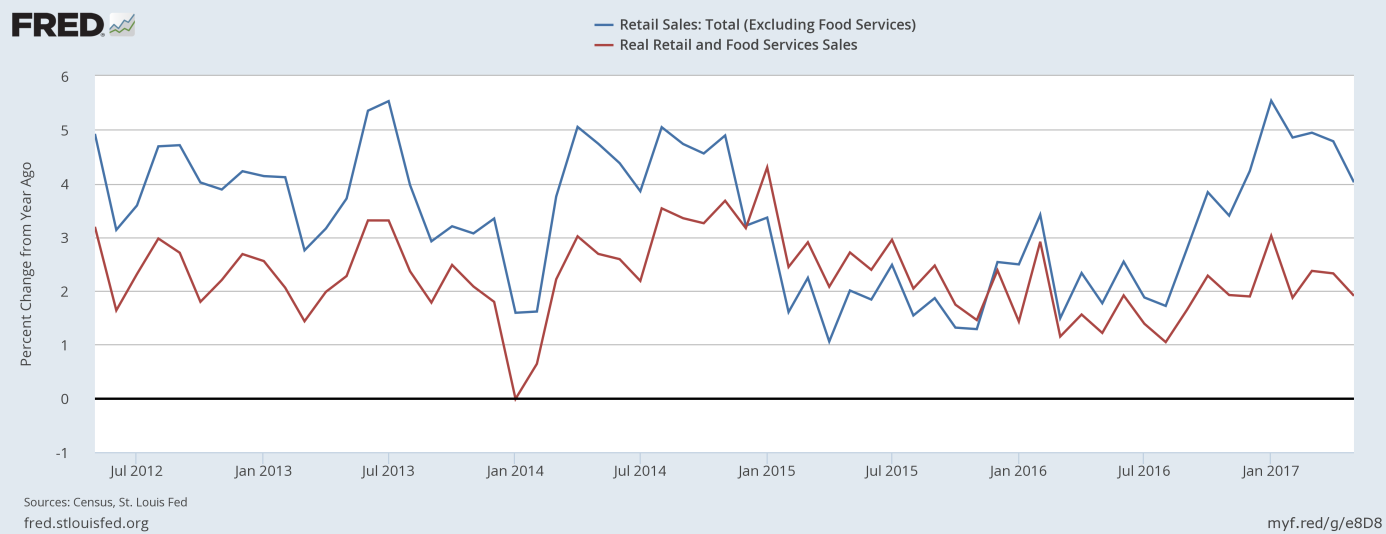

The recent days were eventful. The Fed hiked interest rates, the U.S. Treasury unveiled its deregulation plan, and several important pieces of economic news were published. First of all, retail sales fell 0.3 percent in May following a 0.4 percent rise in April. The number was below expectations. Actually, it marked the worst decline since January 2016. However, the drop was mainly caused by a 2.4 percent plunge in sales of gasoline, which is not the worst thing in the world for consumers. Indeed, when we exclude vehicles and gasoline, retail sales were unchanged in May. And the annual growth, although slowed down, remained satisfactory, as one can see in the chart below.

Chart 1: Real retail sales and food services sales (red line) and retail sales excluding food services (blue line) year-over-year from May 2012 to May 2017.

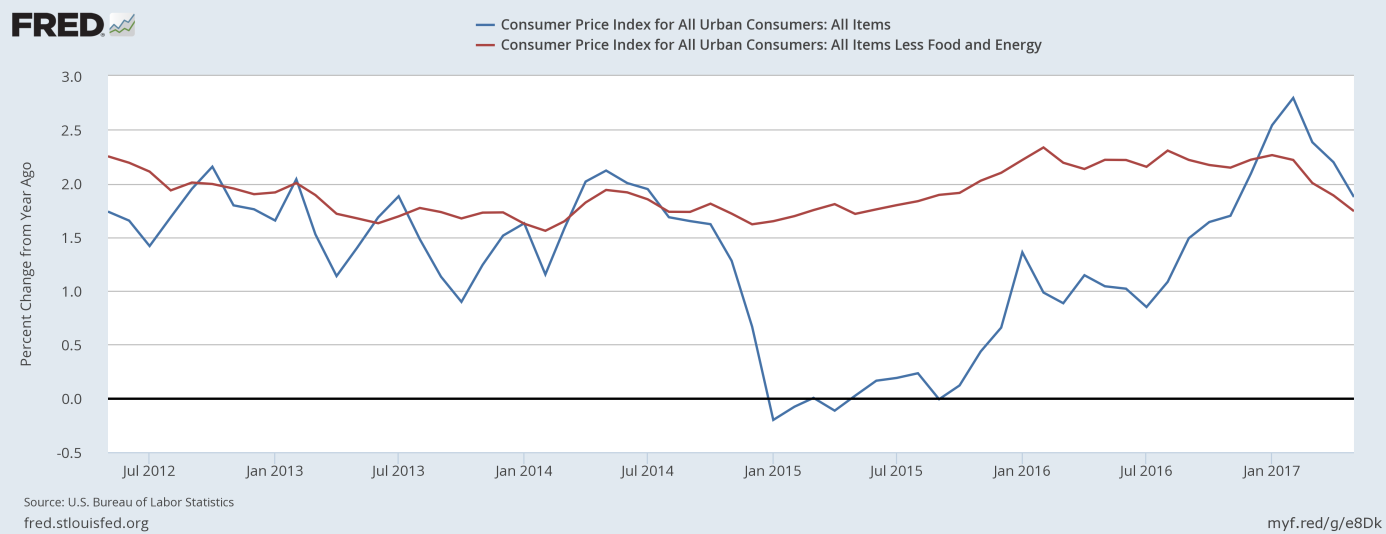

Second, the CPI fell short of expectations in May, as it declined 0.1 percent, while the core CPI rose just 0.1 percent. As the chart below shows, inflation rose 1.9 percent on an annual basis, an important slowdown from 2.7 percent just four months ago, while core inflation increased 1.7 percent year-over-year, following a 1.9 percent jump in April.

Chart 2: CPI (blue line) and core CPI (red line) year-over-year from May 2012 to May 2017.

However, inflation is importantly higher than one year ago. And the recent softness was also caused by cheaper gas, to a large extent. Softer inflation is rather bad for gold. It increases real interest rates, while not discouraging the Fed from tightening its monetary policy.

When it comes to other data, the Empire State index rebounded from -1 in May to 19.8 in June, while the Philadelphia Fed manufacturing index slowed down from 38.8 to 27.6. Hence, both regional manufacturing indices showed strength, which is bad news for the gold market. However, national industrial production was unchanged in May (but it increased on an annual basis). Meanwhile, investors focused on weak housing data, as housing starts fell 5.5 percent in May, and construction permits dropped 4.9 percent last month. The third monthly decline in housing starts in a row may be worrisome, but after a great winter the pullback might be justified.

The bottom line is that the recent U.S. economic data was disappointing, on balance (manufacturing data was positive). Apart from a slowdown in inflation, it could support gold prices. However, the impact should not be too great, as the weakness in retail sales or in the housing sector was not at panic level. The pullback may be only temporary. Gold would need an economic crisis or financial turmoil to soar. In the current environment, a sideways trend may continue. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview