In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the exit target at 1.1165)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 110.04; the exit target at 108.04)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

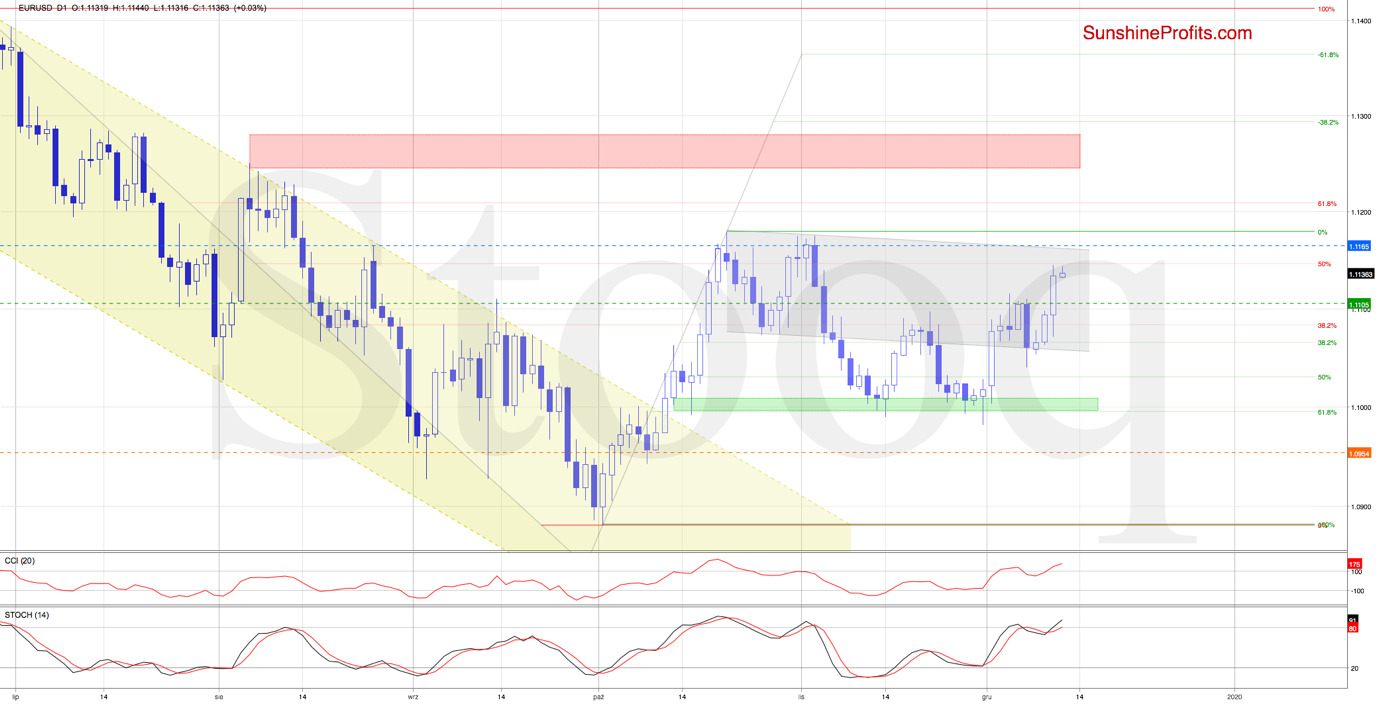

EUR/USD

After Friday's downswing on the heels of strong U.S. jobs data, the euro has rebounded higher. And quite sharply so. Yesterday's FOMC also added to the bonfire. What shall the bulls look forward for?

In our last commentary on this currency pair, we wrote:

(...) the pair pulled back a bit earlier today - but it still keeps trading inside the blue consolidation.

As there are no sell signals by the daily indicators, one more attempt to move higher may be just around the corner.

The situation has indeed developed in line with the above, and EUR/USD has staged an upside reversal recently.

Earlier today, the pair had been trading around yesterday's peak. Combined with the lack of the daily indicators' sell signals, it increases the probability that we'll see a test of the upper border of the grey declining trend channel in the very near future.

Trading position (short-term; our opinion): profitable long positions with a stop-loss order at 1.0954 and the exit target at 1.1165 are justified from the risk/reward perspective.

GBP/USD

GBP/USD has extended gains recently, climbing above the orange resistance area created by the May peaks and the 50% Fibonacci retracement. This move brought the pair also slightly above the upper border of the rising green trend channel.

Let's take a look at the nearest resistance and the extended position of the daily indicators as both the CCI and the Stochastic Oscillator are close to generating their sell signals. As a result, it seems that reversal and lower values of the exchange rate may be just around the corner.

Should we see an invalidation of the above-mentioned breakouts, we'll consider going short.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

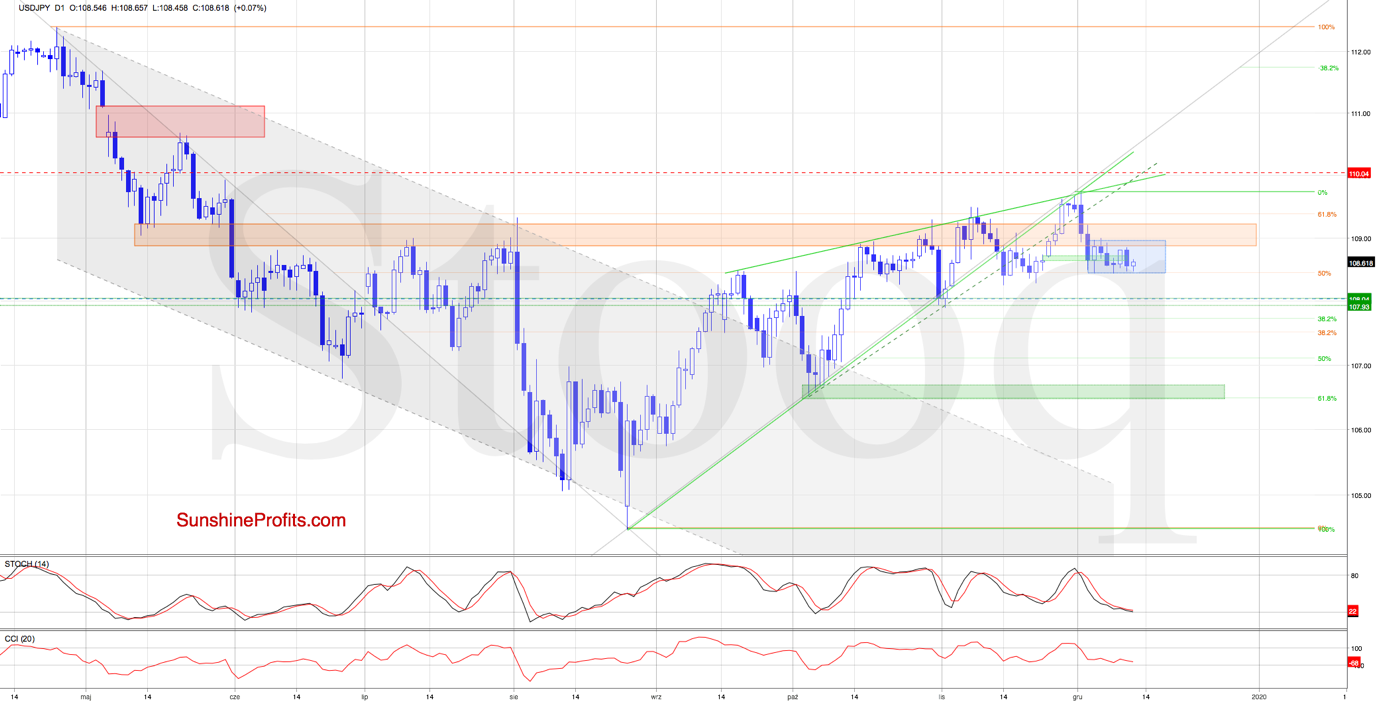

USD/JPY

As can be readily seen on the above chart, the November green gap has been closed. This means one less support for the bullish case, suggesting that one more attempt to move lower may be just around the corner.

Nevertheless, such price action will be more likely and reliable only if the pair drops below the lower border of the blue consolidation. Should we see such price action, the first downside target for the bears would be around 107.93-108.04. This is where the nearest support area (created by the lows at the turn of Oct and Nov) is.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.03 and the exit target at 108.04 are justified from the risk/reward perspective.

USD/CAD

Although USD/CAD moved sharply higher on Friday, the combination of the previously broken lower border of the blue consolidation and the upper border of the declining red trend channel stopped the bulls. Another decline followed since then. As a result, the pair erased the entire rebound and again approached last week's lows.

Additionally, the Stochastic Oscillator flashed its sell signal again, which suggests that we could see another attempt to move lower in the coming day(s). Should it be the case, the first downside target for the bears would be the green support zone based on the lows at the turn of October and November.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

USD/CHF

Let's quote our Friday's commentary:

(...) The sell signals of the daily indicators remain on the cards though, hinting at the high likelihood of another downswing ahead.

Should the pair moves lower from here, we'll likely see a re-test of the green zone or even a move to the Oct 21 low in the very near future.

The situation has developed in line with the above, and USD/CHF has indeed extended losses recently. As the pair broke below the green support, and there being no buy signals of the daily indicators, we'll likely see a test of the next green support area in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

AUD/USD

Although AUD/USD moved lower early in the week, the 61.8% Fibonacci retracement stopped the sellers. A rebound followed, taking the pair sharply up right to the medium-term declining resistance line, which could trigger a reversal in the very near future however.

Nevertheless, taking into account the lack of the sell signals, another upswing and a test of the next declining resistance line can't be ruled out.

Should we see reliable signs of the bulls' weakness, we'll consider going short.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist