Oil Trading Alert originally sent to subscribers on July 23, 2014, 10:02 AM.

Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Tuesday, crude oil lost 0.87% as investors jumped to the sidelines to await the release of the EIA weekly report. As a result, light crude reversed once again and corrected most of Monday’s increase. Will we see something new in the near future?

Yesterday, official data showed that the annual rate of U.S. inflation was at 1.2% in the previous month, while core inflation (without food and energy costs) increased by just 0.1% month-on-month and U.S. consumer prices were up 0.3%. On top of that, U.S. existing home sales increased 2.6%, while analysts had expected an increase of 2%. These bullish numbers fueled hopes that the U.S. economy will demand more fuel and energy and pushed the price of crude oil to an intraday of $103.45.

Despite this increase, the commodity reversed as oil investors jumped to the sidelines to await the release of the EIA weekly report. At this point it’s worth noting that yesterday’s the American Petroleum Institute data showed a 555,000-barrel decline in crude stocks in the recent week. Will the government’s report confirm such drop? Before we know the answer to this question, let’s check the technical picture of crude oil (charts courtesy of http://stockcharts.com).

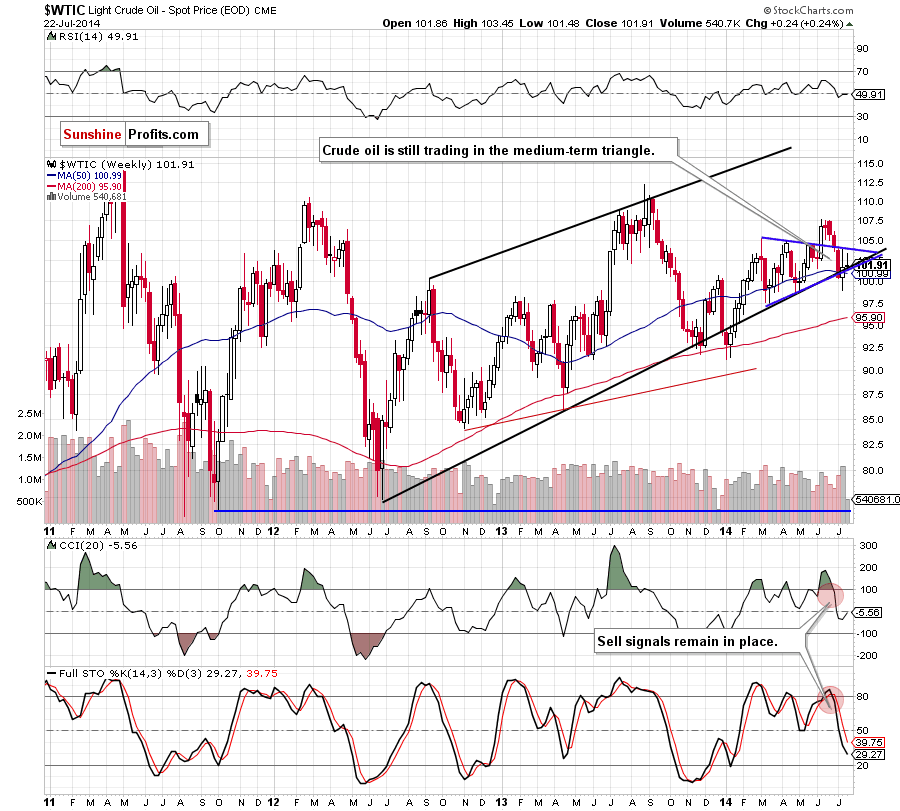

The medium-term picture remains unchanged as the commodity still remains between the lower and upper line of the blue triangle. Therefore, we are convinced that what we wrote in our last Oil Trading Alert is up-to-date:

(…) the support zone created by the 50-week moving average and the lower border of the formation (…) If (...) holds, we’ll see a rebound in the coming week and another attempt to break above the upper line of the triangle. However, if it is broken, crude oil will test the strength of the psychological barrier of $100.

Having say that, let’s take a closer look at the very short-term picture.

Quoting our last Oil Trading Alert:

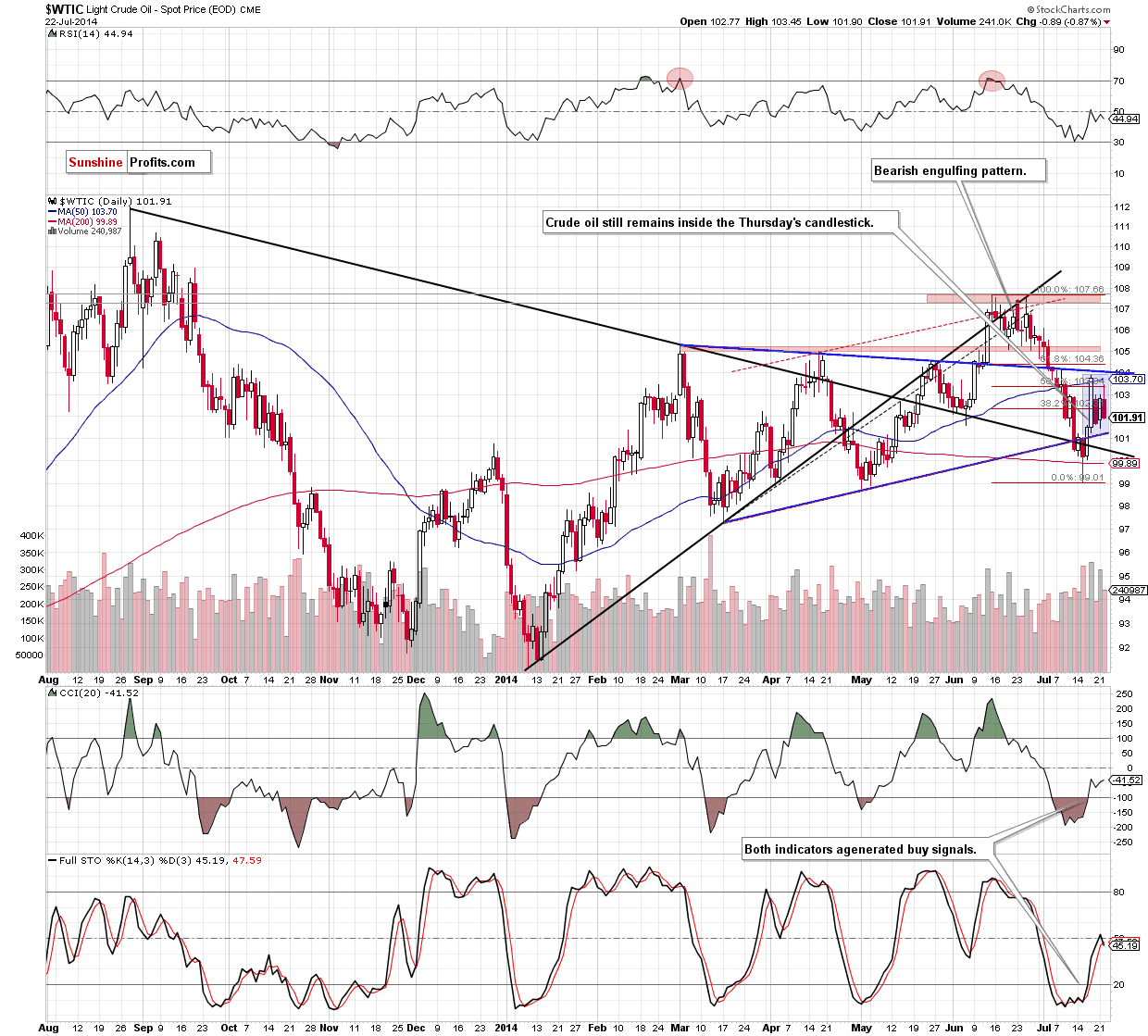

(...) in our opinion, the moment of truth for the commodity will occur when light crude approach the Thursday’s high and the strong resistance zone (created by the 50-day moving average, the upper line of the medium-term triangle and the 61.8% Fibonaci retracement). (...) if this area holds, we’ll see another test of the strength of the Thursday’s low, which is currently reinforced by the lower line of the medium-term triangle. Please keep in mind that slightly below this level is also the strong support area based on the blue and black support lines and reinforced by the 200-day moving average.

Looking at the above chart, we see that although positive technical factors that we discussed yesterday encouraged oil bulls to act, the proximity to the above-mentioned strong resistance area was enough to trigger a pullback, which took the commodity below $102 once again. Despite this move, the situation in the very short-term hasn’t changed much as the commodity is trading inside the Thursday’s candclestick, still above the strong support zone.

Summing up, although crude oil erased most of Monday’s increase, yesterday’s price action didn’t change the very short-term picture. Therefore, we remain convinced that as long as there is no breakout above the resistance zone or a breakdown below the support zone another sizable move is not likely to be seen. Just like we wrote yesterday, it’s too early to say that anything has really changed and opening any position at the moment is not justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts