Gold News Monitor originally sent to subscribers on April 21, 2015, 8:15 AM.

The Credit Managers Index (CMI) has worsened significantly over the last two months and current readings stand at recessionary levels not seen since 2008. What does it mean for the U.S. economy and the gold prices?

The CMI is a monthly economic indicator of financial activity reflecting the credit managers’ responses to levels of favorable and unfavorable factors. It has been published since February 2002 on last day of the month by the National Association of Credit Managers.

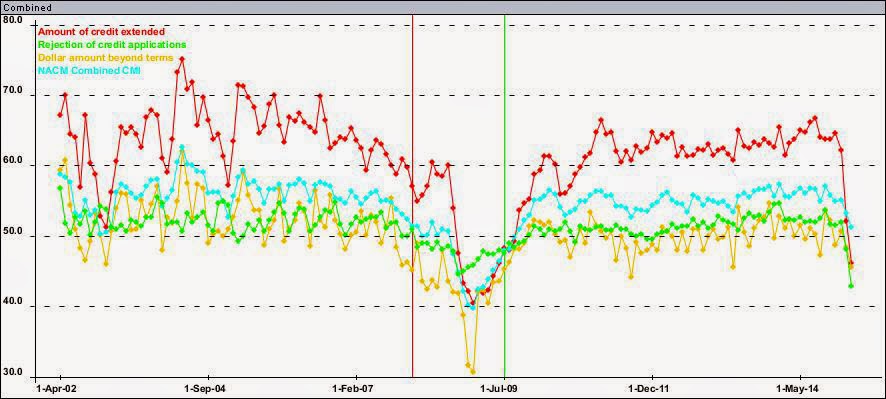

It is an interesting indicator which predicted both the start of the Great Financial Crisis at the end of 2007 and, subsequently, the early recovery exactly at the end of February 2009 (see the chart below, blue line).

Figure 1: The Credit Managers Index

Source: globaleconomicanalysis.blogspot.com

The March report shows some serious financial stress among the companies and this month it is going to be hard to blame it all on the weather. Although the combined score is still above the recessionary zone (it amounts to 51.2, above 50 but down from 53.2 in February), the components from the credit market dived into the recessionary zone (red and green line in the chart above). The amount of credit extended dropped from 52.1 in February to 46.1 in March, while the rejection of credit applications fell from 48.1 to 42.9, signaling that there is a credit crunch underway. In other ways, there are many companies seeking credit, but they are not getting it. We hope investors remember that this was also the story before Lehman’s bankruptcy. “The overall economy didn’t look all that bad in late 2008, except that there was a dearth of credit and that soon led to business failures and struggles”.

There are two possible explanations: either companies are too weak to get credit or those issuing credit are very cautious. Probably both answers are correct, however we would like to point out that even the IMF is warning against a global liquidity shock (partially perhaps due to drying up of petrodollars). In such an environment, banks and other depositary institutions may be less willing to grant new loans. Indeed, revolving credit plunged in January and February 2015 and depositary institutions lending collapsed – it dropped by $15.2 billion in January and $18.8 billion in February.

The consequences can be significant, since the contemporary economy cannot operate without credit. Thus, a credit crunch may fuel a further slowdown, if not a recession. It should be definitely positive for the gold market, however during the initial stage of the liquidity crisis investors may be selling off the yellow metal to raise funds and pay back debts, which may initially lower the gold prices.

To sum up, credit market conditions are deteriorating (assuming that the readings of last month are not temporary aberrations), which is another sign of weak U.S. economic activity. The drying up of credit may translate into business failures and may radically soften the Fed’s monetary stance. Thus, the credit crunch (if it occurs) should eventually be positive for the gold prices, however initially some of the investors may sell gold to meet liquidity needs.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview