Last week, two important U.S. economic reports were released. What do they imply for the gold market?

Recently, geopolitical events – such as the U.S. strike in Syria, tensions over the North Korea, Turkish constitutional referendum, or May’s call for a snap election in the UK – have caught the investors’ attention. However, geopolitical events rarely lead to lasting rallies. Since the macroeconomic backdrop seems to be a more important driver for gold prices in the long-run, let’s catch up and analyze the recent economic data coming out of the U.S.

First of all, retail sales declined 0.2 percent in March, falling short of expectations. Moreover, February’s gain of 0.1 percent was revised to a 0.3 percent decline, marking the worst two-month stretch in two years, which does not bode well for economic growth at the beginning of 2017. Indeed, the Atlanta Fed’s GDPNow model forecasts real GDP growth in the first quarter of 2017 at only 0.5 percent after the publication of the retail sales report. Importantly, excluding both vehicles and gasoline, retail sales rose only 0.1 percent.

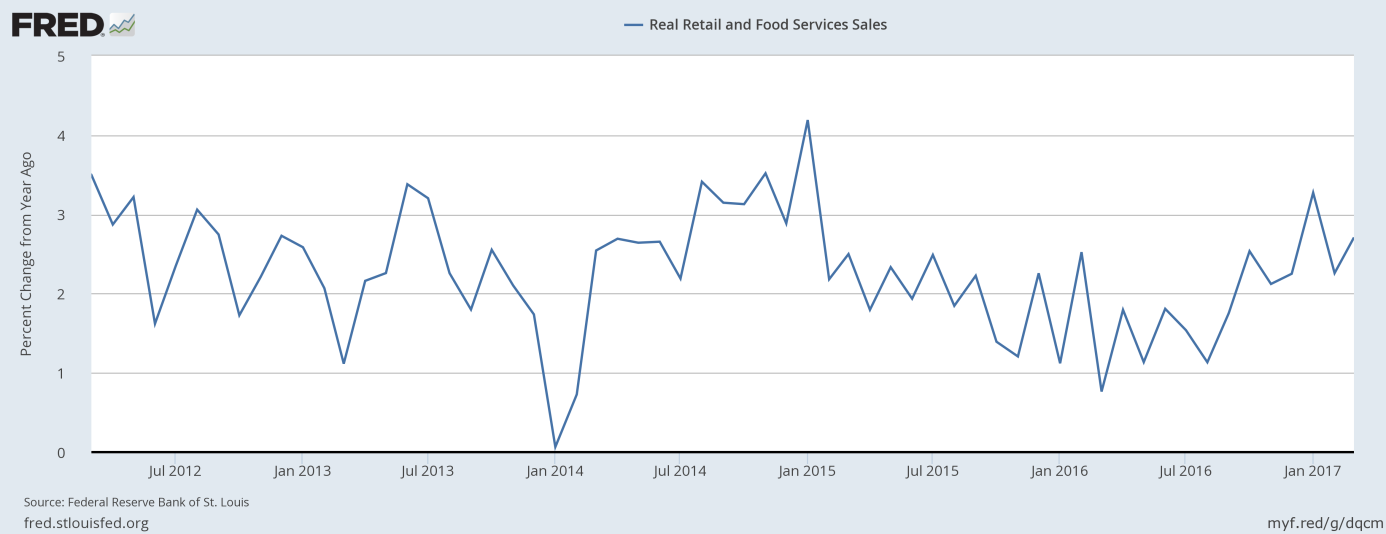

As one can see in the chart below, the annual growth rate in real retail sales has accelerated in the past year, but the long-run trend seems to be less favorable.

Chart 1: Real retail sales year-over-year from March 2012 to March 2017.

Second, consumer prices declined 0.3 percent in March, according to the Bureau of Labor Statistics. It was the first drop in more than a year. Economists polled by Bloomberg had forecast no change. The core CPI, which excludes the volatile energy and food categories, decreased 0.1 percent. On an annual basis, the overall CPI slowed to 2.3 percent, while the core CPI jumped only 2 percent over the last 12 months.

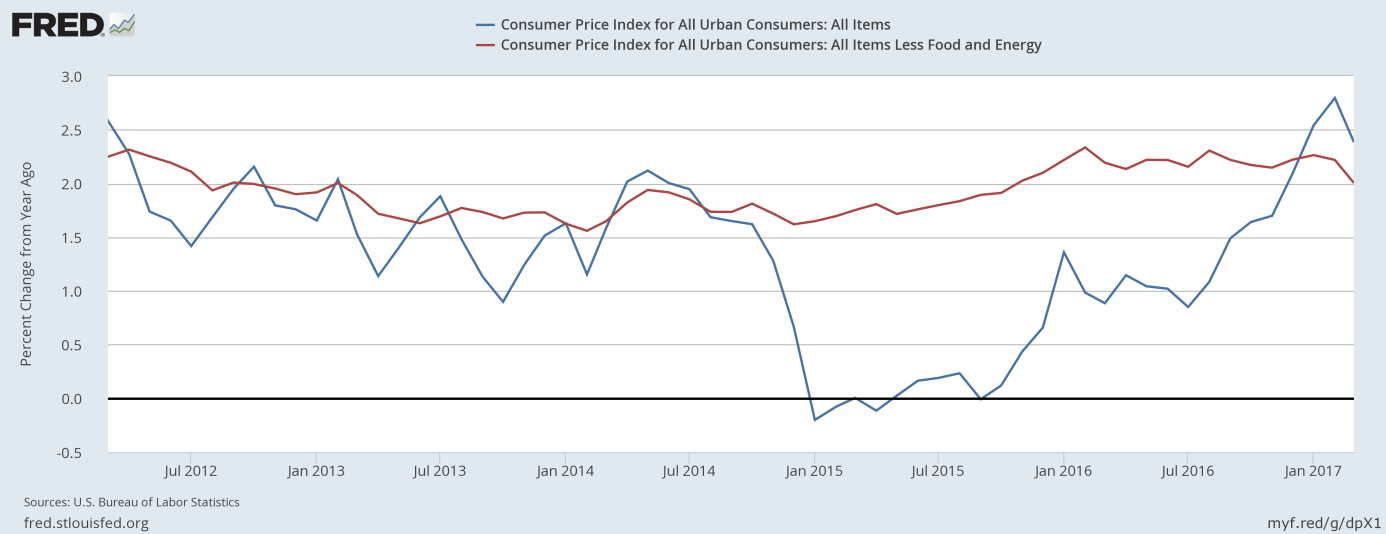

As one can see in the chart below, inflationary pressures softened in March. However, one month does not make a new trend, so there may be a rebound in the near future.

Chart 2: CPI (blue line) and core CPI (red line) year-over-year from March 2012 to February March.

Summing up, both inflation and retail sales were soft in March. While weak inflation may be only temporary due to declines in oil prices, the decline in retail sales is more disturbing. It shows that the recent surge in consumer confidence has been meaningless. Hard data does not confirm the rise in optimism, which is generally positive news for the gold market. Importantly, despite weaker inflation, real interest rates have been declining recently, which – if this trend continues – is a good sign for the yellow metal in the medium term. However, in the short run, gold prices may drop if the current geopolitical risks soften. A lot depends on the French presidential election – the first round is held during the weekend. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview