Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,140, and profit target at 1,980, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook is bearish:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): bullish

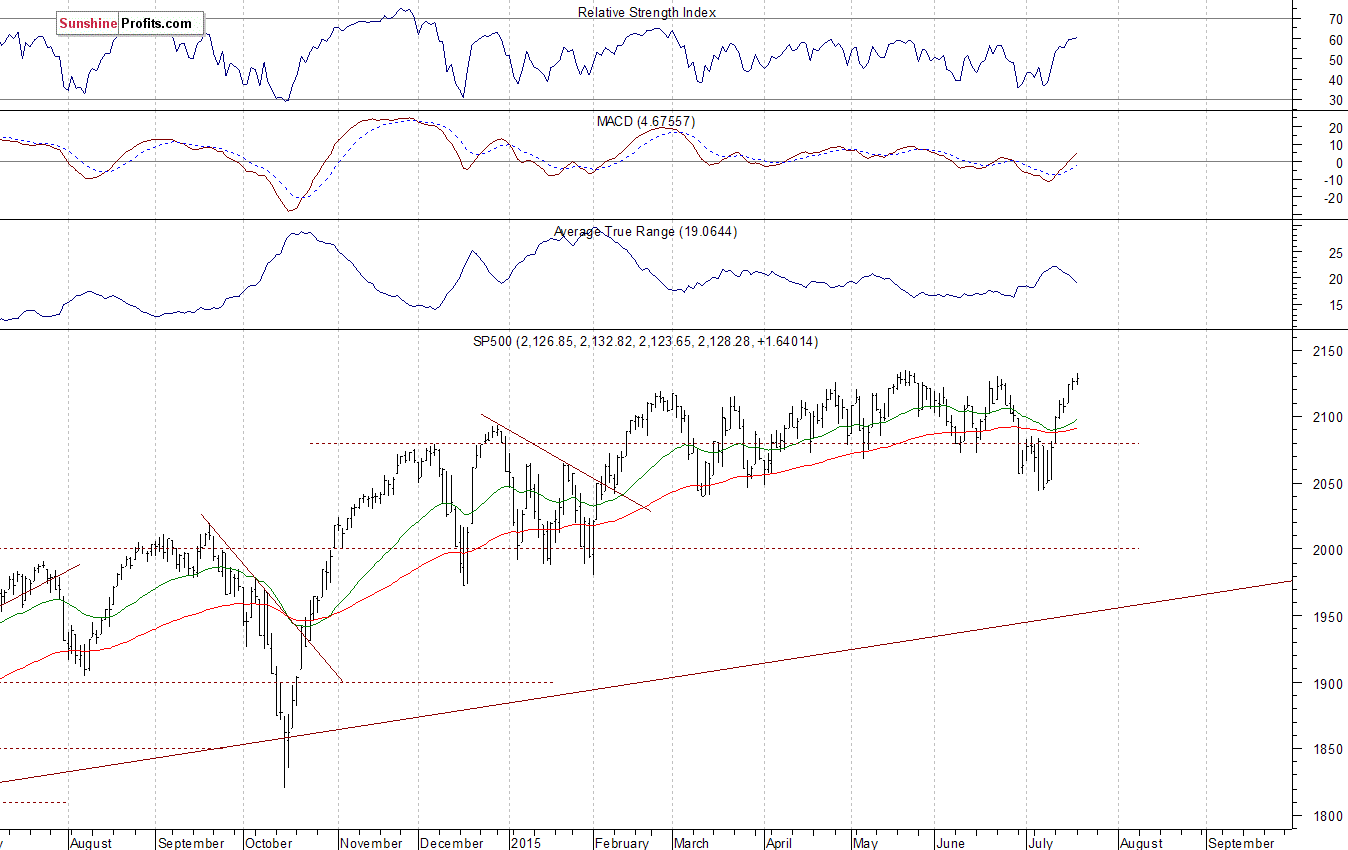

The U.S. stock market indexes gained 0.1-0.4% on Monday, slightly extending their recent rally, as investors reacted to quarterly corporate earnings releases. The S&P 500 got very close to its May 20 all-time high of 2,134.72. The nearest important level of resistance is at 2,130-2,135. On the other hand, support level is at around 2,115-2,120, among others. There have been no confirmed negative signals so far, however, we can see negative technical divergences:

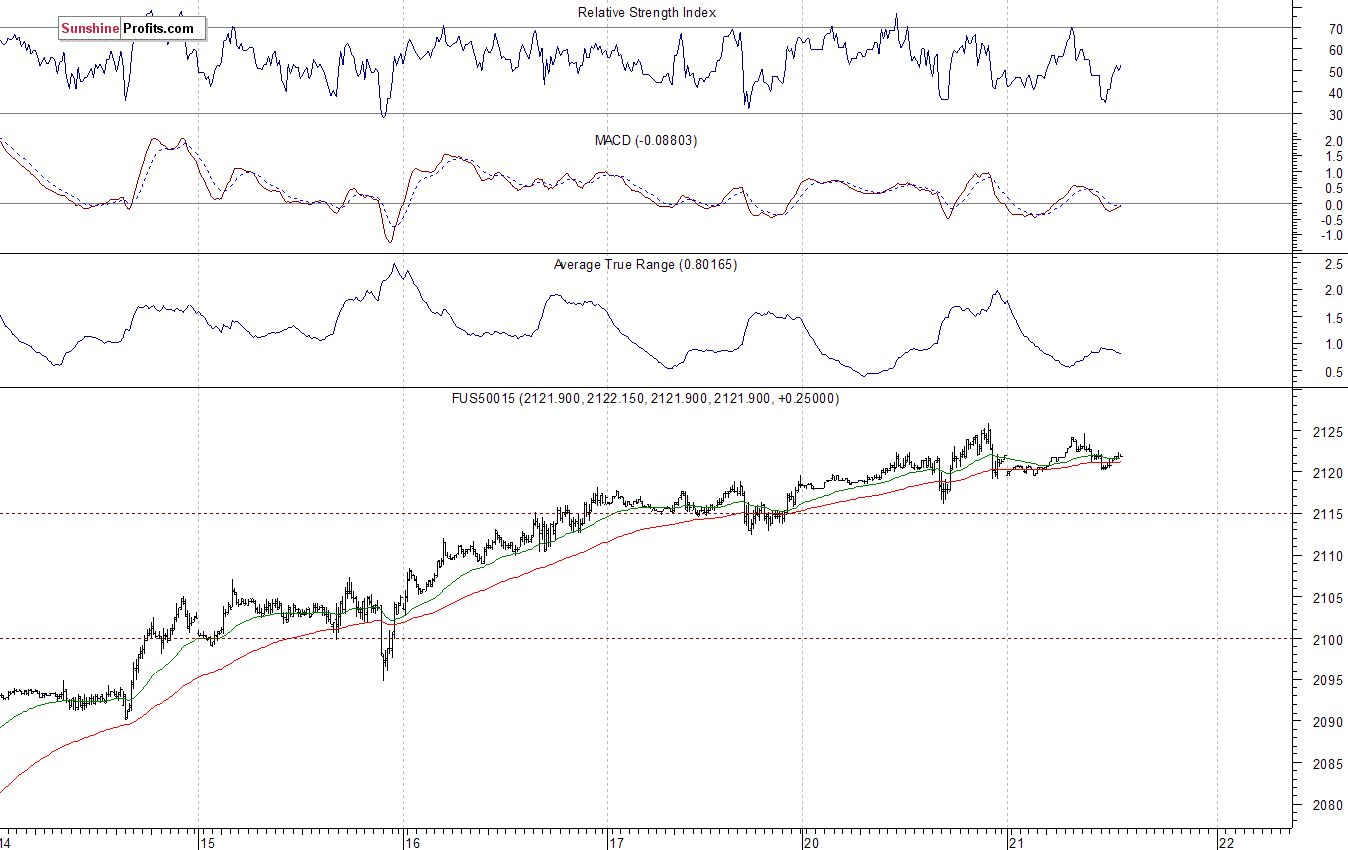

Expectations before the opening of today's trading session are virtually flat. The European stock market indexes have gained 0.1% so far. Investors will wait for further quarterly earnings releases. The S&P 500 futures contract (CFD) trades within an intraday consolidation, following recent move up. The nearest important level of resistance is at around 2,125, and support level remains at 2,115-2,120, as the 15-minute chart shows:

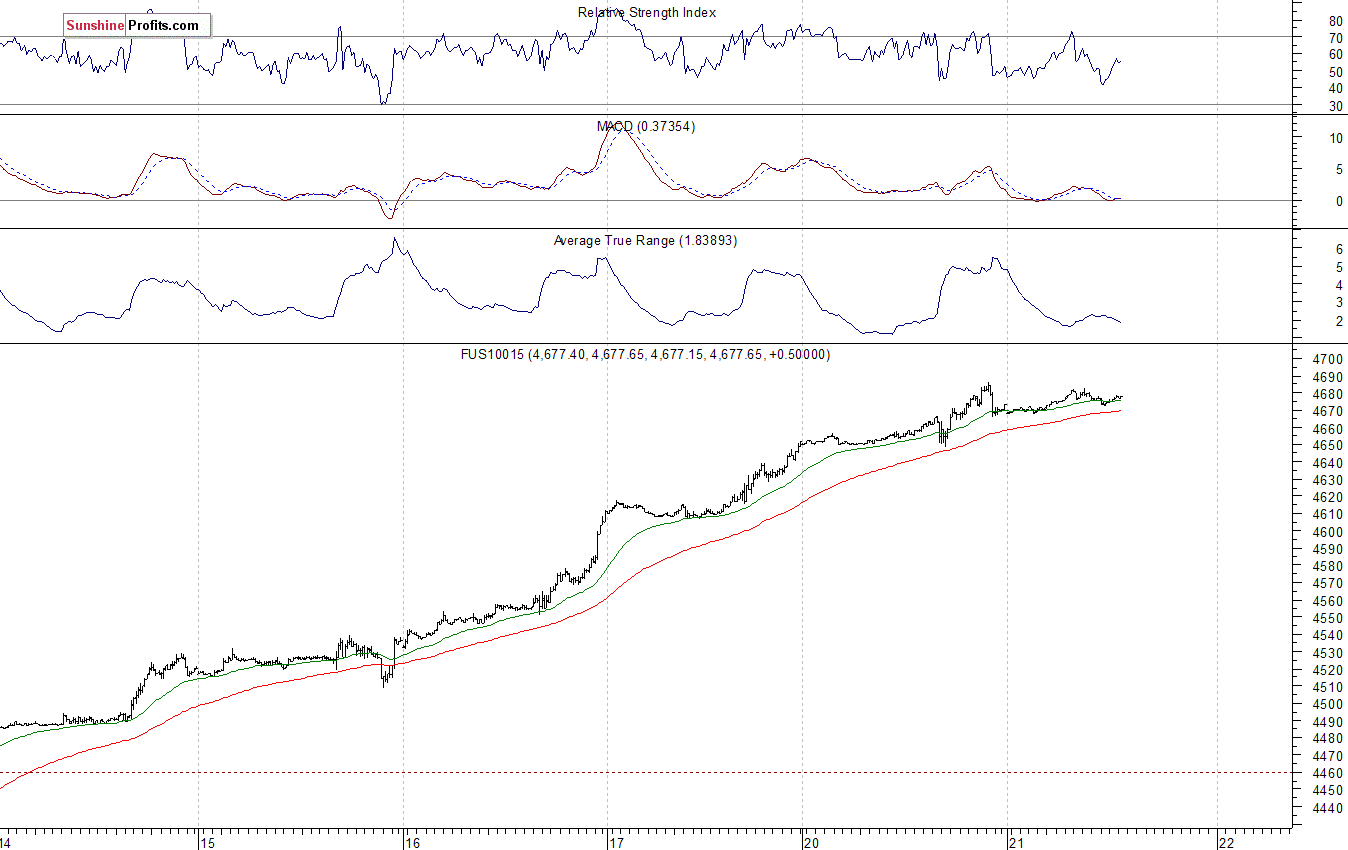

The technology Nasdaq 100 futures contract (CFD) fluctuates along record highs. The nearest important level of resistance is at 4,680-4,700, and support level is at 4,650, as we can see on the 15-minute chart:

Concluding, the broad stock market continues to trade along record highs, as investors react to quarterly earnings releases. There have been no confirmed negative signals so far. However, we continue to maintain our speculative short position (2,098.27, S&P 500 index), as we expect a medium-term downward correction or an uptrend reversal. Stop-loss is at 2,140, and potential profit target is at 1,980. You can trade S&P 500 index using futures contracts (S&P 500 futures contract - SP, E-mini S&P 500 futures contract - ES) or an ETF like the SPDR S&P 500 ETF - SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts