Briefly: In our opinion, no speculative positions are justified at this moment.

Our intraday outlook is neutral, and our short-term outlook is neutral:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

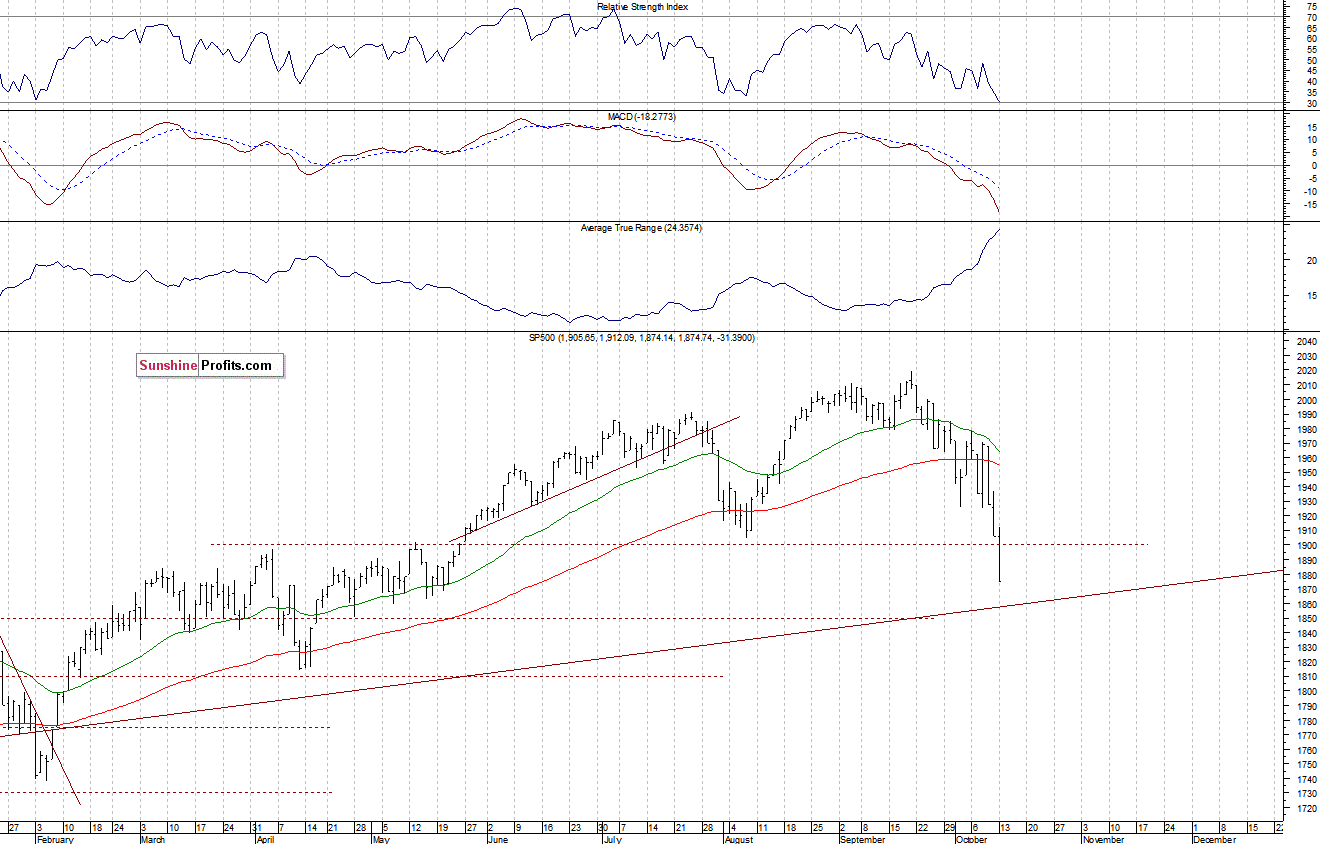

The main U.S. stock market indexes lost 1.4-1.7% on Monday, extending their short-term downtrend, as investors sold stocks ahead of quarterly corporate earnings releases, among others. The S&P 500 index broke below the level of 1,900, which is negative. The nearest important level of support is at around 1,860-1,880, marked by medium-term upward trend line, March-May consolidation, among others. On the other hand, the nearest important resistance level is at 1,900, marked by previous support level, as we can see on the daily chart:

Expectations before the opening of today’s trading session are slightly positive, with index futures currently up 0.1-0.2%. The European stock market indexes have lost 0.6-1.0% so far. The S&P 500 futures contract (CFD) is close to yesterday’s low, as it trades along the level of 1,870. The nearest important level of resistance is at around 1,875-1,880, marked by previous support level, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades along yesterday’s low. The nearest important level of support remains at around 3,790-3,800. On the other hand, the resistance level is at 3,825-2,830, among others:

Concluding, the broad stock market continued its downtrend on Monday, as the S&P 500 index broke below the level of 1,900. There are some short-term oversold conditions which may lead to an upward correction or downtrend reversal at some point. It seems that taking profits off the table yesterday was a good idea, as there may be some volatility ahead. Therefore, we prefer to be out of the market at this moment. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts