Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook remains neutral, and our short-term outlook is neutral:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

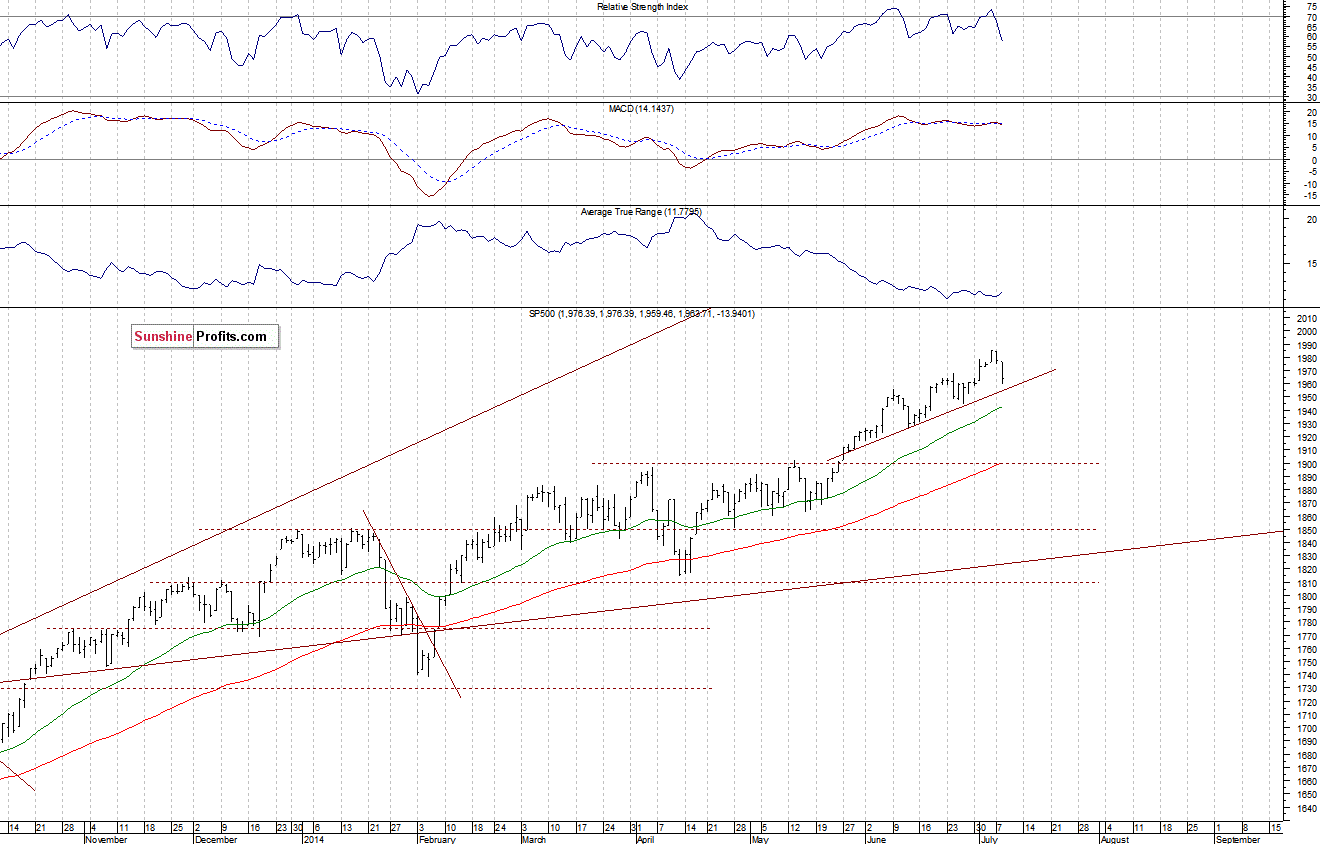

The U.S. stock market indexes lost between 0.7% and 1.2% on Tuesday, extending Monday’s move down, as investors intensified profit-taking following recent rally. The S&P 500 index retraced all of its early July move up, as it broke below its short-term support of 1,975. The nearest important support level is at around 1,950-1,960, marked by month-long upward trend line, among others. On the other hand, the level of resistance is at around 1,975, marked by above-mentioned previous support level. There have been no confirmed uptrend reversal signal so far, however, we can still see some overbought conditions:

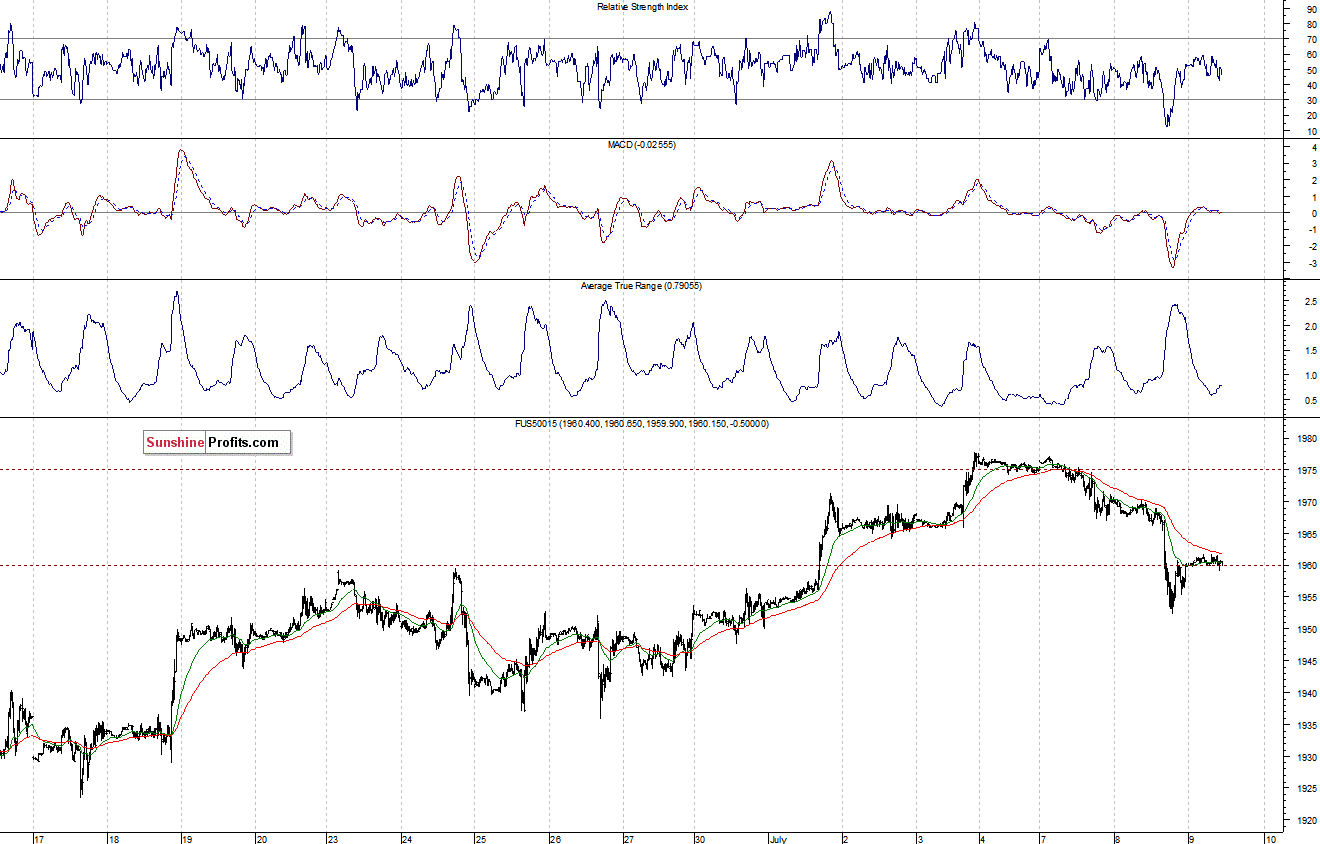

Expectations before the opening of today’s session are virtually flat. The main European stock market indexes have been mixed between -0.1% and +0.4% so far. Investors will now wait for some economic data announcements: MBA Mortgage Index at 7:00 a.m., FOMC Minutes at 2:00 p.m. The S&P 500 futures contract (CFD) is in a relatively narrow intraday trading range, following a slight bounce from yesterday’s heavier selling. The level of support is at 1,950-1,955, and the nearest important resistance level is at around 1,965, marked by previous consolidation, as we can see on the 15-minute chart:

The technology Nasdaq 100 futures contract (CFD) is in a similar intraday consolidation, following yesterday’s selloff. The support level is at around 3,840-3,850, and the nearest level of resistance is at 3,880-3,900. For now, it looks like a correction within short-term move down, as the 15-minute chart shows:

Concluding, the broad stock market corrected its recent move up. There have been no confirmed uptrend reversal signals so far, as the S&P 500 index remains above month-long upward trend line. Therefore, we think that it is still better to stay out of the market at this moment. In other words, we will wait for some better risk/reward opportunity, because in such a choppy market environment, the only true winners are brokers with their commissions, and we care much more about your profits than we care about brokers’ commissions.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts