Briefly: In our opinion speculative long positions are still favored (with stop-loss at 1,850, S&P 500 index).

Our intraday outlook is still bullish, and our short-term outlook remains neutral:

Intraday

(next 24 hours) outlook: bullish

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

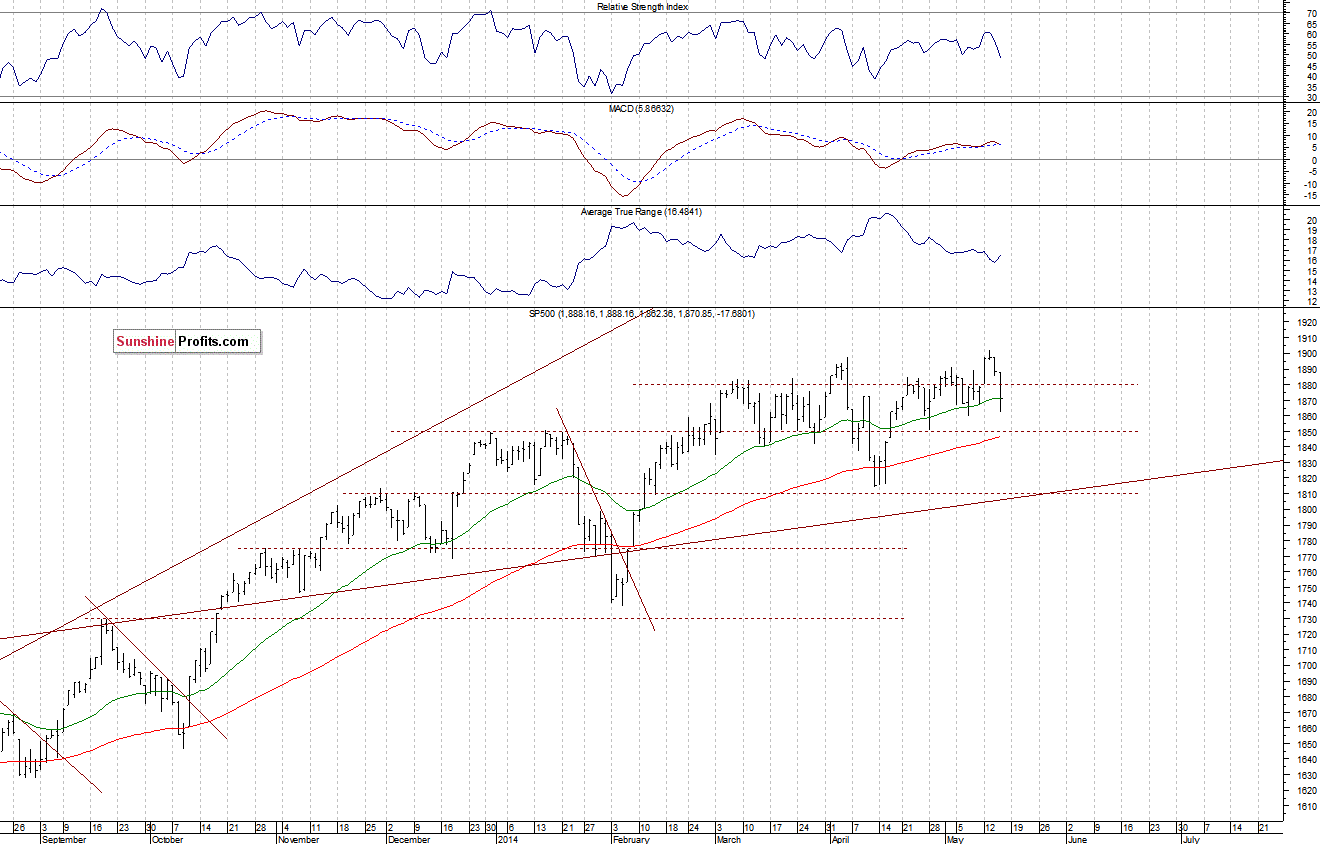

The main U.S. stock market indexes lost between 0.8% and 1.0% on Thursday, extending Wednesday’s move down a bit, as investors intensified their selling following economic data announcements and failure to break above some key technical levels. The S&P 500 index bounced off the resistance at 1,900, retracing recent rally. The resistance is at 1,880-1,900, and the nearest important support is at 1,860. The next support is at 1,850, marked by the late April local low, as we can see on the daily chart:

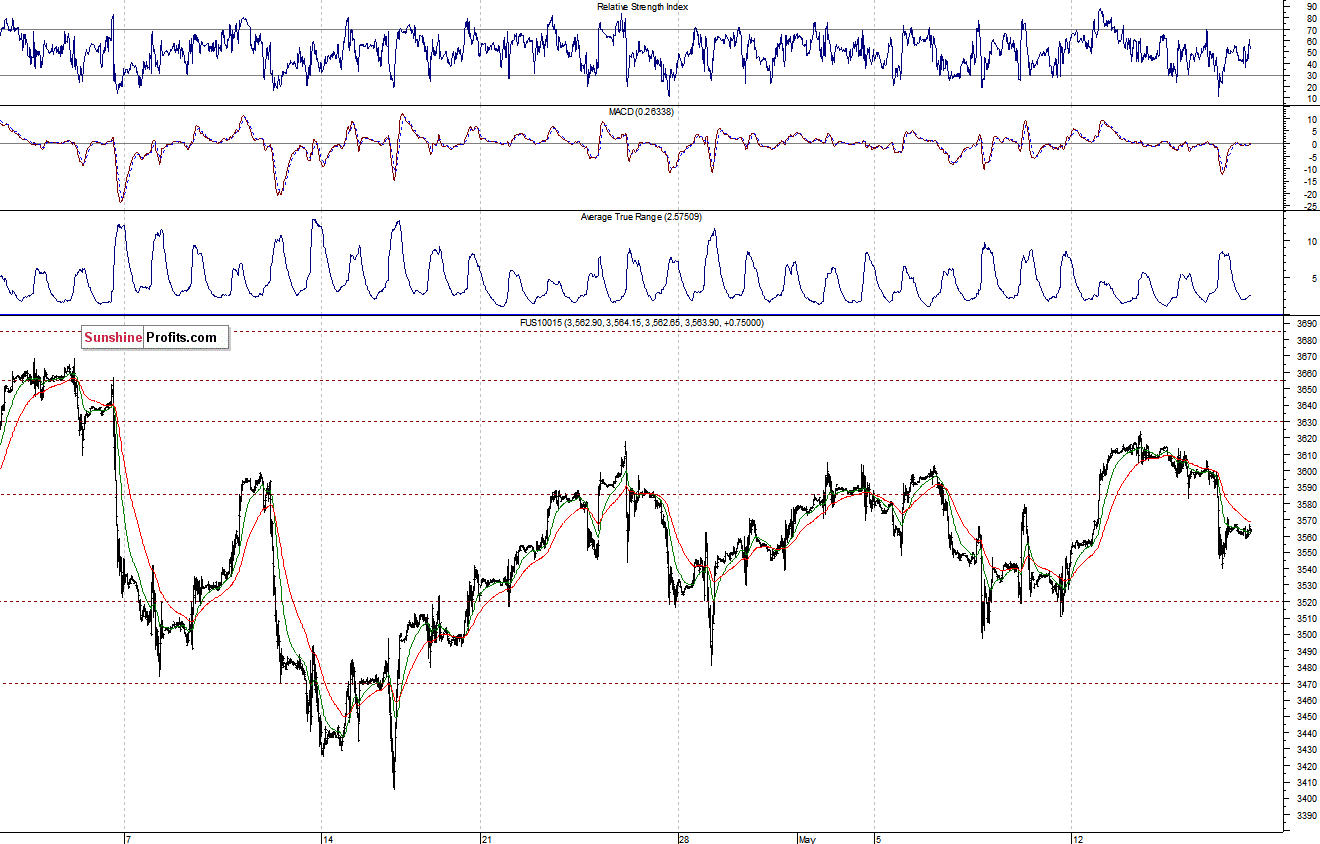

Expectations before the opening of today’s session are negative, with index futures currently down 0.2%. The European stock market indexes have lost 0.3-0.5% so far. Investors will now wait for some economic data releases: Housing Starts, Housing Permits at 8:30 a.m., Michigan Sentiment at 9:55 a.m. The S&P 500 futures contract (CFD) has retraced practically all of its recent move up. It continues to trade within the April-May consolidation. The resistance is at 1,880-1,885, and the nearest important level of support is at around 1,855, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) extends its fluctuations, as it trades along the level of 3,550. The resistance is at 3,600-3,620, and the support level is at 3,500. There has been no clear short-term trend so far:

Concluding, the broad stock market has failed to continue its long-term uptrend, bouncing off the important medium-term resistance. It may be considered as an initial sell signal. However, the sell signal hasn’t been confirmed (the price remains above key support levels), so we continue to maintain our speculative long position, with stop-loss at 1,850 (S&P 500 index).

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts