Briefly: In our opinion speculative long positions are still favored (with stop-loss at 1,850, S&P 500 index).

Our intraday outlook is bullish, and our short-term outlook remains neutral:

Intraday

(next 24 hours) outlook: bullish

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

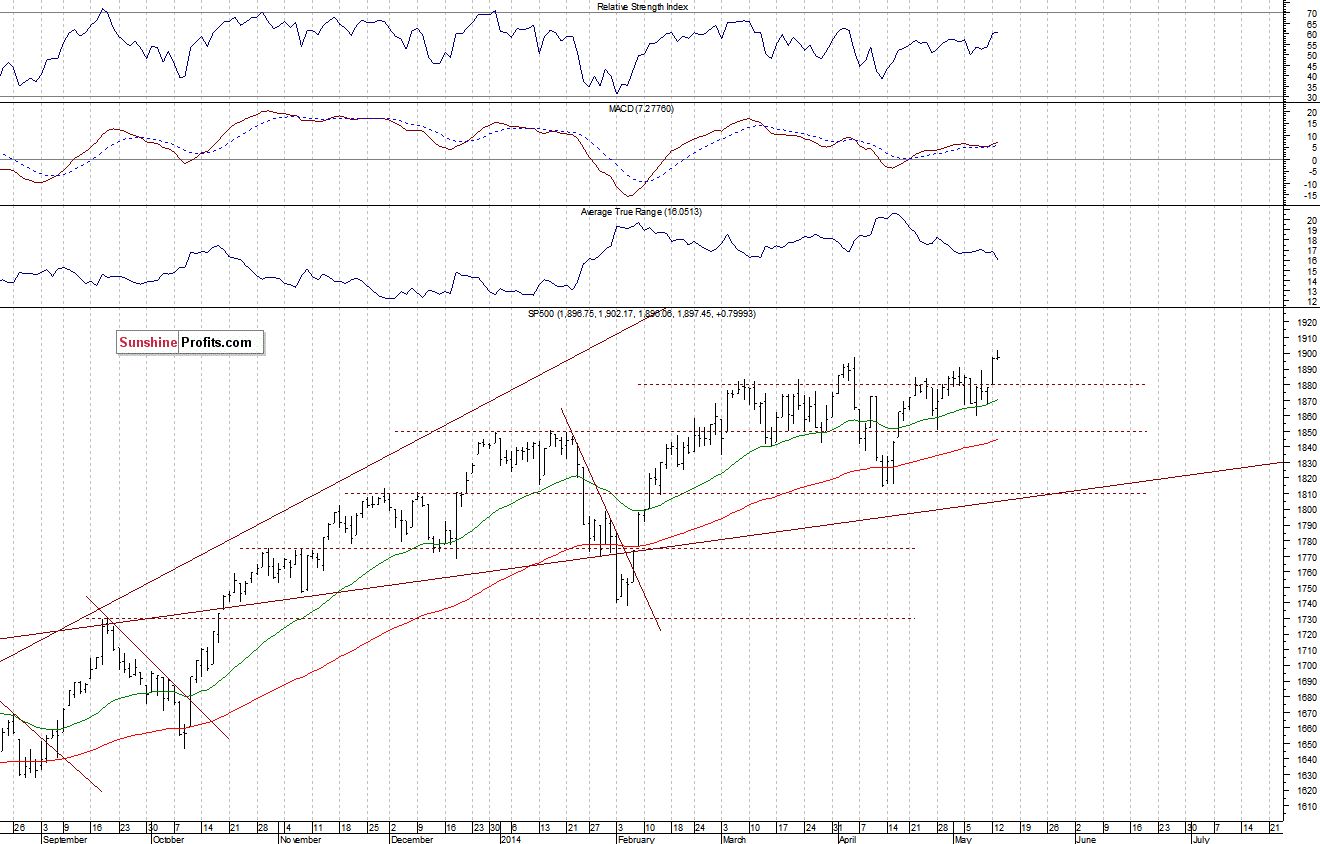

The U.S. stock market indexes were mixed between 0.0% and +0.1%, as investors hesitated following recent move up, and reacted to worse-than-expected Retail Sales report release. The S&P 500 index has managed to reach a new all-time high at 1,902.17, before closing slightly below the psychological level of resistance of 1,900. On the other hand, the support remains at around 1,860-1,870, and the next support is at 1,850. There have been no confirmed negative signals so far, as we can see on the daily chart:

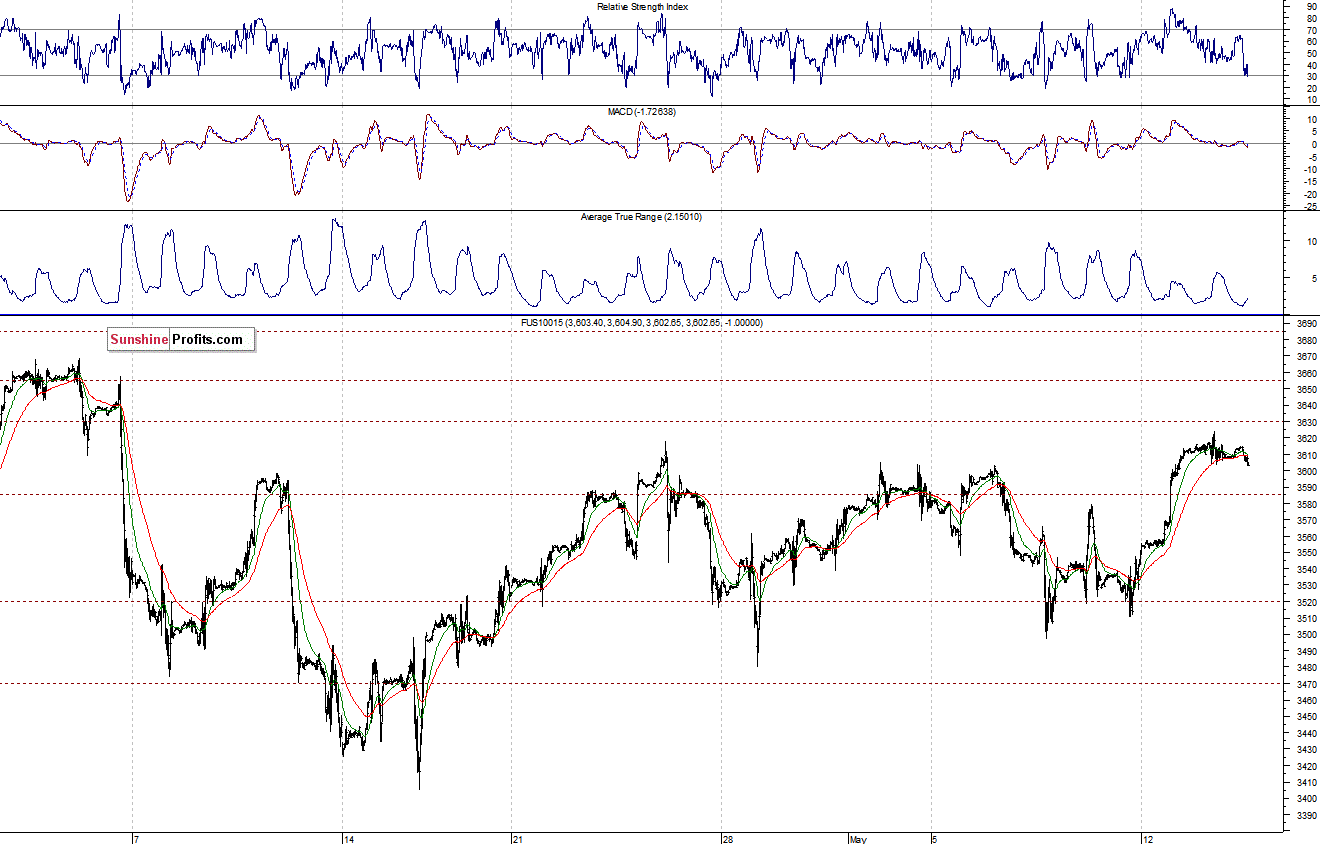

Expectations before the opening of today’s session are slightly negative, with index futures currently down 0.1%. The major European stock market indexes have lost 0.1-0.2% so far. Investors will now wait for the Producer Price Index release at 8:30 a.m. The S&P 500 futures contract (CFD) trades in a relatively narrow intraday range, close to its recent high. The resistance is at the psychological 1,900, and the nearest support level is at 1,880-1,885, marked by the previous resistance, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) is in an analogous, relatively narrow trading range, following recent rally. The resistance is at around 3,620-3,630, and the nearest level of support is at 3,600. For now, it looks like a flat correction within an uptrend:

Concluding, the broad stock market has reached new all-time highs, which confirms its long-term uptrend. We continue to maintain our profitable long position, and our stop loss remains at 1,850 (S&P 500 index). We will move it higher if stocks continue to rally, but it seems it should be left intact at this time.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts