On Tuesday, British pound move lower against the greenback, which resulted in an invalidation of the breakout above two important resistances. How did this negative development affect the technical picture of GBP/USD?

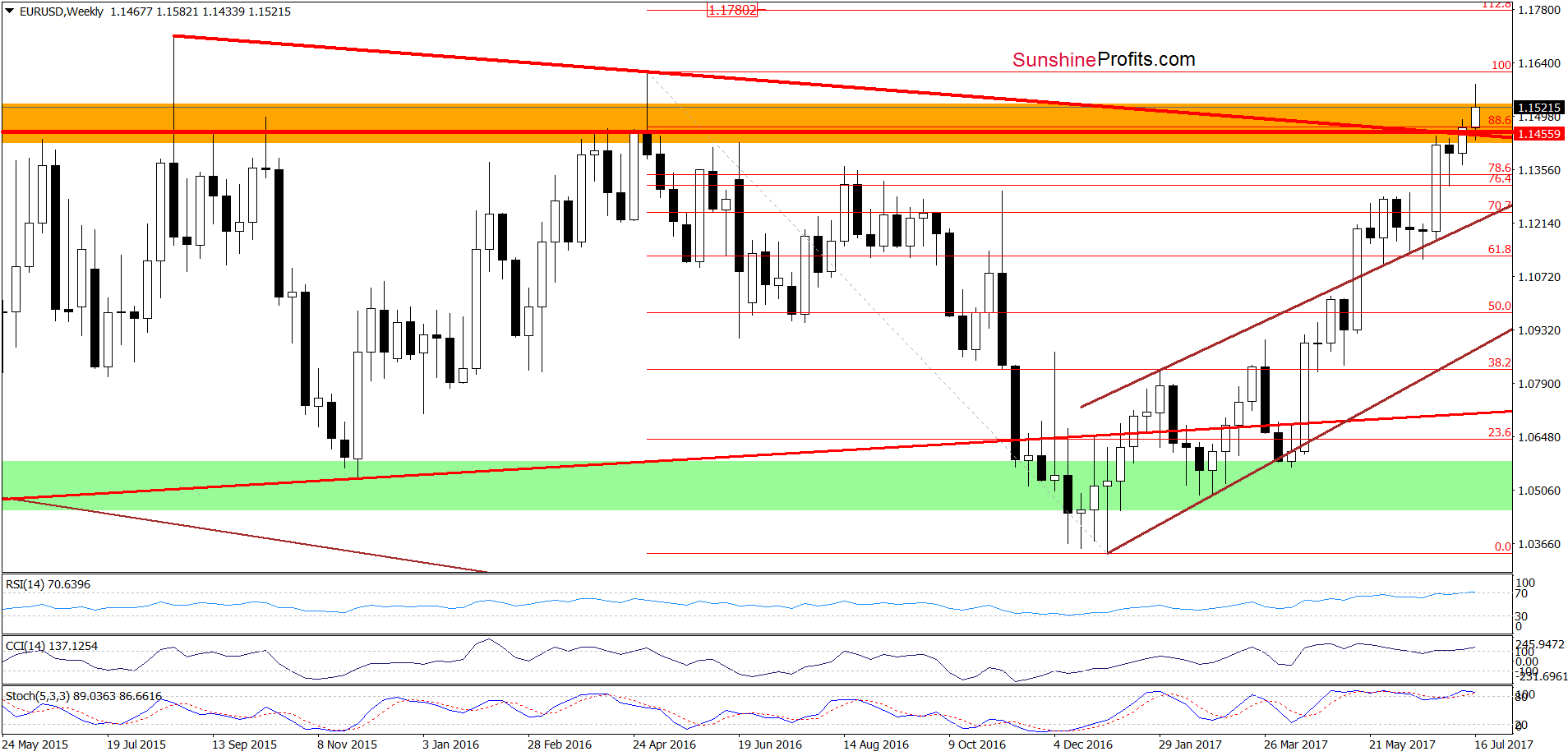

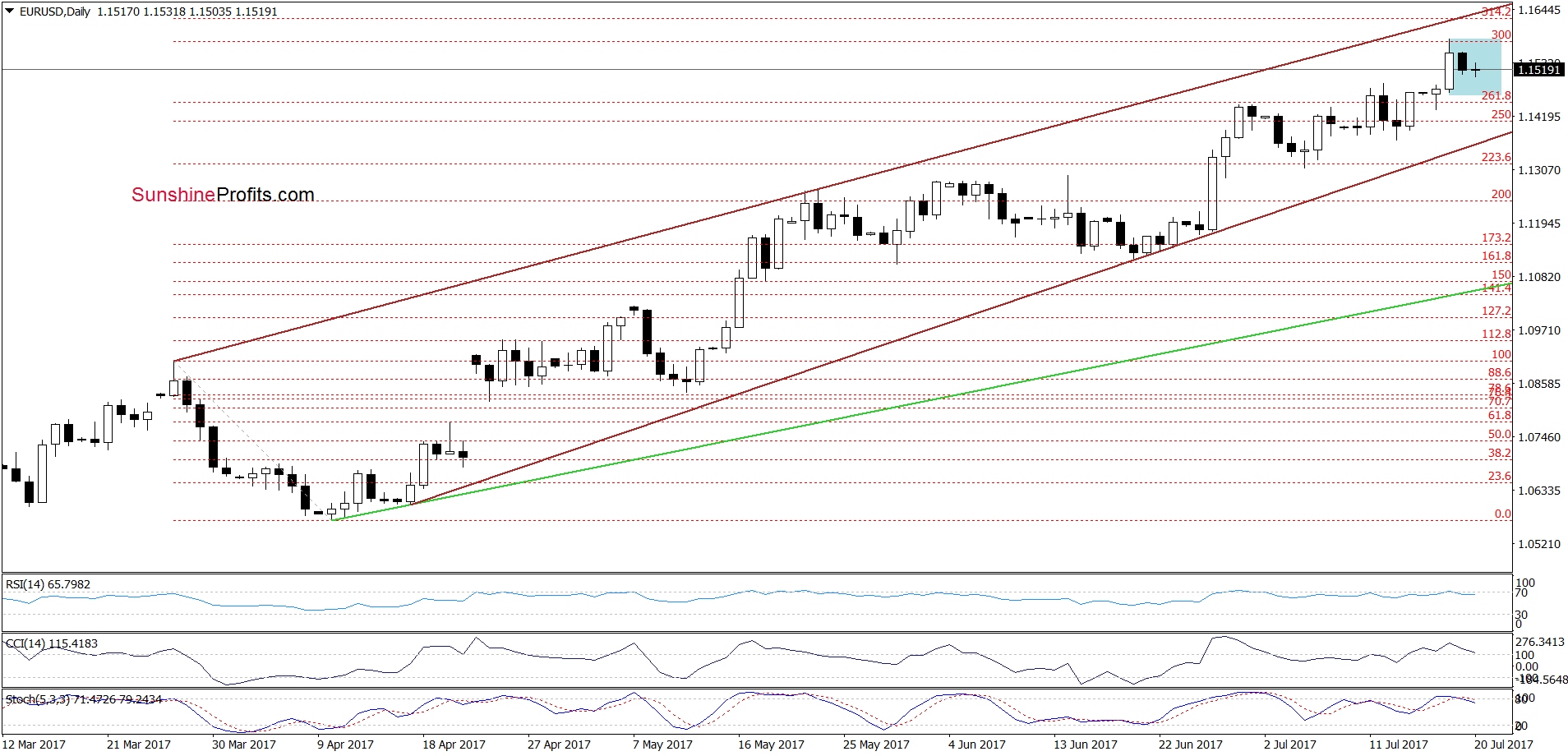

EUR/USD

Looking at the daily chart, we see that the situation in the very short term hasn’t changed much as EUR/USD remains in the blue consolidation not far from the May 2016 high of 1.1615 and the upper border of the brown rising trend channel. What’s next? Taking into account the fact that currency bulls were strong enough to push the exchange rate above the upper border of previous consolidations, it seems to us that we’ll see one more upswing and a test of the above-mentioned resistances before a bigger move to the downside.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

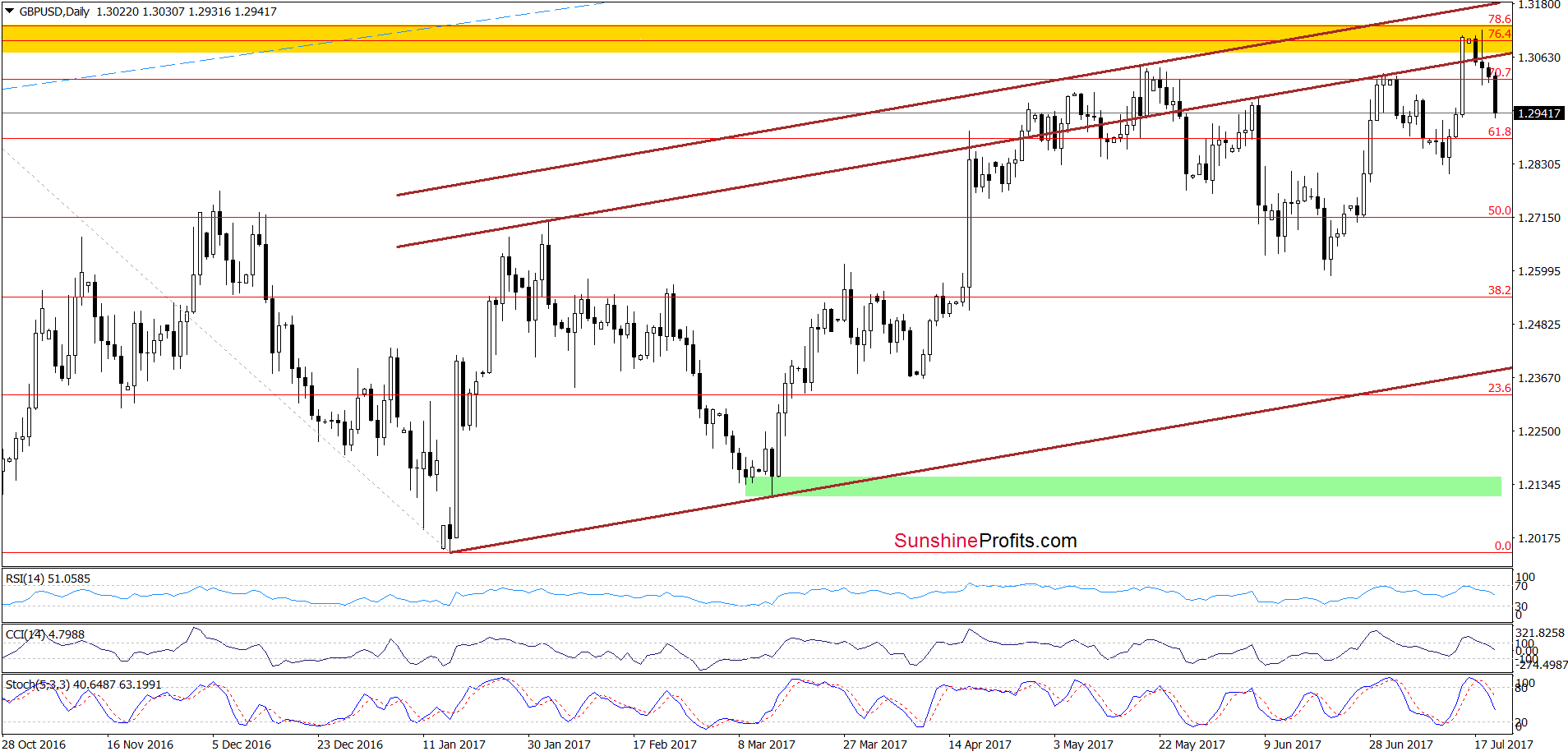

GBP/USD

Quoting our last commentary on this currency pair:

(…) although GBP/USD broke above the upper border of the brown rising trend channel and hit a fresh 2017 high, the yellow resistance zone stopped currency bulls triggering a pullback. As a result, the exchange rate slipped below the brown line, which suggests that we may see an invalidation of the breakout later in the day. In other words, if the pair closes today’s session under the upper border of the brown rising trend channel and the May highs, currency bears will receive important bearish factors to act. If this is the case, we’ll see and acceleration of declines and a test of the mid-July or even late June low in the coming days.

From today’s point of view, we see that the situation developed in line with the above scenario and GBP/USD closed Tuesday’s session under the upper border of the brown rising trend channel and the May highs, invalidating the earlier breakout. This negative event encouraged currency bears to act earlier today, which resulted in a sharp decline. This suggests that we’ll see a realization of the bearish scenario from our previous alert and a test of our downside targets in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

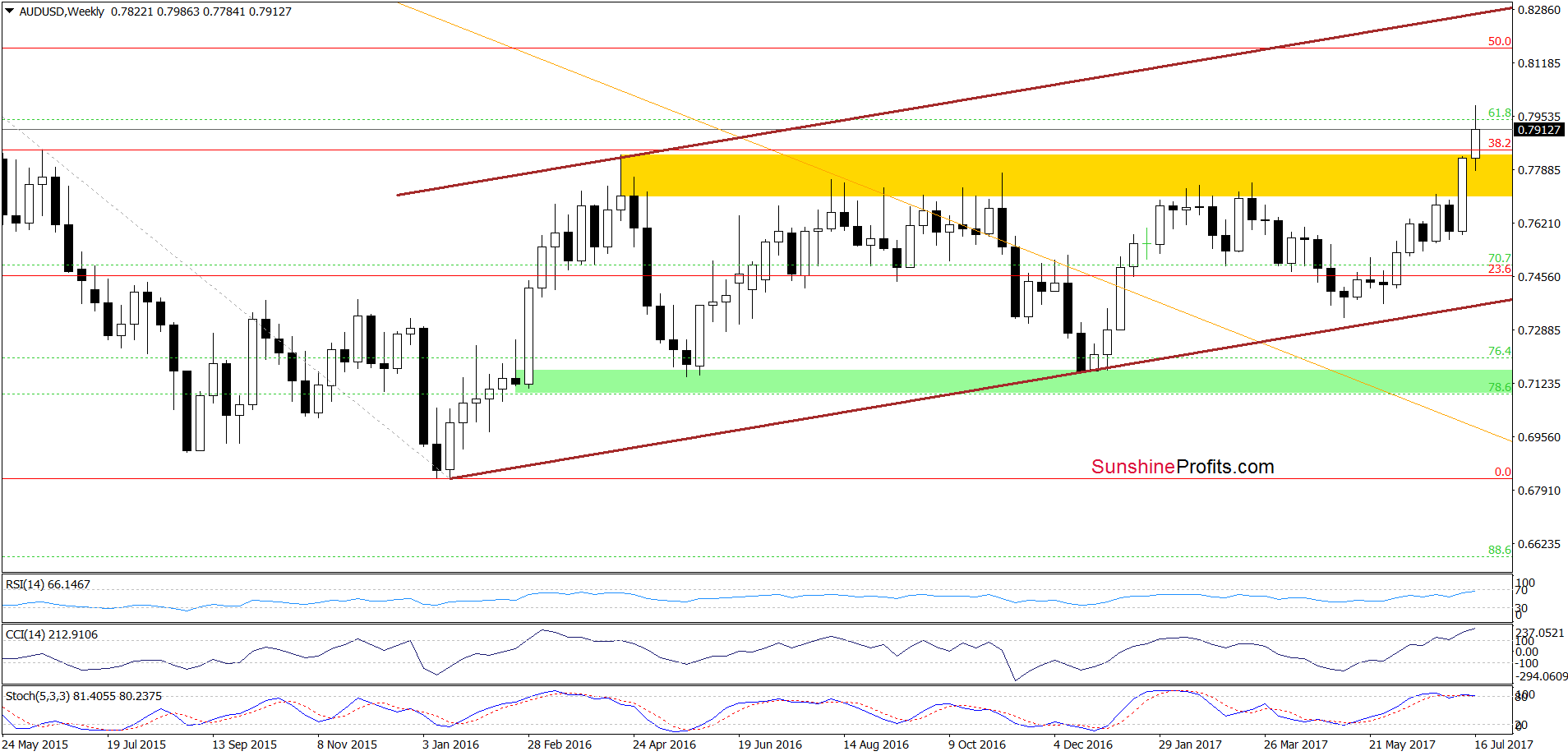

AUD/USD

On Tuesday, we wrote the following:

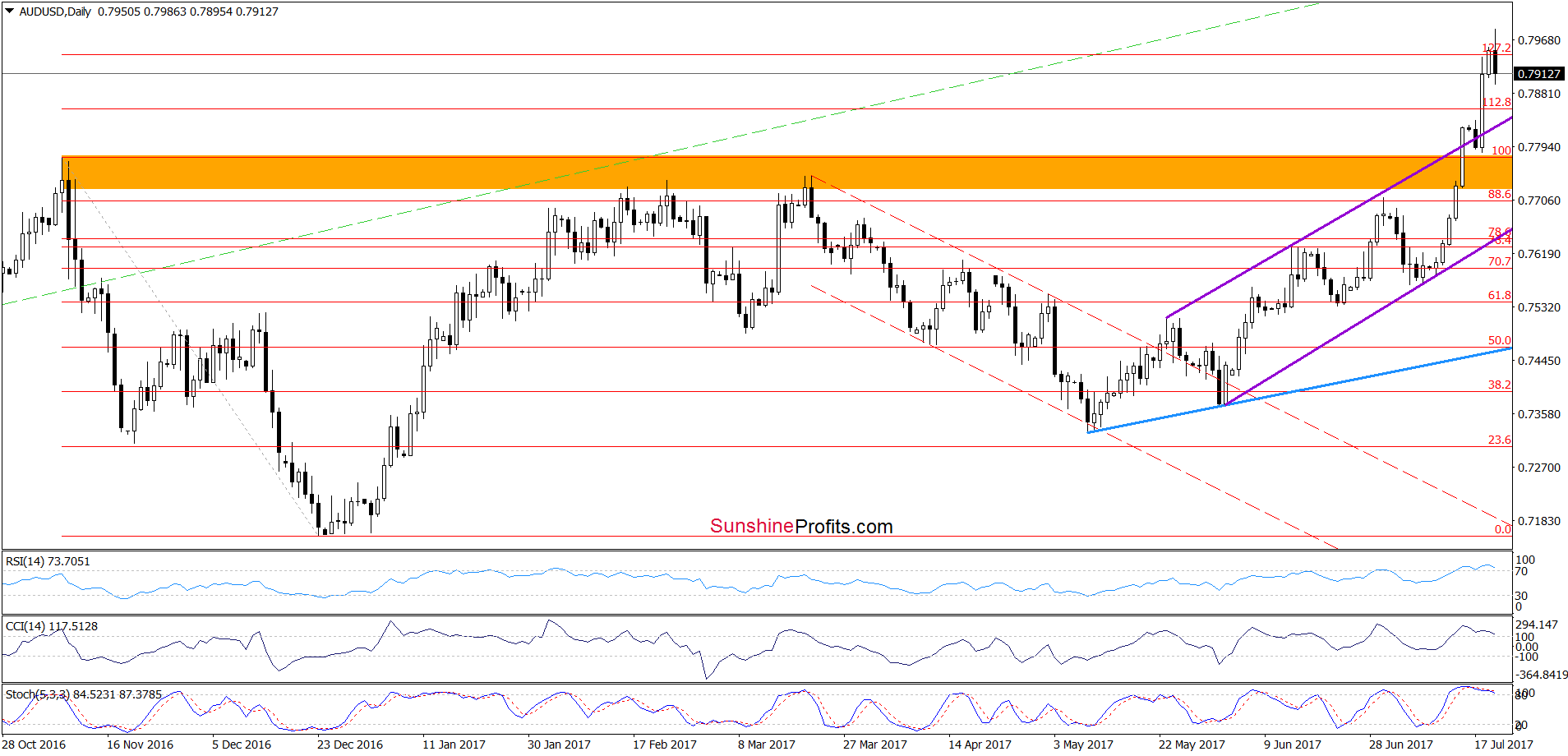

(…) AUD/USD moved sharply higher and broke not only above the orange resistance zone, but also above the upper border of the purple rising trend channel, which is a bullish development, which suggests a test of the 127.2% Fibonacci extension later in the day.

On the daily chart, we see that currency bulls pushed AUD/USD higher (as we had expected) and the exchange rate increases slightly above our upside target. Despite this improvement, currency bulls didn’t manage to hold gained levels, which resulted in a reversal and a decline earlier today. Thanks to today’s drop the pair slipped under the 127.2% Fibonacci extension, invalidating the earlier breakout, which is a negative event. Nevertheless, AUD/USD still remains above the previously-broken upper border of the purple rising trend channel and the November high, which suggests that as long as there is no invalidation of the breakout above these levels another attempt to move higher can’t be ruled out – especially when we factor in the fact that there are no sell signals generated by the indicators, which could encourage currency bears to act.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up today!.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts