Bitcoin Trading Alert originally sent to subscribers on April 24, 2015, 11:07 AM.

In short: speculative short positions, stop-loss at $239, take-profit at $153.

Customers of Starbucks in Hong Kong are now able to pay for their coffee with Bitcoin, we read on newsBTC:

Starbucks branches in Hong Kong are now accepting bitcoin payments and are offering 20% off discount for the purchase using the Fold app. This app is a U.S. startup that is affiliated with the Bitcoin Association of Hong Kong.

To avail of this, a customer has to (…) receive his personal Starbucks code. This will initially show a balance of $0 until it is loaded with bitcoin through the app. It may indicate that the app is untested outside of the U.S. but it is already currently working in Hong Kong.

Bitcoin payments loading options include denominations of $5 or $10. To spend this and avail of the discount in Hong Kong’s Starbucks branches, simply tell the cashier that you will be paying via gift card. The barcode scanner will then be used on the Fold app indicating your current balance then you will get a receipt containing your remaining balance.

This is positive news since Starbucks is a relatively big name which can draw attention to Bitcoin as people who have never heard of the currency might become interested in what Bitcoin actually is and how it might be used. Also, opening up business to Bitcoin in Hong Kong might be a kind of pilot for integrating such payments in other markets. If it turns out that there is interest in Bitcoin, Starbucks might decide to extend this sort of service beyond Hong Kong.

This is not revolutionary in the sense that it doesn’t really create any new features for the Bitcoin system but make no mistake, recognition is very important for Bitcoin. It is definitely one of the areas that need improvement but moves by international companies to use Bitcoin might help in bringing Bitcoin to a larger audience.

For now, let’s focus on the charts.

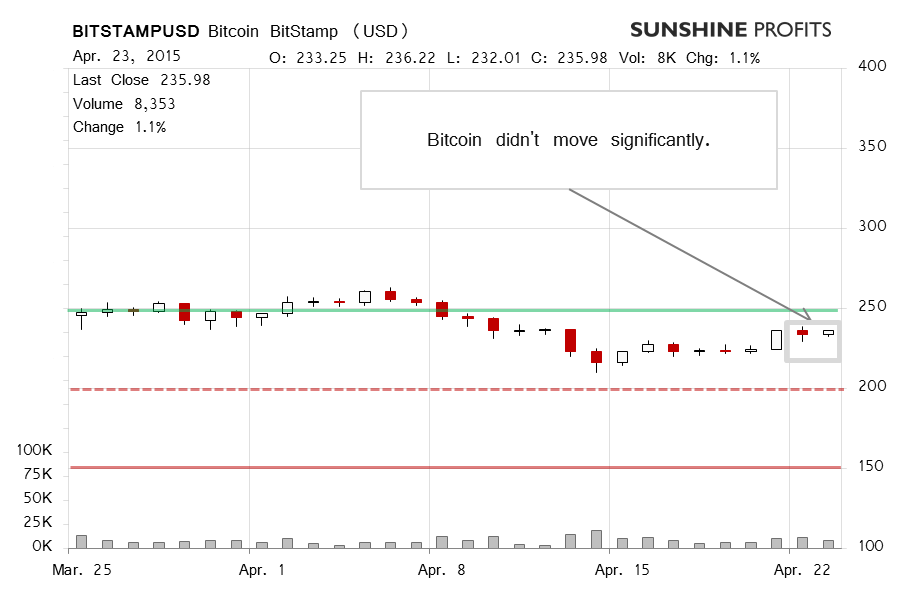

On BitStamp, yesterday was a day of not that much action. Bitcoin fluctuated around $235 and the volume was lower than on Wednesday. Recall that yesterday we wrote:

(…) we haven’t really seen a decisive move either but the volume level is still similar to what we saw yesterday (the day is not over, though). All of this suggests that Bitcoin might be running out of steam as far as the move up is concerned. In any case, the short-term outlook remains unchanged unless we see a more visible move above $240 (and our stop-loss levels at $239 are guarding the already profitable hypothetical short positions against any such move).

This remained the case after our alert was published and today Bitcoin has depreciated some (this is written before 11:00 a.m. ET). The depreciation today makes the short-term outlook more bearish but it is not an indication of a very strong move to the downside. The way the action is shaping up, it seems that today might be an indication of the recent move up being just a jump to the upside. If so, then the current short-term outlook remains bearish.

On the long-term BTC-e chart, we see that yesterday’s action looks very much like a bounce down from a possible declining trend line. Today would also fit well in this pattern as we’ve seen some depreciation. Our yesterday’s comments are still up to date:

Yesterday’s action brought Bitcoin close to the stop-loss level at $239 but the currency didn’t touch it, which suggests that not much actually changed based on yesterday’s action alone. Unless we see a move above this level, we will still view the short-term outlook as largely unchanged. Our take right now is that Bitcoin might resume the declines in the near future. A move above $240 is still possible but our best bet would be on Bitcoin moving back down.

This has so far been the case but we wouldn’t get too optimistic just now. The short-term outlook is bearish but yesterday’s action alone is still not enough to proclaim that the next big move has begun. One way or another, the outlook remains unchanged and it is bearish, in line with the recent trend. Consequently, we still think that short hypothetical positions might become even more profitable than they already are. If we see a move back down on higher volume, the situation would become even more bearish.

On an administrative note, I am taking a day off next week, so there will be no Bitcoin Trading Alert on Monday, Apr. 27, 2015. Bitcoin Trading Alerts will resume on Tuesday, Apr. 28, 2015.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short, stop-loss at $239, take-profit at $153.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts