Last week, the ECB reaffirmed that it would end quantitative easing this year. What does it mean for the gold market?

Interest Rates Unchanged but the End of QE Reaffirmed

Last week, the ECB released its monetary policy statement. It left the policy interest rates unchanged. It also reaffirmed that its asset purchase program would end this year:

The Governing Council anticipates that, after September 2018, subject to incoming data confirming the Governing Council’s medium-term inflation outlook, the monthly pace of the net asset purchases will be reduced to €15 billion until the end of December 2018 and that net purchases will then end.

Hence, the ECB kept its monetary policy completely unaffected. The decision was widely anticipated, so it should not impact the markets significantly. But what is important is that the passive stance of the ECB means that the divergence in monetary policy between it and the Fed is widening.

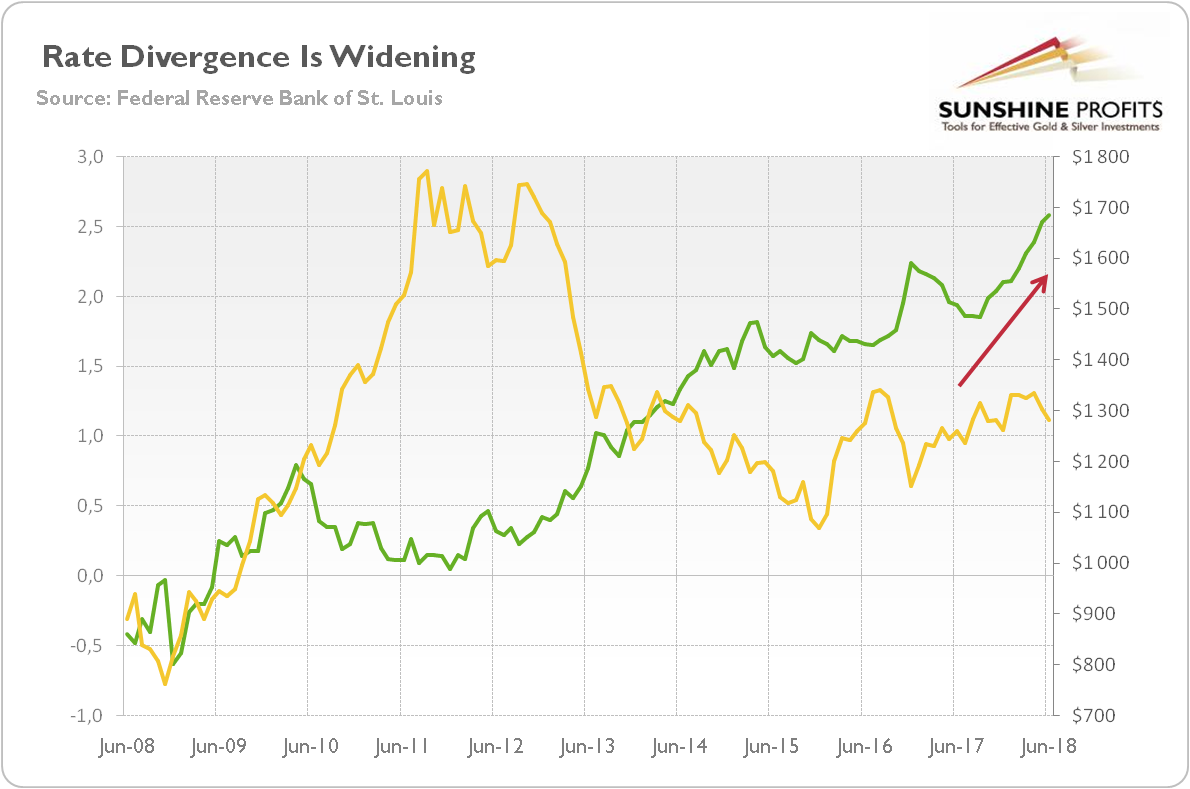

Let’s take a look at the chart below. As one can see, the difference between the U.S. and German 10-year government bond yields has recently widened. The rising divergence supports the greenback, which exerted downward pressure on gold prices. Indeed, the chart below also shows that the divergence started in 2012/2013, at the same time when the bear market in gold began.

Chart 1: 10-year Treasury Yield Divergence between U.S. and Germany from June 2008 and June 2018.

Draghi’s Press Conference

Let’s analyze Draghi’s press conference now. In his introductory statement, the ECB President sounded quite optimistic, as he expressed confidence that the economic recovery would continue and inflation would converge to the 2-percent target even after a gradual winding-down of the asset purchases:

While uncertainties, notably related to the global trade environment, remain prominent, the information available since our last monetary policy meeting indicates that the euro area economy is proceeding along a solid and broad-based growth path. The underlying strength of the economy confirms our confidence that the sustained convergence of inflation to our aim will continue in the period ahead and will be maintained even after a gradual winding-down of our net asset purchases.

Let’s move on to the Q&A session, which is always the most interesting part of Draghi’s press conferences. But not necessarily this time, as the ECB President did not want to say anything about the future reinvestment policy or what the phrase that the ECB interest rates wwould remain unchanged “through the summer 2019” really meant.

However, one question was quite interesting. It was about the divergence in monetary policy we have discussed above. Draghi’s response was that “different monetary policies do reflect the response of monetary authorities to different positions in the business cycle.” So, according to him, the Fed hikes, while the ECB sleeps, because the U.S. economy is in a later stage of the business cycle. If this is true, it might suggest that the divergence will reach a peak soon. When the ECB starts to tighten its monetary policy, the divergence may be narrowing, which should be supportive for the euro and gold.

Conclusions for Gold

The ECB held its monetary policy meeting last week. It didn’t bring any new hints about the ECB stance, which remains dovish. It might be the case that Dragh will squeeze in only one interest-rate hike before the end of his term in November 2019. As the outcome of the meeting was widely expected, the impact on the gold prices should be negligible, if any. However, next week might be more interesting. The FOMC will have its own monetary policy meeting, and the newest report on payrolls will be published. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview