Briefly: In our opinion speculative long positions are favored (with stop-loss at 1,850, S&P 500 index)

Our intraday outlook is bullish, and our short-term outlook remains neutral:

Intraday

(next 24 hours) outlook: bullish

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

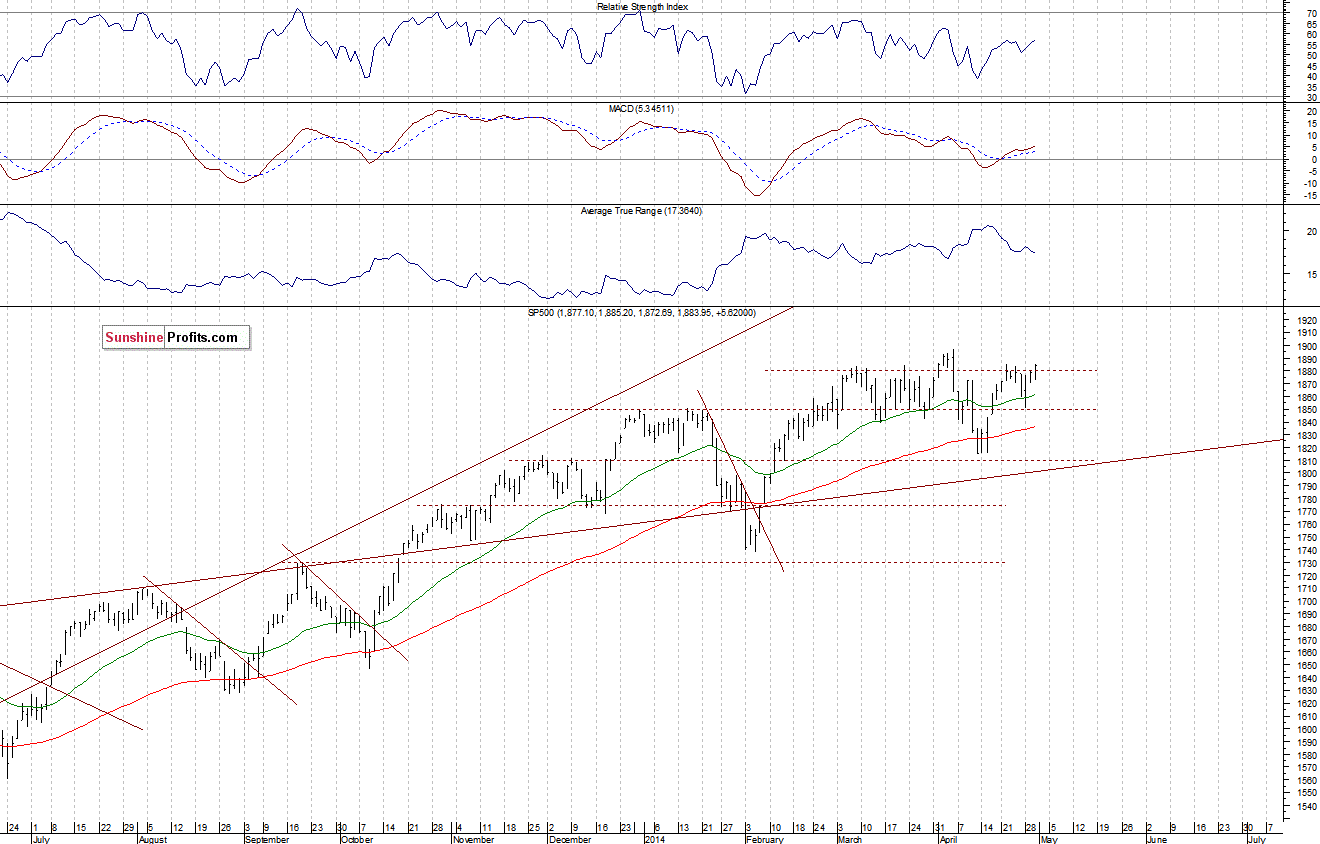

The main U.S. stock market indexes gained 0.2-0.3% on Wednesday (making our long positions more profitable), extending their short-term move up, as investors reacted to the FOMC’s decision concerning further tapering of its asset-purchasing program. The S&P 500 index got closer to the April 4 all-time high of 1,897.28, however, remaining within recent consolidation. The resistance is at 1,880-1,900, and the nearest important level of support is at around 1,870. The next support is at 1,850. There have been no confirmed negative short-term signals so far, as we can see on the daily chart:

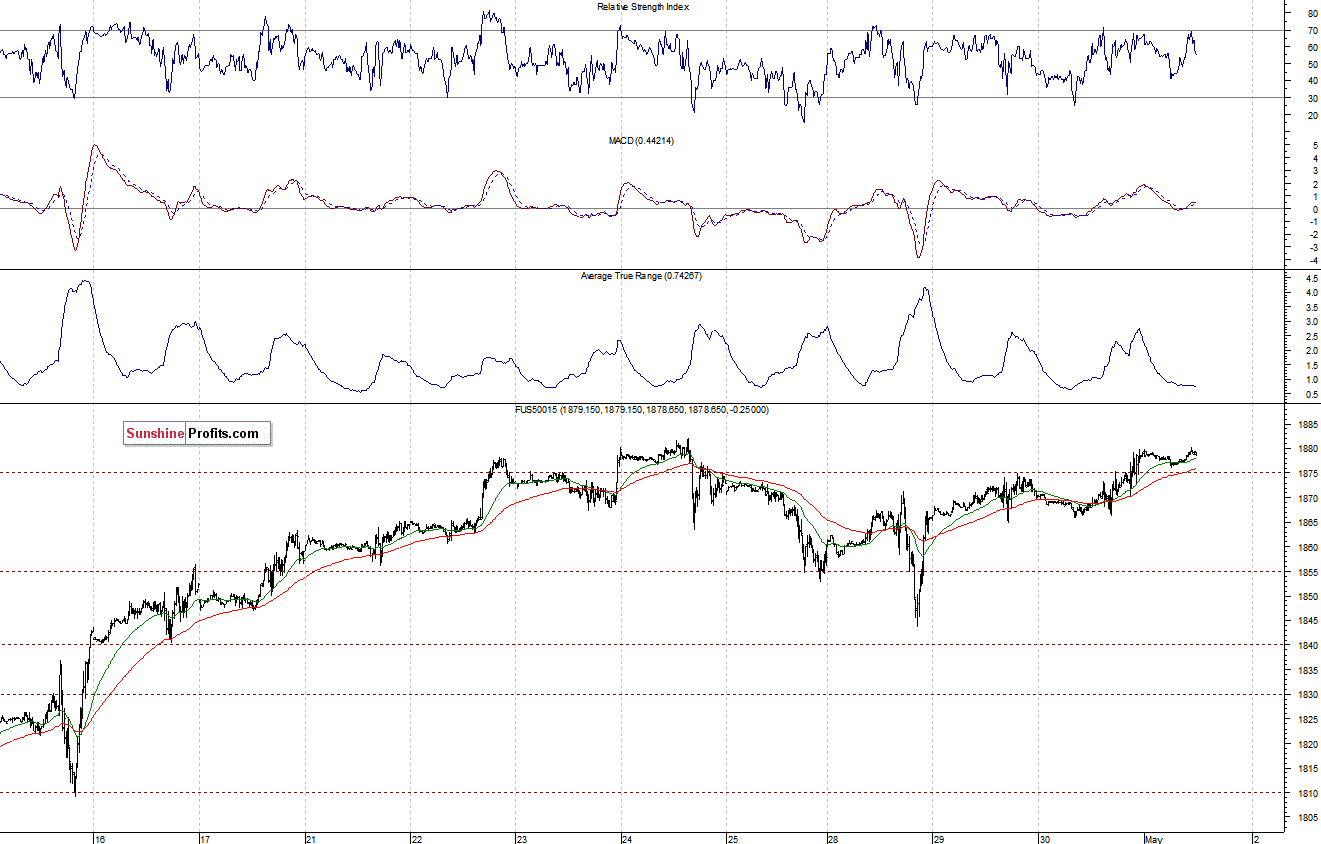

Expectations before the opening of today’s session are slightly positive, with index futures currently up 0.1-0.2%. Most European stock markets are closed for Labor Day. Investors will now wait for some economic data announcements: Challenger Job Cuts report at 7:30 a.m., Initial Claims, Personal Income, Personal Spending at 8:30 a.m., ISM Index, Construction Spending at 10:00 a.m. The S&P 500 futures contract (CFD) remains in an intraday uptrend, as it is at previous high’s resistance of 1,880. There have been no confirmed negative signals so far:

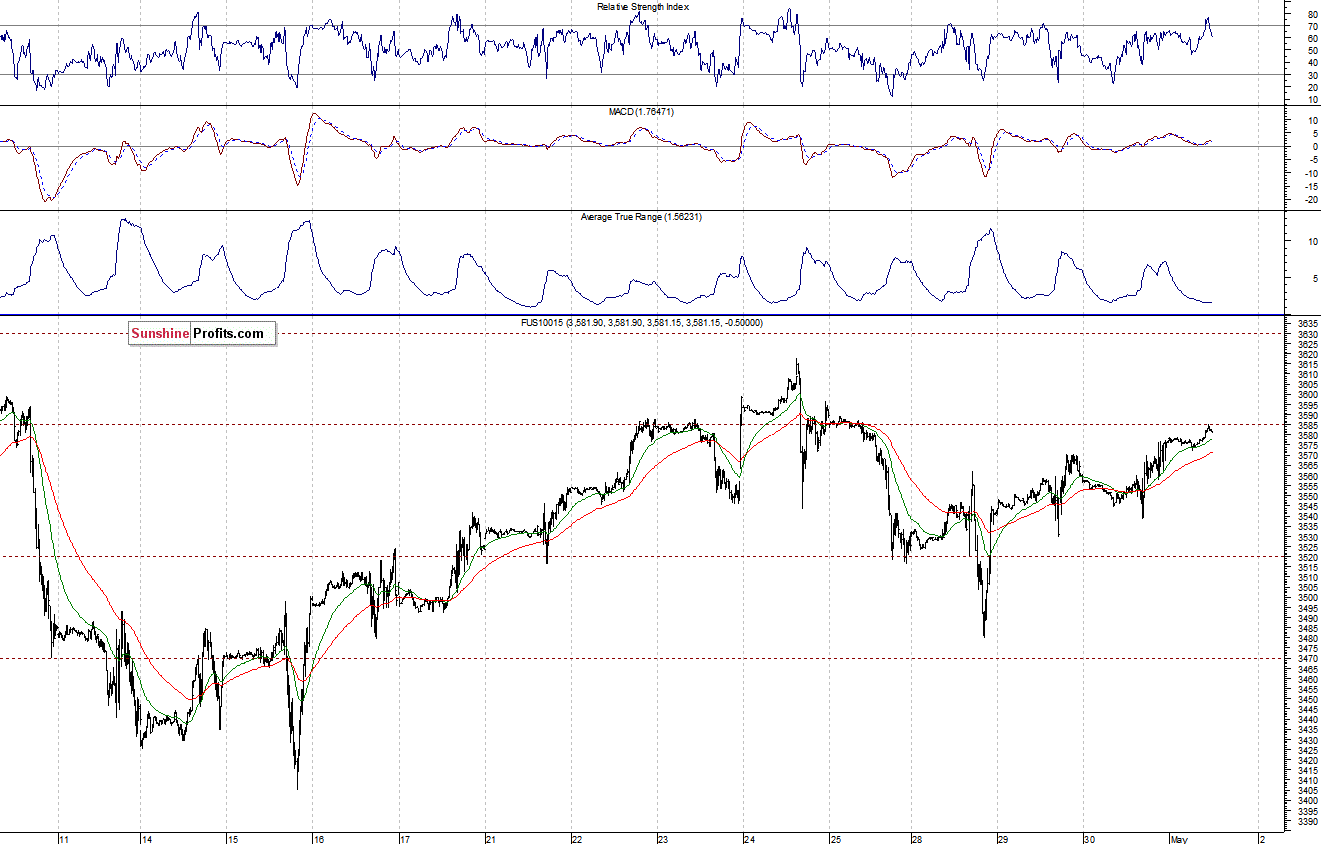

The technology Nasdaq 100 futures contract (CFD) trades in a similar intraday uptrend. The nearest important resistance is at around 3,600-3,620, and the support level is at 3,540-3,550, among others. The market is within its over week-long consolidation, as the 15-minute chart shows;

Concluding, the broad stock market remains close to its early April all-time high, as the S&P 500 index tests the resistance of 1,880-1,900. We remain cautiously optimistic, therefore, only speculative long positions seem to be justified at this moment.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts