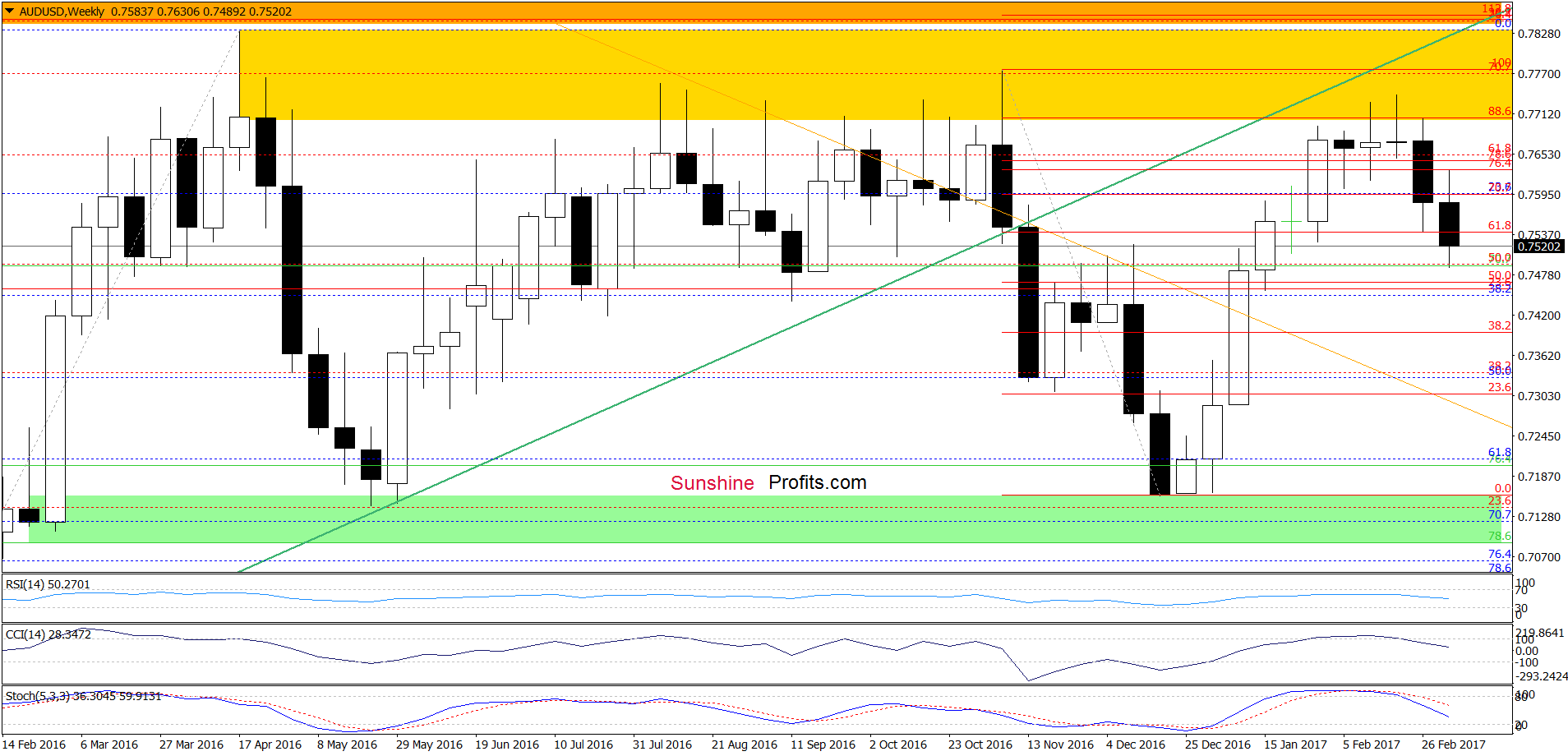

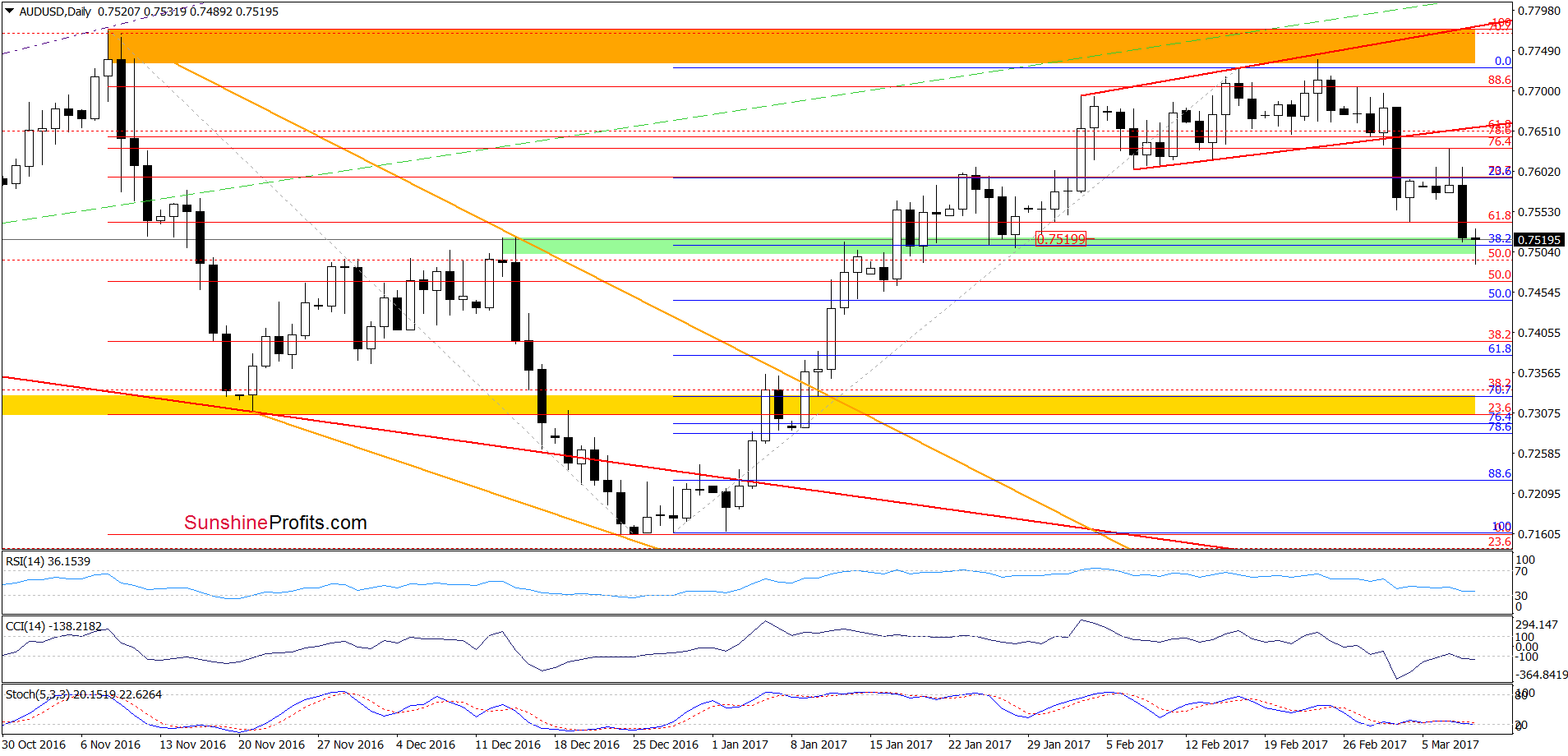

Yesterday, the Australian dollar moved sharply lower against its U.S. counterpart, which took AUD/USD to the support zone. Will it withstand the selling pressure in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.0735; the initial downside target at 1.0388)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 111; the initial upside target at 115.43)

- USD/CAD: none

- USD/CHF: long (a stop-loss order at 0.9891; the initial upside target at 1.0180)

- AUD/USD: none

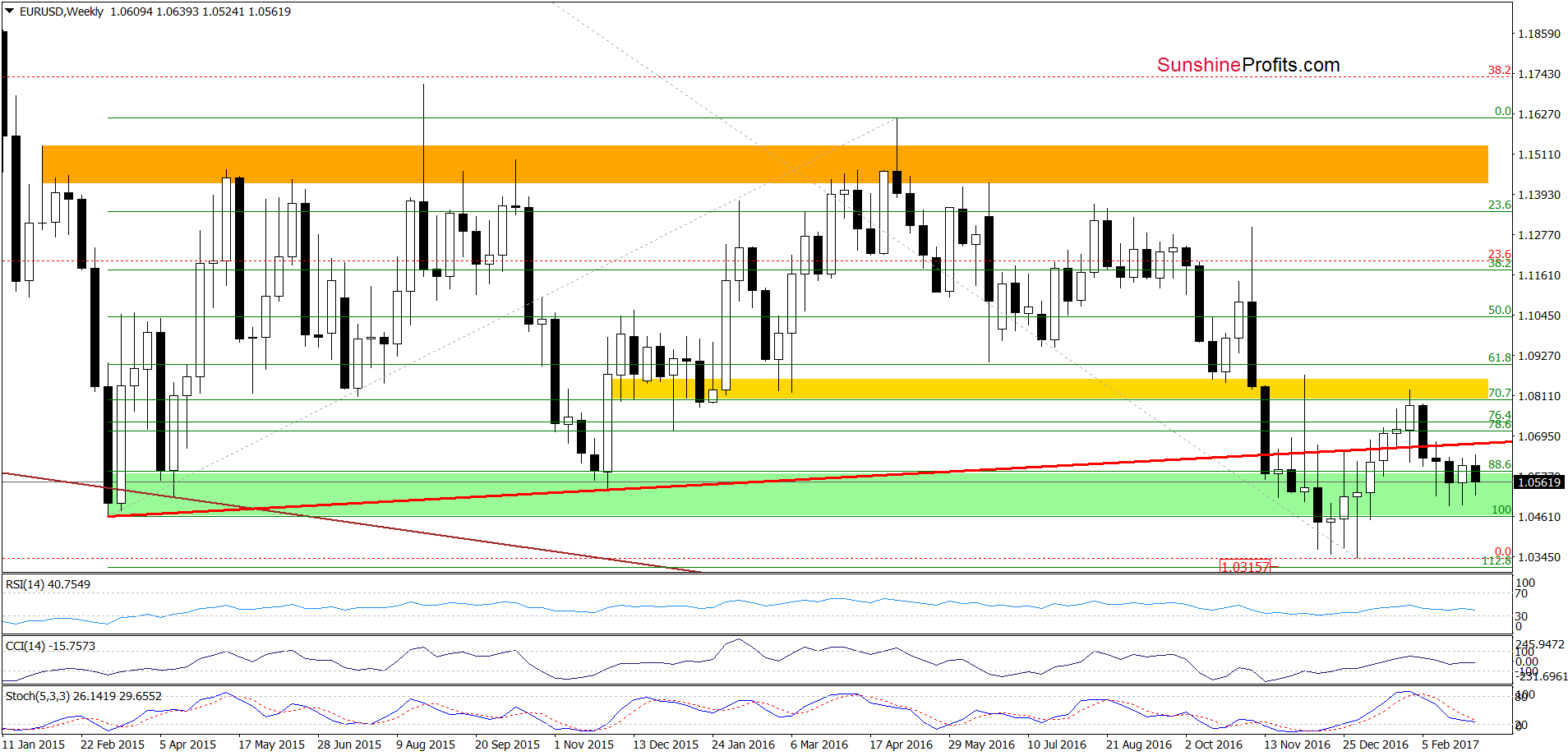

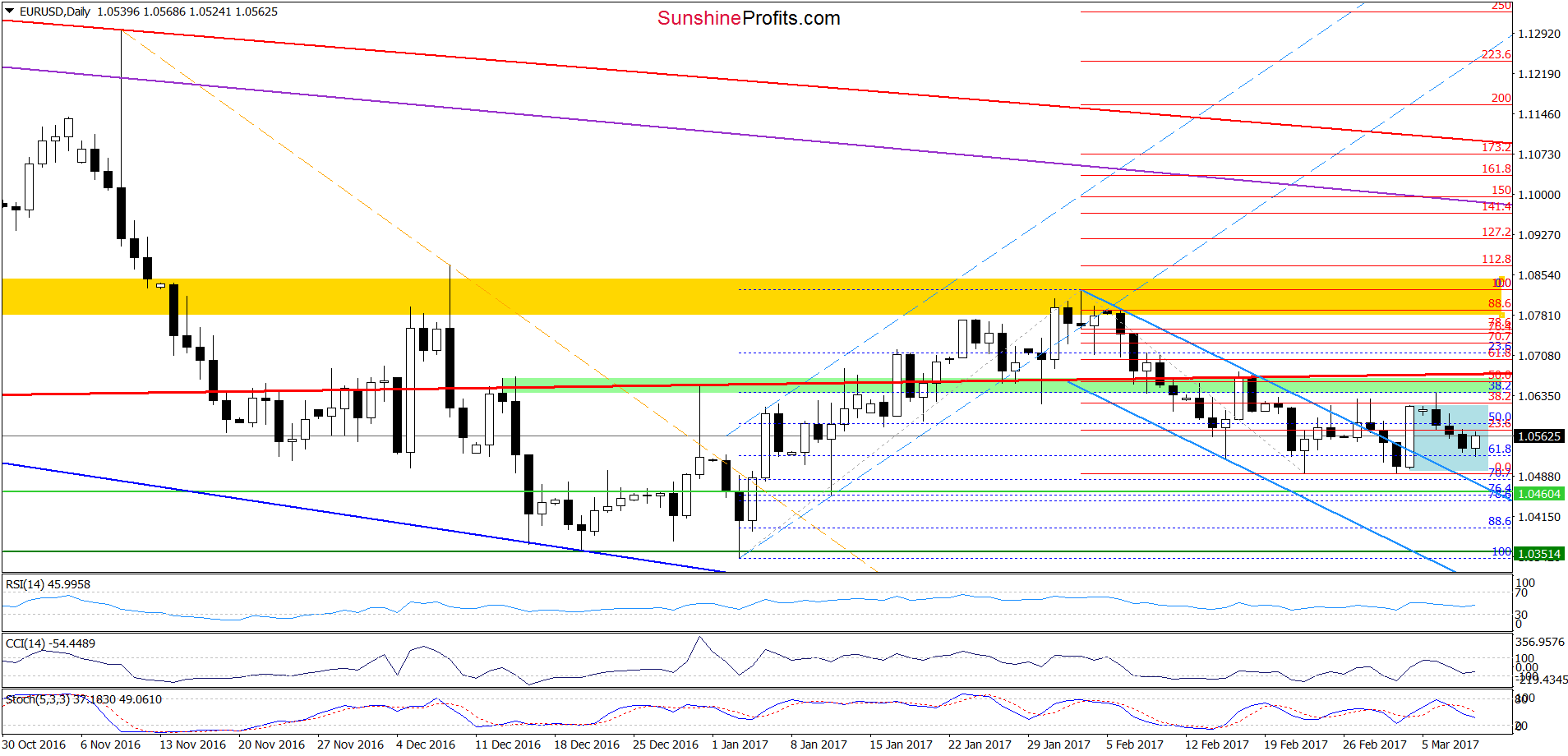

EUR/USD

On the daily chart, we see that EUR/USD rebounded earlier today, but despite this move, the exchange rate is still trading in the blue consolidation under the previously-broken green zone and the red resistance line. Additionally, the sell signal generated by the Stochastic Oscillator remains in play, suggesting that another downswing may be just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.0735 and the initial downside target at 1.0388 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

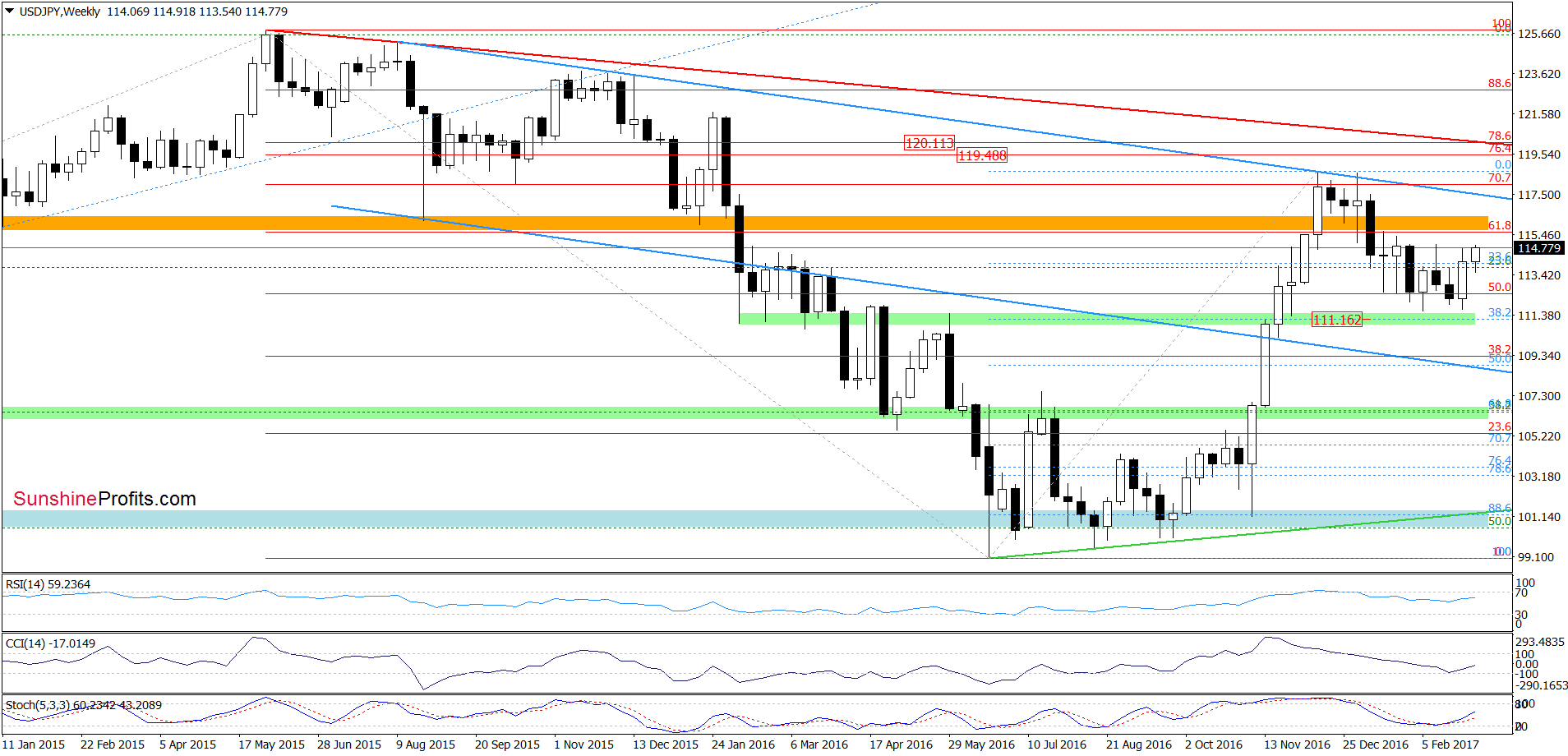

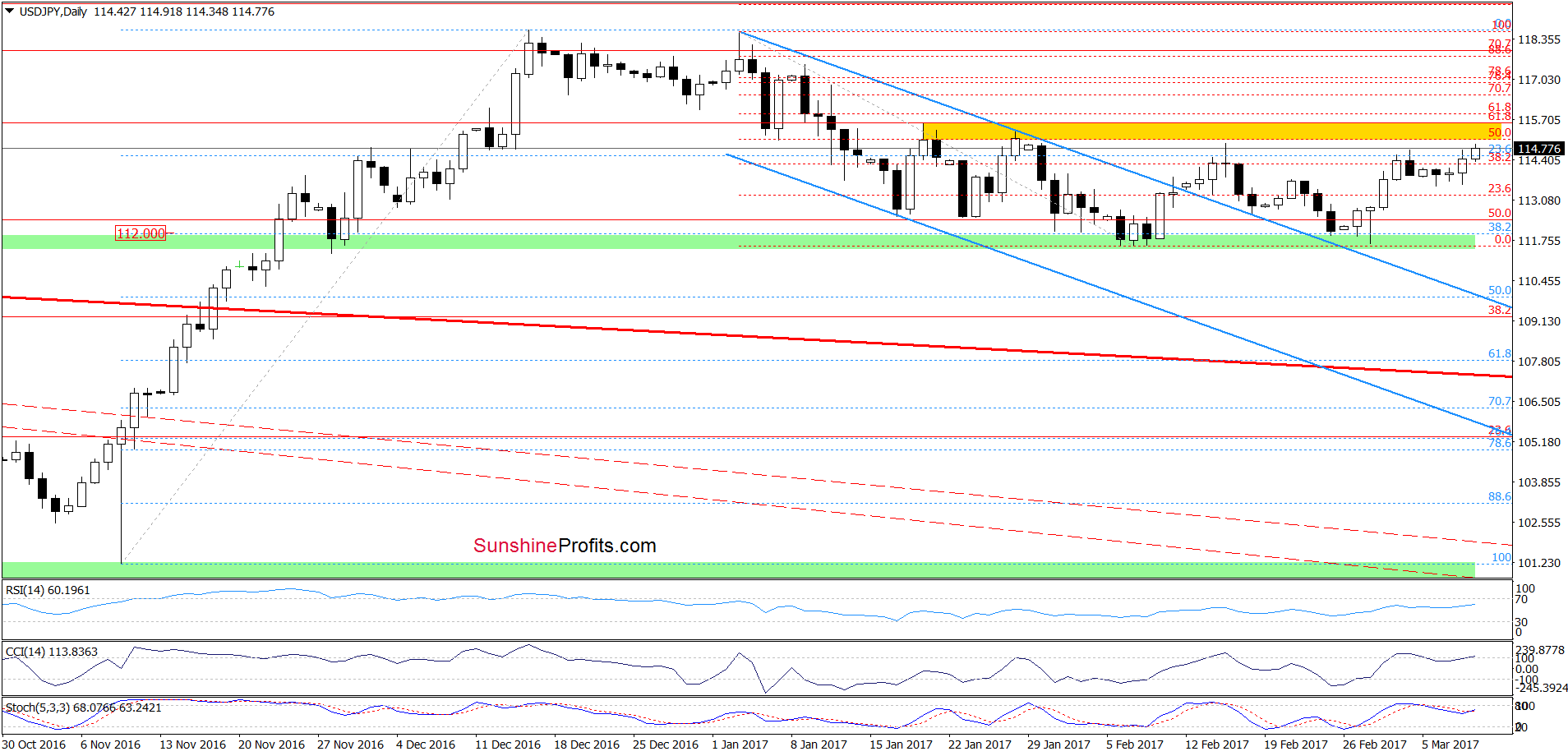

USD/JPY

On the above charts, we see that USD/JPY extended gains, which means that what we wrote on March 1 is up-to-date also today:

(…) USD/JPY moved lower, which looks like another re-test of the strength of the green support zone. Additionally, slightly below current levels is also the previously-broken upper border of the blue declining trend channel, which together with the position of the indicators suggest that (…) reversal is just around the corner. If this is the case and the pair rebounds in the following days, the initial upside target will be the yellow resistance zone.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 111 and the initial upside target at 115.43) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

Looking at the daily chart, we see that the pair extended losses and dropped to the green support zone, which could stop further deterioration. Nevertheless, as long as there are no buy signals generated by the indicators another downswing can't be ruled out. Therefore, if the pair closes today’s session under the green zone, the next downside target for currency bears will be around 0.7443-0.7462, where the 50% Fibonacci retracement (based on the entire December-February upward move) and mid-January lows are.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts