His hand didn’t shake. Powell hiked interest rates at the first FOMC meeting with him as the Chair. But the key factor for the gold market is what he signaled about the future path of the federal funds rate. The crucial word is “three”, not “four”.

Another Meeting, Another Hike

In line with expectations, the FOMC acknowledged the improved economic outlook and raised interest rates again. The key paragraph of the recent monetary policy statement is as follows:

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-1/2 to 1-3/4 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

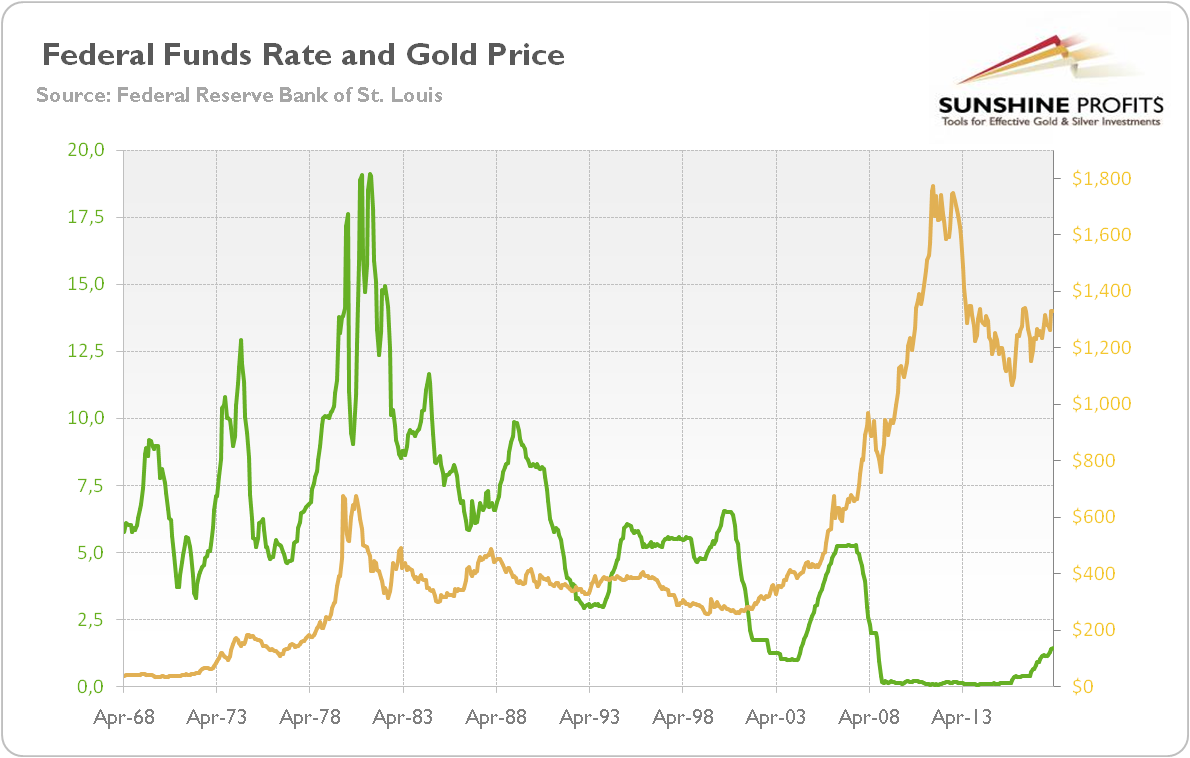

It was the sixth hike during the current Fed’s tightening cycle, but the stance of monetary policy remains accommodative. The federal funds rate remains historically low and the pace of increases is gradual, as the chart below shows.

Chart 1: Effective federal funds rate (green line, left axis, in %, monthly) and the price of gold (yellow line, right axis, London P.M. Fix, in $) from 1968 to 2018.

As in the previous cases, the Fed also raised the interest rate paid on required and excess reserve balances from 1.50 to 1.75 percent and the primary credit rate from 2 percent to 2.25 percent. The vote was unanimous and already priced in the gold prices, so it shouldn’t affect the precious metals market.

Fed Steepens Path, but Forecasts Only Three Hikes in 2018

The March FOMC projections were much more interesting. The members of the Committee raised their forecasts of GDP growth in 2018 and 2019, signaling confidence in the U.S. economy in the short run. They also projected a lower unemployment rate and slightly higher inflation in 2019 and 2020.

And most importantly, the U.S. central bank lifted its expected median federal funds rate in 2019 from 2.7 to 2.9 percent. It implies three rate increases next year, compared with two moves seen in December. Similarly, the FOMC members revised their projection for 2020 from 3.1 to 3.4 percent. It means an additional hike that year. Therefore, the new FOMC turned out to be more hawkish, just as we had been warning investors for a long time (for example, in the December edition of the Market Overview). The more hawkish FOMC may be a headwind for the gold prices in the medium term.

However, the FOMC continued to project a total of three increases this year, just as we predicted on Tuesday. It’s a very important development, as many investors worried that Powell could signal four hikes in 2018. Now, as the Fed turned out to be more dovish than expected in that matter, the markets eased a bit. This is why three is better than four for gold investors. Indeed, as one can see in the chart below, the price of gold spiked yesterday after the Fed indicated that it will stay on course.

Chart 2: Gold prices over the last three days.

Implications for Gold

We believe that the recent FOMC meeting is generally bullish for gold. The U.S. central banks steepened the interest rate path in the 2019 and 2020, but they kept the projected number of hikes this year unchanged. So the investors’ concerns about four rate hikes this year were alleviated – and now gold has some room to move upward.

Please also note that higher dots in 2019 and 2020 are still consistent with a very gradual path of hikes (not more than three per year). And these changes were partially anticipated given the fiscal stimulus and the changed composition of the FOMC. In short, Powell didn’t send a radically new message, as some investors feared. It means that gold has nothing to worry from the new Fed Chair.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview