The first round of presidential elections in France is held on Sunday. What can we expect from that event and how can it affect the gold market?

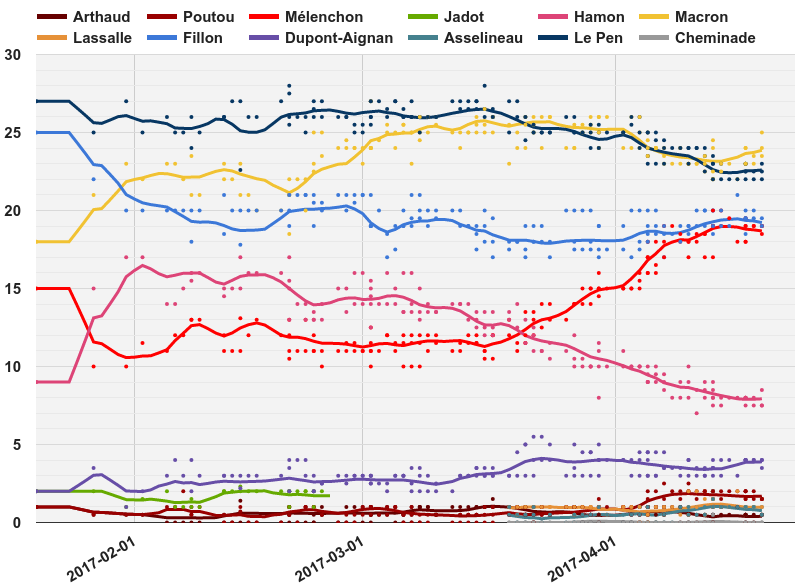

In the recent edition of the Market Overview, we wrote that centrist Emmanuel Macron and nationalistic Marine Le Pen were expected to move on the next round. However, the situation has complicated a bit since then. As you can see on the chart below, actually four candidates have pretty good chances to advance to the next round. It’s because both hard-left Jean-Luc Melenchon and conservative Francois Fillon have gained momentum recently.

Chart 1: Opinion polls for the first round of voting (smoothed 14-day weighted moving average) updated daily from Wikipedia.

It’s good news for the gold market, as it means higher uncertainty. Now, Marine Le Pen is not the only terrifying candidate in town. Jean-Luc Melenchon’s economic program is similarly frightening for the financial markets. For example, he proposed to impose a 100 percent tax on those who earn above €400,000. Yup, you guessed, he is a commie and a fan of Hugo Chavez.

The consensus is that Macron and Le Pen will move on to the next round. Therefore, if this scenario realizes, the markets should not be affected significantly. And since Macron is expected to beat Le Pen in the run-off, there may be a relief rally in the French bonds and the euro. The safe-haven demand for gold should decline then, but a weakening dollar would support the yellow metal.

Macron and Fillon would be the best for the financial markets, as both candidates are from the mainstream, so radical changes would probably not happen. It would be the worst scenario for safe havens, but the best for the euro.

Other scenarios are much more interesting. Fillon and Le Pen would go much more neck and neck than Macron and Le Pen. Higher uncertainty should support the safe-haven demand for the gold market. Melenchon and Fillon would be even more fascinating, as the former is expected to beat the latter in the second round. The vision of a communistic president in France could encourage investors to buy some gold. But probably the best scenario for gold would be a run-off between Melenchon and Le Pen. It would be like a duel between Sanders and Trump, only squared. Such a scenario could trigger some financial panic and boost safe-haven demand for gold.

The bottom line is that there is the first round of the French elections this weekend. The outcome of the election is uncertain, since four candidates have chances to move on to the run-off. If Macron advances on Sunday, he is the most likely to win in the run-off, no matter who he faces. We could see then a relief in risky markets and a decline in gold prices. But if he fails, then any outcome is possible. In this scenario, investors should expect rising uncertainty which should provide additional support for the price of gold. The most market-unfriendly outcome would clearly be a face-off between far-right Le Pen and far-left Melenchon. The risk appetite could soften then, which may boost the safe-haven demand for gold (although the likely appreciation of the U.S. dollar may limit the gains). Will this happen? Given a tarnished reputation of polls and a wild surge in Melenchon’s odds, only time will say. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview