Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective. This position was originally featured on Jan. 12, 2017 at 3:49PM.

Gold seems to be quite strong despite moves higher in the USD Index – it doesn’t slide, even though it seems it should. Is this a bullish sign? In today’s alert we examine gold’s performance in terms of the biggest component of the USD Index – the EUR/USD rate. In other words, we’ll see what we can infer from gold’s price in terms of the euro. Let’s take a closer look (charts courtesy of http://stockcharts.com).

Gold moved higher in terms of the euro in the past few weeks, just like it did in the USD. Unlike the move in the USD Index, however, the move higher in the euro took gold back to the November 2016 highs. This means that gold in terms of the euro has indeed outperformed gold in terms of the USD. Is this something that should make one open long positions in gold?

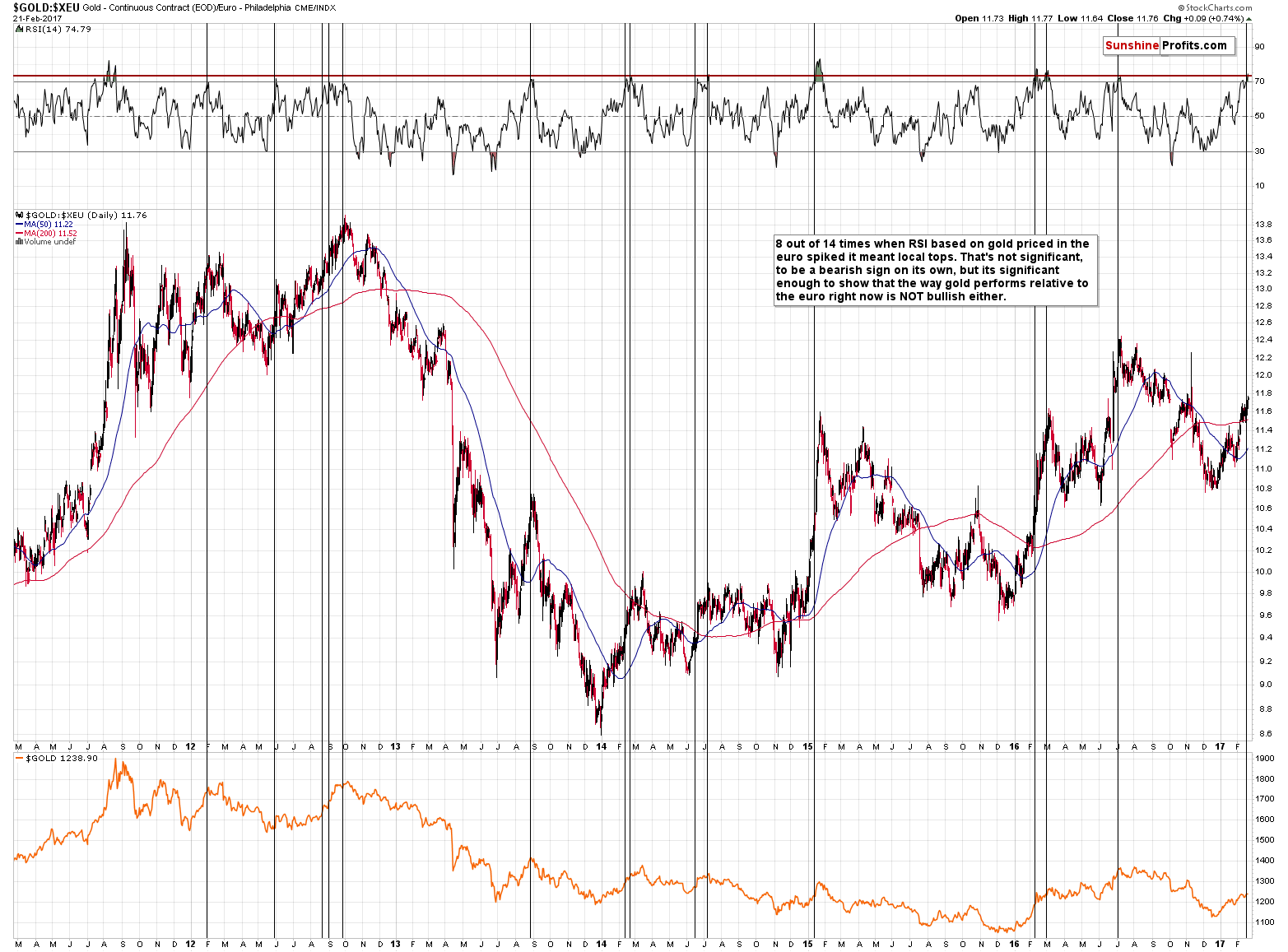

Not really – while it is true that very short-term outperformance (when gold holds up well despite the USD’s gains) can be viewed as a bullish sign (all other things being equal), bigger (but still, not very big) moves in both directions (gold’s under- and outperformance relative to the U.S. dollar) tend to follow each other. In order to estimate the impact of both changes in the gold price and changes in gold’s strength relative to the USD, we can measure how well gold priced in the euro performs and that’s exactly what the above charts shows. The RSI indicator based on it shows that gold’s upswing and its outperformance have been in place for long enough to push the indicator above 70. This level usually marks overbought levels and indicates an upcoming reversal, but before assuming that this is indeed the case here, let’s check how such a reading performed in the past.

We marked similar cases with black vertical lines. It turns out that a bit more than half of the cases were actually local tops, so the implications should be rather bearish. However, the strength of the signal is too weak to really consider it. Does it mean that it’s worthless? No, it simply tells us something different – not what’s useful, but what isn’t. While gold’s outperformance and rally could be seen as a bullish sign on a short-term basis, the size of both phenomena is still in tune with the past patterns and at this time it indicates declines rather than a continuation of the rally. In other words, gold’s rally and it’s good performance relative to the USD Index is not really a bullish sign at this time.

Naturally, if the USD Index continues to move much higher (say, above 105) and gold still fails to decline, it will likely indicate a change in the gold-USD link and show that higher prices are to be expected. For now, however, it looks like gold’s “strong performance” is rather normal and it moved to levels that are significant enough to indicate a reversal, but not extreme enough to suggest a change in the trend.

From the short-term point of view, gold and silver held up relatively well yesterday (compared with the USD Index’s daily upswing), but at the same time gold stocks moved lower and this underperformance nullified any short-term bullish implications of gold’s relative strength vs. the USD.

Summing up, gold’s “strength” vs. the USD Index is not as bullish as it may seem at the first sight. While the daily price changes are not particularly meaningful, the long- and medium-term signals that are very important (being highly effective in the past) continue to paint a very bearish picture for the precious metals sector for the upcoming weeks and months.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: exit-profit-take level: $1,063; stop-loss: $1,263; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $48.47

- Silver: initial target price: $13.12; stop-loss: $18.67; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $19.87

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $104.26; stop-loss: $10.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

In 2017, gold rallied despite the hawkish Fed and the bearish macroeconomic fundamentals. What does it mean for the relationship between the U.S. monetary policy and the gold market?

Has the Fed Lost Its Influence on Gold?

Earlier today, the British pound moved lower against the greenback after the Office for National Statistics showed that GDP growth for the whole of 2016 was smaller-than-expected. In this environment, GBP/USD invalidated the earlier breakout above the resistance line. Will this development trigger a drop below 1.2400 in the coming days?

Forex Trading Alert: GBP/USD – Invalidation of Breakout

=====

Hand-picked precious-metals-related links:

CHART: Hedge funds diverge on gold, silver price

Alan Greenspan Admits Ron Paul Was Right About Gold

Gold Gets a Shot in the Arm from Inflation and China

=====

In other news:

Global stocks top 2016 gains, dollar up before Fed minutes

Euro Slips, Bonds Gain as Investors Turn Cautious: Markets Wrap

ECB Can Renew Free Loans to Banks If Needed, Council Member Says

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts