Our intraday outlook is bearish, and our short-term outlook is neutral:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

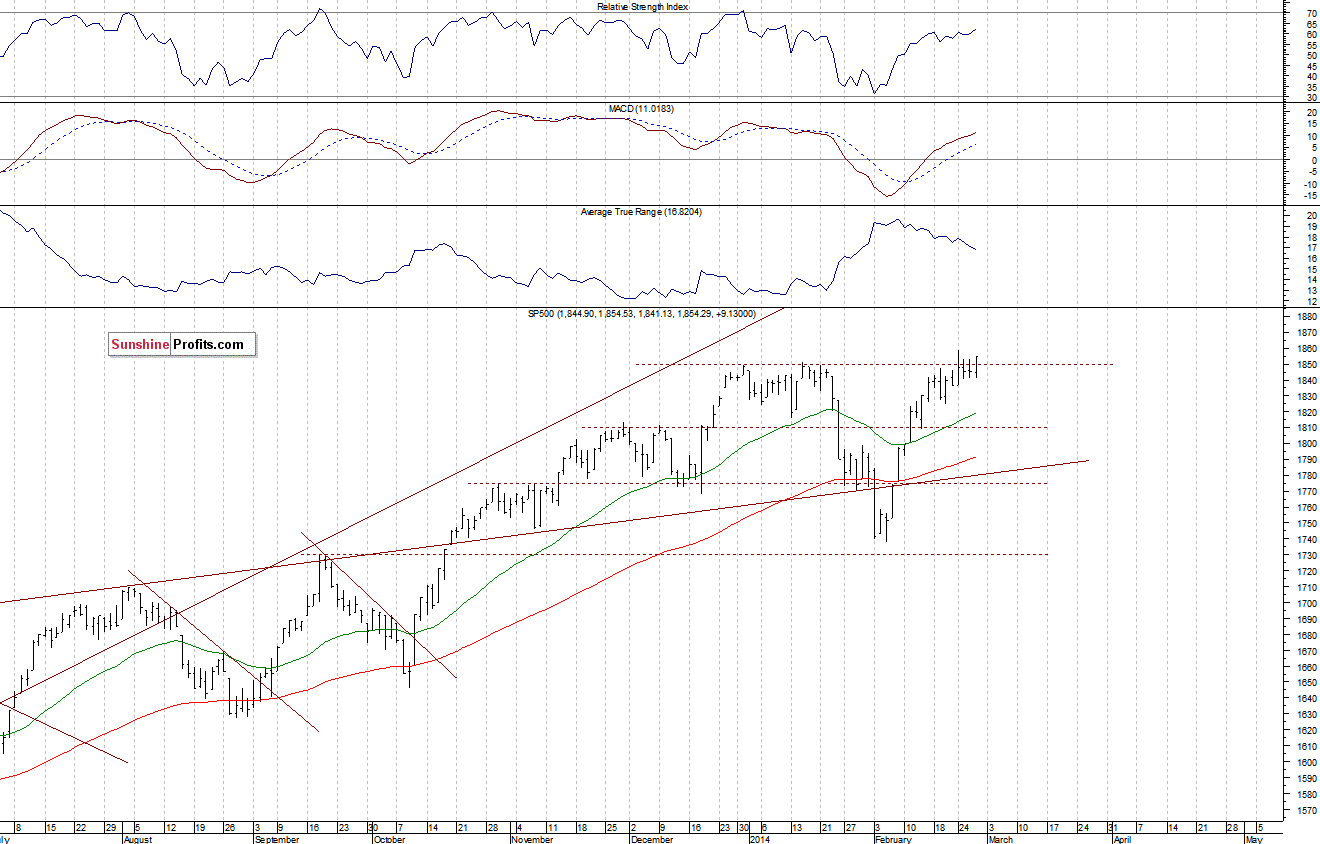

The U.S. stock market indexes gained 0.5-0.6% yesterday, as sentiment improved following Fed Chairman Janet Yellen’s speech. The S&P 500 index remains near Monday’s all-time high of 1,858.71. The resistance is at around 1,850-1,860. On the other hand, the support is at 1,825-1,840. For now, it looks like another flat correction within an uptrend:

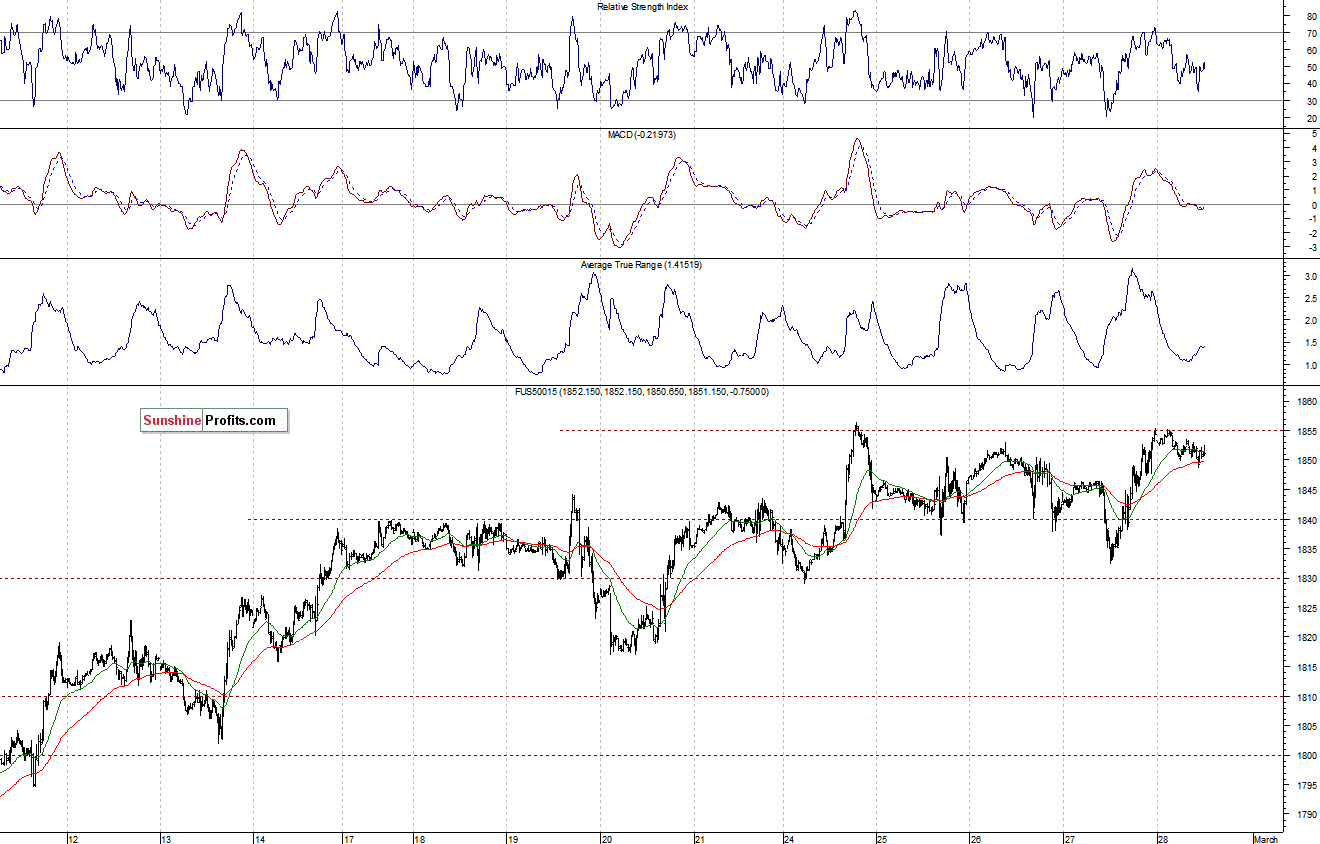

Expectations before the opening of today’s session are virtually flat, with index futures currently down 0.1%. The main European stock market indexes have been mixed so far. Investors will now wait for some economic data announcements: U.S. Q4 GDP at 8:30 a.m., Chicago PMI at 9:45 a.m., Michigan Sentiment at 9:55 a.m., followed by Pending Home Sales number at 10:00 a.m. The S&P 500 futures contract (CFD) trades close to its recent high, testing the resistance at around 1,850-1,855. The nearest important support remains at 1,840, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) fluctuates near its new long-term high, which is slightly above the level of 3,700. The nearest support is at 3,660-3,670. For now, there have been no confirmed uptrend reversal signals, however, the market practically extends its short-term consolidation, as the 15-minute chart shows:

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts