Oil Trading Alert originally sent to subscribers on February 25, 2015, 11:47 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil lost 0.45% as ongoing worries over a supply glut in the U.S. pushed the price down. In this way, light crude slipped below its key support line and closed the day below it. Does it mean that lower values of the commodity are still ahead us?

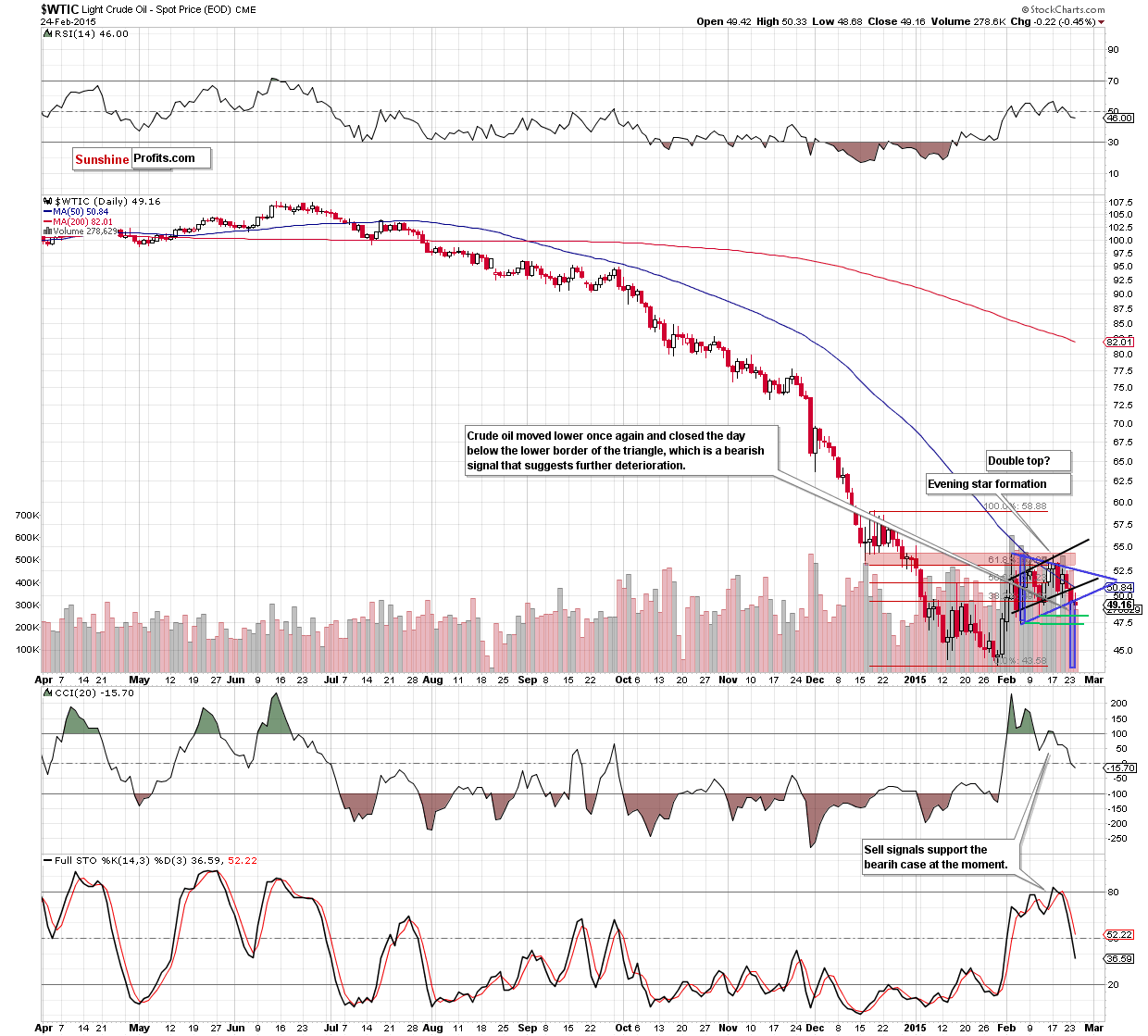

Although the number of rigs drilling for oil in the U.S. dropped to the lowest since August 2011, domestic oil supplies stand at their highest level in at least 80 years, which suggests that lower prices that we have observed in recent months haven’t affected the output yet. These circumstances continued to weigh on oil investors’ sentiment and pushed the commodity lower, which resulted in a drop to an intraday low of $48.68. Will we see lower values of light crude in the coming days? (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

(…) Although the lower line of the triangle could trigger a small rebound from here (…), we think that all negative signals that appeared in the last days (disappointing fundamental reports, the evening star formation, sell signals generated by the CCI and Stochastic Oscillator, the fact that the commodity is still trading well below the previously-broken 61.8% Fibonacci retracement and the Dec lows, and the medium-term picture) will continue to weigh on the price, encouraging oil bears to act.

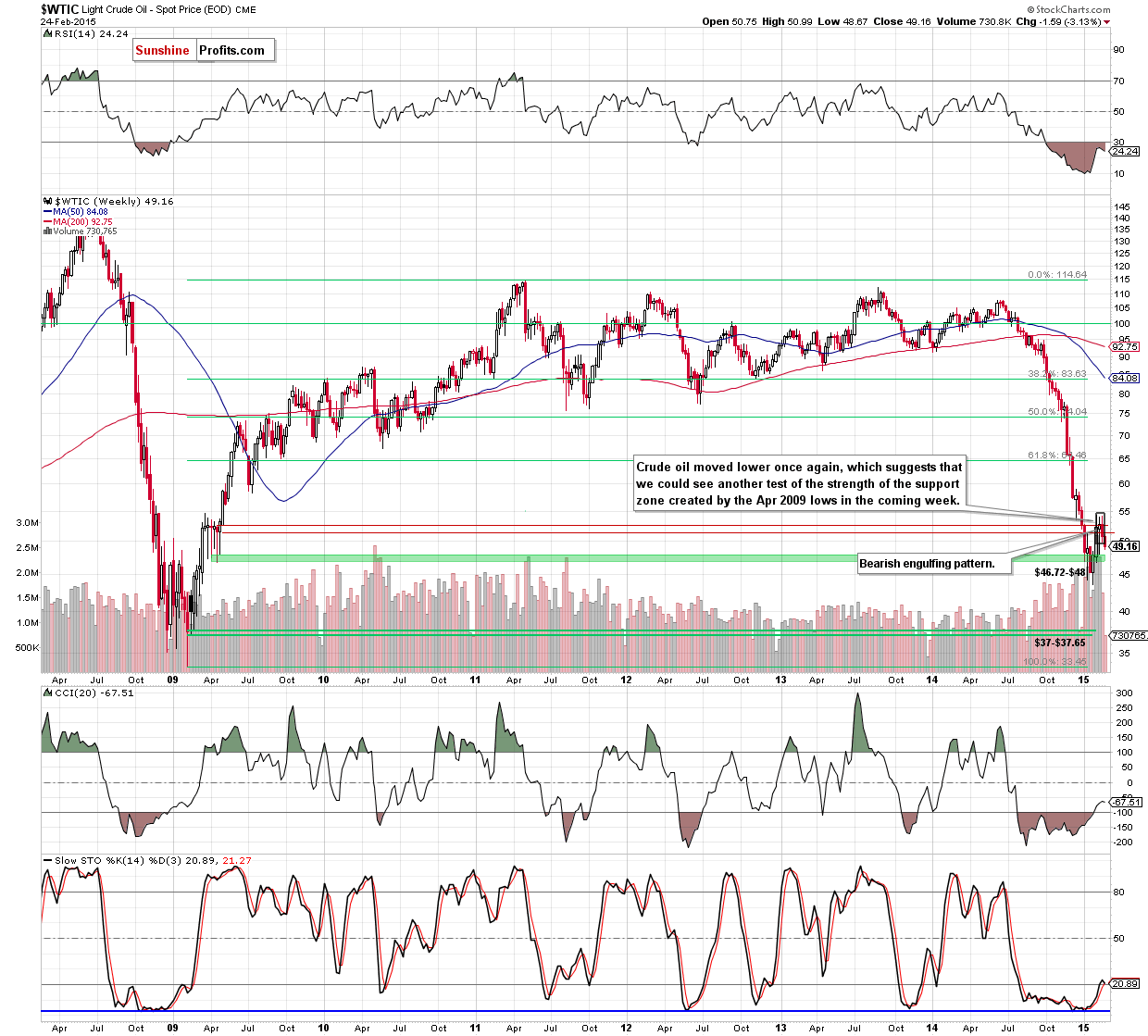

Looking at the above charts, we see that although crude oil moved little higher after the market’s open, the proximity to the previously-broken lower black resistance line triggered a reversal and decline. With this downswing the commodity slipped below the lower line of the triangle and closed the day below it, which is a bearish signal. Taking this fact into account, and combining it with all the above-mentioned negative factors that appeared in the last days and the medium-term picture (crude oil is trading under the resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels and the bearish engulfing pattern is still in play) it seems that further deterioration is just around the corner. If this is the case, the initial downside target would be around $46.72-$48, where the Apr 2009 lows and the bottoms of the previous pullbacks are.

Summing up,crude oil moved lower once again and closed the day under the lower border of the blue triangle. This is a bearish signal, which in combination with all the above-mentioned negative factors that appeared in the last days and the medium-term picture suggests further deterioration. Nevertheless, as long as the breakdown is unconfirmed another attempt to push the commodity above the lower line of the formation can’t be ruled out. In these circumstances, we think that opening any position is not justified from the risk/reward perspective as the situation is too unclear.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts