Briefly: In our opinion speculative long positions are still favored (with stop-loss at 1,910, S&P 500 index).

Our intraday outlook is neutral, and our short-term outlook remains bullish:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: bullish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

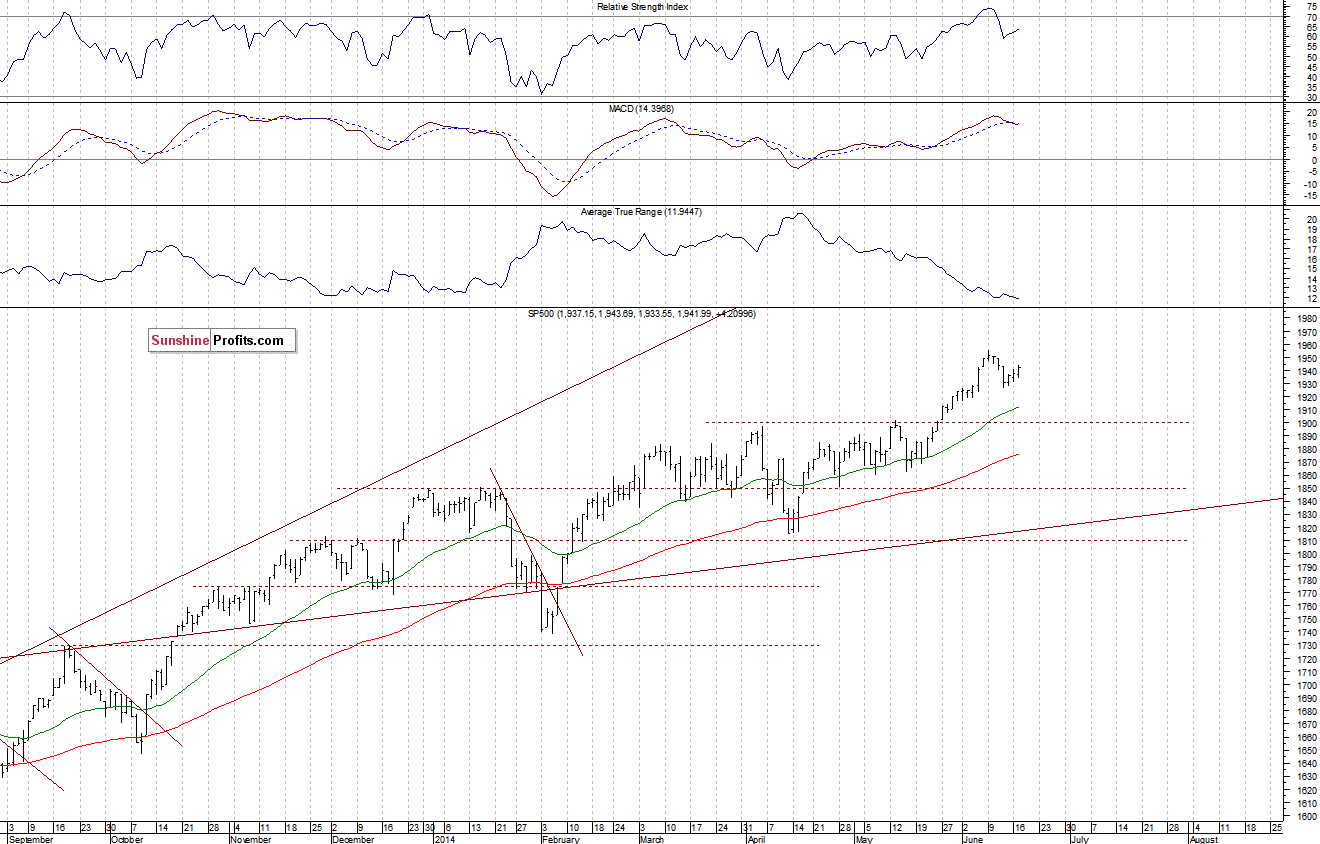

The U.S. stock market indexes were mixed between 0.0% and +0.2% on Tuesday, extending their short-term consolidation, as investors awaited economic data releases, today’s FOMC Rate Decision announcement. The S&P 500 index remains quite close to last week’s all-time high of 1,455.55. The resistance level is at 1,950-1,955. On the other hand, the level of support is at around 1,915-1,925, marked by previous consolidation. There is no clear short-term direction, as we can see on the daily chart:

Expectations before the opening of today’s session are virtually flat, with index futures mixed between 0.0% and +0.1%. The main European stock market indexes have gained 0.1-0.4% so far. Investors will now wait for the FOMC Rate Decision release at 2:00 p.m. The S&P 500 futures contract (CFD) continues to fluctuate in a relatively narrow trading range. The resistance level is at around 1,940, and the nearest important support is at 1,925, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) is in a similar short-term consolidation, following the early June Advance. The support level is at 3,750, and the nearest important level of resistance is at 3,790-3,800:

Concluding, the broad stock market extends its short-term consolidation. We expect some more uptrend following this relatively flat downward correction. Therefore, we continue to maintain our already profitable long position, with stop-loss (protect-gain in this case) at 1,910 – S&P 500 index.

There will be no Stock Trading Alert tomorrow. We will post the next alert on Friday. Meanwhile, the stop-loss (protect-gain) orders remain up-to-date, so you remain protected. We apologize for the inconvenience.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts