Briefly: In our opinion speculative long positions are still favored (with stop-loss at 1,885, S&P 500 index).

Our intraday outlook is neutral, and our short-term outlook is bullish, following a breakout above consolidation:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: bullish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

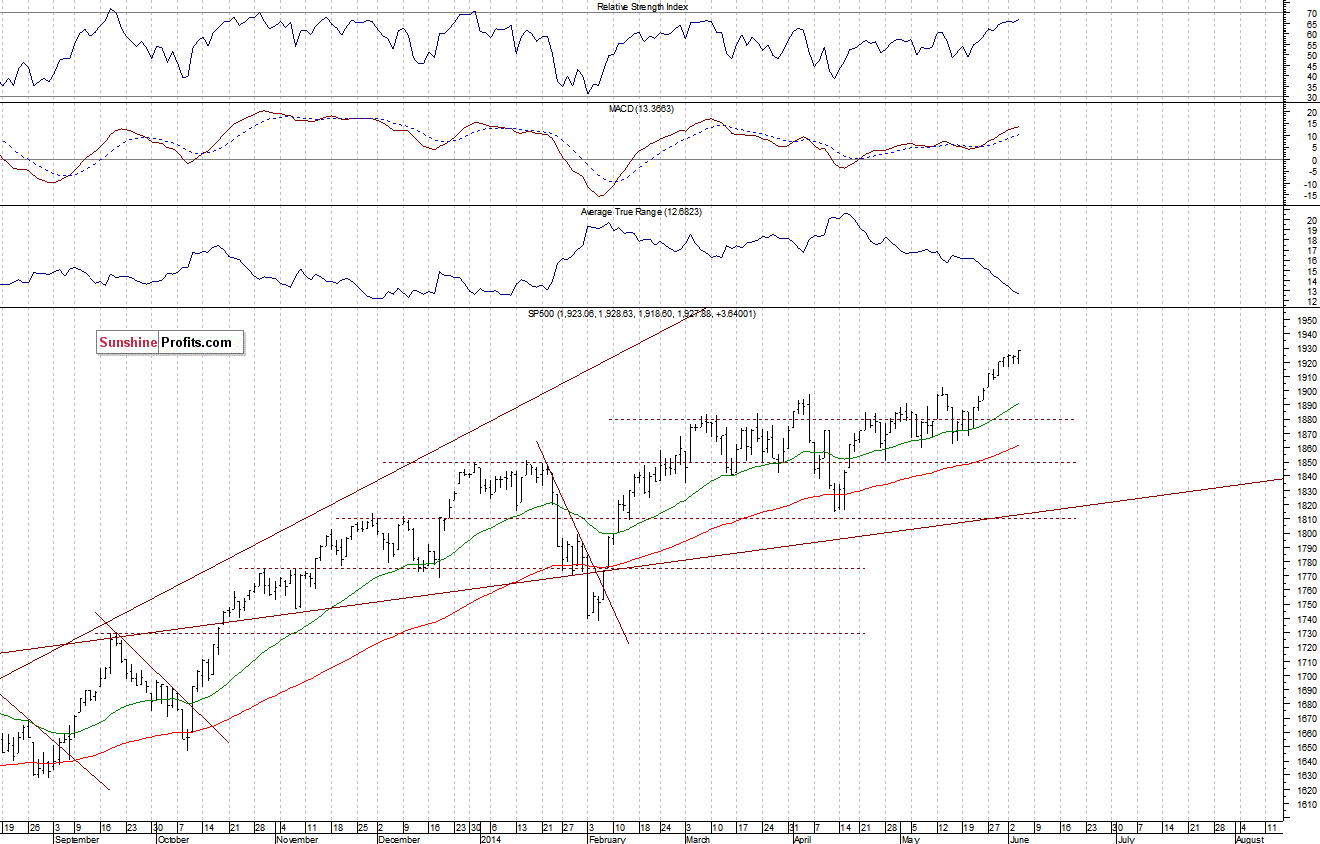

The U.S. stock market indexes gained 0.1-0.4% on Wednesday, slightly extending their recent uptrend, as investors reacted to some mixed economic data announcements. The S&P 500 index has reached the new all-time high at 1,928.63, moving further away from the level of 1,900. The nearest important support level is at around 1,915, marked by recent local lows, and the next support is at the psychological 1,900. On the other hand, a potential level of resistance is at 1,950. There have been no confirmed trend reversal signals so far. However, a profit-taking correction cannot be excluded here:

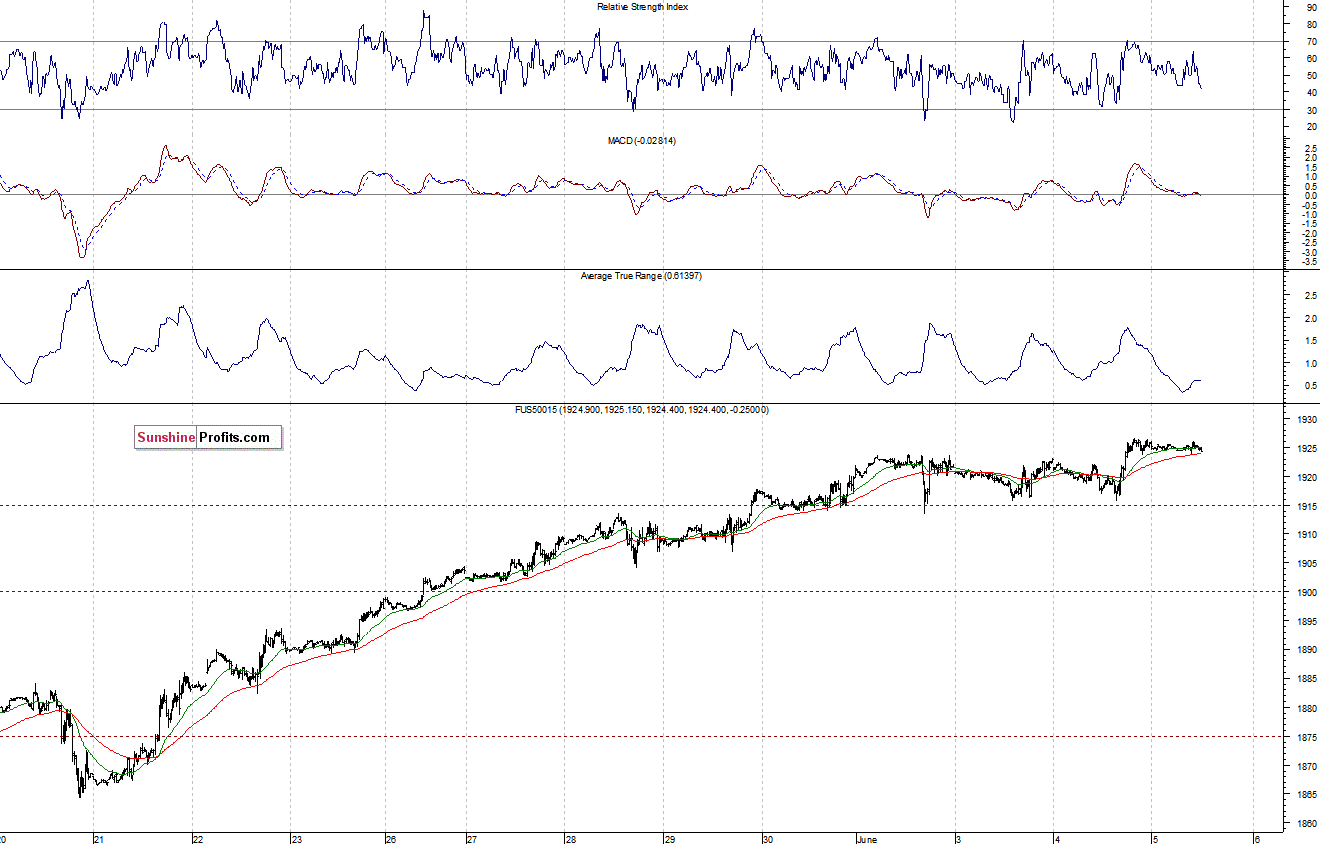

Expectations before the opening of today’s session are slightly positive, with index futures up 0.1-0.2% vs. their yesterday’s closing prices. The main European stock market indexes have been mixed between -0.1% and +0.4% so far. Investors will now wait for some economic data releases: Challenger Job Cuts report at 7:30 a.m., ECB Rate Decision at 7:45 a.m., Initial Claims at 8:30 a.m. The S&P 500 futures contract (CFD) trades close to yesterday’s high, along the level of 1,925. The support level remains at around 1,915, marked by recent local lows, as we can see on the 15-minute chart:

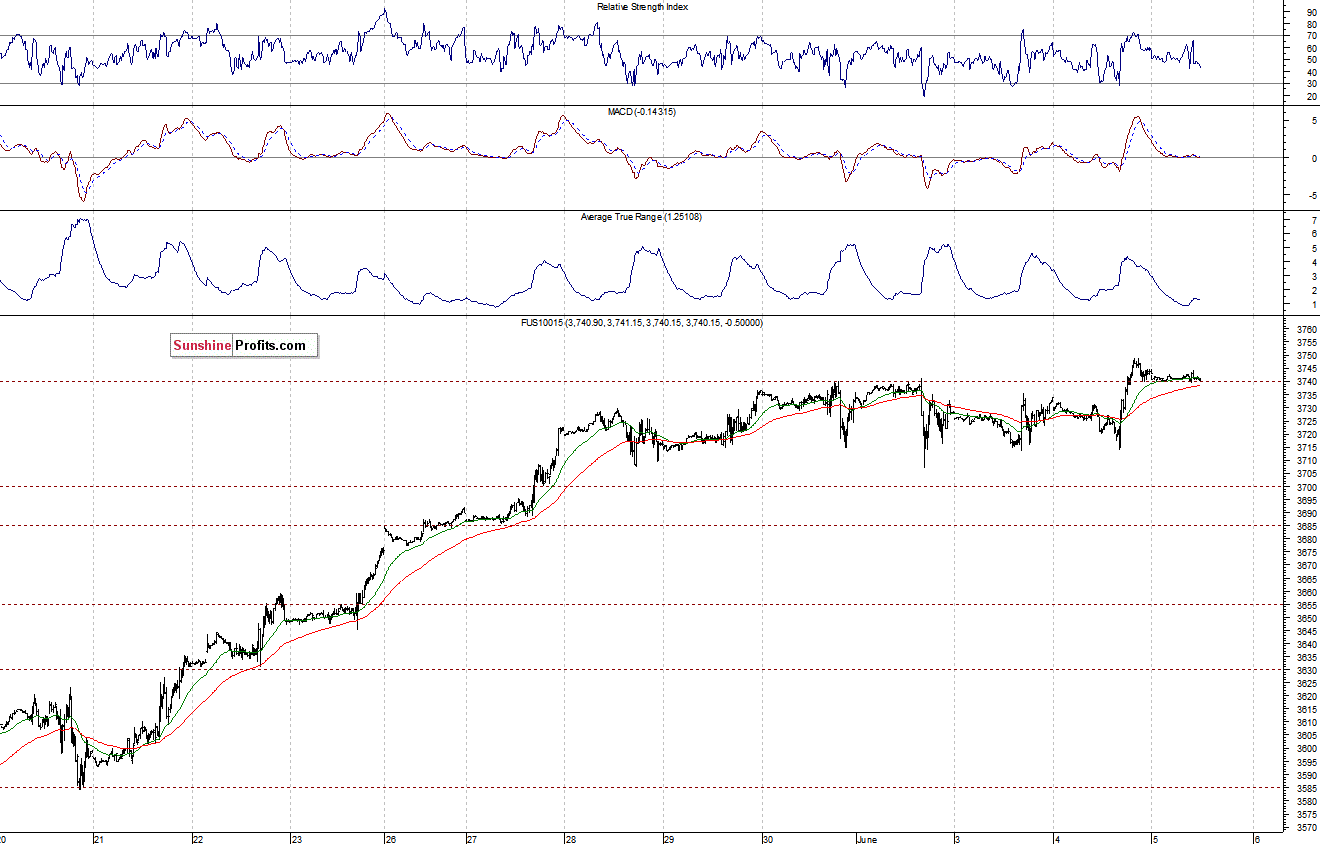

The technology Nasdaq 100 futures contract (CFD) is in a similar intraday consolidation, close to its recent high. The support level is at around 3,710-3,720. There have been no confirmed negative signals so far, as the 15-minute chart shows:

Concluding, we remain cautiously optimistic, expecting the continuation of the uptrend, and we continue to maintain our already profitable long position. The stop-loss is at 1,885 (S&P 500 index).

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts