Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year's all-time high:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

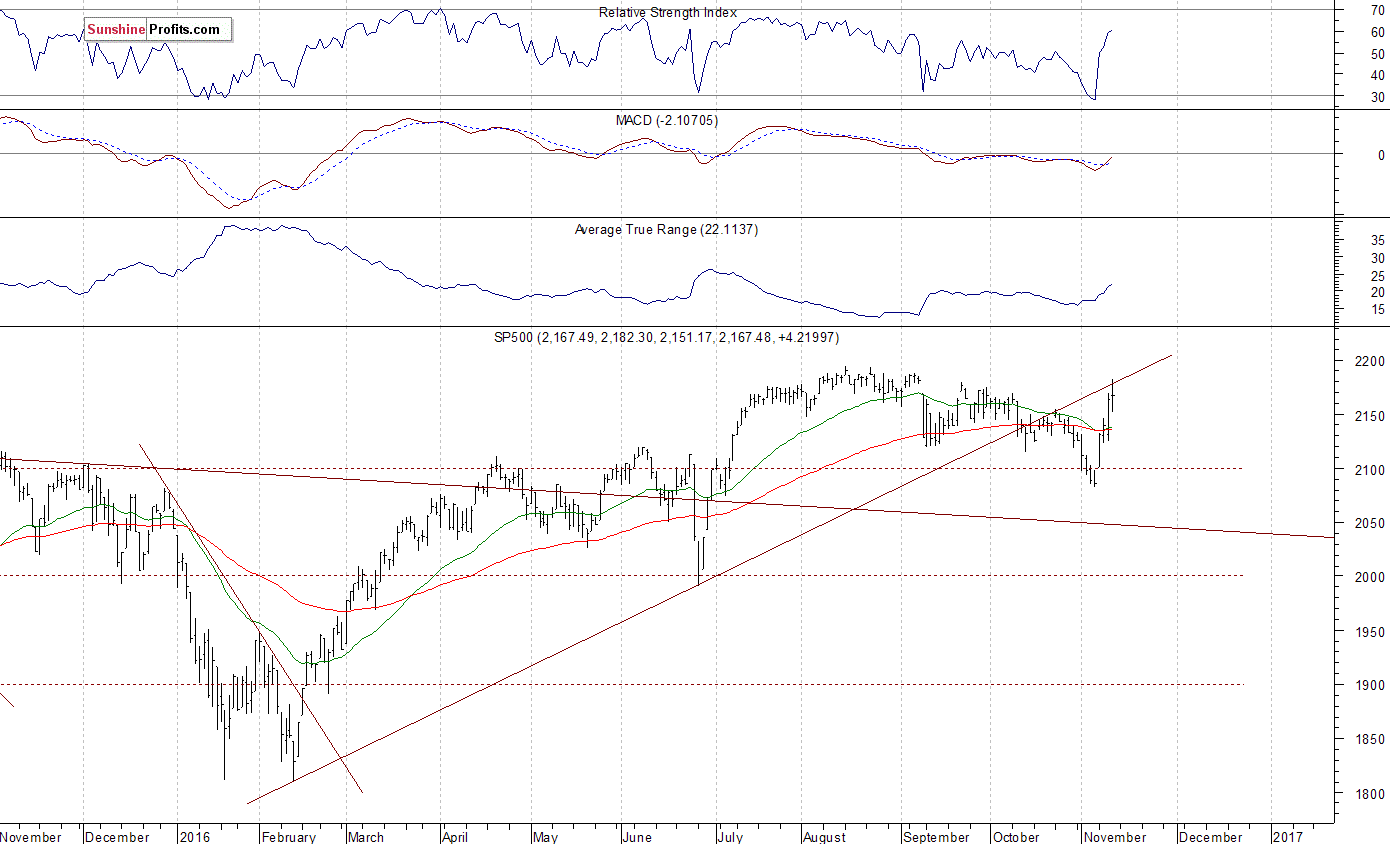

The U.S. stock market indexes were mixed between -1.6% and +1.2% on Thursday, as investors hesitated following presidential elections' volatility. The S&P 500 index broke above the resistance level of 2,150-2,160 on Wednesday, marked by previous local highs. The next resistance level is at 2,180-2,200, marked by record high. On the other hand, support level is at 2,100-2,120, marked by previous resistance level. The next important level of support remains at around 2,080, marked by recent local lows, as we can see on the daily chart:

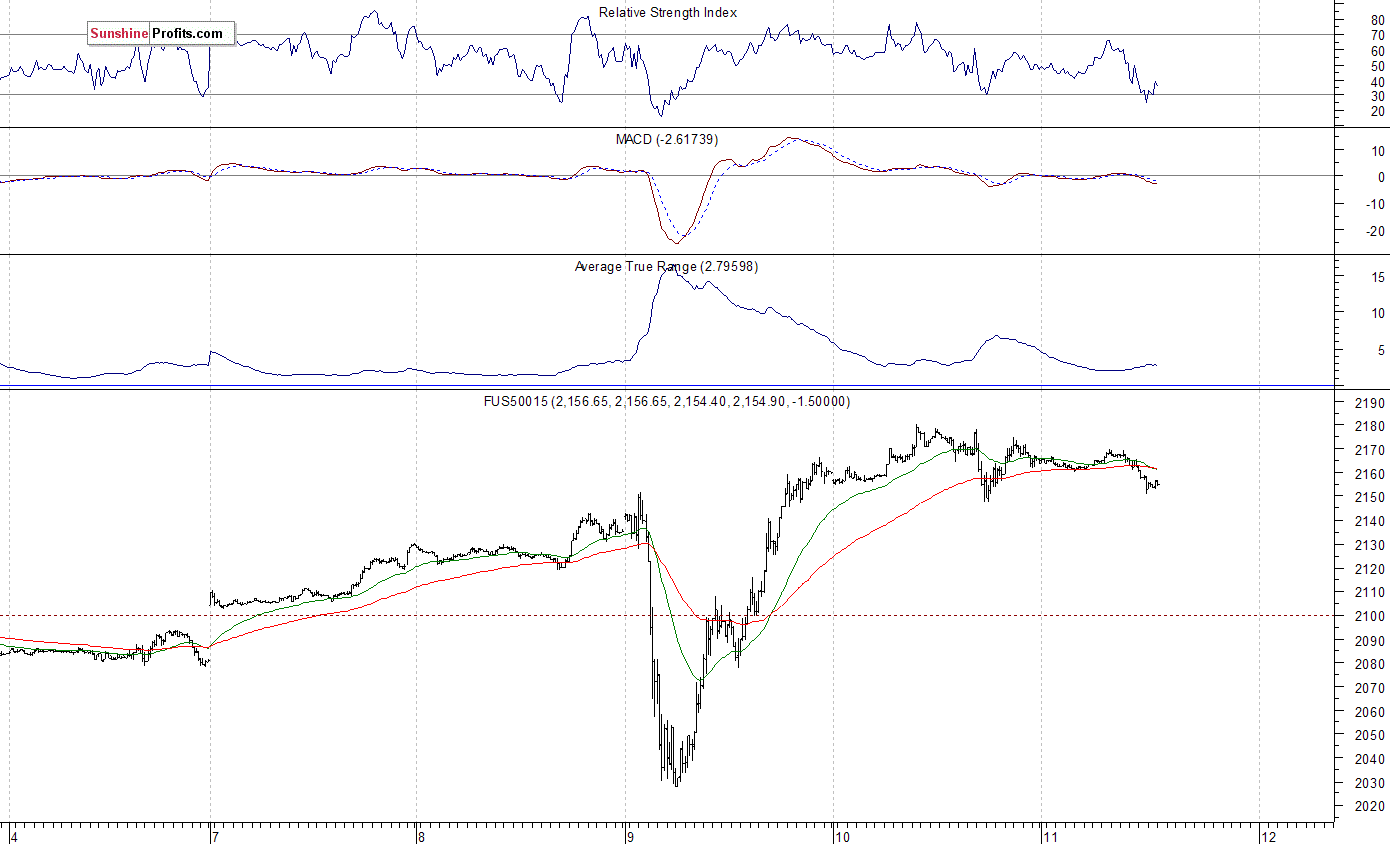

Expectations before the opening of today's trading session are negative, with index futures currently down 0.3-1.0%. The European stock market indexes have been mixed so far. Investors will now wait for the Michigan Sentiment number release at 10:00 a.m. The S&P 500 futures contract trades within an intraday downtrend, as it retraces its yesterday's move up. The nearest important support level is at around 2,140-2,150, marked by short-term local lows. The nearest important resistance level remains at 2,170-2,190, marked by medium-term highs.

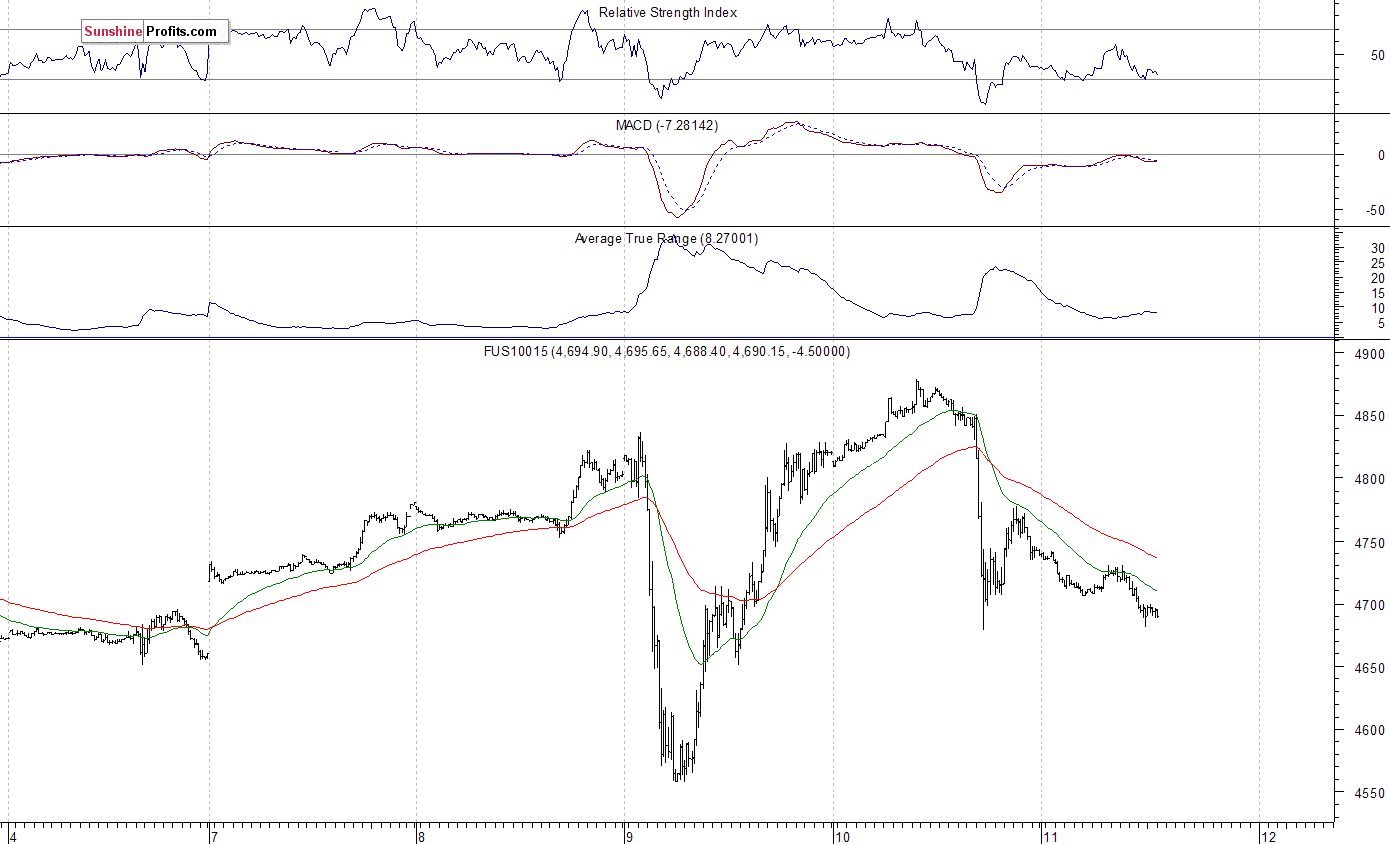

The technology Nasdaq 100 futures is relatively weaker, as it currently trades close to its recent local low below the level of 4,700. The nearest important resistance level is at around 4,750. On the other hand, support level is at 4,650, among others, as the 15-minute chart shows:

Concluding, the broad stock market continued its rally yesterday, as the S&P 500 index got even closer to its August - September medium-term highs. Will it continue higher, despite technology stocks' relative weakness? We decided to close our profitable short position (opened on July 18 at 2,162 - S&P 500 index) at the opening of last week's Friday's trading session - the average opening price of the S&P 500 index was at 2,085. Overall, we gained 77 index points on that over three-month-long speculative short trade following June - July rally off "Brexit" low. Currently, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts