Oil Trading Alert originally sent to subscribers on April 29, 2015, 8:46 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil gained 0.58% as ongoing tensions in Yemen and a weaker greenback supported the price. Despite this increase, light crude verified earlier breakdown under its support line. What does it mean for the commodity?

Yesterday, the Conference Board reported that its consumer confidence index declined to 95.2 this month, well below the forecast of 102.5. Thanks to this disappointing data, the USD Index extended losses and dropped to slightly above 96, making crude oil more attractive for buyers holding other currencies. On top of that, the escalation of fighting in Yemen between Saudi Arabia and Shiite-led Houthi rebels supported the price as well. Thanks to these circumstances, crude oil closed the day slightly below $57, but will we see further improvement in the coming days? (charts courtesy of http://stockcharts.com).

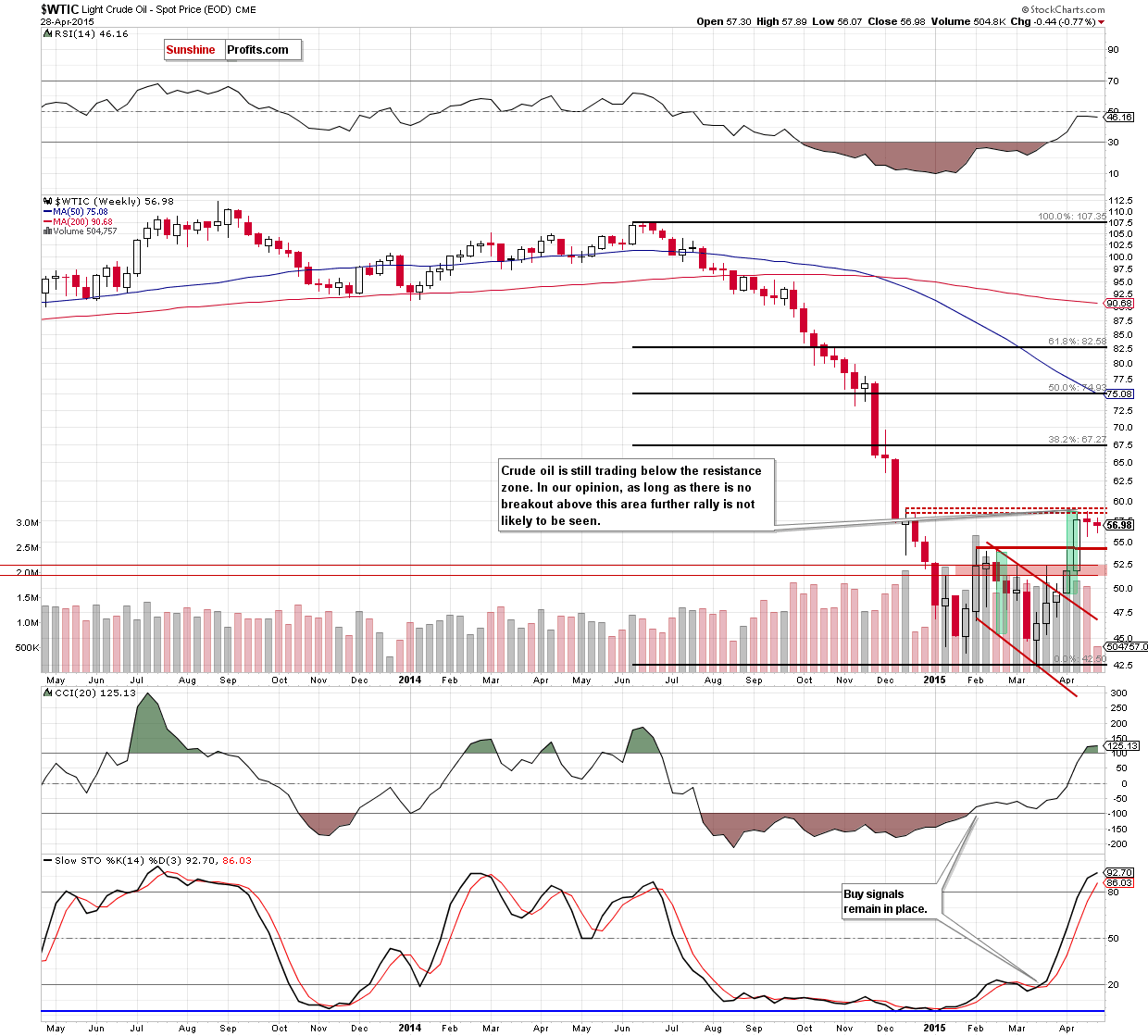

Looking at the weekly chart, we see that although crude oil moved little higher, the situation in the medium term hasn’t changed much as the commodity is still trading in a narrow range between the last week’s low and the resistance zone created by the Dec 15 and Dec 22 highs. In our opinion, as long as there is n breakout above this area, further rally is not likely to be seen and further declines should not surprise us.

Will the very short-term chart give us more clues about future moves? Let’s examine the daily chart and find out.

Yesterday, we wrote the following:

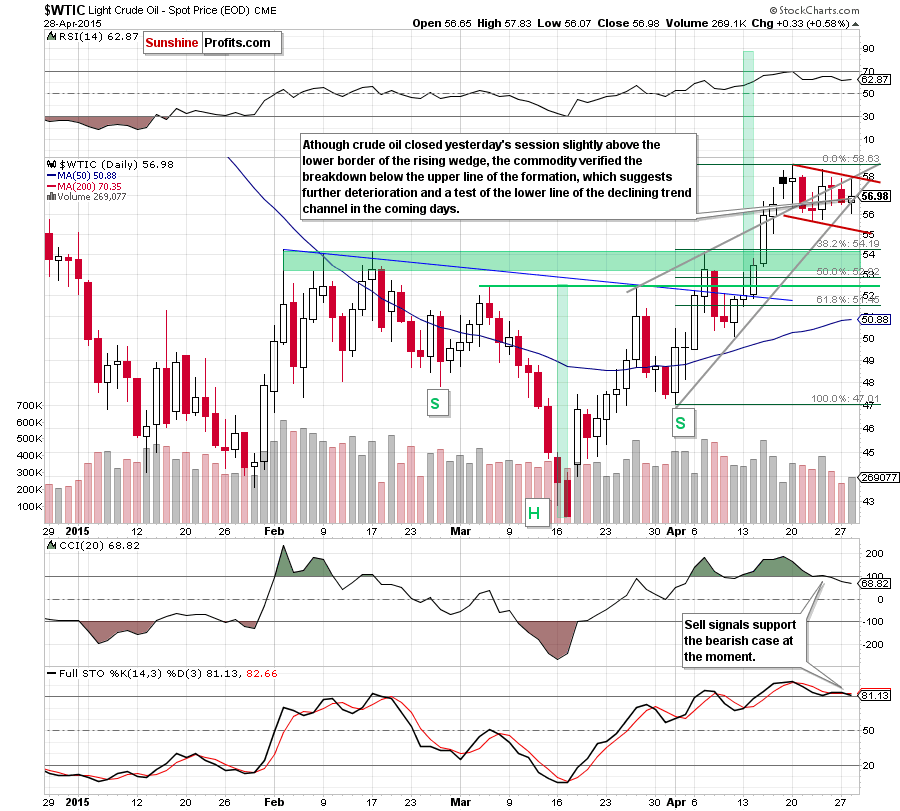

(…) If (…) light crude declines, the initial downside target would be around $56.20, where the lower border of the rising wedge is.

As you see on the daily chart, the commodity not only reached our target, but also slipped little lower. Despite this deterioration, oil bulls managed to push crude oil higher, which resulted in an invalidation of earlier breakdown. This positive sign triggered further improvement, but as it turned out later, the combination of the upper line of the rising wedge and the upper border of the very short-term declining trend channel stopped further improvement and triggered a pullback once again.

In this way, light crude verified the breakdown below the upper border of the rising wedge, which is a negative signal. Additionally, the Stochastic Oscillator generated sell signal (while sell signals generated by the CCI and RSI remain in place), suggesting another attempt to move lower.

If this is the case, and light crude slips below the lower border of the rising wedge, the initial downside target would be around $55.20, where the nearest support line (the lower line of the very short-term declining trend channel) is. If this line withstands the selling pressure, we’ll see another upswing and an attempt to break above the resistance zone (the upper borders of both formations marked on the daily chart). However, if currency bears manage to push crude oil lower, we’ll see a test of the green support zone based on the Feb highs in the coming week. At this point, it is also worth nothing that this area is also supported by the 38.2% Fibonacci retracement level (based on the Apr rally), which could stop potential decline.

Before we summarize today’s alert please note that the American Petroleum Institute reported that domestic crude oil inventories increased by 4.2 million barrels last week. If today’s EIA report confirms another build in inventories, the realization of the bearish scenario will be more likely. Nevertheless, we should keep in mind that lower reading could push the price of crude oil higher.

Summing up, crude oil verified the breakdown below its key support/resistance line, which in combination with the current position of the indicators and the limited space for further growth suggests another attempt to move lower in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts