Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,085 and profit target at 1,950, S&P 500 index).

Our intraday outlook is now bearish, and our short-term outlook is bearish:

Intraday

(next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

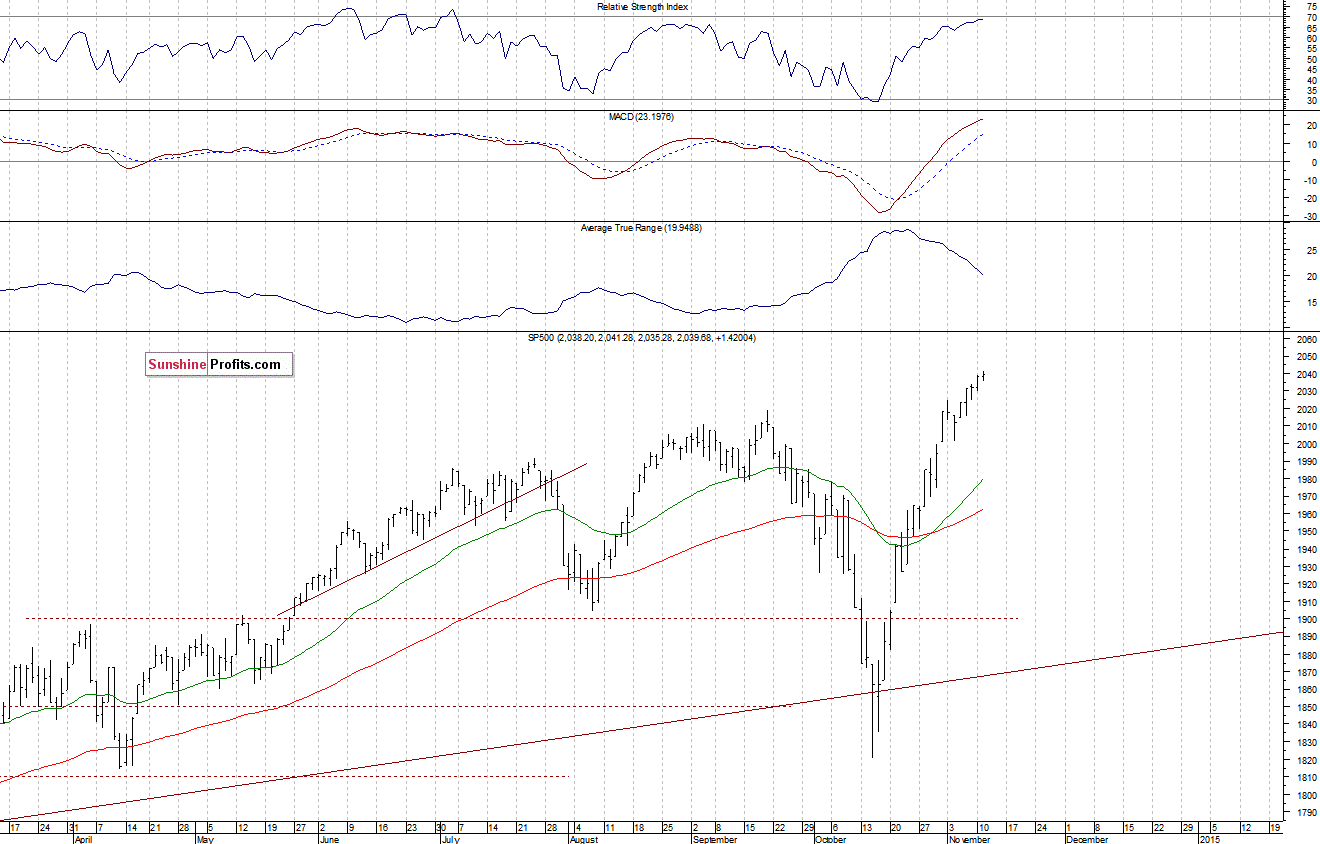

The main U.S. stock market indexes were virtually flat on Tuesday, as they extended short-term consolidation following recent move up. Our yesterday’s intraday neutral outlook has proved accurate. The S&P 500 index reached new all-time high at the level of 2,041.28, before closing up less than 0.1%. The nearest important support level remains at around 2,020-2,025, marked by previous local extremes. On the other hand, potential level of resistance is at 2,050. There have been no confirmed negative signals so far, however, we can see some overbought conditions which may lead to a downward correction:

Expectations before the opening of today’s trading session are slightly negative, with index futures currently down 0.2%. The European stock market indexes have lost 0.2-0.6% so far. Investors will now wait for the Wholesale Inventories number announcement at 10:00 a.m. The S&P 500 futures contract (CFD) extends its short-term fluctuations along the level of 2,030. The nearest important resistance level is at around 2,030-2,040, marked by local highs. On the other hand, support level remains at 2,020-2,030, among others, as we can see on the 15-minute chart:

The technology Nasdaq 100 futures contract (CFD) remains close to its long-term high, as it fluctuates along the level of 4,180. The level of resistance is at around 4,180-4,200. There have been no confirmed negative signals so far, however, short-term downward correction scenario cannot be excluded:

Concluding, the broad stock market remains close to all-time highs, as it extends recent fluctuations. We expect a downward correction or an uptrend reversal. Therefore, we decided to open a speculative short position at the open of today’s cash market trading session. Stop-loss is at 2,085 and potential profit target is at 1,950 (S&P 500 index).

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts