Forex Trading Alert originally sent to subscribers on October 1, 2015, 10:55 AM.

Today, the U.S. Department of Labor showed that the number of initial jobless claims in the week ending September 26 increased by 10,000, missing forecasts for a 3,000 rise. Thanks to these numbers, the USD Index reversed and declined, which pushed EUR/USD higher. But did this move change anything in the short-term picture?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1887; the downside target around 1.0938)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

On Monday, we wrote the following:

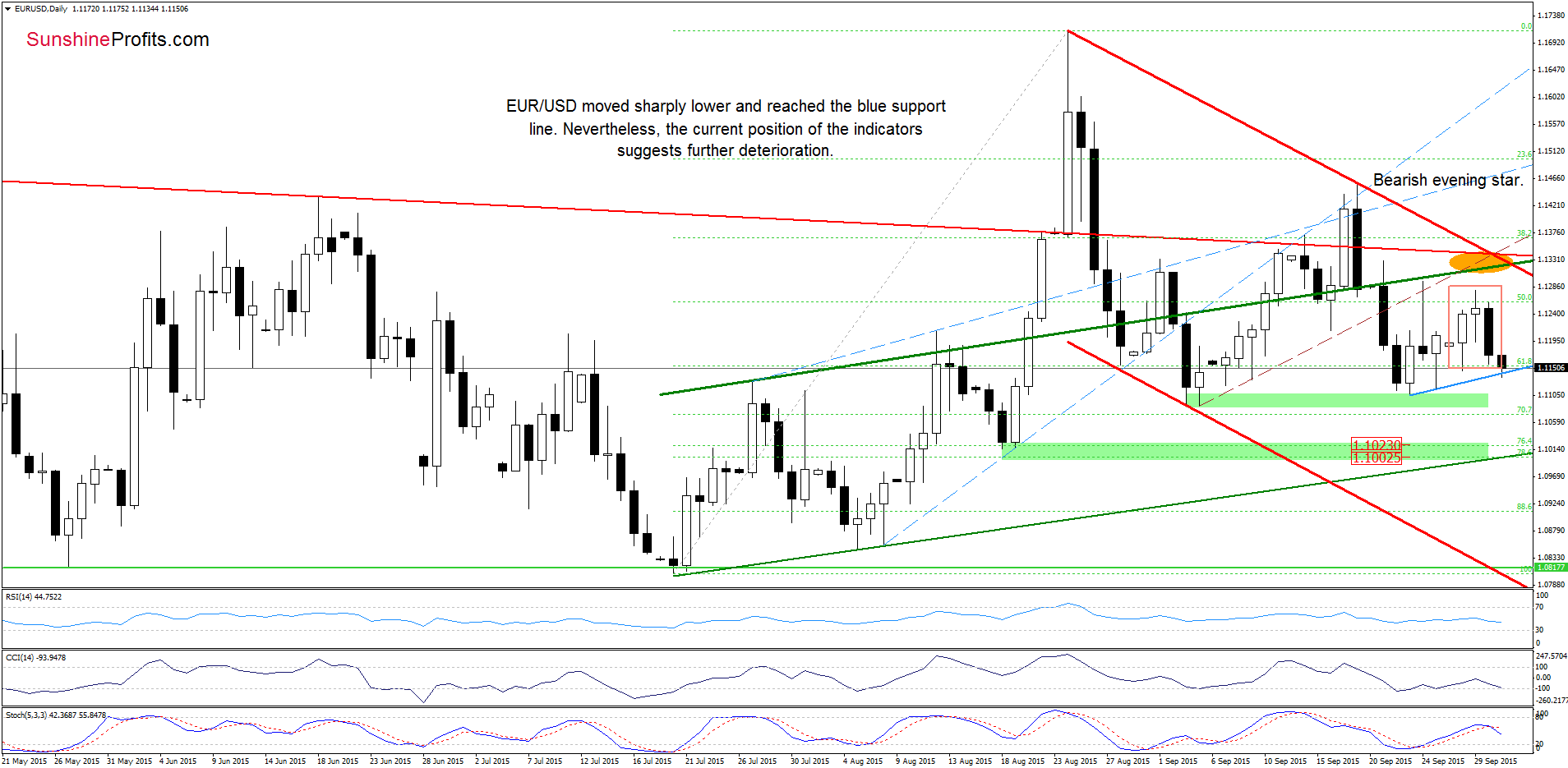

(…) we think that the pair will extend losses in the coming day(s) and we’ll see a test of the blue support line marked on the daily chart

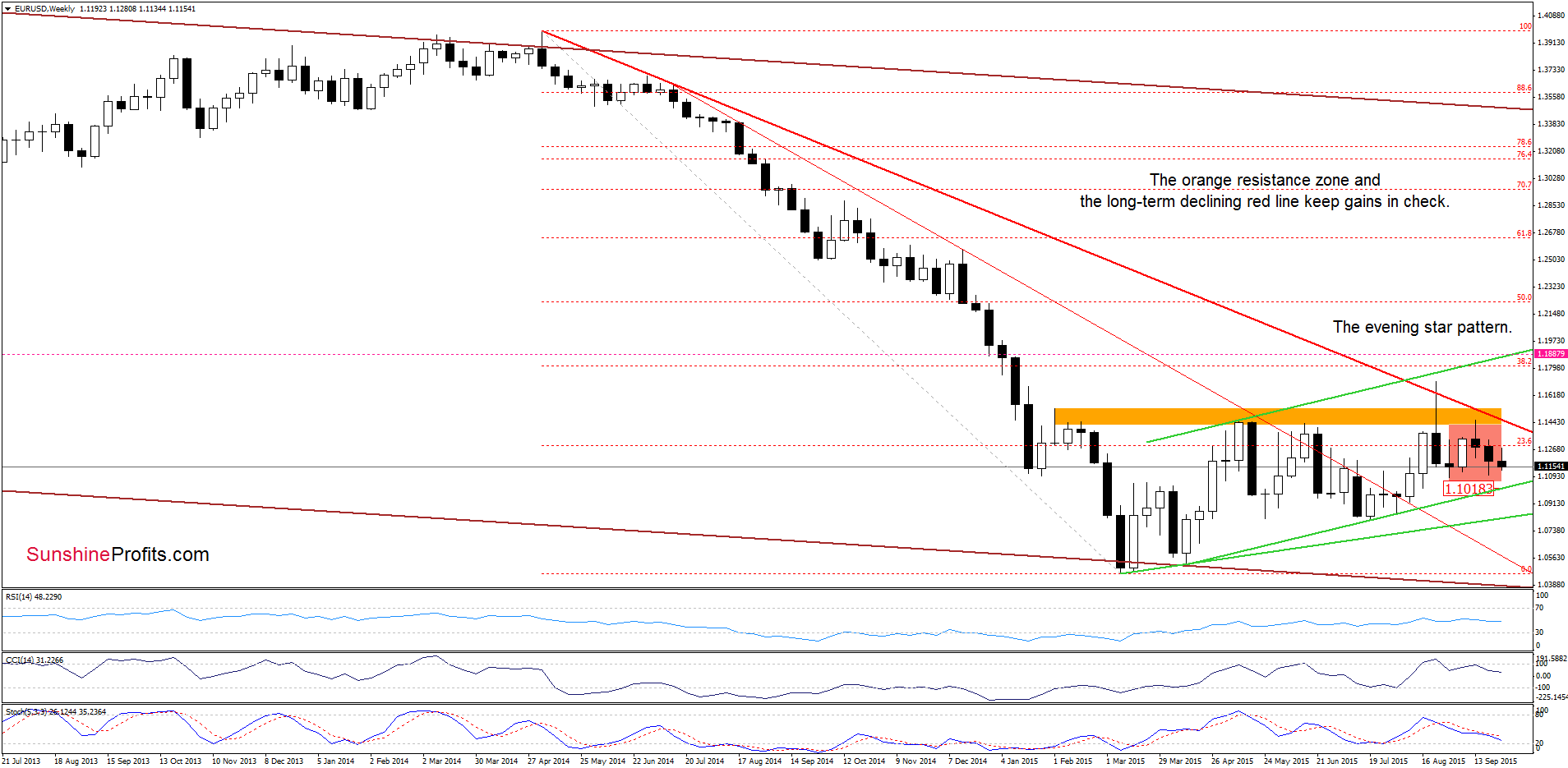

As you see on the daily chart currency bears pushed the pair to our initial downside target earlier today. Although this support line could trigger a rebound from here, the current position of the indicators suggests that lower values of the exchange rate are ahead us. This scenario is also reinforced by the medium-term picture - EUR/USD is still trading well below the orange resistance zone and the red declining resistance line, which are reinforced by the bearish evening star. Additionally, sell signals generated by the weekly indicators remain in place, suggesting further deterioration.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1887 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

On Tuesday, we wrote:

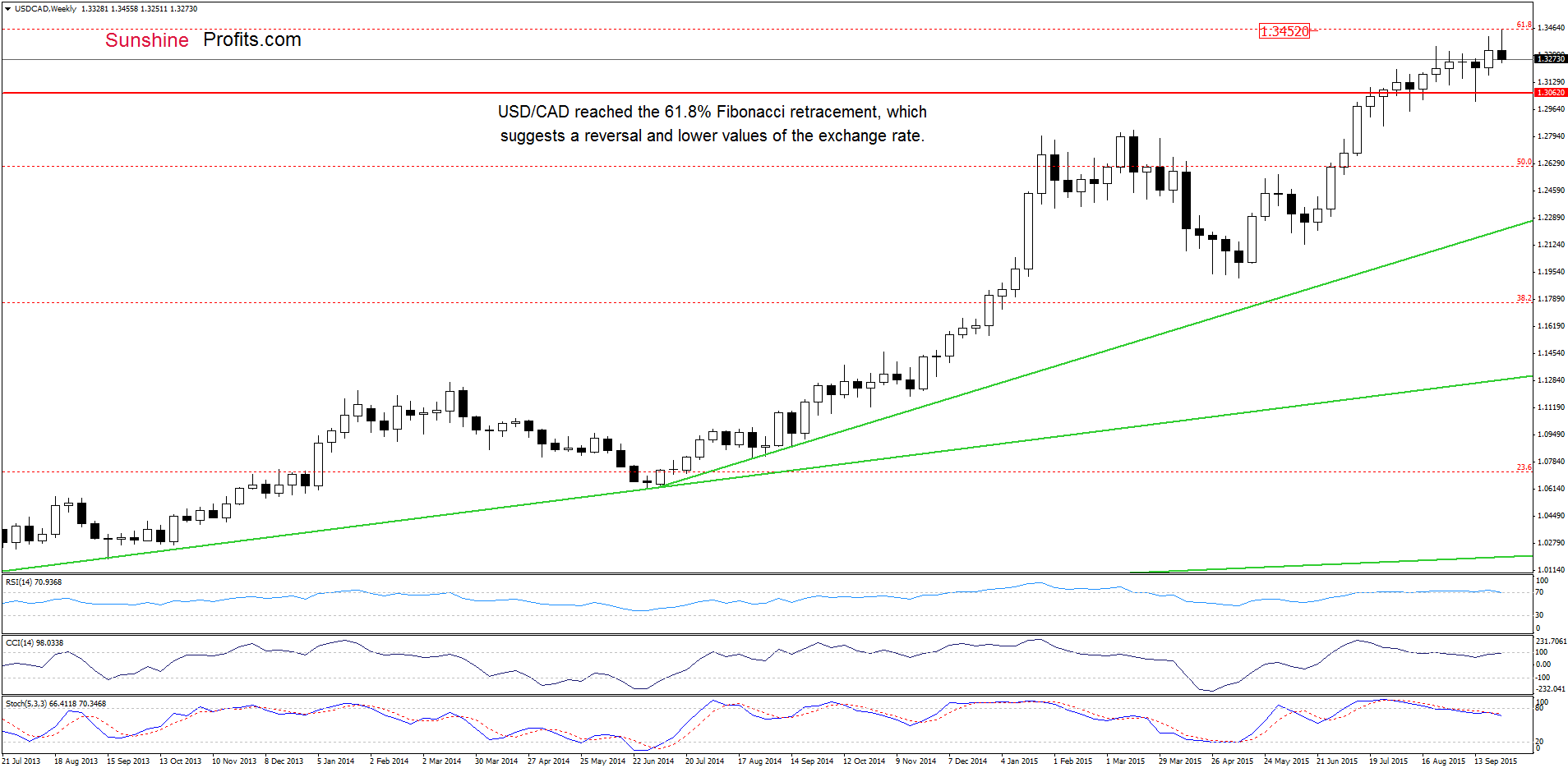

(…) USD/CAD broke above the upper border of the consolidation once again, hitting a fresh 2015 high (…) How high could the pair go? In our opinion, (…) the initial upside target for currency bulls would be around 1.3452, where the 61.8% Fibonacci retracement is (at 1.3444 is also the 127.2% Fibonacci extension based on the Aug-Sep decline). Nevertheless, we should keep in mind that the position of the indicators suggests that reversal is just around the corner.

Looking at the charts we see that the situation developed in line with the above scenario and USD/CAD reversed after an increase to our initial upside target. With yesterday’s decline the pair invalidated the breakout not only above the previous Sep high but also the Aug high, which is a negative signal – especially when we factor in the fact that recent candlesticks formed a bearish evening star on the daily chart. Additionally, sell signals generated by the indicators remain in place, suggesting further deterioration. If this is the case, and USD/CAD closed the day below the upper border of the red declining trend channel, we may see a decline even to the green support line (currently around 1.3135) in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

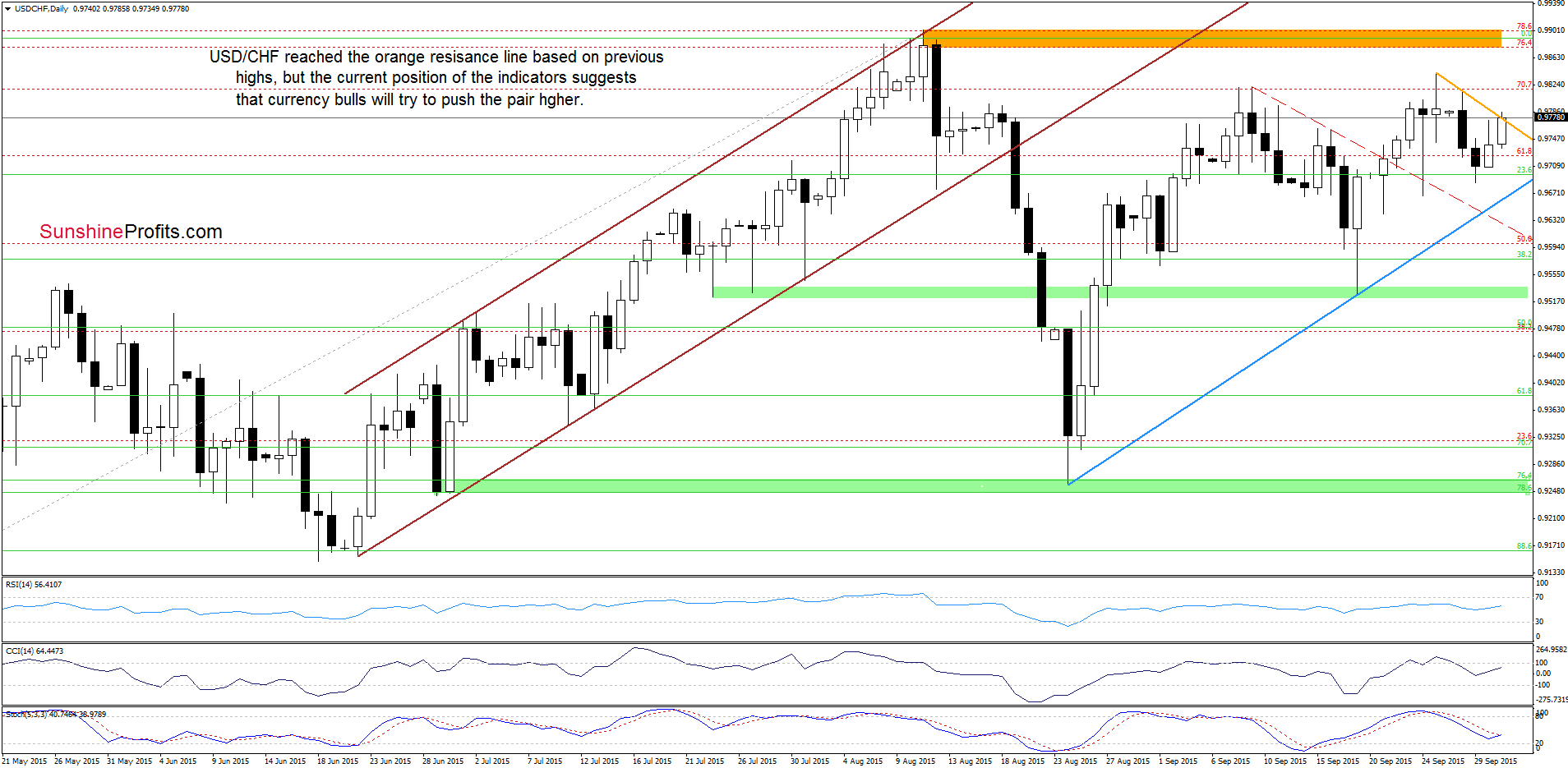

The situation hasn’t changed much as USD/CHF is trading above the previously-broken orange support/resistance line. Today, we’ll focus on the daily chart.

On the above chart, we see that USD/CHF reversed and increased to the orange resistance line based on the previous highs. As you see the current position of the indicators suggests that currency bulls will try to push the pair higher. However, if they fail, and we’ll see a daily closure under this line later today, the exchange rate may reverse and test the blue rising support line in the coming days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts