Last week, several U.S. economic reports were released. What do they imply for the gold market?

The FOMC meeting and parliamentary election in the Netherlands prevented us from covering recent economic data coming out from the U.S. Let’s catch up. First of all, inflation continued to strengthen. Consumer prices increased 0.1 percent last month, according to the Bureau of Labor Statistics. It was the smallest rise since last summer and much below a 0.6 percent surge in January. Core CPI, which excludes the volatile energy and food categories, increased 0.2 percent, only slightly faster. However, overall CPI rose 2.7 percent on an annual basis, the highest level since early 2012. Core CPI jumped 2.2 percent over the last 12 months.

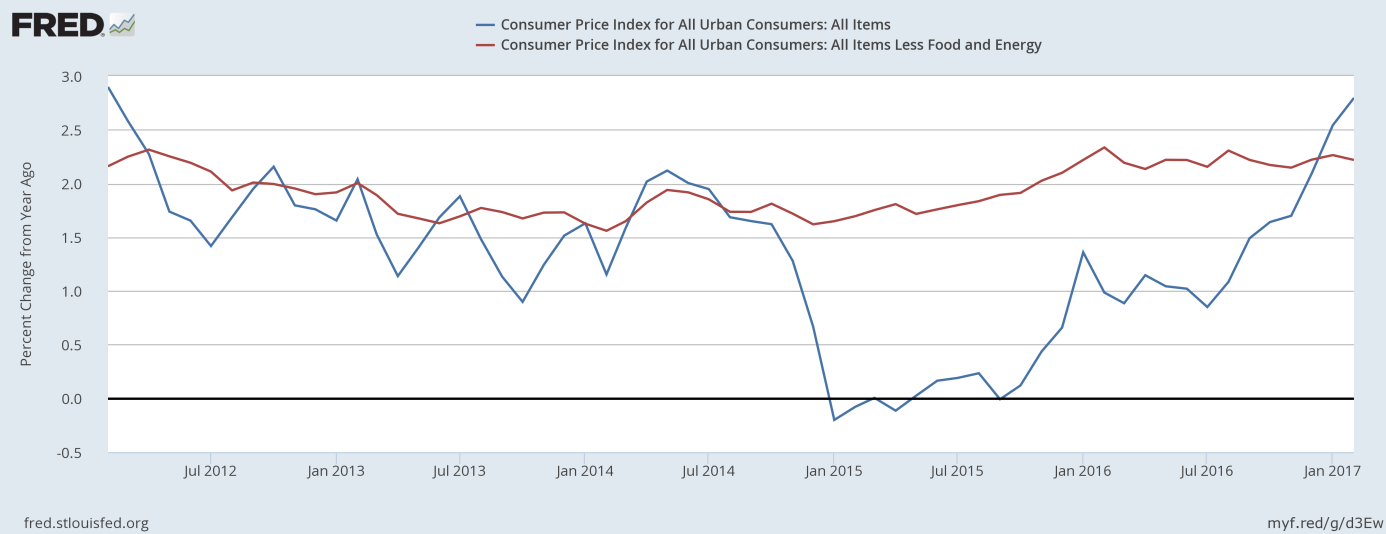

As one can see in the chart below, the overall consumer inflation rate significantly accelerated over the last several months. The inflation rate rose from 0 percent in September 2015 to almost 3 percent currently. It strengthens the hawks’ camp in the U.S. central bank, which is generally bad news for gold bulls. However, until the Fed remains behind the curve, gold may gain due to lower real interest rates.

Chart 1: CPI (blue line) and core CPI (red line) year-over-year from February 2012 to February 2017.

When it comes to other data, retail sales rose just 0.1 percent in February, following a 0.6 percent jump in January. Weak sales – despite unseasonably warm weather, are a negative surprise, which does not bode well for economic growth. As a reminder, the Atlanta Fed’s GDPNow model forecasts real GDP growth in the first quarter of 2017 at only 0.9 percent.

National industrial production was flat in February, but regional manufacturing indices, such as Philly Fed and Empire State remained at high levels in March (although they corrected a bit). Permits to build new homes dropped 6.2 percent, but housing starts climbed 3 percent in February. And the sentiment among home builders also surged, as the National Association of Home Builders’ confidence index jumped 6 points to 71 in March, the highest level since June 2005.

The bottom line is that retail sales were weak in February, but inflation accelerated on an annual basis. However, given a big drop in oil prices, inflation may soften in the months ahead. Anyway, the recent data on inflation does not affect significantly the prospects of the Fed hikes. A hawkish Fed is rather negative for the yellow metal, although two more hikes in 2017 have been probably already priced in. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview