Briefly: In our opinion short positions are favored (stop-loss at 1,850, short-term profit target at around 1,800, S&P 500 index).

Our intraday outlook isbearish, and our short-term outlook is now bearish, following breakdown below March-April consolidation:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

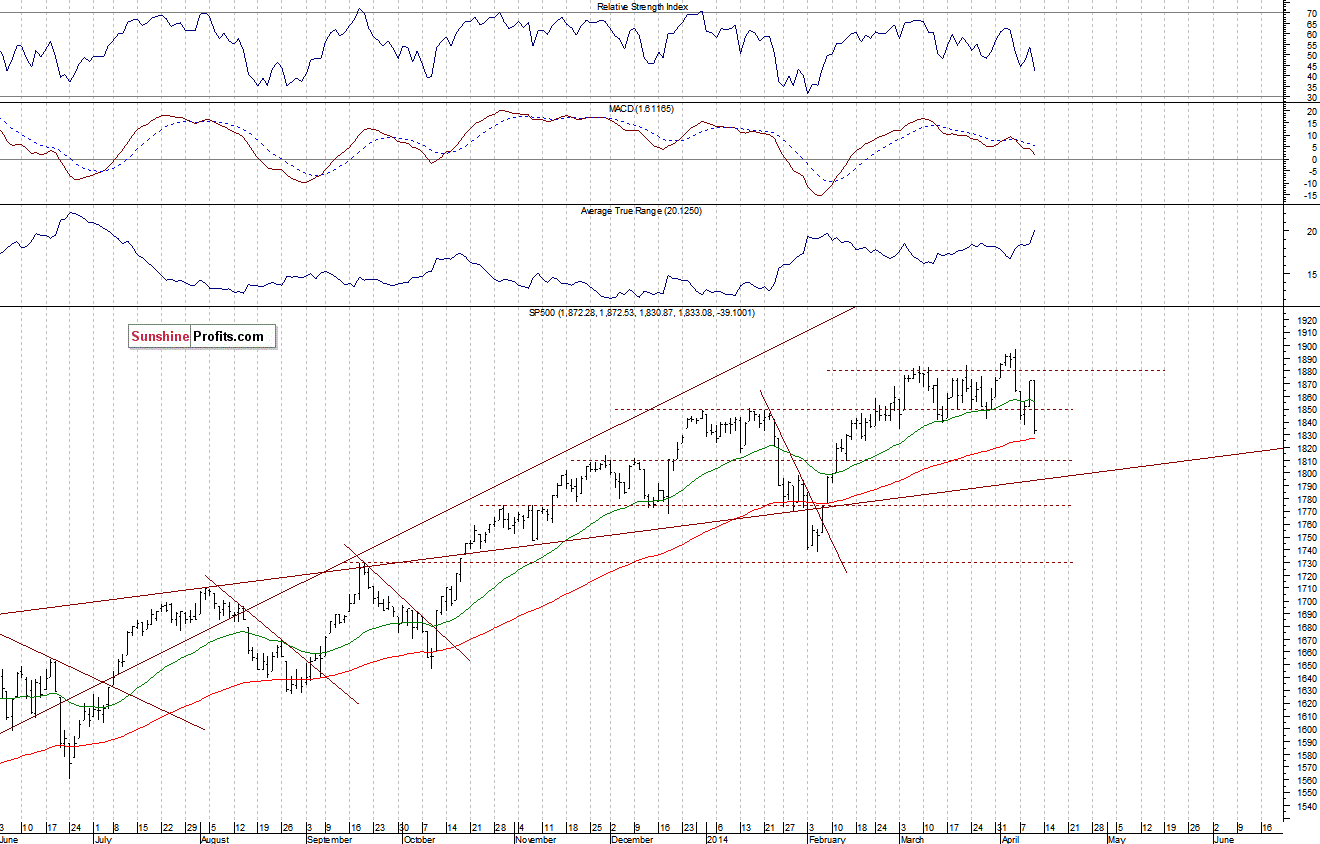

The U.S. stock market indexes lost 1.6-3.1% yesterday, as investors were selling stocks as fast as they could, ahead of quarterly earnings releases, monetary policy tightening fears, uncertain geopolitical environment. The S&P 500 has deepened its recent move down, breaking below the support at around 1,840-1,850. The nearest important resistance is at 1,840-1,850, and a potential support is at 1,800-1,810, marked by some of the previous local extremes. Certainly, a breakdown below March lows is negative for the market, at least from the short-term perspective. However, we can see some potential levels of supports below current prices, as the daily chart shows:

Expectations before the opening of today’s session are virtually flat, with index futures slightly down. The main European stock market indexes have lost 1.2-1.5% so far. Investors will now wait for some economic data announcements: Producer Price Index at 8:30 a.m., Michigan Sentiment number at 9:55 a.m. The S&P 500 futures contract (CFD) trades in a relatively narrow intraday range, following yesterday’s selloff. For now, it looks like a flat correction within short-term downtrend. The nearest resistance is at around 1,835-1,840, and a potential support is at 1,800-1,810, as we can see on the 15-minute chart:

The technology Nasdaq 100 futures contract (CFD) has retraced Wednesday’s rebound completely, reaching new low. The nearest support is at around 3,470, and the resistance is at 3,490-3,500. There have been no confirmed positive signals so far:

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts