Although everyone agrees that the electric revolution is looming, there is no consensus about the pace and the detailed form of the upcoming shifts in the automotive industry. In particular, some miners and analysts believe that fuel cell cars will spur or at least support the demand for platinum and palladium. For example, the world’s three largest platinum producers (Anglo American Platinum, Impala Platinum and Lonmin) invested in projects related to fuel cell technologies. Indeed, the white metal is used in catalysts in fuel cells vehicles, where power comes from combining hydrogen and oxygen over a platinum catalyst. The game is definitely worth the candle: today’s fuel cell cars need a full ounce of platinum versus a 2-4 grams PGM loading for the average gasoline or diesel vehicle.

But the rescue will not come from this side. First of all, hydrogen technology is inferior to battery electric vehicles. The key point is that hydrogen is actually not an energy source, but merely a carrier. Hence, you have to get hydrogen from natural gas or water in very energy intensive process, and then you have to compress it into liquid and transport it to the final destination. Finally, the consumers must pump the liquid hydrogen into their car, where a fuel cell converts it into electricity to drive other electric vehicles. So why should anybody bother storing energy in hydrogen instead of charging a battery pack directly? Indeed, electric cars are at least three times more energy efficient than hydrogen fuel cell vehicles.

Moreover, the latter technology needs much more expensive infrastructure (think about all these large factories/refineries, pipelines, trucks, storage facilities, compressors, hydrogen gas stations, and so on), while the former relies on already existing power grid. There are, thus, much more charging stations than hydrogen fueling stations. Lack of infrastructure is perhaps the biggest barrier for fuel cell vehicles.

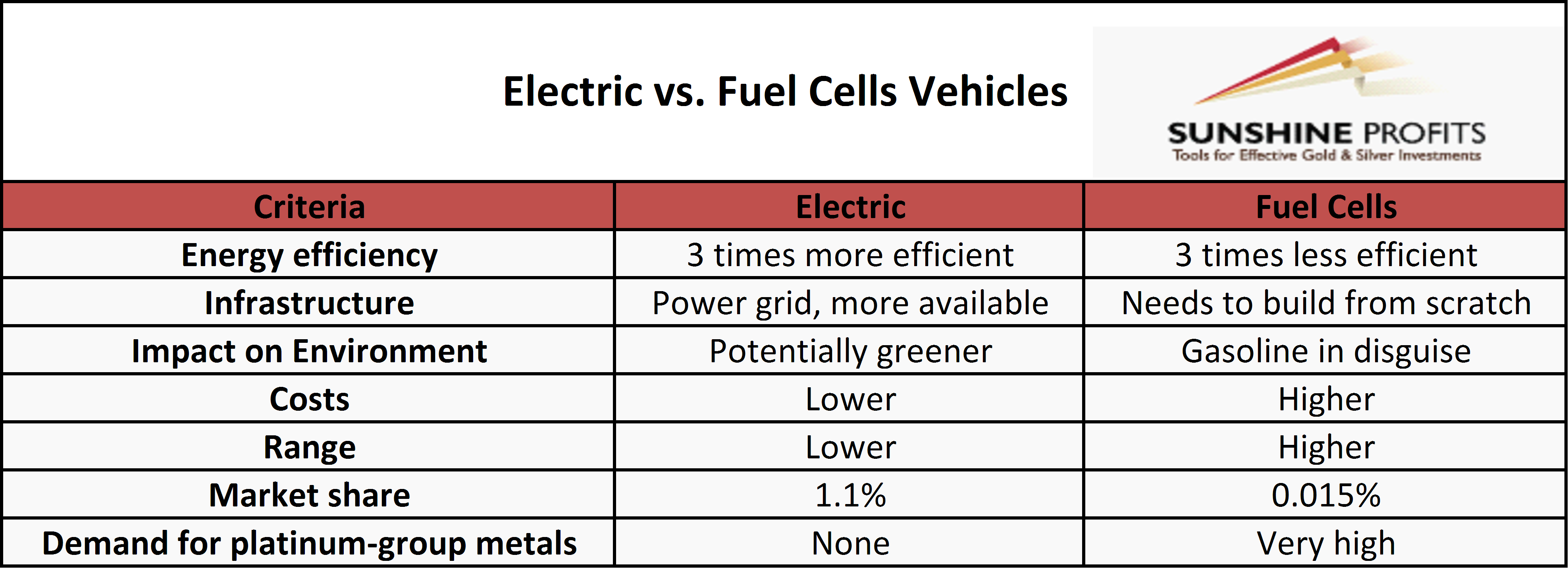

And hydrogen is not actually clean technology, at least not in the U.S. when it is mainly produced from natural gas. It’s a fossil fuel but in a green disguise. Finally, electric cars are cheaper than hydrogen vehicles – actually, in some countries, the total costs of ownership of an electric car are on parity with conventional cars (due to a per-mile fueling cost below that of gasoline). It cannot be said the same about the fuel cells vehicles, and steadily declining battery prices will even increase the advantage of electric cars even further. The comparison of these two technologies is presented in the table below:

Table 1: Electric vs. fuel cells vehicles.

Actually, the high price of platinum is one of the major challenges that the fuel cell cars face. It’s not surprising, given that platinum represents about 50 percent of the cost of a fuel cell stack. Hence, researchers continuously try to reduce the need for the white metal. Do not count on palladium in this matter, as it is only slightly cheaper than platinum. Instead, scientists at the U.S. Department of Energy’s Argonne National Laboratory have recently developed a new non-precious metals fuel cell catalyst. Meanwhile, Toyota announced the availability of a new, smaller catalyst that uses 20 percent less precious metal while maintaining the same exhaust gas purification performance. Another example is the study of Chalmers University of Technology and Technical University of Denmark, which discovered a new method of creating a nanoalloy which could reduce the amount of platinum required for a fuel cell by about 70 percent. Hence, even if the fuel cell technology succeeds and wins the battle with electric cars, which is highly unlikely, it would achieve it only through reducing the need for platinum.

Moreover, the use of platinum-heavy fuel cell technology in the electric car market is growing much too slowly to offset falling autocatalyst demand. While the hybrid and electric cars made up about 1.1 per cent of global automotive sales, the market share of fuel cell vehicles amounted to just about 0.015 percent. The truth is that the latter technology lags behind electric cars. It would take several years to refine it and build the whole infrastructure necessary for fuel cell cars, while electric vehicles are already on hyper-drive.

Hence, the demand for platinum from hydrogen cars could replace only about 10-20 percent of demand from the car industry at best, while more than 40 percent of platinum demand comes from gasoline and diesel catalysts. However, it does not matter, since even if hydrogen electric technology preserves some automotive demand for platinum, which is not certain, the share of the overall automotive demand will shrink significantly. Investors should be concerned primarily about the replacement of platinum group metals by battery electric technologies – since, as Chris Griffith, the Anglo American Platinum chief executive, said, “if fuel cells are not adopted, we may have no auto market for platinum by 2050.”

If you enjoyed the above analysis and would you like to know more about the impact of the upcoming changes in the automotive sector on the precious metals, we invite you to read the August Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview