Briefly: In our opinion, no speculative positions are justified

Our intraday outlook is neutral, and our short-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): bullish

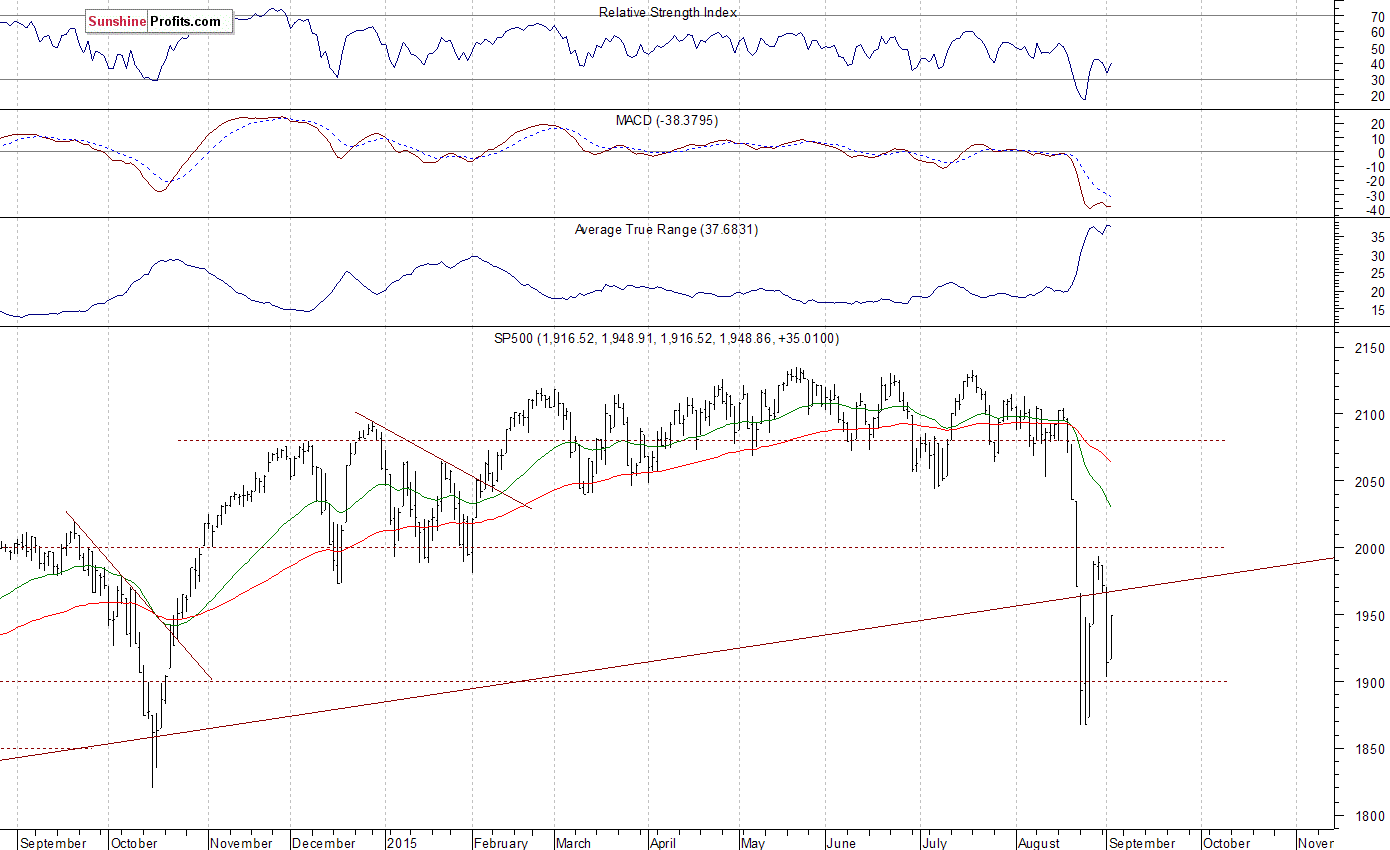

The main U.S. stock market indexes gained between 1.8% and 2.7% on Wednesday, as investors reacted to economic data announcements. The S&P 500 index bounced off support level at around 1,900. However, it still remains below technically important level of 2,000. The nearest important level of resistance is at 1,980-2,000. On the other hand, support level is at 1,900-1,920. There have been no confirmed positive signals so far. For now, it looks like a flat correction following recent sell-off:

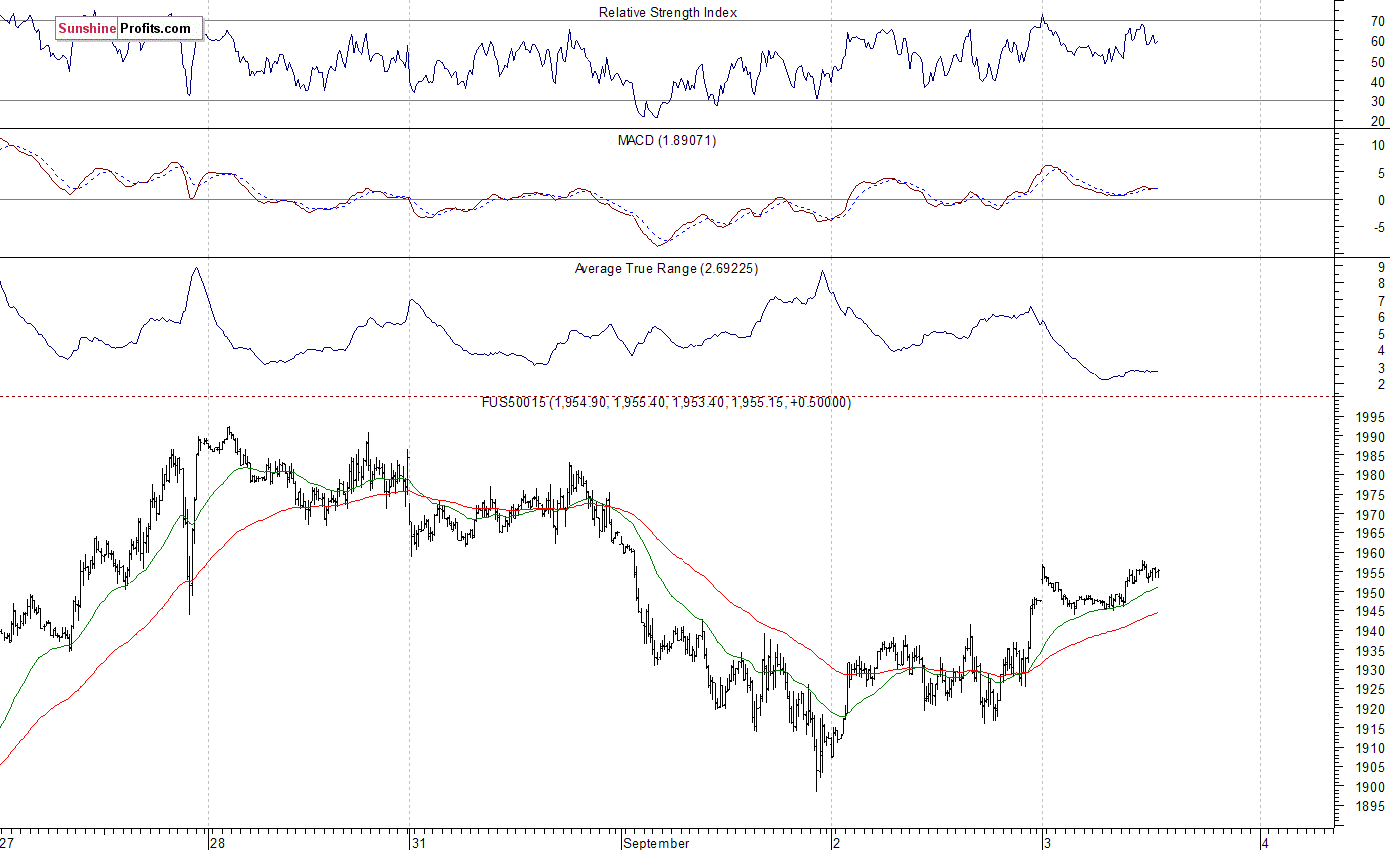

Expectations before the opening of today's trading session are positive, with index futures currently up 0.4%. The European stock market indexes have gained 1.3-1.5% so far. Investors will now wait for some economic data announcements: Initial Claims, Trade Balance at 8:30 .m., ISM Service number at 10:00 a.m. The S&P 500 futures contract (CFD) trades within an intraday uptrend, as it continues its yesterday's move up. The nearest important level of resistance is at around 1,960, marked by previous consolidation. On the other hand, support level is at 1,930, among others, as the 15-minute chart shows:

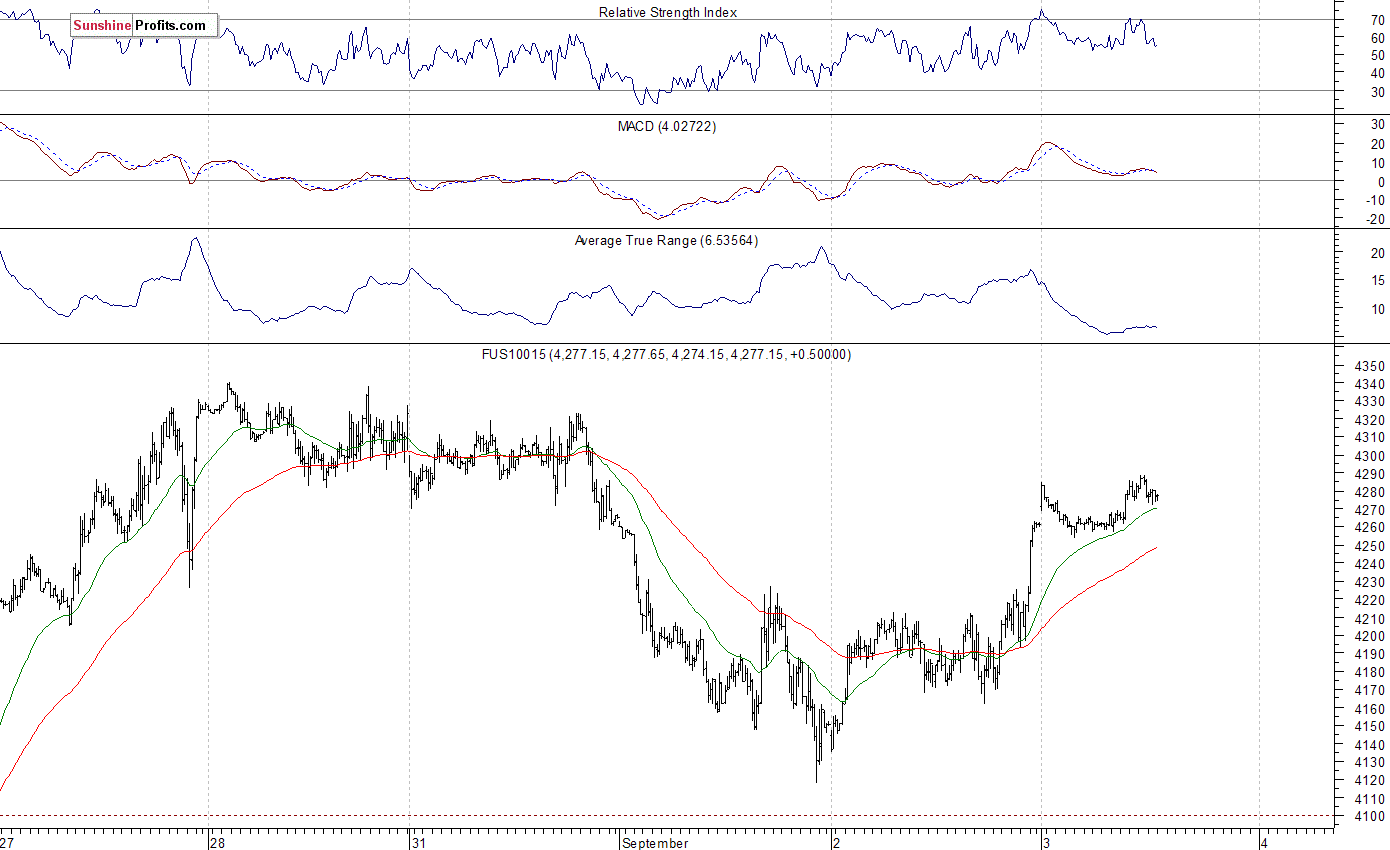

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it extends yesterday's advance. The nearest important level of resistance is at 4,300, and support level remains at 4,200, as we can see on the 15-minute chart:

Concluding, the broad stock market extends its relatively volatile short-term consolidation, following late August sell-off. There have been no confirmed positive signals so far. For now, it looks like a consolidation following recent decline. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts