Earlier today, the British currency extended losses against the greenback as the result of the last week’s election in UK continues to weigh on investors sentiment. In these circumstances, GBP/USD approached Friday’s low. Will we see further deterioration in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1402; the initial downside target at 1.1009)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: long (a stop-loss order at 107.62; the initial upside target at 113.08)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7598; the initial downside target at 0.7385)

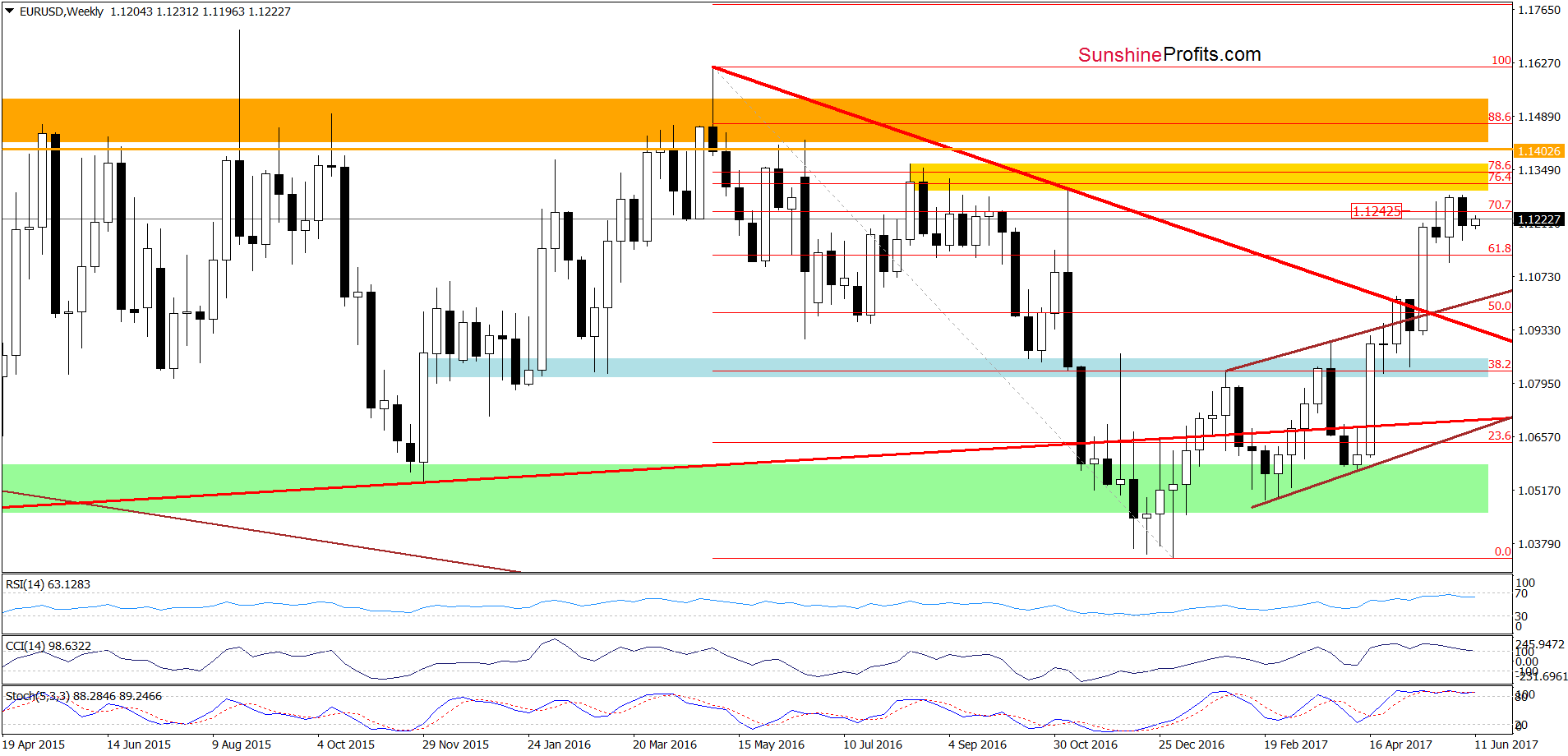

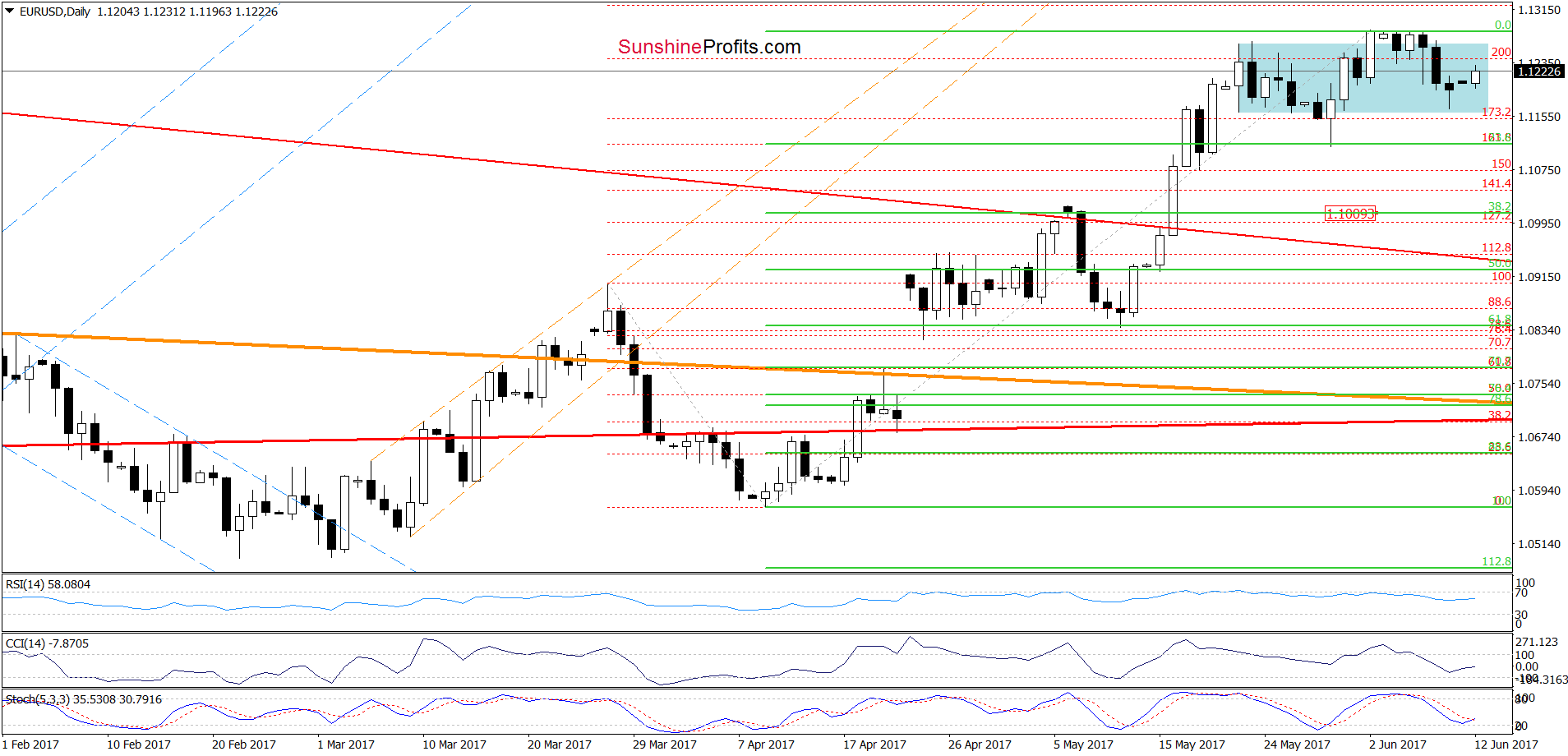

EUR/USD

Looking at the daily chart, we see that although EUR/USD moved a bit higher earlier today, the exchange rate remains in a narrow range below the upper border of the blue consolidation and the Fibonacci retracements. This suggests that as long as there is no another breakout above these levels, reversal and lower values of the exchange rate are likely. If this is the case, the pair will break under the lower border of the blue consolidation and w will likely see a drop to (at least) the 38.2% Fibonacci retracement in the coming week.

Very short-term outlook: bearish Short-term outlook: mixed with bearish bias MT outlook: mixed LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1402 and the initial downside target at 1.1009) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

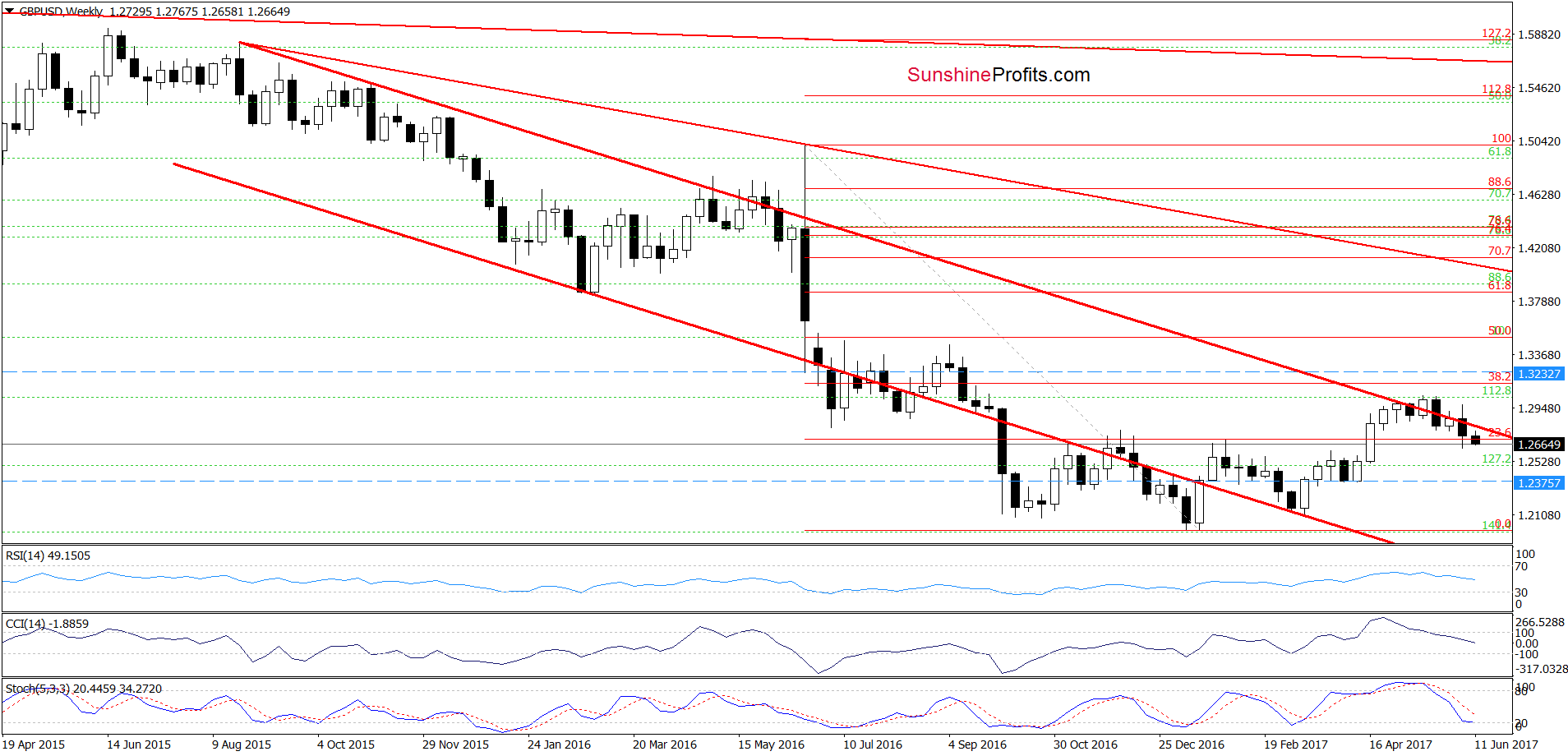

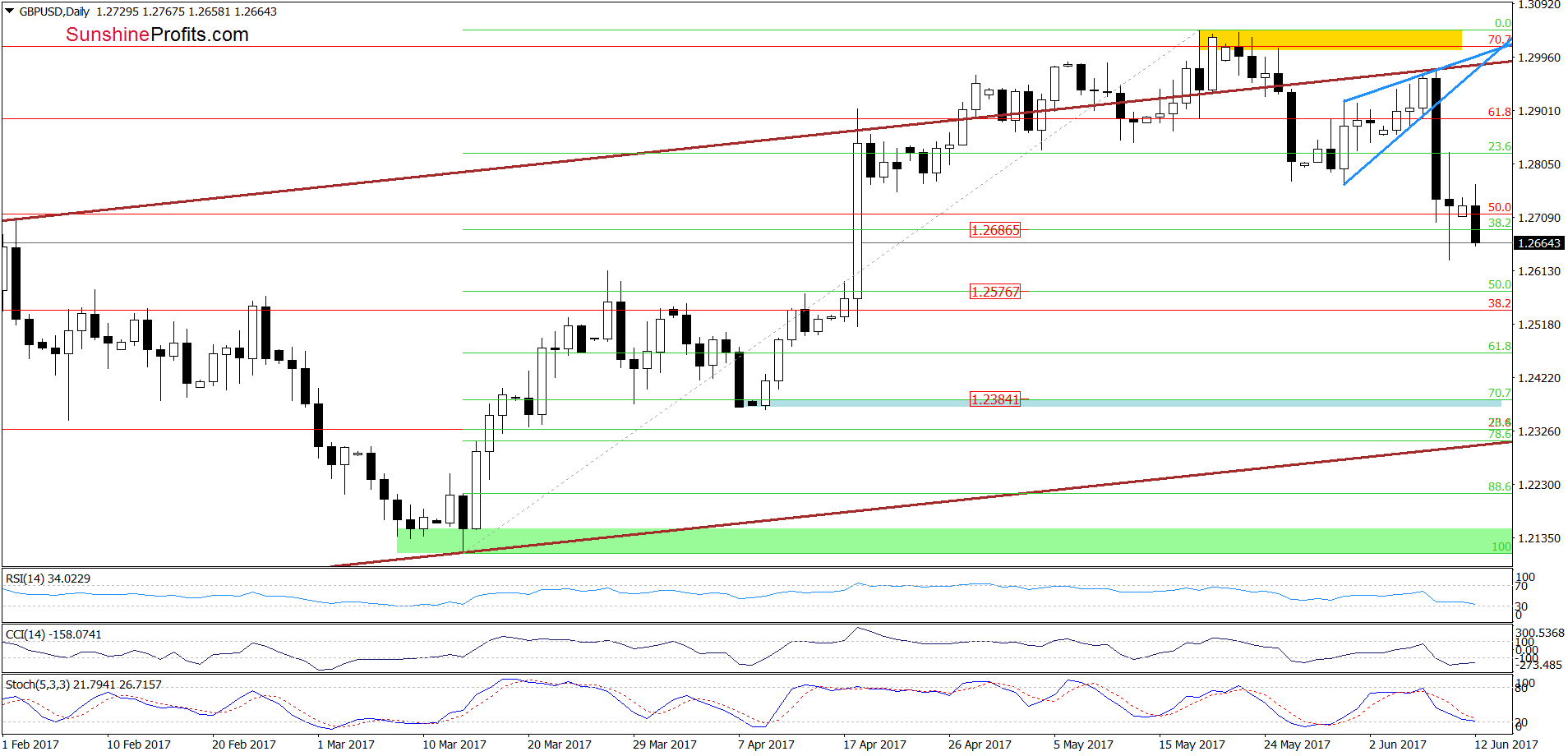

GBP/USD

The first thing that catches the eye on the weekly chart is an invalidation of the breakout above the long-term red declining resistance line, which together with the sell signals generated by the medium-term indicators doesn’t bode well for currency bulls.

How did this drop affect the very short-term picture? Let’s check.

Quoting our Thursday’s alert:

(…) the combination of the upper border of the brown rising trend channel and the upper line of the blue rising wedge triggered a pullback earlier today, which suggests a test of the lower blue line in the coming day. If the exchange rate breaks below it, we’ll see a drop to the first downside target around 1.2686, where the 38.2% Fibonacci retracement is.

From today’s point of view, we see that the situation developed in line with the above scenario and GBP/USD moved sharply lower, not only reaching, but also breaking below the 38.2% Fibonacci retracement. Earlier today, currency bulls pushed the exchange rate lower once again, which suggests further deterioration and even a drop to the blue support zone created by the 70.7% retracement and the early April lows in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short (already profitable) positions (with a stop-loss order at 1.3232 and the initial downside target at 1.2375) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

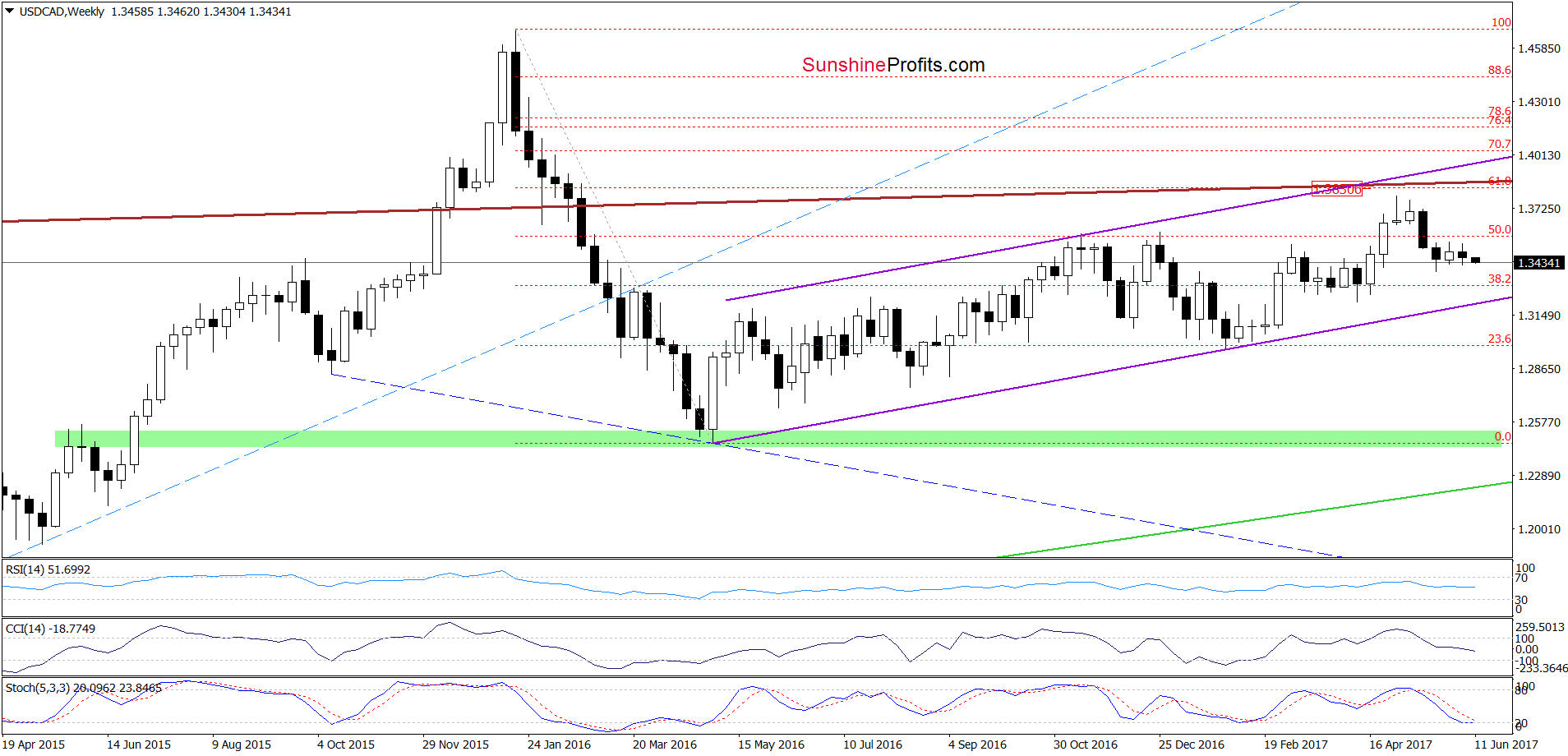

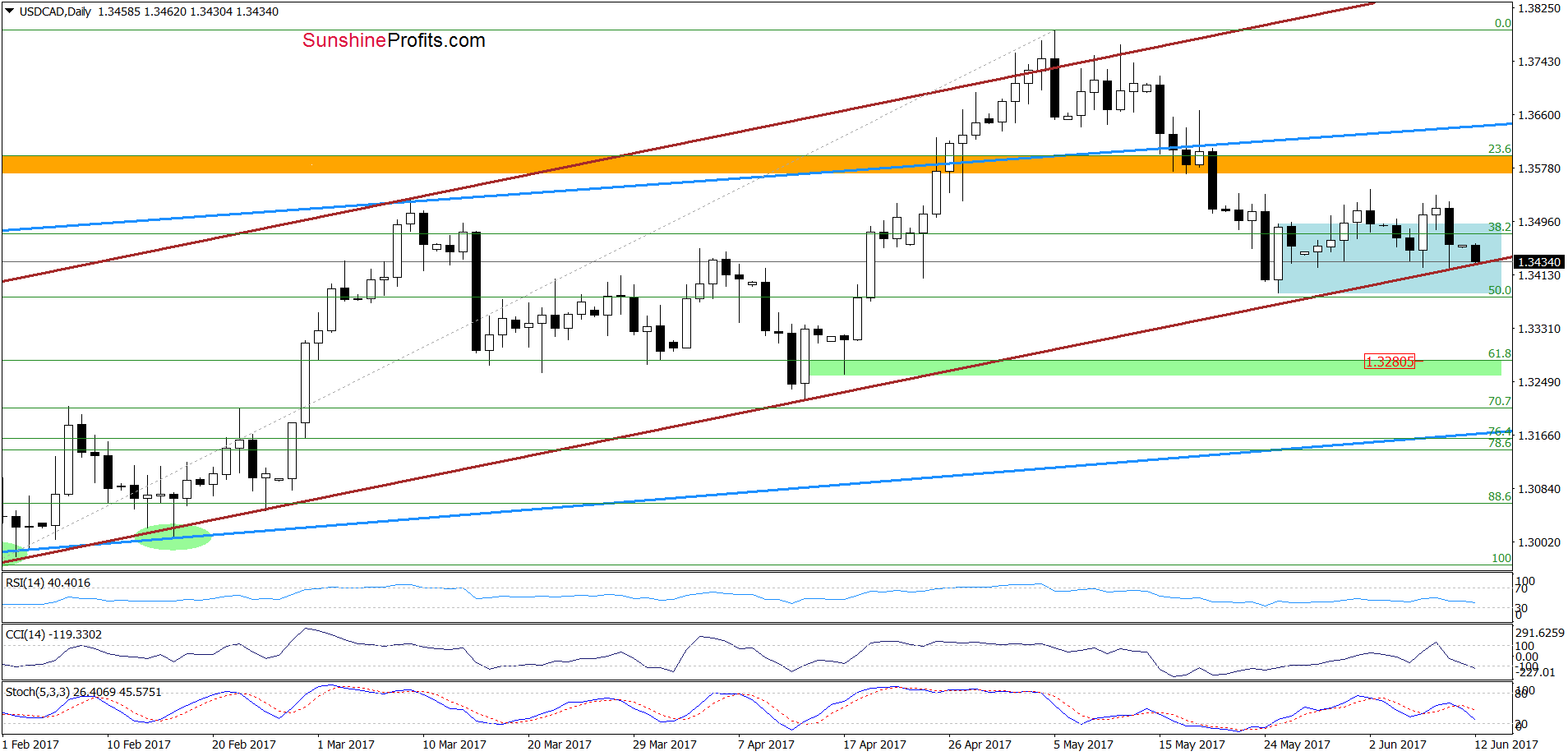

USD/CAD

On the daily chart, we see that although USD/CAD increased above the upper border of the blue consolidation once again, currency bulls didn’t push the pair higher, which resulted in a reversal and a drop to the lower border of the brown rising trend channel. What’s next? Taking into account the fact that this important support was strong enough to stop currency bears several times in the past, it seems that another reversal may be just around the corner. Nevertheless, the current position of the daily indicators suggests that another downswing and a test of the recent lows can’t be ruled out. Connecting the dots, the short-term picture is not clear enough to open any positions at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, there will be no regular Forex Trading Alerts on Tuesday and Wednesday this week due to your Editors travel schedule. However, we will be monitoring the market regardless of the above and if anything urgent and important happens we will send out an intra-day alert anyway.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts