Briefly: In our opinion no speculative positions are justified.

Our intraday outlook remains neutral, and our short-term outlook is neutral:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

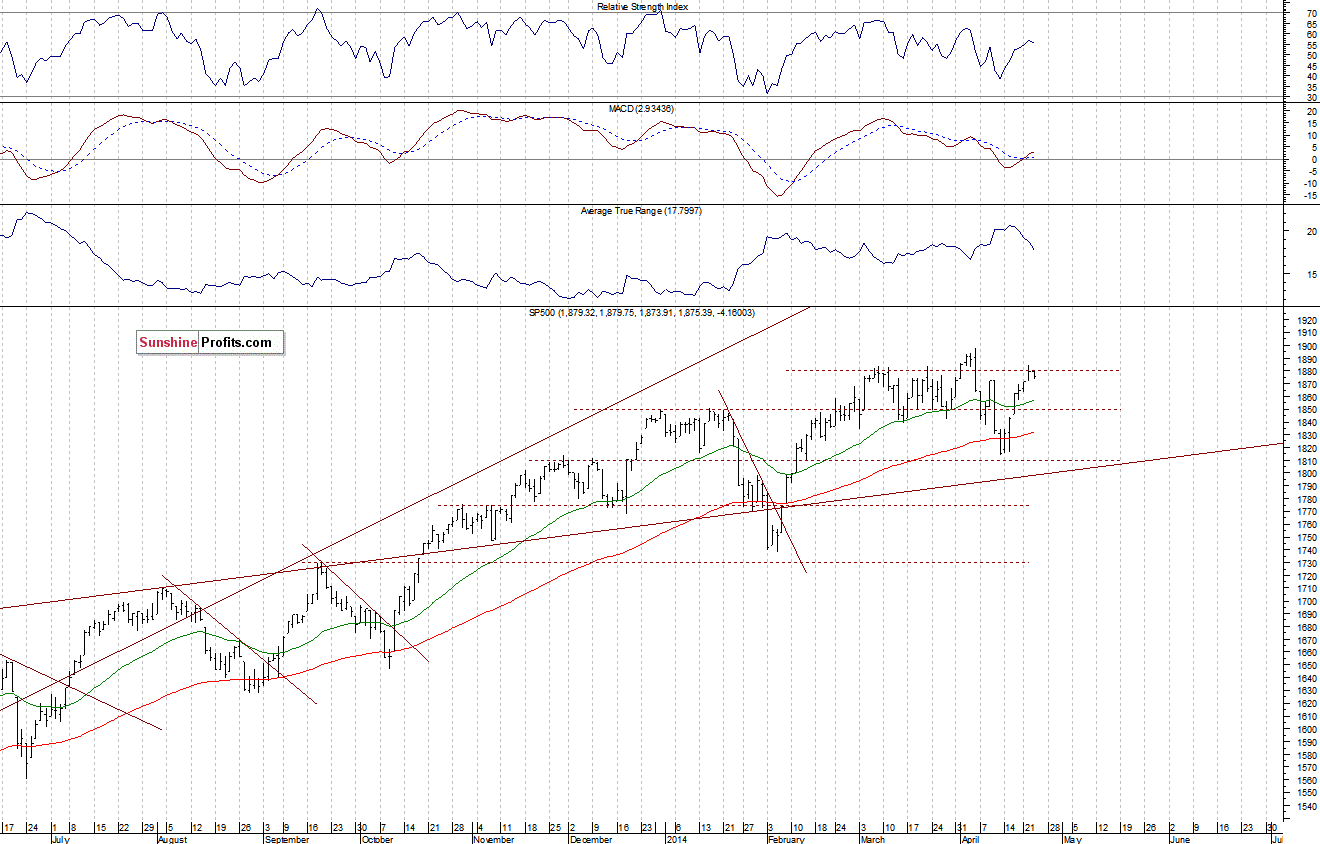

The main U.S. stock market indexes lost between 0.1% and 0.9% yesterday, retracing some of the recent move up, as investors decided to take profits off the table. The S&P 500 index remains quite close to its April 4 all-time high of 1,897.28, however, it continues to fluctuate along previous local highs. Our yesterday’s neutral outlook has proved accurate, as the broad market index has lost a mere 0.2%. The resistance is at 1,880-1,900, and the nearest important resistance level is at around 1,840-1,850, marked by previous local lows. For now, it looks like some further medium-term consolidation, following last year’s move up, as we can see on the daily chart:

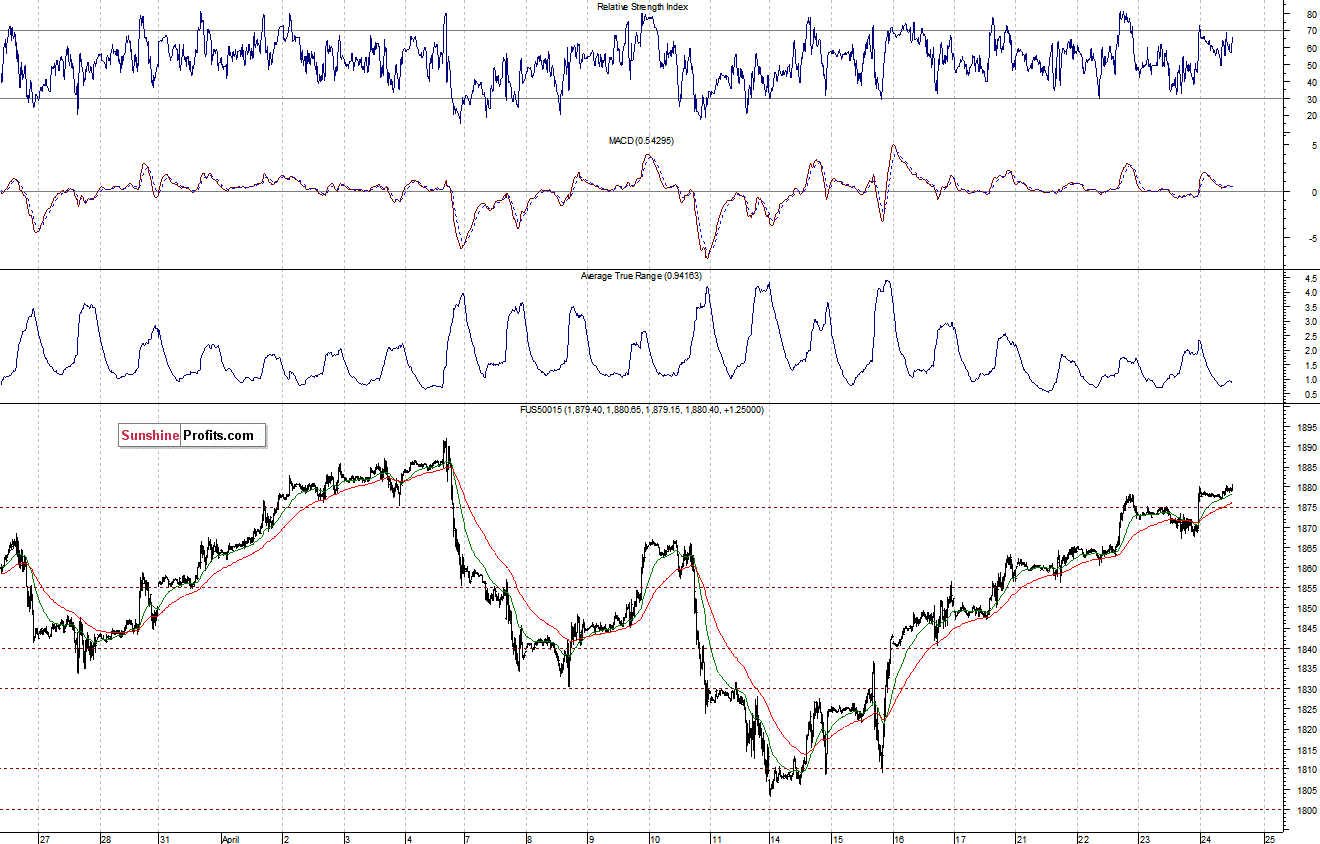

Expectations before the opening of today’s session are positive, with index futures currently up 0.3-1.5%, as investors react to yesterday’s quarterly earnings report release from Apple Inc. The European stock market indexes have gained 0.7-1.0% so far. Investors will now wait for some economic data announcements: Initial Claims, Durable Orders at 8:30 a.m. The S&P 500 futures contract (CFD) trades in a relatively narrow intraday range, close to its short-term highs. The resistance is at around 1,890-1,900, and the nearest important support level is at 1,865-1,870, marked by yesterday’s lows, as the 15-minute chart shows:

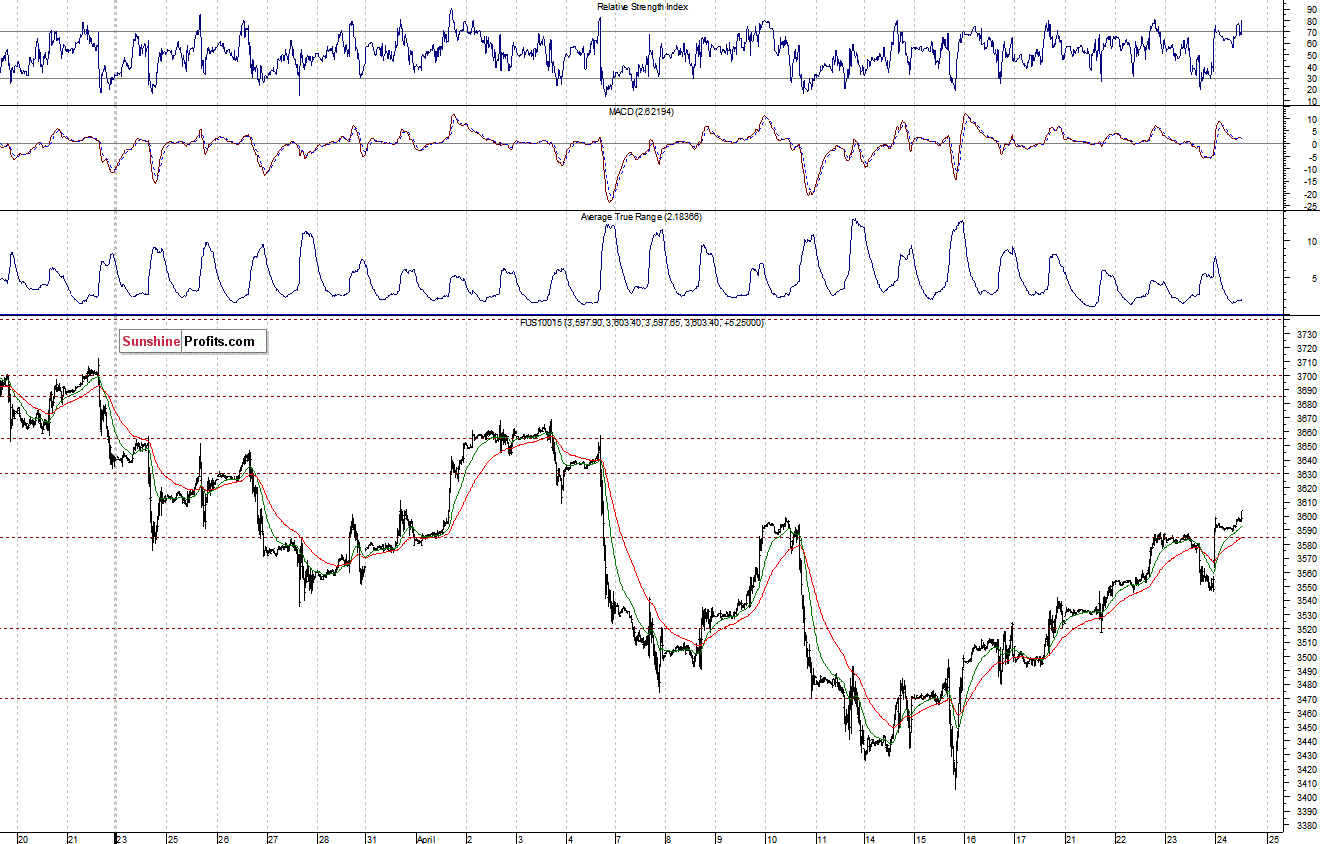

The technology Nasdaq 100 futures contract (CFD) remains in a short-term uptrend, retracing more of its month-long decline. The resistance is at the psychological level of 3,600. On the other hand, the support is at 3,540-3,550, marked by yesterday’s lows. There have been no confirmed negative signals so far:

Concluding, the broad stock market continues to fluctuate within its medium-term consolidation, as the S&P 500 index remains quite close to the early April all-time high at around 1,900. We will wait for another opportunity to open a trading position - at this time opening one doesn't seem justified from the risk/reward point of view.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts