Although the euro moved a bit higher against the greenback yesterday, currency bears didn’t give up and EUR/USD declined earlier today. How low could the exchange rate go in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

Quoting our last Forex Trading Alert:

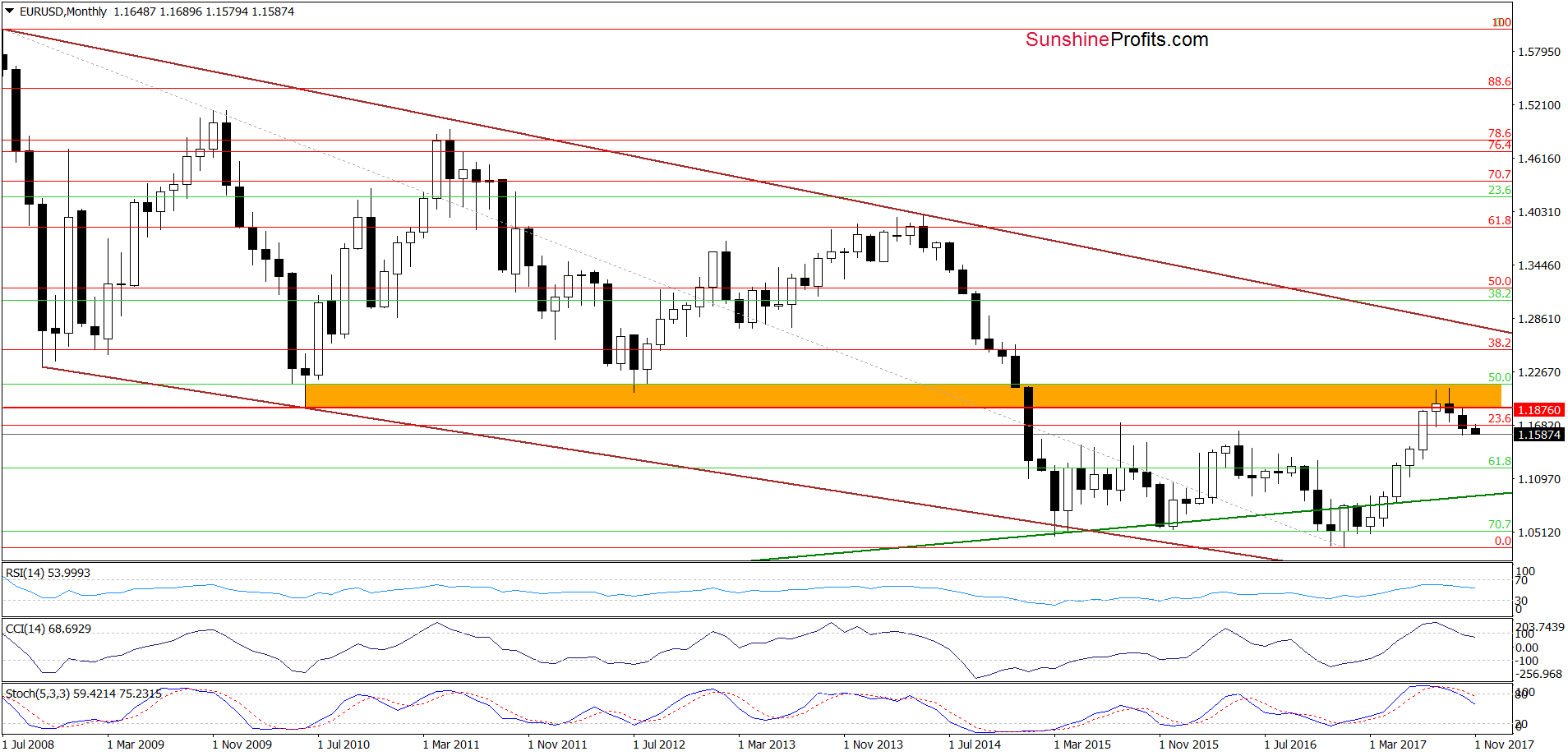

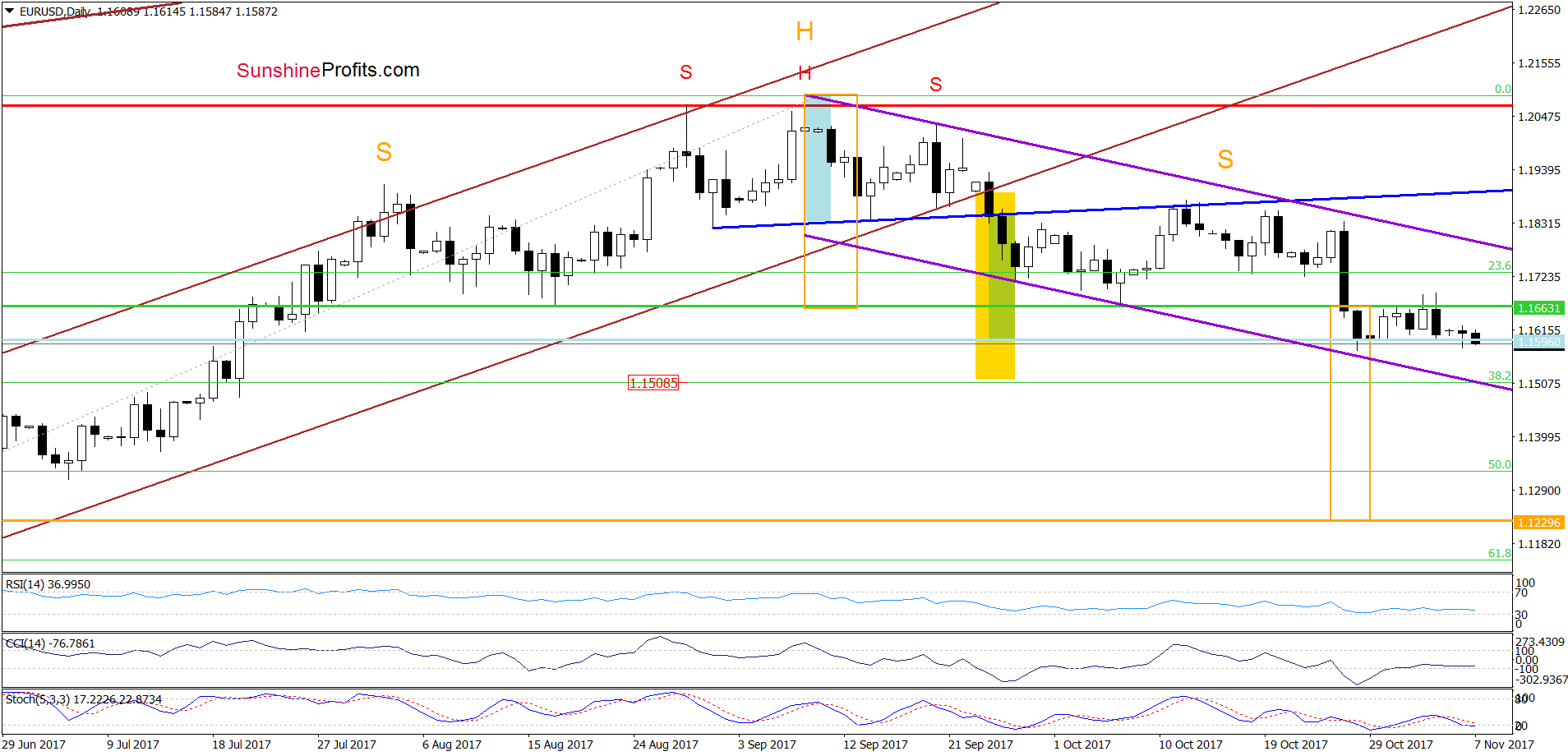

(…) EUR/USD declined on Friday, invalidating the tiny move above the green horizontal line. In this way, the exchange rate verified the earlier breakdown under this important line (this is a neck line of a bigger hear and shoulders pattern), which suggests further deterioration (…)

Looking at the daily chart, we see that although EUR/USD moved a bit higher yesterday, currency bears pushed the pair lower earlier today, which suggests that we’ll see a realization of our Friday scenario in the coming days:

(…) What does it mean for the exchange rate? In our opinion, if this is the case and EUR/USD reverses from current levels in the near future, currency bears will likely not only test the recent lows, but also push the exchange rate to around 1.1508, where the size of declines will be equal to the height of the brown rising trend channel. Additionally, slightly below this level is also the 38.2% Fibonacci retracement, which increases the probability of reversal.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Profitable short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

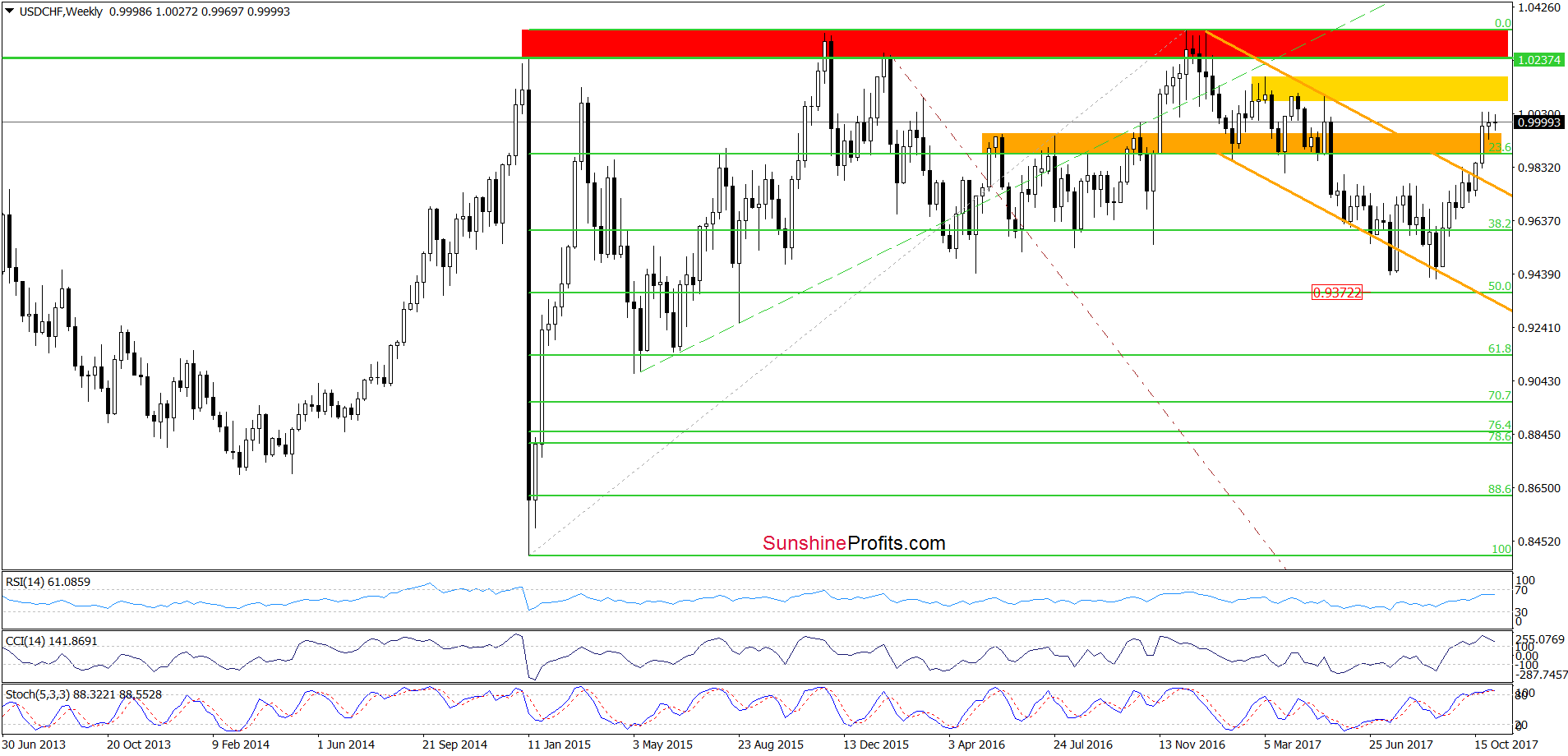

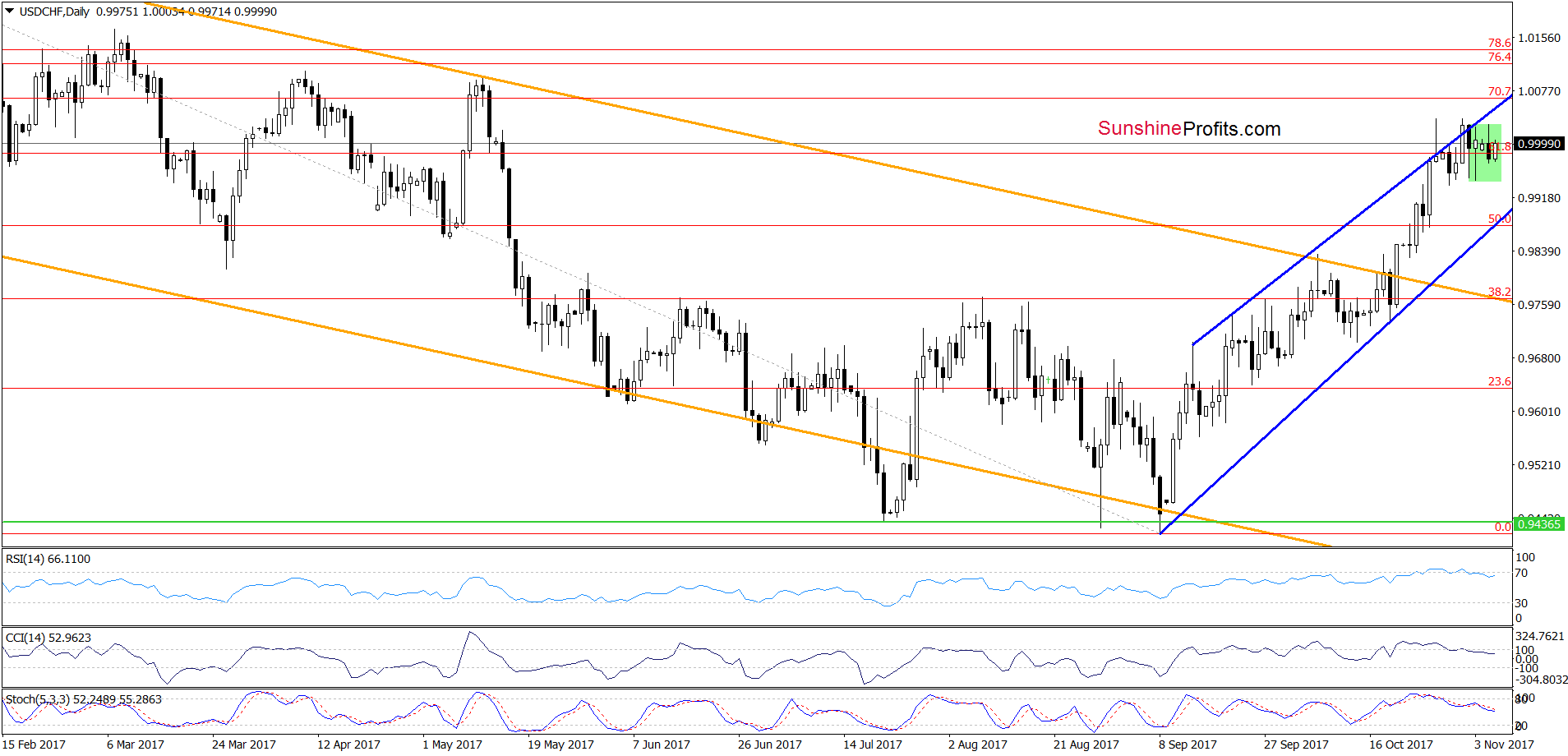

From today’s point of view, we see that the overall situation in the very short term hasn’t changed much as USD/CHF remains in a green consolidation around the 61.8% Fibonacci retracement under the upper border of the blue rising wedge.

Where will the exchange rate head next? Taking into account the sell signals generated by the daily indicators and two invalidations of the breakout above the upper border of the blue rising wedge, it seems that the pair will test the lower border of the formation in the coming week. Nevertheless, before we see such price action, one more attempt to move higher can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

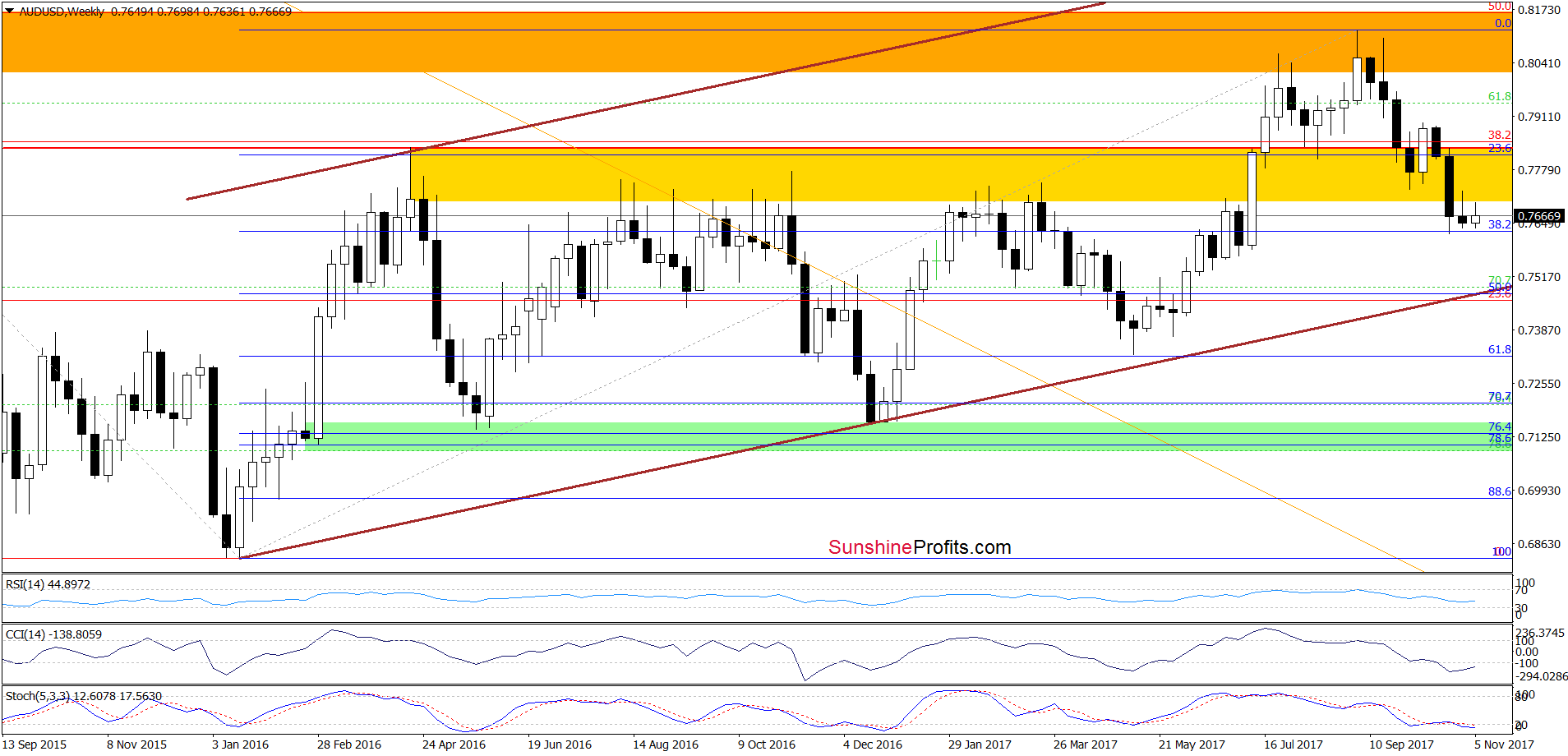

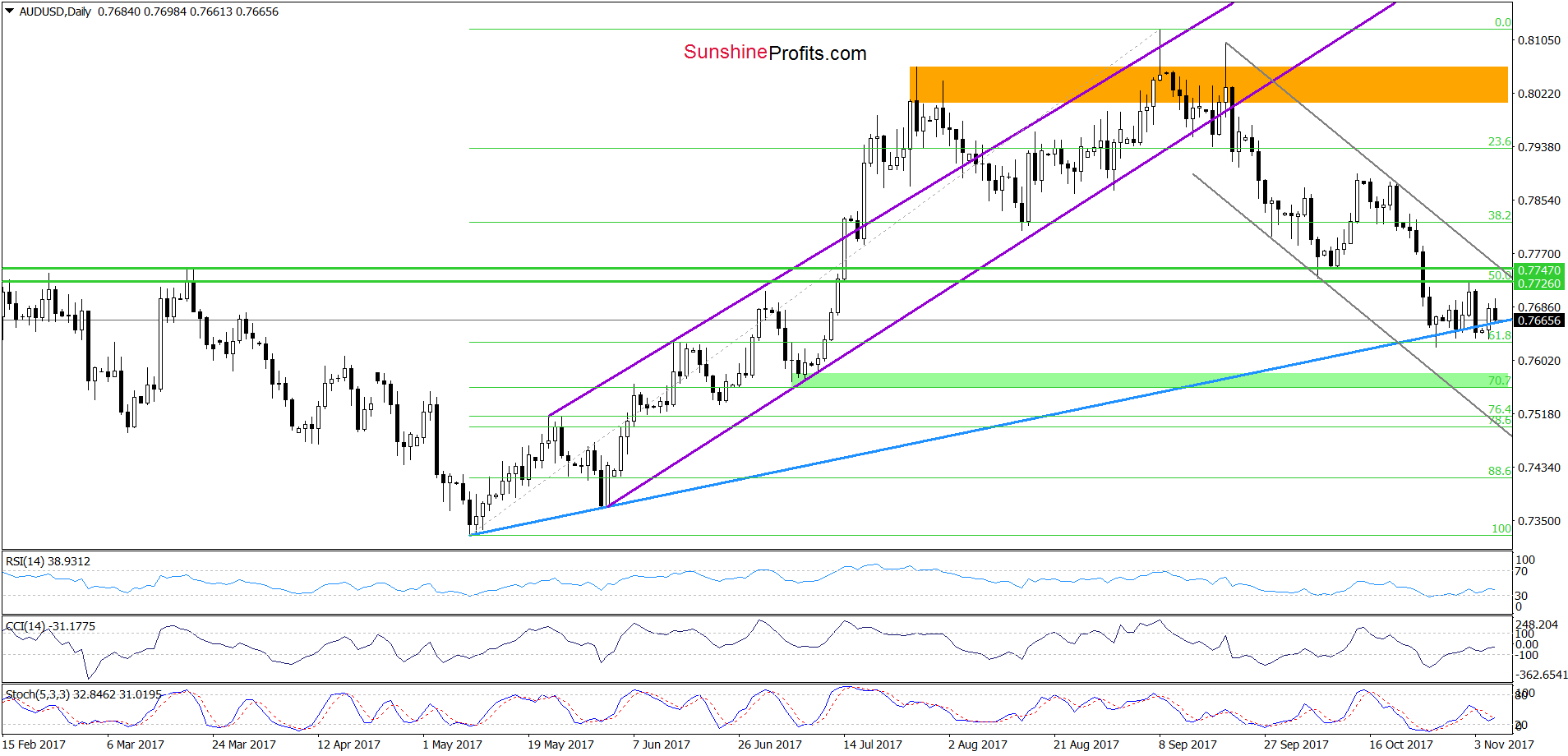

AUD/USD

On Friday, we wrote:

(…) currency bulls didn’t manage to push the pair higher, which encouraged their opponents to act. As a result, the exchange rate reversed and declined, which suggests a test of the Fibonacci retracements and the recent low in the coming day(s).

As you see on the daily chart, the situation developed in tune with our assumptions and AUD/USD approached the last week lows yesterday. Although this area encouraged currency bulls to act, the pair reversed and declined earlier today, which together with the sell signal generated by the Stochastic Oscillator increases the probability of one more downswing and a test of the October low in the very near future.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts