Some nice action in the currencies world today. The euro is on the move and it carries great and pleasant implications. And we decided to prudently act upon them. All the time keeping an eye on the other pairs to jump right at the next promising opportunity. See for yourself our rich explanations below. Truly worth it.

- EUR/USD: short (a stop-loss order at 1.1341; the exit target for 1st half of the profitable short position at 1.1260 to take profits off the table, and the 2nd half of the profitable short position remains with the new initial downside target at 1.1240 – full details below)

- GBP/USD: none

- USD/JPY: none

- USD/CAD:long (a stop-loss order at 1.3247; the initial upside target at 1.3530)

- USD/CHF: none

- AUD/USD: none

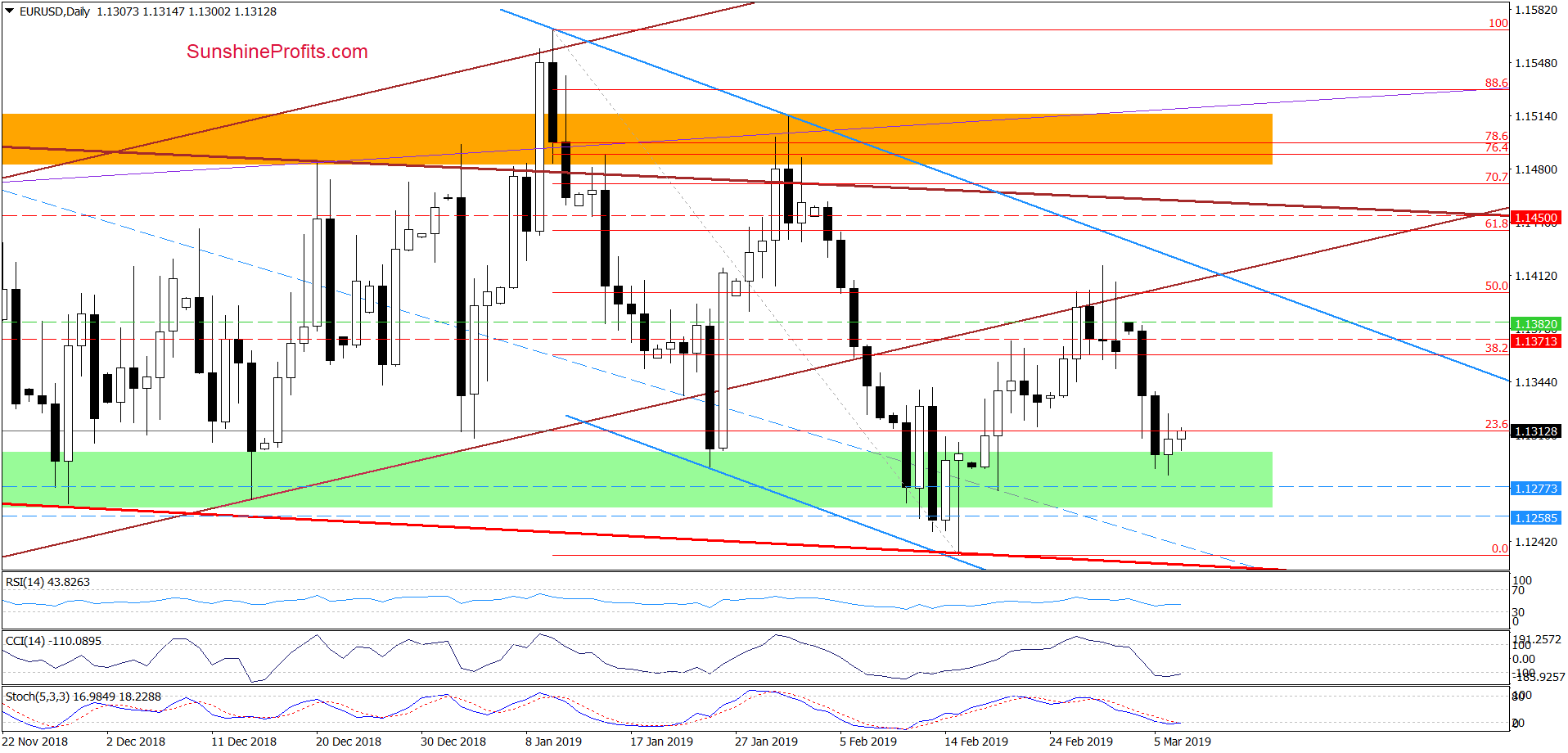

EUR/USD

Yesterday, EUR/USD cut through to the green support zone only to bounce higher the next moment. We witnessed similar indecision in the subsequent bullish move as evidenced by the long upper knot. Overall, the size of yesterday’s move was small compared to the declines of previous days.

Earlier today, the pair attempted another move higher but plunged lower subsequently. Frankly, any kind of short-term gyration isn’t hard to imagine in the midst of the green support zone. Turning to the facts that the daily indicators tell us, we see that there are no buy signals at the moment. All in all, one more downswing is still likely ahead of us – actually, not ahead but right here and now.

In situations like this, thinking about capital preservation is key. We are in markets for the long haul after all. There is absolutely no shame in taking whatever reasonable profit the market is offering us. We can’t influence the market but we can influence our decisions – the kind of positions we take, our stop-loss and take-profit orders.

Taking all the above into account, we decided to move the stop-loss order lower (to 1.1341) to protect our respectable gains (as a reminder, we opened the position when EUR/USD was trading at around 1.1382). At the same time, we are also setting the exit target for 1st half of the short position at 1.1260 while keeping the 2nd half of the short position in with a new initial downside target at 1.1240.

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at 1.1341 and the exit target for 1st half of the short position at 1.1260 while keeping the 2nd half of the short position in with a new initial downside target at 1.1240 are justified from the risk/reward perspective.

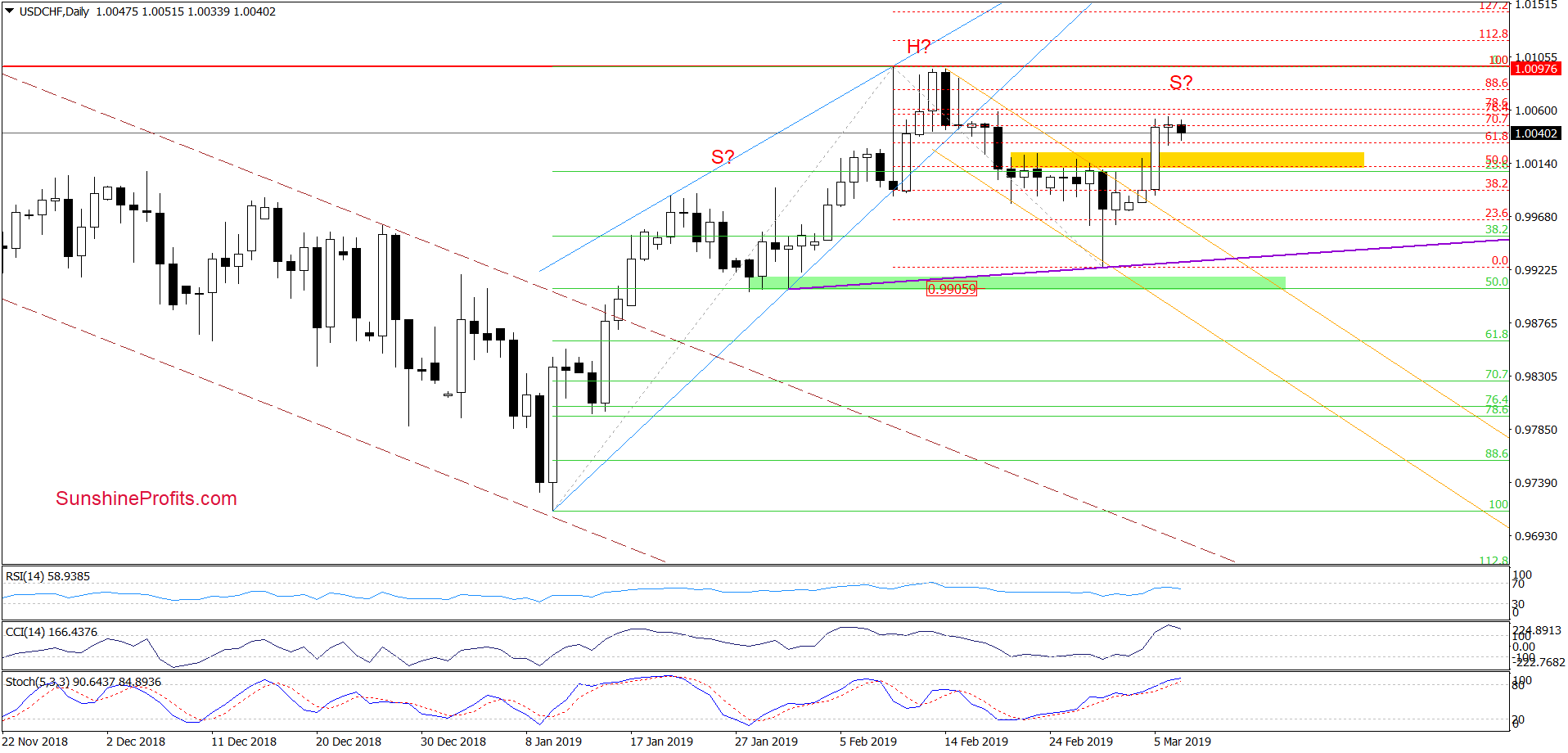

USD/CHF

In our last commentary on this pair, we wrote that the bulls:

(…) took the price back to the vicinity of the Monday’s peak and the above mentioned yellow resistance zone.

The buy signals generated by the daily indicators continue to support the bulls. In our opinion however, higher values of USD/CHF will be more likely and reliable only if we see a successful breakout above the yellow resistance first.

Indeed, they broke above the yellow resistance zone and as a result, the pair approached the February 19 high and the resistance area created by the 76.4% and 78.6% Fibonacci retracements. The small pullback earlier today alone doesn’t change the picture into a bearish one. As long as there are no sell signals on, one more upswing and a test of the above mentioned resistances still remains likely.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

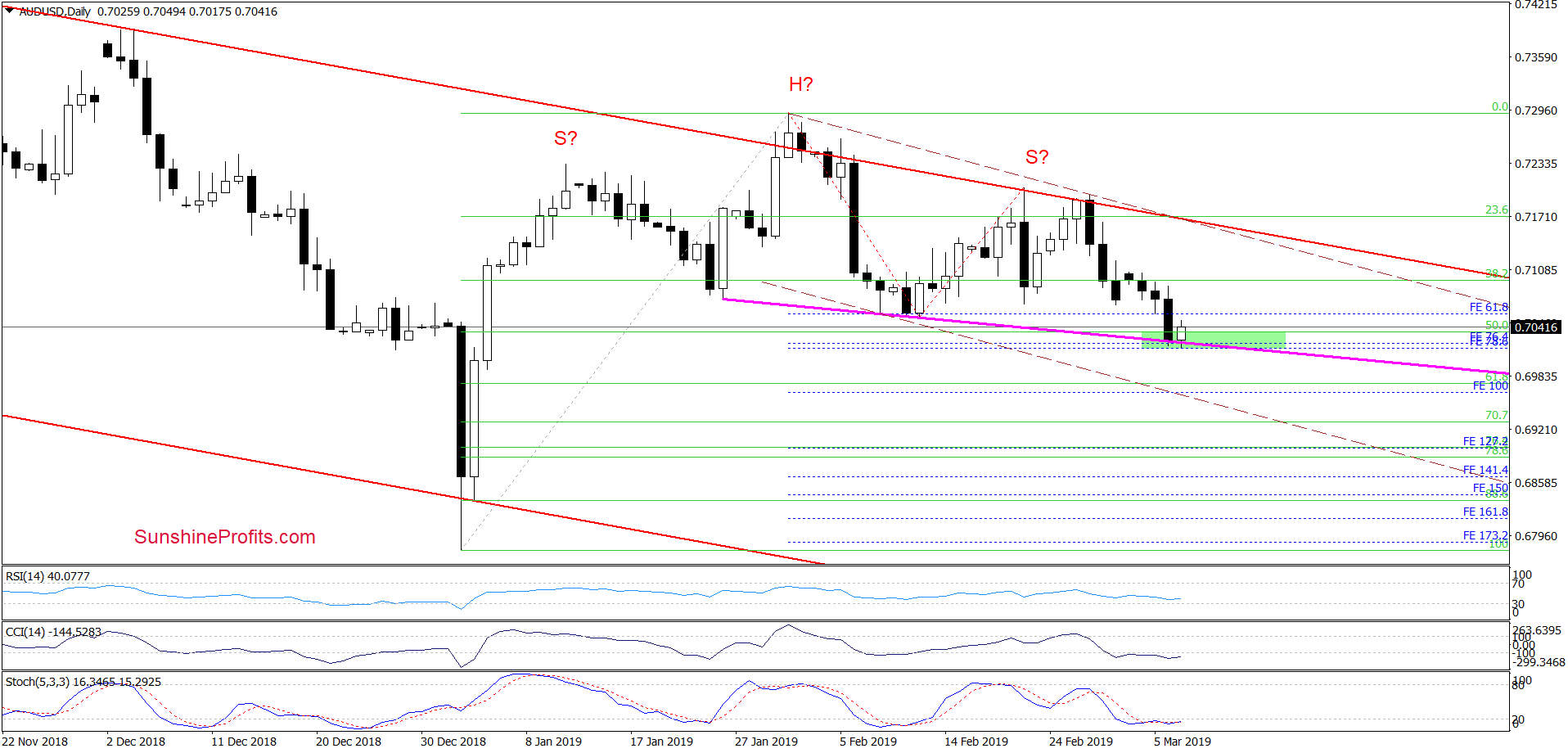

AUD/USD

Yesterday, half of our recent profitable short position has been just closed automatically by a take-profit order (the previous half had been also profitably closed on February 7th) to your delight. Yesterday’s drop took the exchange rate to the green support zone that is further reinforced by the declining pink support line.

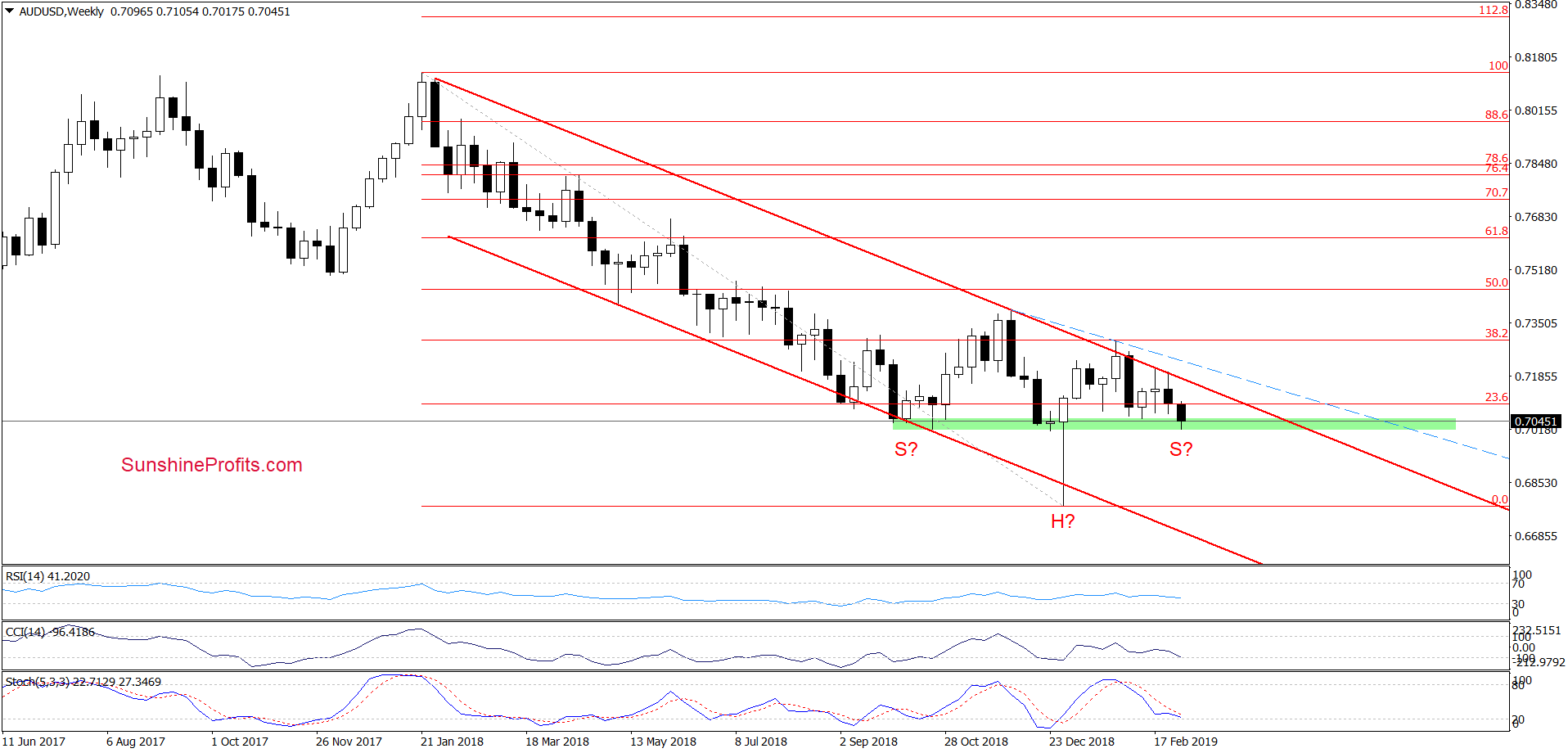

As you can see on the daily chart, this could be a neck line of a potential head and shoulders formation as marked with appropriate letters. As it is a formation in progress and not yet completed, it carries no implications yet. Therefore, as long as there is no daily close below the potential neck line, reopening short positions is not justified from the risk/reward perspective. Especially so when we factor in the current position of the daily indicators and the green support zone marked on the weekly chart below.

As this higher timeframe perspective shows, we see that the above mentioned support area continues to keep declines in check since the beginning of October 2018. There was a short-lived breakdown attempt at the end of the previous year but the bulls swiftly took AUD/USD back above the green zone, which increases its importance as a support. Additionally, the current decline could be forming the right arm of another potential reverse head and shoulders formation. As we are talking a weekly timeframe in need of more time to develop a formation, it would be too premature to write about its potential implications now. We will keep you informed on all the important developments.

Trading position (short-term; our opinion): No short positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist