On Friday, the reports on U.S. consumer inflation and retail sales were released. What do they imply for the gold market?

Retail Sales Spike in September

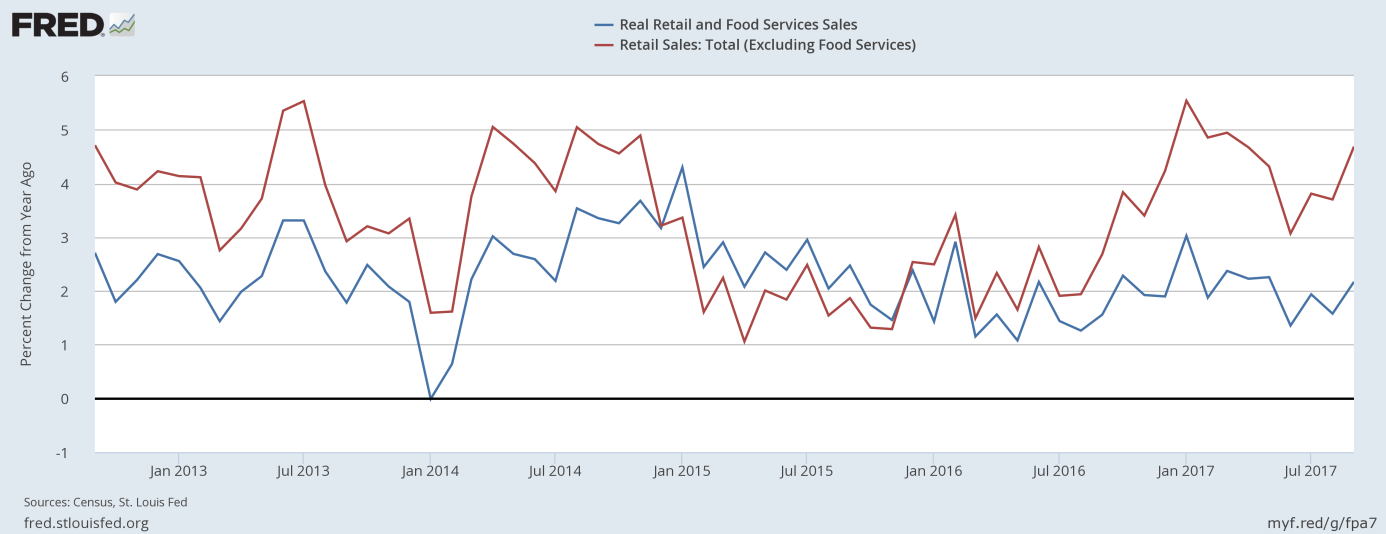

Last month we wrote: „(…) although the impact of hurricane Harvey on retail sales was limited in August, the cleanup after it (and Irma) may cause some volatility in the upcoming reports”. And indeed, this is what happened. U.S. retail sales soared 1.6 percent in September following a 0.3 percent rise in July (after a downward revision from 0.6 percent). The number was strong and above expectations. Actually, it has been the biggest increase since 2015. However, the jump was mainly caused by a rebound in sales of cars and trucks triggered by replacement demand after damages caused by hurricanes Harvey and Irma. When we exclude vehicles, retail sales rose 1 percent in September. It is still an excellent number, but partly caused by higher gas prices. When adjusted for this factor, retail sales rose 0.5 percent. A significantly lower number – but still robust. And the annual growth also accelerated, as one can see in the chart below.

Chart 1: Real retail sales and food services sales (blue line) and retail sales excluding food services (red line) year-over-year from September 2012 to September 2017.

The jump in retail sales was distorted by the landfalls of hurricanes and the following rebound. However, the increase was robust, even when we take into account these effects. Hence, the report signals that the U.S. economy remains in good shape, which is bad news for the gold market.

CPI Also Soars in September

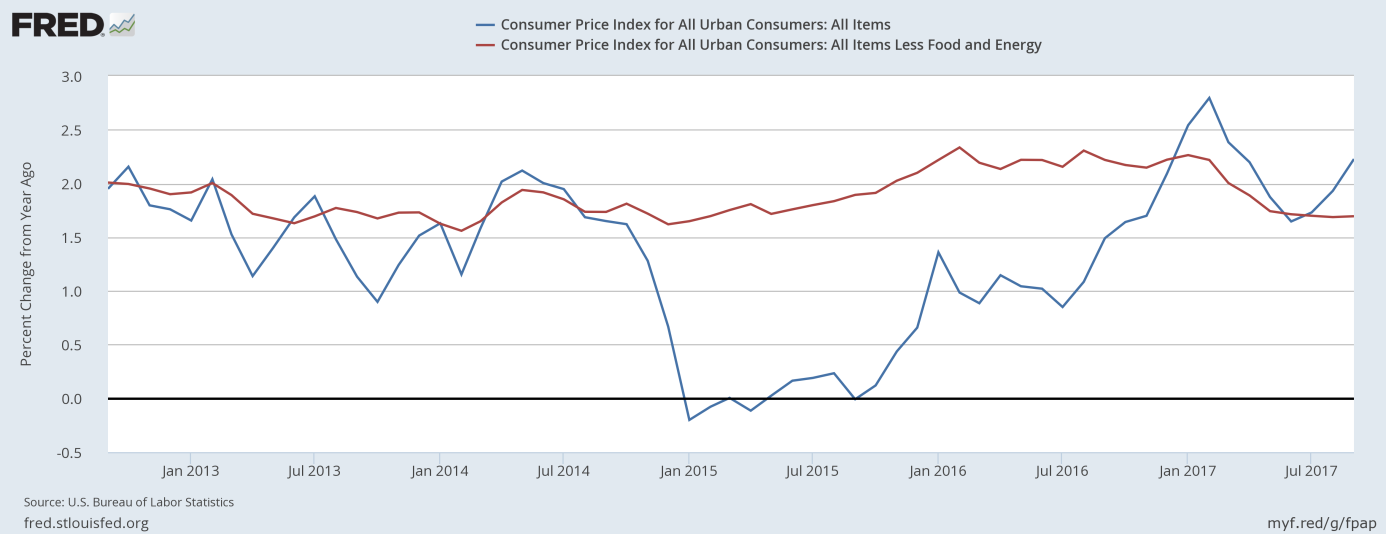

Consumer prices jumped 0.5 percent last month. However, the move was driven mainly by higher gas prices due to disruptions caused by hurricanes Harvey and Irma. The price of gasoline soared 13.1 percent last month. Hence, the core CPI, which excludes food and energy, increased merely 0.1 percent. On an annual basis, the change in core CPI remained at 1.7 percent, while the overall index soared 2.2 percent, exceeding the Fed’s target. Therefore, there was an acceleration in inflationary dynamics, as one can see in the chart below.

Chart 2: CPI (blue line) and core CPI (red line) year-over-year from September 2012 to September 2017.

However, the mini-surge in inflation was caused mainly by higher energy prices triggered by temporary factors. Hence, the acceleration may be short-lived, as the price of gasoline should decline next month when refineries return to business. And importantly, the data on inflation was weaker than expected. This is why the U.S. dollar fell after the release of the report, while the price of gold rose, as the next chart shows.

Chart 3: Gold prices from October 11 to October 13.

Conclusions

The key takeaway is that both retail sales and inflation soared in September. However, the jumps were caused by one-offs and should not affect the medium-term pace of economic growth or inflationary outlook. The Fed’s stance should not, thus, be significantly affected by these reports. Indeed, the market expectations of a December hike were hardly changed – the odds remained at about 83 percent. It’s true that the CPI jumped above the Fed’s 2-percent target, but the rate of the core index was unchanged at 1.7 percent. And it was a disappointment for the markets, as it signaled that inflationary pressures remained subdued. The soft inflation will weigh on U.S. yields, which should be positive for the gold market, but investors should not assume that the recent economic report will fundamentally change the Fed’s stance. The latest data has been somewhat distorted by the hurricanes, so the U.S. central bank will wait for more reliable data to alter its course. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview