The so-called “Trump rally” appears to have run its course. What does it imply for the gold market?

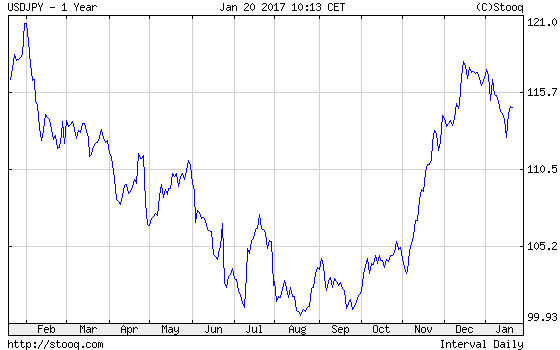

As everyone knows, gold prices plunged after Trump won the presidential election. The free fall lasted until the very beginning of 2017, when the price of the yellow metal started to rise. From the fundamental perspective, the main reason was that the U.S. dollar pulled back after the explosive “Trump rally” ran out of steam. The chart below shows the January’s depreciation of the greenback against the Japanese yen.

Chart 1: The USD/JPY exchange rate over the last 12 months

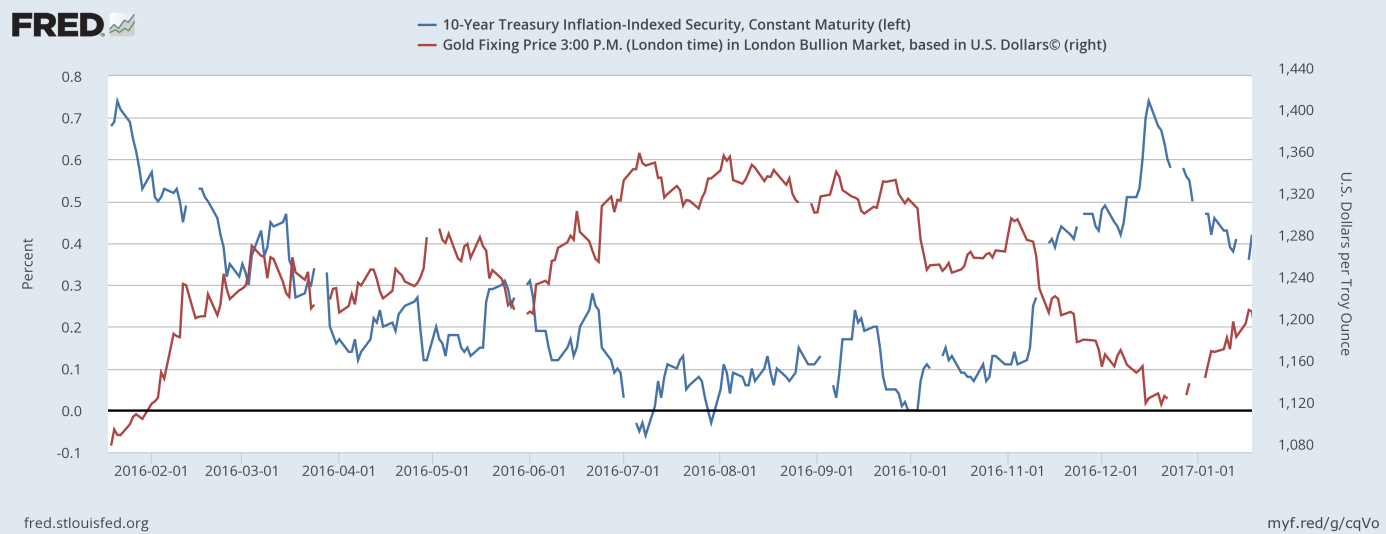

Also, real interest rates corrected, as one can see in the second chart. The strong negative correlation between them and the price of gold still holds.

Chart 2: U.S. real interest rates (blue line, left axis, yield of 10-year inflation-indexed Treasury, in %) and the price of gold (red line, right axis, London P.M. Fix) over the last 12 months.

Some analysts believe that gold is likely to rally in the near future, as the Trump rally faded. Surely, the markets’ response to Trump’s victory was probably a bit exaggerated. And the investors’ focus will be now not on Trump’s promises, but on delivering on them. However, the reason behind the recent rally in gold may be different. It may be the case that investors decided to build up a hedge against the inaugural address and the first days of policy actions. Remember Brexit and the U.S. presidential election? The uncertainty about these two events supported the price of gold, but when it vanished after they unfolded, gold prices went south. A lot depends on what Trump will say and what his first decisions will be. However, if the history from the last year repeats, we should see the end of the relief rally in gold, at least unless Trump triggers World War III. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview